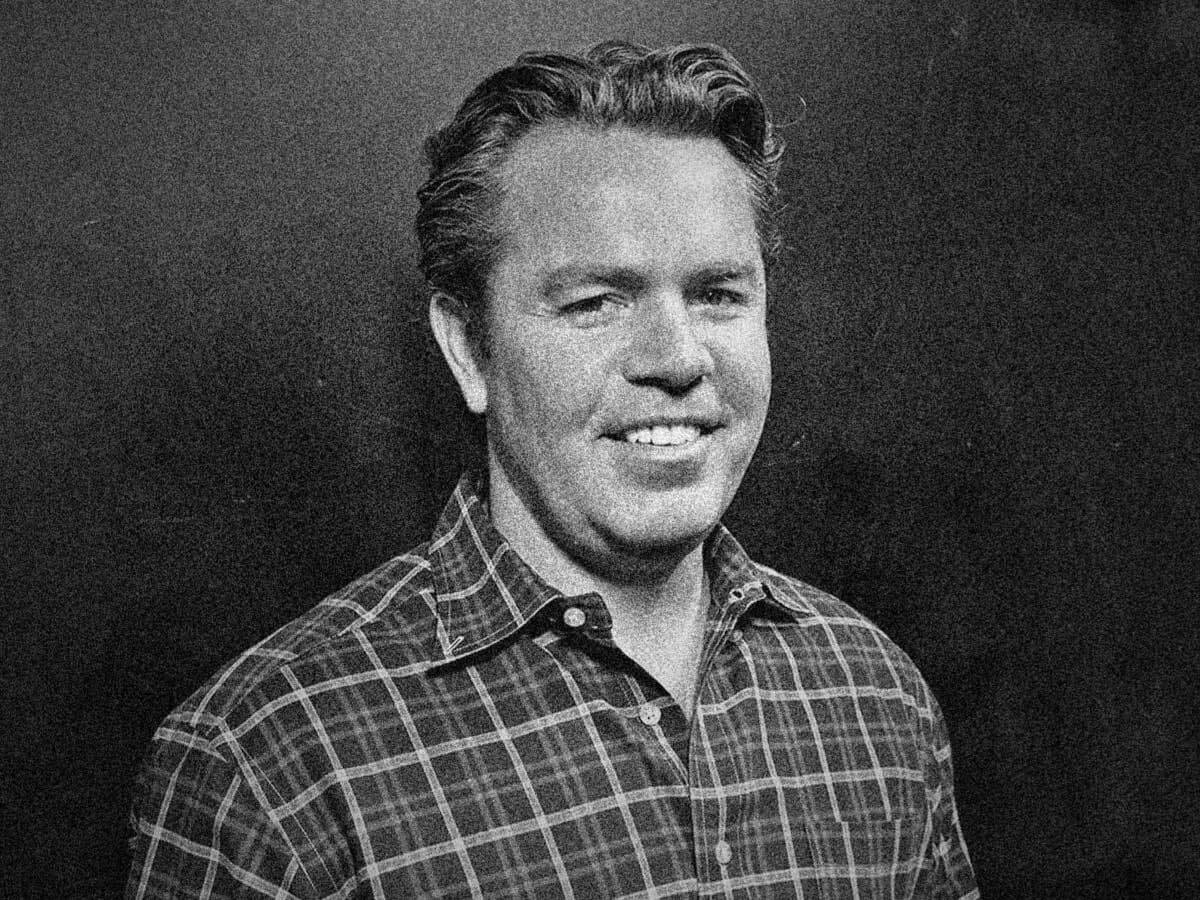

When Keith McCullough co-founded Hedgeye Risk Management in 2008, he set out to help people – or what his firm likes to call the ‘Hedgeye Nation’ – save and make money.

Since then, McCullough has fostered a reputation for his transparent data-led approach and built a team of more than 40 analysts that use a proprietary growth inflation policy model to assess the macroeconomic environment.

LISTEN TO THE INTERVIEW:

Hedgeye’s investment approach is underpinned by the rate of change rather than absolute change, and that’s because it’s “not subject to opinion”, McCullough told Opto Sessions during his second appearance on the show.

“Rates of change are mathematical and derive through the secrets to the universe, as [mathematician] Steven Strogatz, who wrote Infinite Powers, would say,” he explained, adding that he focuses on the rate of change in both economic data and volatility within market signals.

“I run it on what I call the immediate-term trade duration, three weeks or less, the intermediate-term trend duration, which is three months or more (quarterly), and then long-term tail risk duration, which to me is inside of three years”

Delving into his investment approach, McCullough broke down his multifactor model, which consists of price, volume and volatility. “Those three things are my signal. Then I run it, not just on one duration. I run it on what I call the immediate-term trade duration, three weeks or less, the intermediate-term trend duration, which is three months or more (quarterly), and then long-term tail risk duration, which to me is inside of three years.”

Hedgeye also uses a framework to try to front-run the behaviour of policymakers based on rates of change, whether they be growth, inflation or economic. “That is my framework,” McCullough said, “that’s why we call it our ‘GIP’ [growth inflation policy] model. Growth, inflation, measuring and mapping, constantly and stochastically, the rates of change of that data, and front running policymaker responses.”

Hedgeye’s proprietary GIP model uses economic growth, inflation and the marginal rates of change in those two factors to separate the economy into four distinct economic quadrants.

“Growth, inflation, measuring and mapping, constantly and stochastically, the rates of change of that data, and front running policymaker responses”

The first quadrant, described as “Goldilocks”, is defined by accelerating growth on a real basis with inflation benign. The second quadrant is characterised by “white-hot” nominal growth accelerating at the same time as inflation. Quad three is where the growth rate decelerates amid stagflation, while quad four is when you have growth and inflation slow at the same time.

However, “it’s also really important to not see any market down days, as ‘oh, we’re going into quad four’. That would be the opposite way to read the signal, which is front-running those four economic quads,” McCullough said.

To find out more about McCullough’s investment philosophy and how he is positioning in the current macro environment, listen to the full episode.

And for more ways to listen:

Listen to the full interview and explore our past episodes on Opto Sessions.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy