In today’s top stories, individual investors have been more bullish than hedge funds this year. China’s reopening boosts the country’s IPO outlook, while LG Energy Solutions is investing $3.1bn into a smart factory for EV batteries. Analysts are favouring Apple’s “moonshot” AR/VR project and two solar stocks have upsides over 50% and 70%.

Individual investors more bullish than hedge funds

Institutional investors have been pulling back on their bearish positions in December, despite the fact the Fed won’t stop raising rates anytime soon. But institutional investors remain far from bullish, while individual investors are more optimistic, according to research from Goldman Sachs. Managing director Ben Snider told the Wall Street Journal that they’d usually expect to see individual investors sell equities once the S&P 500 falls 10% from its peak. The fact they’re not is “surprising”.

China’s reopening boosts IPO outlook

Hong Kong’s IPO market is expected to be a beneficiary of China’s reopening. “I am actually quite positive that after Chinese New Year the pipeline will pick up,” Victoria Lloyd, a partner in Baker McKenzie’s capital markets practice in Hong Kong, told Bloomberg. Goldman Sachs strategists are expecting the reopening to boost Chinese equities and strengthen the renminbi against the dollar.

Korean battery maker’s expansion plans

LG Energy Solutions [373220.KS] has announced it’s to invest 4trn won ($3.1bn) between now and 2026 in building a new facility near Seoul and expanding its EV battery capacity. "We plan to set up a diversified product portfolio including pouch-type and cylindrical batteries to respond to customer needs in a timely manner, and differentiate production capabilities based on a 'smart' factory," an LG Energy Solutions spokesperson said in a press release.

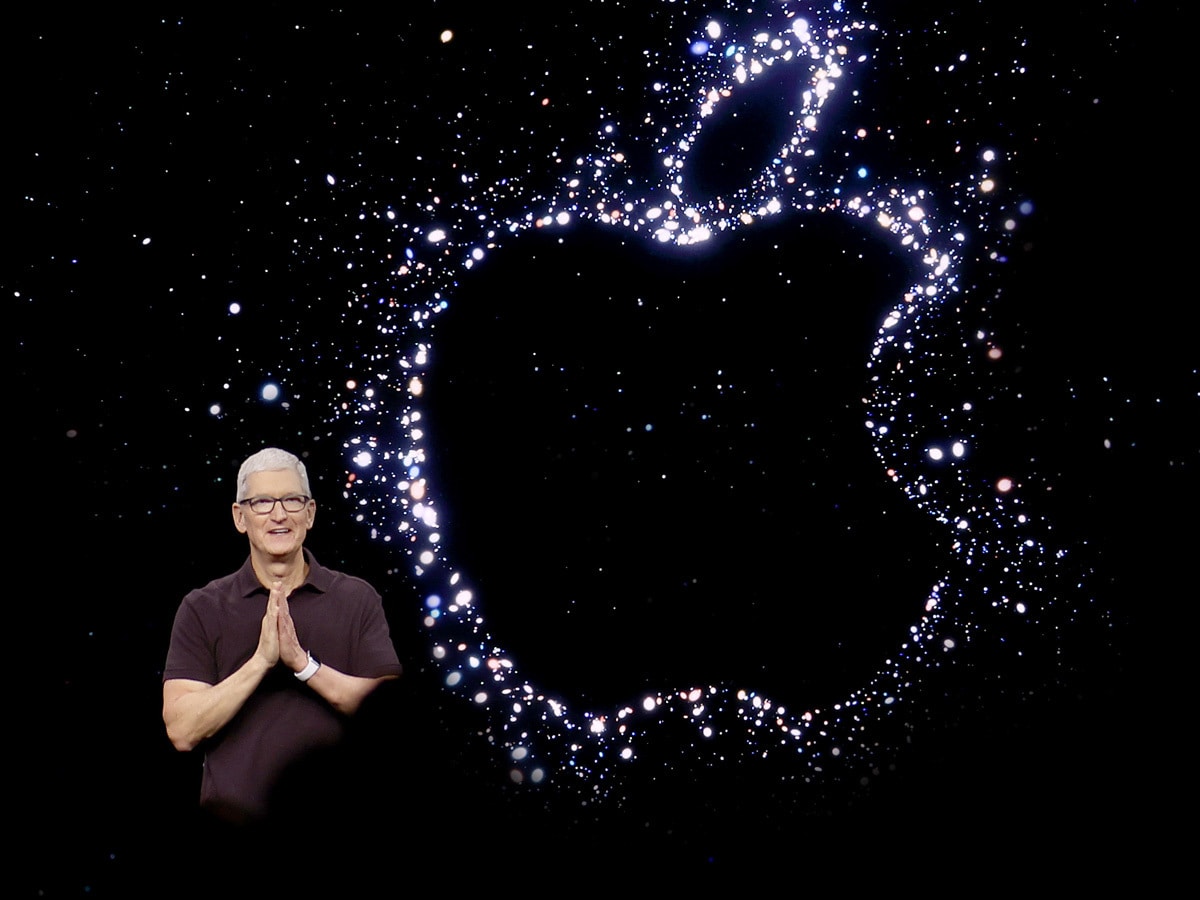

Evercore likes Apple’s “moonshot” AR/VR project

Disruption in China means fewer consumers will be unwrapping new Apple [AAPL] IPhone models this Christmas. Evercore analyst Amit Daryanani isn’t concerned and believes current headwinds are “transitory and investors should remain focused on the long-term opportunity”. In a note to clients seen by MarketWatch, Daryanani highlighted its “moonshot” projects, including the anticipated launch of its AR/VR headset next year, which could potentially contribute $18.1bn in revenue and $0.19 EPS.

Solar stocks that could soar

The energy crisis has pushed coal consumption to a record high in 2022, but according to the International Energy Agency, solar power adoption will overtake coal within five years. This should boost stocks like Sunnova Energy [NOVA] and Sungrow Power Supply [300274.SZ], which have upsides to their average price target of 72.17% and 57.02%, according to a CNBC screening of the Global X Solar ETF [RAYS].

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy