Over the past decade, the traditional banking landscape has witnessed significant transformation, with disruptions in payments, lending, wealth management, and retail banking. This change extends beyond fintech, as big tech and ecommerce giants like Apple, Google, Amazon, Facebook, and Alibaba have been leveraging their vast reach and technological prowess to pose a significant threat to both traditional banks and fintech competitors.

- On 24 April, Apple launched a high-yield savings account with Goldman Sachs, offering US clients a 4.15% annual yield and seamless integration with its Wallet app.

- Apple's expanding financial services pose a significant threat to traditional banks and fintech competitors, leveraging its vast reach and technology.

- The ARK Fintech Innovation ETF offers exposure to the fintech theme and is up 24.42% year-to-date as of 28 April.

Within fintech, the digital payments segment boasts the largest transaction volume, set to surpass $15trn by 2027, according to Statista. This market encompasses three main categories: wallet providers like Venmo and PayPal, online payment interface providers such as Stripe, and B2B offline payment providers like Square.

Apple's [AAPL] extensive global reach and consumer trust positions it to become a powerful financial institution. With the launch of a high-yield savings account with Goldman Sachs, Apple has expanded its financial offerings, which already include a credit card, peer-to-peer lending, Wallet app, and an interest-free "buy now, pay later" (BNPL) service.

As Apple continues to broaden its financial services, banks reported a staggering $60 bn loss in deposit outflows in the first quarter. While the impact of big tech entering the banking sector remains a topic of debate, Apple's unique position may enable it to address long-standing issues faced by traditional banks, potentially transforming the financial landscape.

Apple’s push into banking

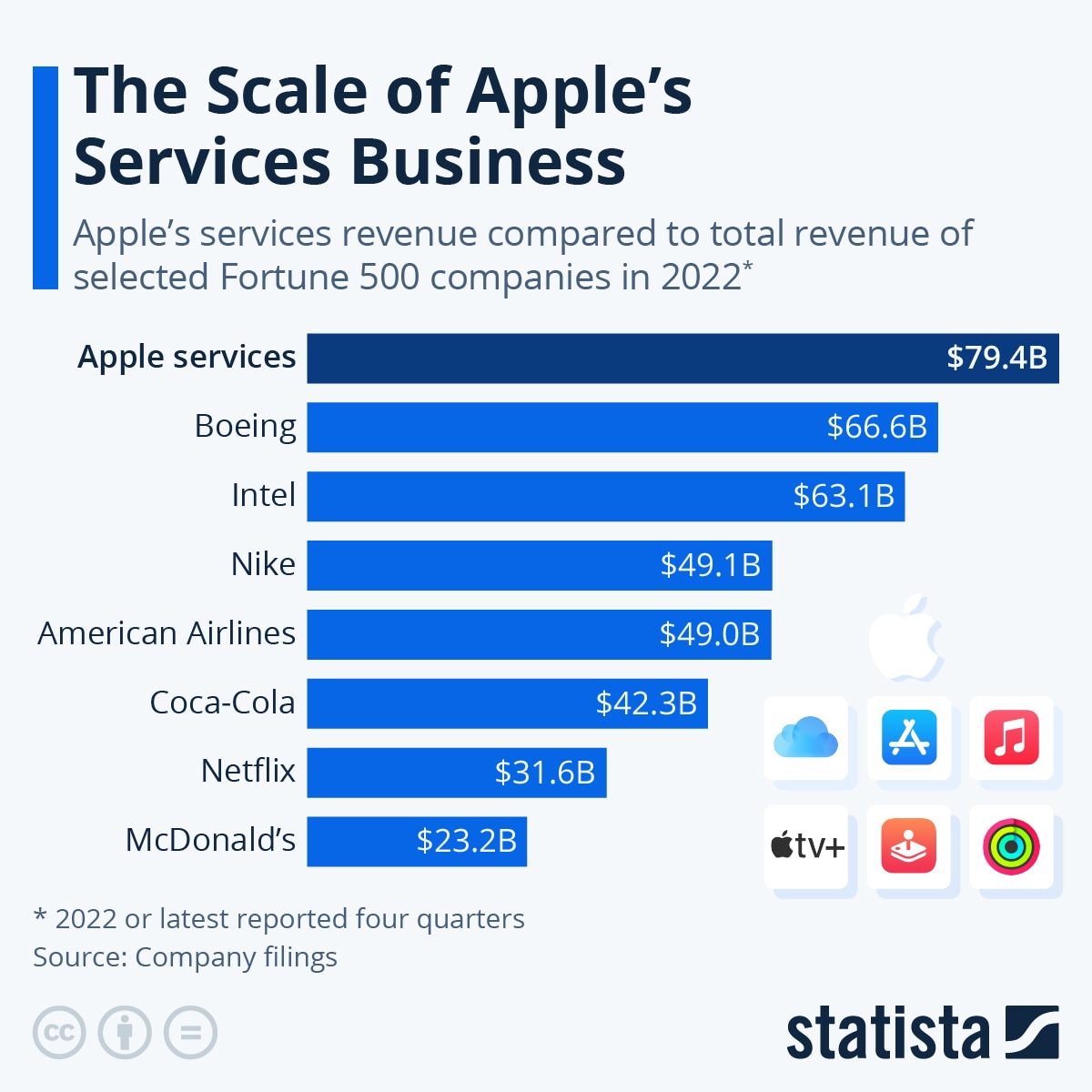

On 24 April, Apple launched a high-yield savings account in partnership with Goldman Sachs, aiming to entice US financial clients with a competitive 4.15% annual yield and seamless integration with its Wallet app. The launch marks Apple's latest foray into the financial sector, as it seeks to expand its services revenue, which now accounts for around 20% of the company's sales. Apple’s services business generated $79.4bn in 2022, as the Statistainfographic below illustrates.

The savings account, accessible to Apple Card users without any fees, minimum deposit, or balance requirements, puts the tech giant in direct competition with small and midsize banks that are struggling to retain customers amid Silicon Valley Bank's recent collapse. Apple's attractive rate, more than ten times the national average, has the potential to intensify the fight for depositors and pressure other financial institutions to protect their funding.

BlackRock CEO Larry Fink predicted that traditional bank accounts will continue to lose deposits as they flow into alternative investments like ETFs and money market funds. This trend could further benefit Apple as it expands its financial services portfolio. However, not all of Apple's financial endeavours have been seamless; the rollout of their "buy now, pay later" service experienced significant delays, and the high-yield savings account took six months to launch after its announcement.

The glacier

Apple has a controversial track record, being accused of eating its business partners. Joe Kiani, founder of blood-oxygen measurement technology company Masimo that Apple approached for its Apple Watch, told the Wall Street Journal, “when Apple takes an interest in a company, it’s the kiss of death. First, you get all excited. Then you realise that the long-term plan is to do it themselves and take it all.”

According to Gene Munster, managing partner of Deepwater Asset Management, “they move at the speed and force of a glacier”, the Financial Times reported. He highlighted Apple's tendency to partner with others until it becomes advantageous to go solo, suggesting this could be their endgame in finance as well. Apple's methodical approach to entering new sectors often avoids extravagant acquisitions in favour of incremental steps that ensure a sustainable competitive edge.

Apple Pay, the wireless payment technology launched with the iPhone 6 in 2014, exemplifies the company's slow-burn approach in finance. According to three former Apple employees, the tech giant is meticulously laying the groundwork to capture a larger share of the finance and payments market in the long run, FT said.

Disrupting banking and fintech

JPMorgan Chase CEO Jamie Dimon has referred to Apple as a bank, highlighting the tech giant's growing presence in the financial sector. As Apple's financial offerings continue to expand, industry leaders like American Express CEO Stephen Squeri admit to feeling "paranoid" about the competition from tech powerhouses like Apple and Amazon. Munster believes in five to 10 years, “we’ll think of Apple in the same vein as Citi, JPMorgan and Wells Fargo.”

The potential implications of Apple's expansion are significant: if both the buyer and the merchant use Apple devices for transactions, a closed-circuit payment system could emerge that bypasses traditional banking partners and payment networks like Visa and Mastercard. As Apple Pay gains traction, the company could gain leverage and reduce its reliance on banks.

Sam Shawki, CEO of MagicCube, suggested that the ability to securely process payments via smartphones and tablets could render the $48bn payment device market, dominated by Verifone and Ingenico, obsolete. Ultimately, Apple may aim to challenge major players like Visa and PayPal in the long term.

Regulatory knots

Some industry insiders, however, argue that Apple's foray into payments and banking primarily aims to expand the iPhone's reach and keep users "locked in" to the Apple ecosystem, rather than posing an existential threat to traditional banks. Eva Wang, former American Express executive and current head of partnerships at Firework, highlighted that Apple prioritises user experience while avoiding complex regulatory aspects tied to banking.

Apple's network effect strategy creates an interdependent ecosystem that may make it challenging for users to leave. This raises questions regarding potential monopoly issues, which could draw the attention of antitrust regulators like the Federal Trade Commission.

Should Apple's financial services significantly disrupt the banking sector, regulators may scrutinise its business model more closely, while the company must also ensure that consumer data usage does not trigger antitrust concerns.

The Apple advantage

A former Apple executive revealed that the company's customer acquisition cost for Apple Card is significantly lower than other credit card companies due to its extensive distribution channels, FT said. Apple's vast iPhone user data offers a long-term advantage for more comprehensive credit risk assessments compared to traditional FICO scores. Apple's acquisition of UK-based alternative credit scoring startup Credit Kudos last year highlights its commitment to leveraging data for improved lending decisions.

Charlotte Principato, an analyst at Morning Consult, emphasised the importance of Apple's data in making better-informed lending decisions. Apple's equity-funded lending activity reduces risk compared to traditional banks that are typically highly leveraged. The company's strong brand and trustworthiness further differentiate it from competitors reliant on targeted advertising and surveillance capitalism for revenue.

Apple intends to continue expanding its financial services offerings, with plans for an iPhone subscription program and an expanded Pay Later program called Apple Pay Monthly Instalments on the horizon.

Funds in focus

Several ETFs allow you to invest in the fintech and mobile payment themes.

The ARK Fintech Innovation ETF [ARKF], a product of Cathie Wood’s ARK Invest, holds a diversified portfolio of fintech companies that are transforming various aspects of the financial sector, including mobile payments, digital wallets, online lending, blockchain technology, and artificial intelligence-based financial services. By investing in the ETF, investors can gain exposure to the rapidly growing fintech sector without having to pick individual stocks. The fund is up 23.43% year-to-date as of 1 May.

The ETFMG Prime Mobile Payments ETF [IPAY] focuses on companies involved in mobile and electronic payment technologies, digital wallets, and other financial transaction services. These companies are transforming the way financial transactions are conducted, especially through mobile and digital platforms. The fund is up 6.21% year-to-date as of 1 May.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy