As the pioneer of the world’s first cryptocurrency index fund, Bitwise Asset Management has become one of the largest and fastest-growing crypto asset managers amid the increasing popularity for investing in digital currencies.

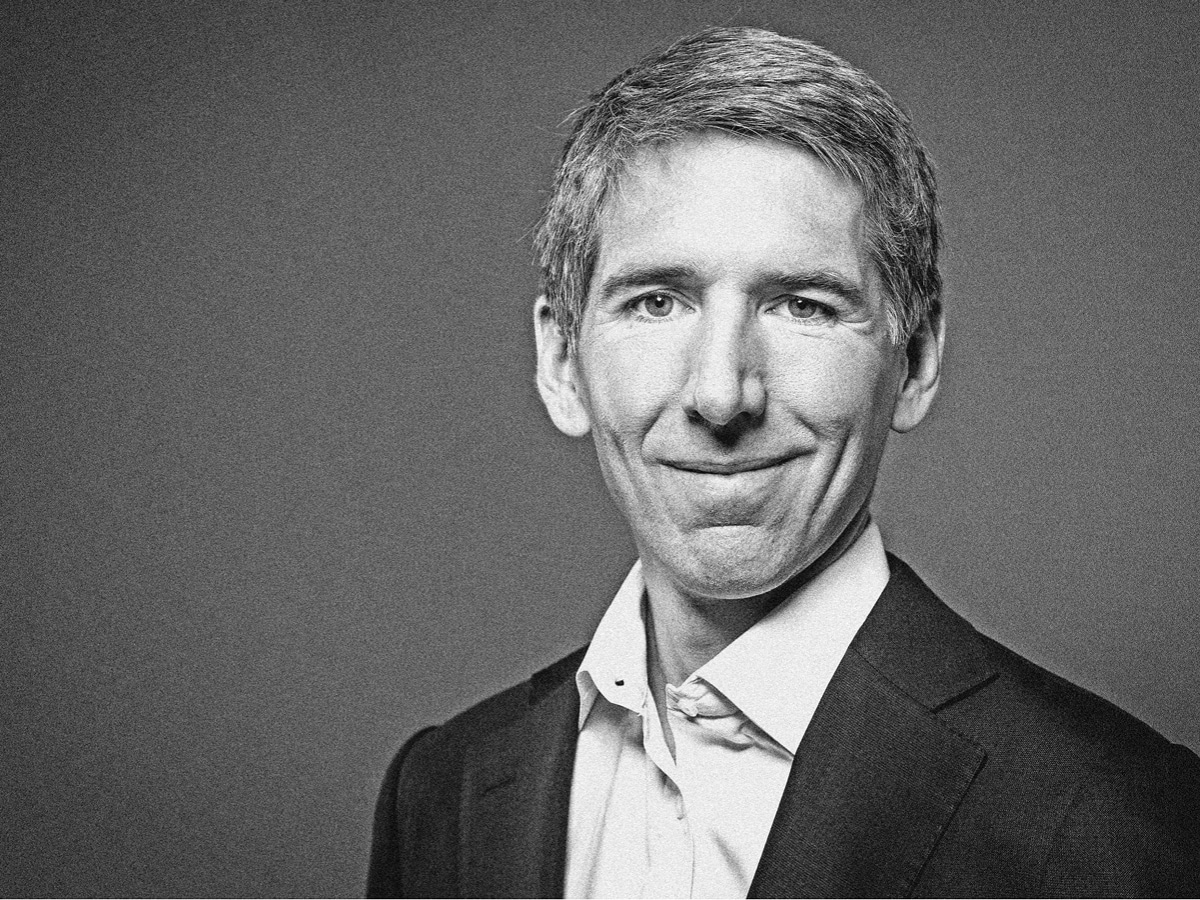

Matt Hougan is chief investment officer of the firm, where he leads development for its flagship fund, the Bitwise 10 Crypto Index Fund [BITW]. He stepped into the role in October last year, following a close-to three-year stint as the global head of research at Bitwise. Hougan also has extensive experience in spearheading the ETF space’s growth — he was previously the CEO of ETF.com and Inside ETFs.

Listen to the interview:

“I see a lot of parallels between the journey that ETFs took and the journey that crypto is taking today,” Hougan tells Opto Sessions. While digital currencies are still a burgeoning market, he says future growth is based on three main benefits: “Money moves at internet speeds, you can program money, and you can create digital property rights.”

Looking ahead, he sees Bitcoin becoming the digital gold as a “virtual certainty”. “Bitcoin probably has the lock on that market, and that’s a very big market. Programmable money, self-driving banks and decentralised finance have a chance of disrupting the traditional financial industry in the same way that software and automation disrupted almost every other industry in the world,” Hougan explains.

“Bitcoin probably has the lock on that market, and that’s a very big market. Programmable money, self-driving banks and decentralised finance have a chance of disrupting the traditional financial industry in the same way that software and automation disrupted almost every other industry in the world”

Of course, there are a huge number of risks involved. However, as an alternative investment, Hougan says that crypto has been one of the best-performing assets over the last 10 years.

His approach to investing in the market is through index funds “because I have a high degree of confidence in crypto’s future, but I know that picking and choosing the winners is going to be difficult”.

To hear more from Hougan, including who sparked his initial interest in Bitcoin, why he loves direct index investing and to learn more about the firm’s recently launched Bitwise Crypto Industry Innovators ETF [BITQ], listen to the full episode on Opto Sessions.

Or for more ways to listen:

Listen to the full interview and explore our past episodes on Opto Sessions.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy