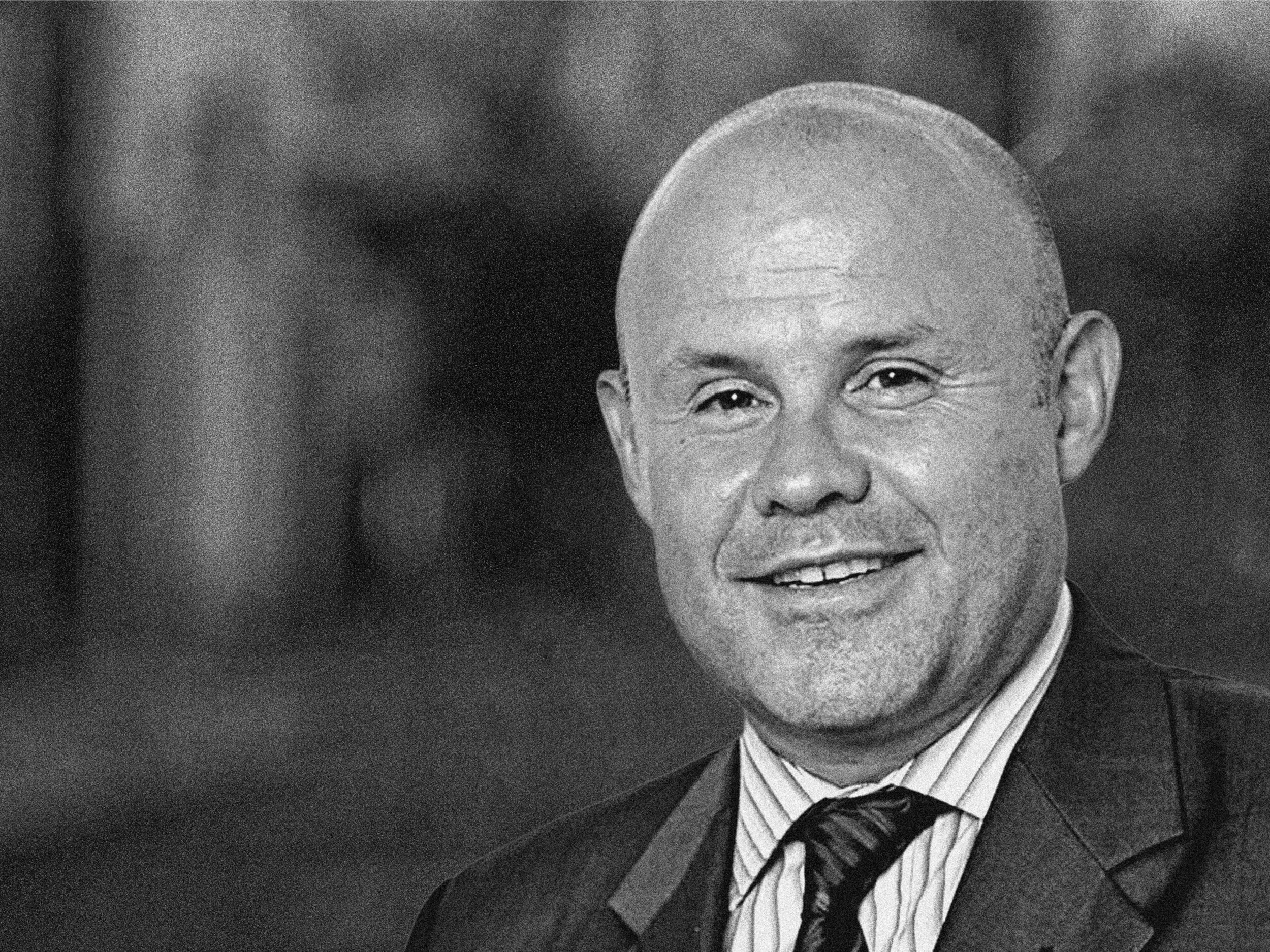

With more than 19 years of investment experience under his belt, Hector McNeil, founder and co-CEO of HANetf, believes thematic ETFs make life simpler for investors. Given investors’ modern consumerism perspective, he believes that the investment process is changing.

“My son is never going to own a chequebook. He’s going to want to do everything on his phone. He’s never going to fill a form and wait a week to get a price, which is what you have to do in the mutual fund world. He wants Amazon Prime gratification, and ETFs give you that.” McNeil expects to meet this expectation with HANetf’s offerings.

Listen to the interview:

HANetf has emerged as one of Europe’s best pure-play ETF issuers in the enterprise software segment, having achieved returns of more than 50% in the past 12 months and close to a fivefold increase in the past five-year period. Going forward, “I think the 50% is defendable going forward. The 500% would be hard to promise. But I do think this sector is open for exponential growth,” McNeil tells Opto Sessions.

The top mistake investors tend to make is that “they get in too late and get out too early,” he says. Unlike a diversified portfolio, a surgical or thematic ETF tends to help narrow the risk to a single vertical. In the case of HANetf, these augurs with a compounded growth rate of 15% per annum for the last some years, as McNeil points out. The COVID-19 pandemic has boosted his business. “Software can now reach something like 99.8% of midsize firms, never mind large.”

“I think the 50% is defendable going forward. The 500% would be hard to promise. But I do think this sector is open for exponential growth”

HANetf is among the few firms that have an aggressive presence in Europe, unlike most of its peers that are focused on the US and are not available to European investors. McNeil explains that Europe’s “30 plus countries, lots of different currencies and languages, taxes and cultures, [while] the US is one market, one currency and one language.” This will remain HANetfs distinguishing feature to find less penetrated markets, categories or change the way things are done. “We want to be in that sort of added value space where we’re bringing a product to market is either not been done before, or significantly better than what exists out there today.”

Regarding his investment strategy, McNeil says that in addition to fundamental analysis, “we use a piece of software…which basically is sort of an AI scraper that picks up the top 300 companies in this sector that we then select from on that basis.”

To hear more from McNeil, listen to the full episode on Opto Sessions.

Listen to the full interview and explore our past episodes on Opto Sessions.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy