California is considering dropping a residential solar panel fee, which could increase adoption in the US’ leading state for solar-generated power. Solar stocks across the world, including First Solar, NextEra Energy and the UK’s NexEnergy Solar Fund, received a boost in the wake of the news.

- Solar stocks soared after California proposed new rooftop solar incentives

- The industry is forecasted to grow at a compound annual growth rate of 18.3% between 2022–2028

- However, Chinese stocks weigh on solar ETFs’ performances

Solar stocks such as First Solar [FSLR], NextEra Energy [NEE] and NextEnergy Solar Fund Limited [NESF.L] (NESF) all soared following news that California had overhauled its proposal to regulate rooftop solar installations.

The state has revised a previous plan to charge residential solar customers a $60 monthly grid access fee for selling excess energy back to the grid. The fee had been proposed in response to complaints from utilities companies that their so-called net metering payments increased costs for non-solar customers.

While net metering payments are set to be cut down by as much as 75%, the abandonment of the grid access fee spells good news for solar customers in the state, and increases the likelihood of further installations.

The First Solar share price gained 3.9% on 10 November when the news broke. Shares in NextEra Energy and the NextEnergy Solar Fund also gained 6.4% and 2.9% respectively.

The news comes at a time when the global spotlight is shining brightly on renewable energy, with the COP27 summit underway amid reports that global policies are not on track to meet the 1.5C warming pact agreed at COP21 in 2015.

Bookings leave bulls buoyant

In its most recent earnings report, First Solar posted an earnings miss and revised its full-year’s profit guidance downwards. On the other hand, NexEra posted an earnings beat and increased its full-year guidance.

Since reporting its results on 27 October, First Solar’s share price has gained 21.7% (through 15 November). Meanwhile, NextEra’s stock is up 4.9% since reporting its results on 28 October.

One major factor driving First Solar’s overperformance is its positioning in relation to the IRA. Various analysts, especially Joseph Osha of Guggenheim, view First Solar as one of the best-positioned companies to benefit from the legislation’s renewable energy provisions. “Investors have not fully digested how transformational the IRA could be for [First Solar’s] business,” he wrote in a note to clients soon after the IRA passed.

More recently, Osha has pointed to the strong bookings pipeline that First Solar reported in earnings as a greater indicator of its growth potential despite the “so-so results” it reported recently. Shahriar Pourreza, another Guggenheim analyst, raised the firm’s NextEra price target from $91 to $108 on 12 September.

Solar-powered growth

The good news from California has further boosted the outlook for solar stocks. “While the proposal doesn’t check every box on the industry’s wishlist,” wrote Colton Bean, an analyst at Tudor Pickering Holt, “it’s a significantly better outcome than the previous iteration and should be a particular boon to the residential storage industry.”

A 10 November report from Vantage Market Research forecasts the global solar panel market to enjoy a 18.37% compound annual growth rate (CAGR) from 2022–2028, reaching a value of $209.4bn in the process. While investors see Solar First as one of the key growth players within the overall theme, NextEra is one of the major incumbents of this still-growing industry. It is already one of the world’s largest producers of wind and solar energy.

Meanwhile, NESF’s investments look set to fuel a boost in solar energy in the UK. The fund recently acquired a 250MW strategic battery storage portfolio in the East of England for £32.5m. NextEnergy Group CEO Michael Bonte-Friedheim said “the project will provide crucial grid balancing services… helping manage the ebbs and flows of renewable energy generation and nationwide demand for electricity.”

Funds in focus: Invesco Solar ETF

News of California’s long-awaited proposal has helped drive gains in the First Solar share price, which is up 83.1% year-to-date. Over the same period, NextEra Energy’s share price has fallen 9.7%, but it has gained 15.5% in the past month. The NESF is up 2.4% and 11.3% over the same periods.

First Solar has outperformed its peers. Paling in comparison to the company’s 83.1% share price rally this year, the Invesco Solar ETF [TAN] has gained just 6.3% in the year to 16 November.

First Solar is the fund’s second-largest holding as of 14 November, with a 9.8% weighting. NextEra is not held by the fund as of this date. Given the company’s remaining fossil fuel presence, it doesn’t yet feature on pure-play solar or renewable energy ETFs.

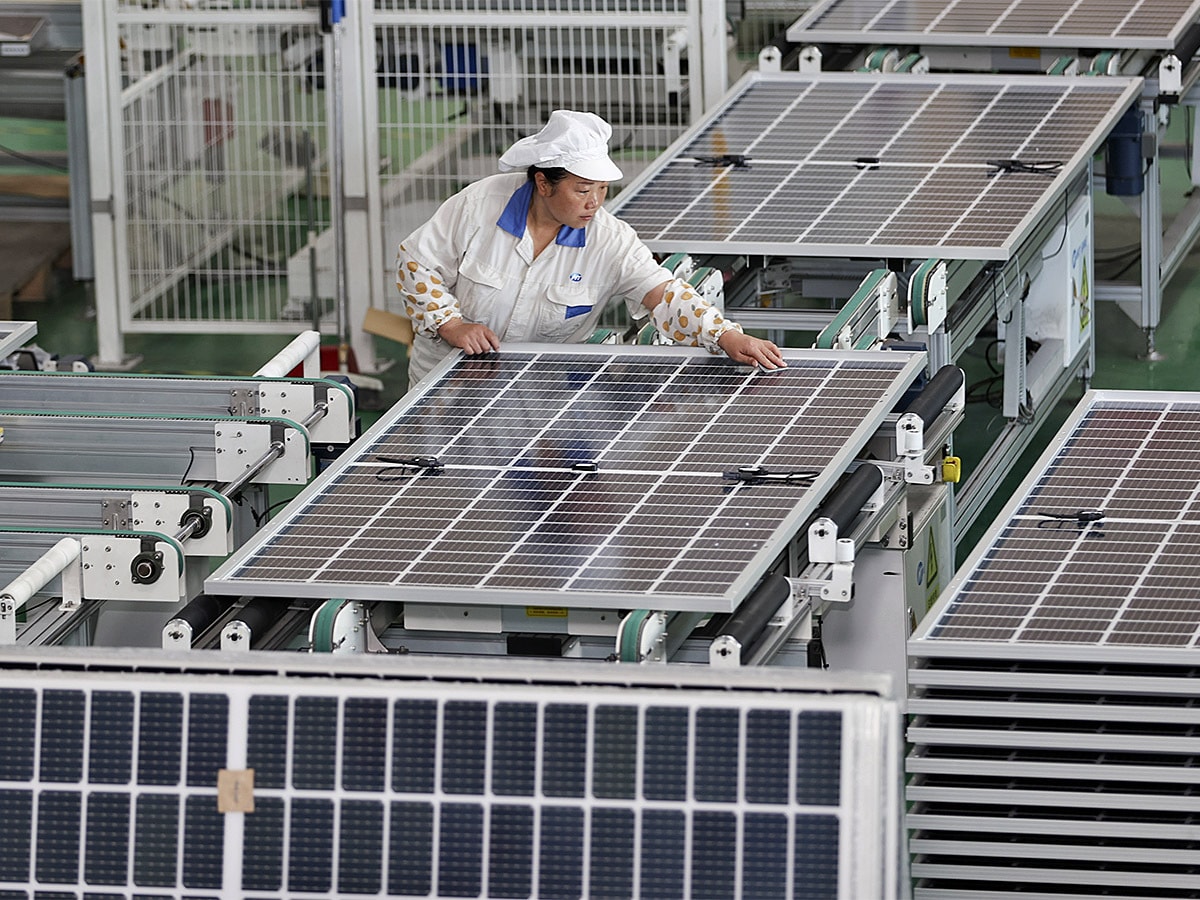

While First Solar’s performance will have driven much of the Invesco Solar ETF’s gains this year, the fund has been held back by substantial holdings in Chinese stocks such as GCL Technology Holdings [3800.HK] and Xinyi Solar Holdings [968.HK], which are the fourth and fifth holdings at 5.42% and 5.11% respectively. CGL Technology Holdings has fallen 13.4% in the year-to-date, while Xinyi Solar Holdings has dropped by 24%.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy