In this article, US-based investment manager Direxion analyses the US banking sector’s fourth quarter earnings from the start of the year.

2021 has been a fickle year so far for big banks in the US.

The group of JPMorgan [JPM], Citigroup [C], Bank of America [BAC], Goldman Sachs [GS], Wells Fargo [WFC], and Morgan Stanley [MS] mostly reported fourth quarter earnings and revenue above consensus analyst estimates, keeping with the long-term trend.

This time around, only Bank of America, Wells Fargo, and Citigroup came in below revenue estimates — and only just so. And yet, followers of the financials know what usually happens next: the banks show weakness.

While each of the banks was still outperforming the S&P 500 for the year at the end of January, they were all trading down since their reports. It’s a familiar refrain for followers of the financials, who have come to expect earnings to be a “buy the rumour, sell the news” event. Unsurprisingly, this short-term rotation has benefited financial bulls.

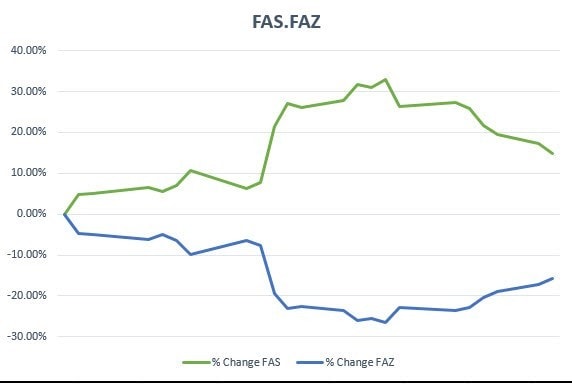

The Direxion Daily Financial Bear 3X Shares [FAZ] was down almost 19% over the 30 days to 27 January. Likewise, the Direxion Daily Financial Bull 3X Shares [FAS] was up about the same amount in this time period.

Renewed interest in regionals

Moving down the market cap ladder, the action in the regional banks has dwarfed that of its national counterparts.

Just like the big banks, most regional banks reported earnings beats for the fourth quarter, including First Republic Bank [FRC], PNC Financial Services [PNC] and Citizens Financial Group [CFG]. But while the fundamental story between the two groups is similar, the trading action is not.

The Direxion Daily Regional Banks Bull 3X Shares [DPST] was up 128% over the last three months (through 27 January), and year-to-date has taken in over $28m in inflows.

Regional banks’ performance can again be chalked up to increased account activity, with PNC Financial Services reporting strong deposits and, like its larger counterparts, additional capital that was previously set aside for potential loan loss.

The enthusiasm represents a decisive change in fortune for the regional banks, which, even more so than the big banks, drastically lagged the market through the bulk of 2020.

Of course, these smaller financials also carry the same risk of a default wave as the big banks. What’s more, revenue among these smaller institutions is also handicapped by the current low interest rate environment that diminishes their ability to generate revenue through lending or owning rate-sensitive assets.

Big picture

That question of interest rates, as well as the larger question about the current national macroeconomic picture, will likely determine how long this bank rally may last.

Currently, the banks seem to be in relatively healthy financial condition, all things considered. Loan losses don’t appear to be as bad as expected, and several even mentioned resuming buybacks.

Despite Wall Street’s optimism (what some would call overly optimistic) over the past six months, its bullishness on the banking sector is seemingly on solid footing.

This article was originally published in Direxion’s Spotlight newsletter on 27 January.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy