1. Introduction

Artificial intelligence (AI) has become one of the most promising fields of technology in recent years, with the potential to revolutionise virtually every aspect of our lives. AI refers to the development of computer systems that can perform tasks which have traditionally required human intelligence, such as those which involve recognizing speech, interpreting data and making decisions.

The global AI industry is already worth billions of dollars and is set to grow rapidly in the coming years. According to a report by Grand View Research, global AI market size is expected to reach about $1.8trn by 2030, expanding at a compound annual growth rate (CAGR) of 37.3% between 2023 and 2030. The latest breakthrough in the sector, OpenAI’s ChatGPT, a generative AI chatbot which produces content indistinguishable from human output in some cases, took the world by storm in late 2022, and has ushered in a new paradigm of possibilities.

37.3%CAGR

AI market size growth between 2023 and 2030

Global spending on AI is expected to more than double between 2022 and 2026, from $118bn to $300bn, according to the International Data Corporation (IDC). It is estimated that Global AI software revenues will grow at a CAGR of 35%, with the healthcare industry leading the gains, followed by the advertising, consumer and public sectors. China is currently the global leader in AI research and development, and tops the charts in growth fuelled by AI innovation. In a survey that asked experts which country would make the biggest impact in AI between 2022 and 2025, 53% answered China. Baidu [9888.HK] is one of the country’s biggest AI investors and has recently launched its own ChatGPT rival, namely the chatbot Ernie. Meanwhile, Tencent’s [0700.HK] AI investments are mostly in healthtech.

2. Key players

The following companies are the major publicly-listed players in the industry.

Alphabet [GOOGL]

- Alphabet is known for its advanced AI algorithms that power services such as Google Search, Google Assistant and Google Translate, and has established Google Brain, a research project focused on deep learning.

- One of the most active AI investors, Alphabet’s largest and most famous AI investment was the acquisition of DeepMind Technologies for $600m in 2014.

- Google launched its own ChatGPT rival, the chatbot Bard, in March 2023.

Microsoft [MSFT]

- Microsoft has been making significant investments in AI technology over the last two decades. Microsoft Ventures launched an AI fund in 2016, backing start-up incubator Element AI, and Tact, an AI-powered CRM. Microsoft’s latest AI investments include TwoHat (a content moderation platform), OpenAI (the research lab responsible for ChatGPT), C3.ai (an AI software provider), and Nuance Communications (AI-powered voice recognition software).

- Microsoft’s Azure cloud platform hosts a range of AI services such as speech recognition, natural language processing (NLP), and computer vision. Microsoft has also developed several AI-powered applications such as Cortana, its virtual assistant.

- Microsoft is building the world’s first AI supercomputer. In March 2017, Microsoft, in partnership with NVIDIA [NVDA], unveiled a new hyperscale GPU accelerator called HGX-1, designed for AI workloads in the cloud.

IBM [IBM]

- IBM is a pioneer in the AI space, having developed the first AI-powered computer, Deep Blue, in 1996, which became known for beating the world chess champion.

- IBM’s Watson AI platform is being used across a range of industries, including healthcare and finance. It was also used to power General Motor’s [GM] upgraded onboard car system, OnStar Go.

- The Power8 server powered by NVIDIA Tesla [TSLA] GPUs is part of IBM's new PowerAI Enterprise suite. The company introduced the IBM Telum Processor in August 2021, enabling users to employ deep learning inference at scale.

3. Background

During the last few decades, the evolution of AI has primarily hinged on developments in linguistic, mathematical and logical reasoning capabilities. The next phase of AI advancements, however, focuses on developing emotional intelligence (EI). EI denotes the ability to distinguish emotions and use that input to determine appropriate communication and manage conflict. In recent years, deep learning has allowed for massive improvements in EI, helping machines to process the physical world, as well as facilitating their use across several industries.

Future AI systems that can exhibit EI which closely mimics human interaction will be the most successful, according to Bronwyn van der Merwe, group director at Accenture Song's [ACN] design and innovation arm Fjord Australia and New Zealand.

4. Growth drivers

Fuelling the growth of the AI sector is a surge in venture capital funding and investor interest. Funding for AI almost doubled in 2021, and total funding between 2015 and 2021 grew at a CAGR of some 48%, with the number of deals nearly tripling from 955 to 2,841, according to CB Insights.

Some of the sector’s main growth drivers include:

Advancements in Computing Power and Storage —

About 80% of AI industry growth is due to advancements in computing power, according to Dileep George, co-founder of machine learning start-up Vicarious. As computing power and storage capabilities continue to improve, it becomes possible to analyse larger and more complex data sets in real time, enabling the development of increasingly sophisticated AI algorithms. This has led to breakthroughs in a wide range of AI applications, including NLP, computer vision and machine learning.

Expansion of AI Applications —

As AI technology becomes more advanced, businesses are using it to address a growing number of challenges across a wide range of industries, including healthcare, finance and manufacturing. For example, healthcare workers are using it to analyse patient data and develop personalised treatment plans, as well as to facilitate processes such as genomics and drug discovery. Meanwhile, finance and cybersecurity businesses are using AI to detect fraud and malware, and manage risk. In the entertainment industry, AI is facilitating video editing and movie distribution.

Availability of Big Data —

As more and more data is generated and collected, it provides a rich base of information for AI systems to learn from. Developers can use this data to train machine learning algorithms, enabling them to recognize patterns and make predictions with a high degree of accuracy. With the proliferation of smart devices and the Internet of Things, the amount of data being generated is growing exponentially, facilitating the development of new AI applications. Research by IDC estimates that the amount of big data produced by the current digitised economy is increasing by 40% annually and will reach 163 trillion gigabytes by 2025.

5. The investment case for AI

The AI industry is still in the early stages of development, signifying high growth potential and an early-mover advantage for investors. While a large volume of AI innovation currently comes from start-ups, and very few AI companies are publicly listed, there are other ways of investing in the sector. Stocks in companies that have a focus on AI investments, such as Microsoft and Google, reap the benefits of such innovation through the start-ups they fund.

As companies look to leverage the power of AI to improve efficiency, reduce costs and enhance their products and services, the demand for AI solutions is likely to continue to grow. Recent breakthroughs in generative AI—such as the GPT-3 and GPT-4 updates to ChatGPT—have pushed the boundaries in the sector, bringing to life decades of research and development. About 80% of the US workforce could see generative AI perform at least 10% of their tasks, according to a paper published by GPT-4 creator OpenAI alongside researchers at the University of Pennsylvania.

Elsewhere, a March 2023 Goldman Sachs report predicts advancements in transformative technology will create a boom, boosting global GDP by 7% over a 10-year period. In the US alone, AI could increase productivity by approximately 1.5 percentage points per year for more than a decade.

Young companies are disrupting traditional industries, such as insurance, with AI. For instance, Insurtech company Lemonade is using AI to analyse ever-more comprehensive data inputs at speed, while it uses Cooper, its own internal bot, to help automate processes within the business, as chief financial officer Tim Bixby explained to Opto Sessions.

6. ETFs that provide exposure to AI

Several ETFs are designed to provide exposure to companies that stand to benefit from the increased adoption of AI technology and robotics.

GLOBAL X ROBOTICS & ARTIFICIAL INTELLIGENCE THEMATIC ETF [BOTZ]

The BOTZ ETF is diversified across multiple industries, including healthcare, industrial automation and ecommerce, among others. It includes companies that are involved in the development and manufacturing of robots and other automation technologies, as well as those that are developing software and AI algorithms.

Click here to see the fund’s top 10 holdings.

ISHARES ROBOTICS AND ARTIFICIAL INTELLIGENCE ETF [IRBO]

The IRBO ETF is designed to provide investors with exposure to the potential growth of the robotics and AI industry, with its holdings spread across companies that are involved in the development and manufacturing of robots, automation technologies and AI software.

Click here to see the fund’s top 10 holdings.

FIRST TRUST NASDAQ ARTIFICIAL INTELLIGENCE & ROBOTICS ETF [ROBT]

This ETF provides focused exposure to the AI and robotics sectors through a broad range of companies across different industries, including healthcare, industrials, information technology and consumer goods.

Click here to see the fund’s top 10 holdings.

7. Innovation & development

As AI technology continues to improve and mature, it is likely to become increasingly integrated into our daily lives, creating new business opportunities and driving economic growth. Several key innovations are set to shape the future of the field:

Deep learning: Deep learning is a subset of machine learning that involves training artificial neural networks (ANNs) on large amounts of data. ANNs are designed to imitate the way a human brain works. As the amount of available data continues to grow, and as computing power continues to increase, deep learning is likely to become even more powerful and effective, enabling AI systems to make more accurate predictions and better decisions. Deep learning applications include crop monitoring in agriculture and teaching autonomous vehicles the process of steering a car.

NLP and Generative AI: NLP is a field of AI that focuses on enabling computers to understand and interpret human language. As NLP technology continues to improve, it is likely to become increasingly integrated into our daily lives, powering virtual assistants, chatbots and other conversational interfaces. The global market revenue from chatbots alone is set to exceed $10bn by 2026, growing at a CAGR of 22.9% between 2022 and 2026, according to Statista.

Explainable AI: Explainable AI refers to AI systems that are designed to provide clear explanations for their decisions and recommendations. This is becoming increasingly important as AI is integrated into more sensitive areas, such as healthcare and finance, where it is essential to be able to understand how decisions are being made.

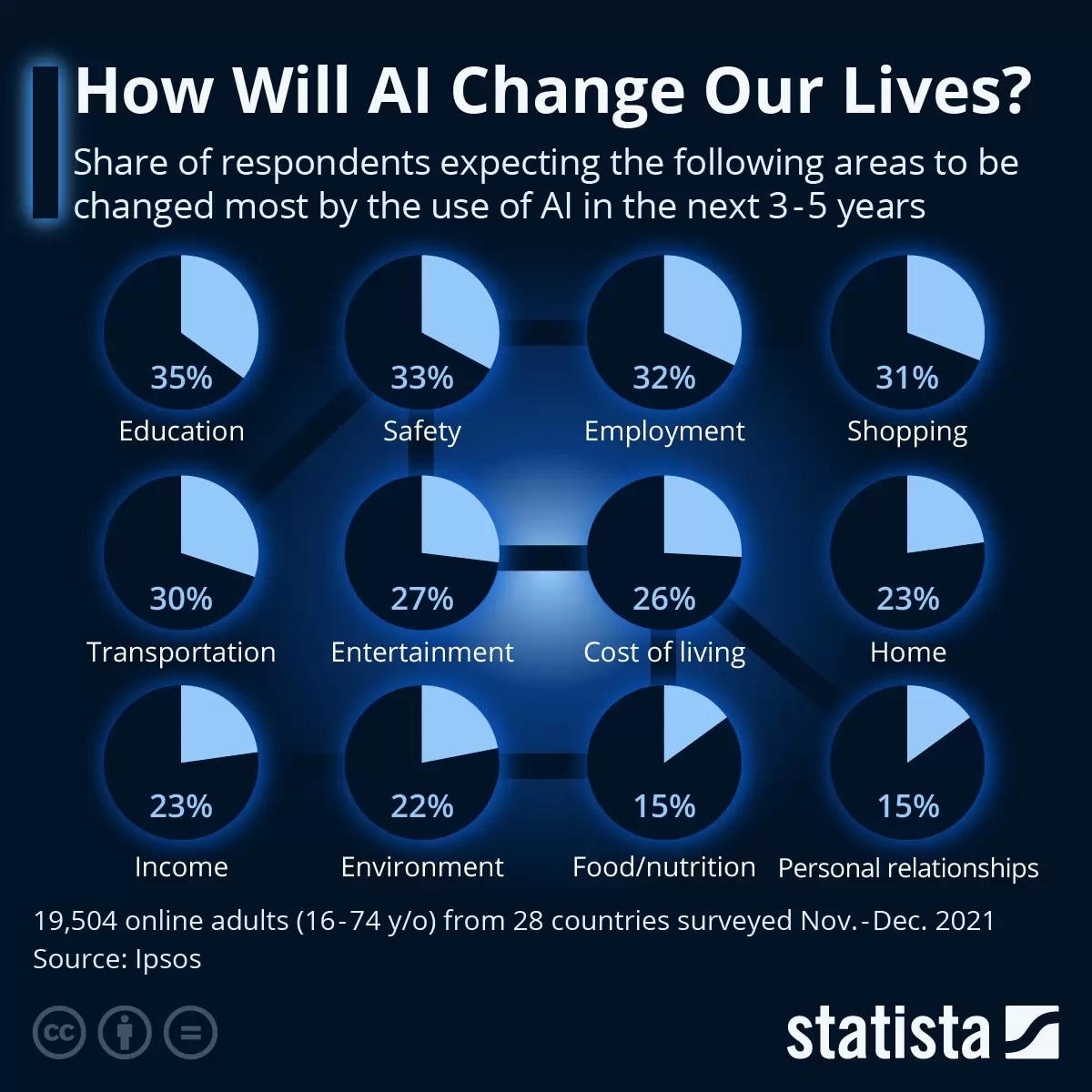

AI appears to be the way forward, with the potential to transform many different industries, as the Statistainfographic below visualises. However, these advancements also come with risks. Given it is a complex and rapidly evolving field, companies operating in this space face significant technological and regulatory hurdles. Goldman Sachs forecasts that generative AI systems could result in the automation of about two-thirds of jobs in the US and Europe, or roughly 300 million, bringing “significant disruption” to the labour market. However, the productivity boost may be twofold: employees will spend time on more valuable tasks, and the displaced jobs will be replaced with new kinds of work.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy