The Angus Energy share price is rocketing off the back of a possible takeover and the need for gas in a post-Russian energy future, but a suitable offer has so far been elusive. Its CEO believes that the market is discounting the value of its Saltfleetby gas field, but do bidders agree?

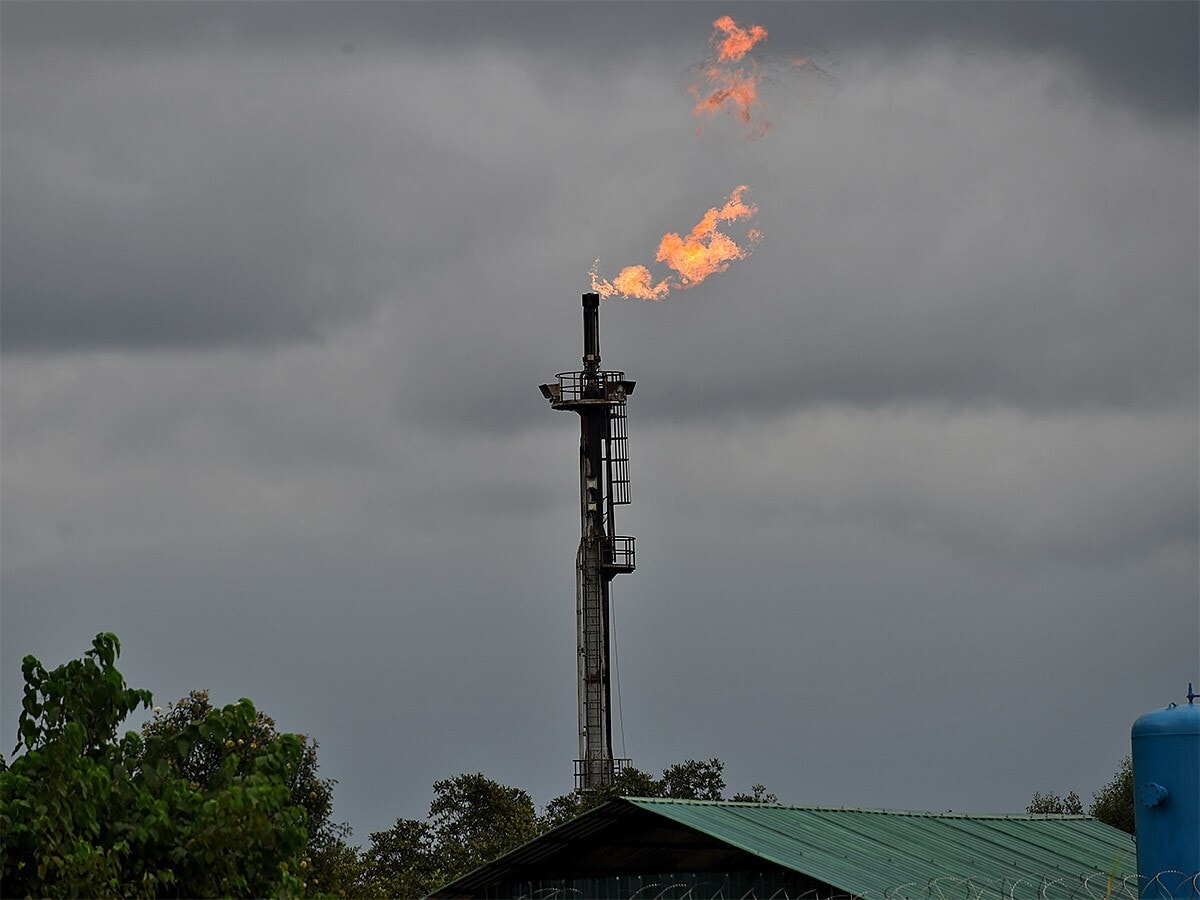

In January, independent UK onshore oil and gas development, production and operations company Angus Energy [ANGS.L] put itself up for sale. Management, led by Angus Energy CEO George Lucan, said that the “formal sales process” was influenced by a series of feelers and one indicative offer for some or all of its 51% interest in the Saltfleetby gas field in Lincolnshire.

The company said some potential bidders were even interested in buying the entire company.

Lucan said that another key driver for the sale offer was because the market had not properly valued the potential of its Saltfleetby operation – which is working towards first gas production – and its geothermal ambitions in the south-west of England as it looks to transition from fossil fuels. The huge surge in gas prices as a result of supply squeezes and faltering renewable energy output in the UK and Europe put Angus even more in focus.

Later, Angus said it had received a possible £21.6m offer from energy transition group Sound Energy [SOU.L], which holds the largest area of onshore petroleum licences in Morocco. This was, according to Morningstar, Sound’s fourth bid for the group, and above Angus’s market valuation of £12.46m.

$21.6m

Value of prospective offer Sound Energy made for Angus Energy

Sound shareholders would get around 62% of the enlarged company, which would “prioritise the development of gas assets in jurisdictions where high gas pricing, attractive fiscal terms and a beneficial regulatory environment are supportive to project development,” according to a report in Proactive Investors.

Sound said it had received support for the offer, representing some 13.92% of Angus Energy’s issued share capital.

Offer rubs off on Angus share price

Sound Energy’s proposed takeover of Angus is still making waves. The deadline to accept the offer was 11 March and has now been extended to 8 April. It is what is known as a ‘put up or shut up deadline’ where Sound Energy will have to commit to a decision or walk away.

Both Sound and Angus stated that “discussions and mutual due diligence between the parties remain ongoing” and that the extension would allow further time for these discussions to take place.

The delay could be down to issues over the price and factors encountered by Sound during due diligence, such as increased risk or vulnerability, or the impact of the Russian-Ukraine war and what that means in terms of the value of oil and gas companies. Domestic fossil fuel suppliers could benefit from a switch away from the dependence on Russian oil and gas imports.

The Angus Energy share price continues to shine despite the wait. It has risen 35% since the start of the year. The Sound Energy share price, however, has dropped 19%, an indicator of investor nervousness around potentially taking on gas and oil assets.

CEO believes Angus is undervalued

Lucan is firm that the market is undervaluing energy companies. “The resulting shortage of new gas supply, and deficit of renewable sources, is likely to lead to periodic crises such as we saw recently in the UK and a very high forward gas price in years to come,” he explains. The market is yet to factor the cash flow prospects of the Saltfleetby gas, he said in January. The Saltfleetby field is now expected to begin production in May.

The outbreak of the Russia-Ukraine war is likely to have boosted his case.

Sound Energy has not made many public comments on the proposed deal, but said in its possible offer statement: “The board of directors of Sound Energy consider that the potential combination would create an enlarged business with substantial capabilities that would be greater than the sum of the two parts.”

Deal or no deal?

As reported by Proactive Investors at the time of the Sound Energy offer, analysts SP Angel said it was fair and valued Angus at a healthy premium.

When and if Sound makes a formal offer, it is up to the Angus board to recommend for or against and shareholders will have the final vote to approve it.

Currently there is scepticism over a final deal. A recent Share Chat on the London South East website highlighted concerns over Angus Energy’s financial strength and lack of gas production to date. There were also fears that the offer still undervalued the potential of Angus, especially in the current climate.

Angus shareholders seem confident that the UK administration needs Saltfleetby and that “any gas which isn’t fracking will get fast-tracked” given the Russian crisis. If the Angus gas starts to flow, then Sound Energy may have to make a bigger noise with an increased bid.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy