Cameron Stewart, CFA, Founder and Host of Rational Investing, joins Opto Sessions to discuss his take on key attributes of a stock’s long-term performance. He also delves into Nvidia’s outlook, citing several downside risks that he believes could mean the company’s stock is overvalued.

Widely recognised for his expertise in the corporate finance and valuation space, Cameron Stewart, CFA, is Founder and Host of Rational Investing, a financial education YouTube channel and podcast. His podcast focuses on undervalued stocks with high free cash flow yields and capital appreciation for the long-term investor.

While Rational Investing is his passion, Stewart works full time as the Chief Financial Officer (CFO) of West Coast Fitness, overseeing all aspects of finance and accounting for a private equity group that represents more than $60m of annual revenues and 50 Orangetheory retail gym locations.

Prior to his role at West Coast Fitness, he was the acting CFO for Fragrant Jewels and Vice President of Finance at Fox Rent-A-Car, an entity with over 100 retail locations and $300m in annual revenue.

Stewart has nearly 20 years of experience in finance and on Wall Street, and has brought in more than $6bn for companies seeking to raise capital towards debt and equity. A passionate value investor, he works with start-ups, turnarounds and mature businesses.

A Rational, Long-Term Approach

When assessing stocks, Stewart looks to five key attributes to measure an asset’s long-term outlook and how to value a potential asset over a period of 10–30 years: whether the company in question has growing revenue, rising earnings, strong free cash flow, low levels of debt and a well-priced stock.

These attributes are especially important as it is difficult, if not impossible, to read a company’s own forecast with any real level of confidence. “The business can be surprised by its own performance [or] it can be surprised by the economy’s performance”, as happened with the pandemic. To help protect against such uncertainties, Stewart tells Opto, the most important thing to do is buy stocks at reasonable prices. “If you buy a business cheap enough, there is enough downside protection there… that will help your margin of safety and help you perform well over time.”

The performance of equities is “highly uncertain”, and fluctuates. Equities never follow a “smooth, upward-sloping line”, he says, underscoring the importance of looking to the long term instead of investing in whichever company’s stock is grabbing headlines. Keeping these attributes in mind will help rational investors make secure decisions. “You do not want to buy a stock where the forecast is so high that if they underperform, you lose money. You buy stock with a forecast that’s small, and you hope they beat it,” he says.

“If you buy a business cheap enough, there is enough downside protection there… that will help your margin of safety and help you perform well over time.”

Downside Risks

Nvidia’s [NVDA] stock is up a staggering 222% year-to-date, but according to Stewart its “growth story is getting way too far ahead of itself”.

“Right now, Nvidia trades at 73 times earnings, an absolute monster valuation. If this stock comes back anywhere near what it has traded historically, in the 30 range, it’s an $85 stock — and that’s a collapse of almost 90% in value”.

Stewart compares Nvidia’s stock performance with that of companies which collapsed after the dot-com bubble of the late 1990s, such as Amazon [AMZN] and Microsoft [MSFT].

“They went through the same pattern: earnings were growing strong, and the market continued to give the companies way too much credit for growth. Eventually, the companies ran into a ceiling and simply could not get any more credit. Once that stopped, the downside was in and everyone was selling and you could not get away from the stock fast enough.”

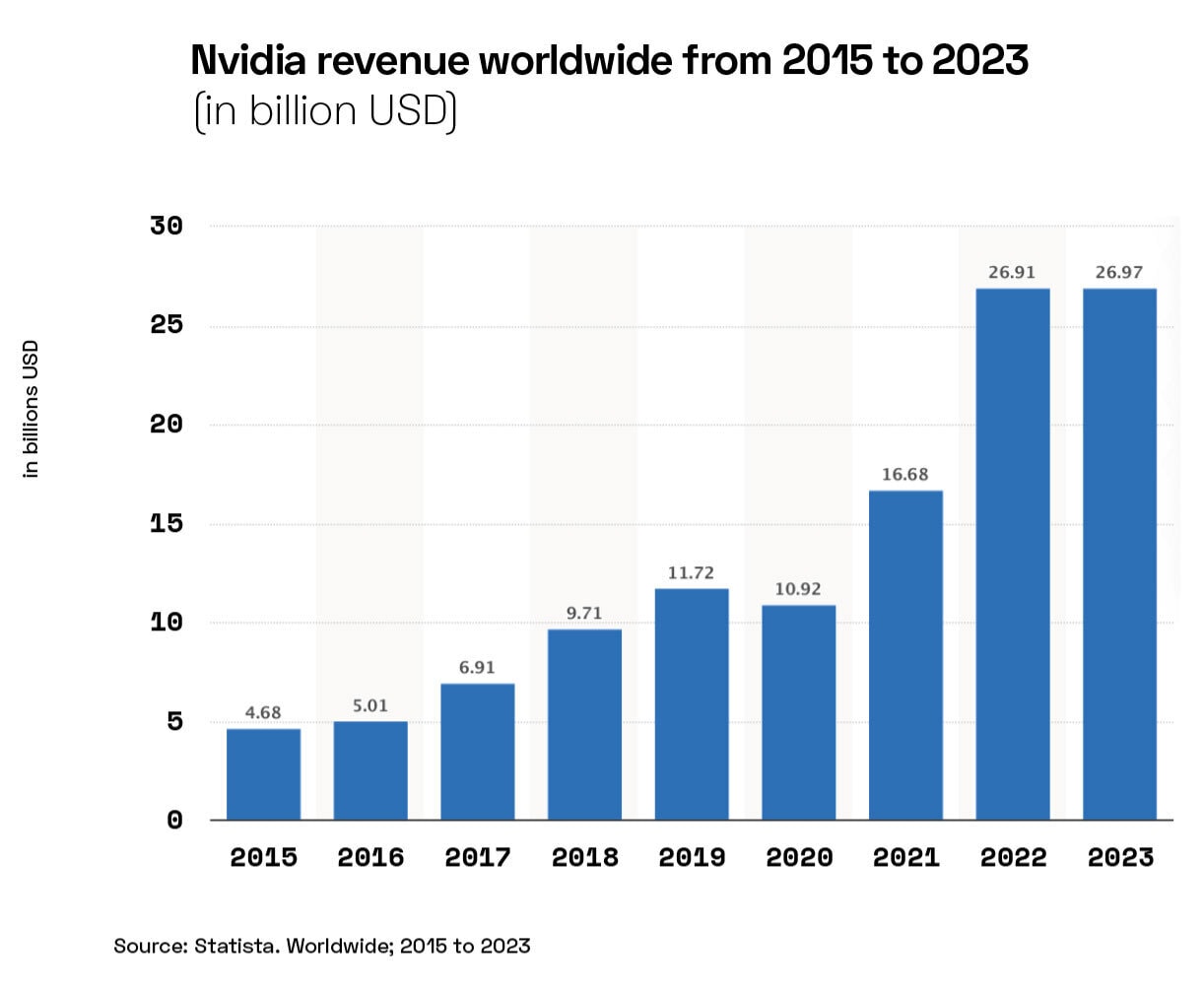

Between fiscal year (FY) 2015 and FY 2023, Nvidia’s revenue expanded from $4.7bn to $27bn, at an average annual growth rate of 23%. While impressive, Stewart noted that revenue was flat over the last two fiscal years. During this period, the company’s gaming operations collapsed, but the stock has nonetheless reaped the rewards of the artificial intelligence (AI) boom.

“The reason the stock has taken off is because they mentioned AI about 1,000 times in their press conferences. So people are chasing what they believe is the next magic number,” says Stewart.

Non-GAAP earnings grew from $728.4m in FY 2013 to $8.4bn in FY 2023, but were actually down from $11.3bn the year prior. In the meantime, Nvidia’s market capitalisation “absolutely exploded”, from $7.8bn in February 2013 following its yearly earnings report, to $580.3bn in February 2023, after peaking in November 2022 at $822bn. Since mid-June of this year, however, the chipmaker has maintained its position over $1trn.

“The reason the stock has taken off is because they mentioned AI about 1,000 times in their press conferences. So people are chasing what they believe is the next magic number.”

“This is the interesting thing, that you have companies whose revenue and earnings continued to grow, but the market can no longer afford the premium assigned to those earnings. While the company continues to perform well… the market no longer gives the same earnings multiple on those earnings. So the stock price falls as the market multiple collapses back down to normal, even though earnings continue to grow.”

Cash flow from operations was $4.4bn last year, down from a peak in 2020 on the back of gaming and cryptocurrency sales. However, taking into account stock-based compensation of $2.7bn — or roughly 10% of revenue — free cash flow was really at $2.9bn, says Stewart.

With the number of outstanding shares at 2.5 billion and net cash flow less capital expenses at $1bn, he says this means that “the stock does not have strong free cash flow. The stock makes $0.44 of cash flow and currently trades at $446 [$470.61 as of 6 September]. That is 0.1% free cash flow yield…I would venture to say that anyone buying the stock obviously is not buying for the cash flow, because it is not there. Despite it paying a dividend, I think you are paying an absolutely astronomical price for the stock.”

“It is very hard for a stock that is 70 times market multiple to go even higher, kind of betting [that] the greater fool is going to pay you 100 times, 150 times earnings in the future,” Stewart says.

Watch the full video here. You can also check out all our episodes via our YouTube Channel.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy