In the most recent instalment of a long running series covering different sectors, Chelsea Rodstrom, a research analyst at Global X, analyses the Chinese information technology sector, and what investment opportunities this might present.

For years, China has focused on moving its industries up the global value chain, including the development of a robust domestic Information Technology (IT) sector.

China’s supportive government policies, along with its massive domestic market of one billion internet users and 882 million smartphone users have given domestic IT firms room to flourish.1,2

China’s rapid advances in next-generation fields like 5G, mobile payments, ecommerce and artificial intelligence (AI) have not gone unnoticed by the international community. Other countries are increasingly attentive to the meteoric rise of China’s IT firms, as they seek to protect their own domestic high-tech industries from China’s growing competitiveness.

As the next instalment in an ongoing series about 11 major economic sectors in China, this piece will examine the Chinese Information Technology sector, which is tracked by the Global X MSCI China Information Technology ETF [CHIK].

Key Stats

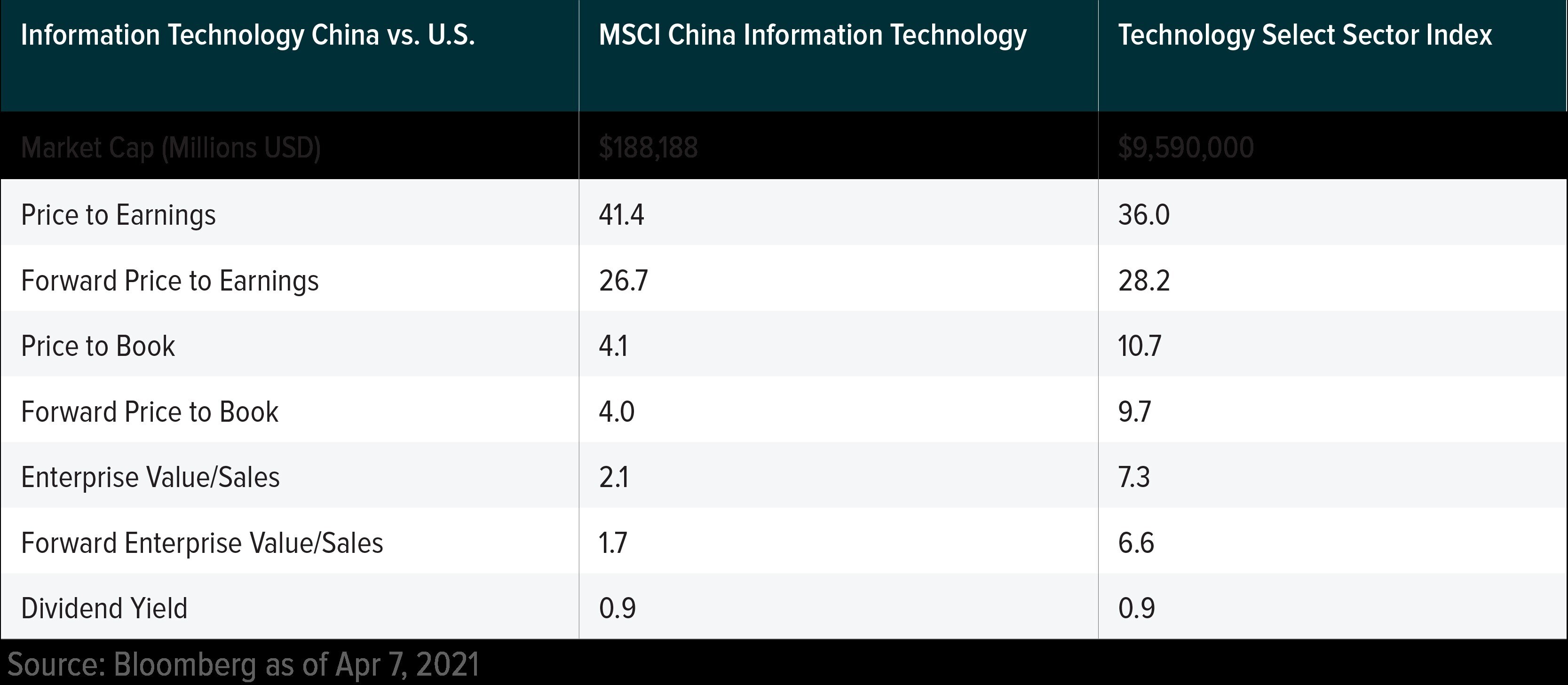

Economic output from telecommunications, software and IT in 2020 was $587.4bn, according to the Chinese Ministry of Statistics. Value added by the sector grew by an impressive 16.9% last year, despite the fact that COVID-19 led to low or negative growth rates for several other sectors. Prior to the pandemic, growth was 18.7% in 2019, only 1.8% higher than 2020’s figures, showing the resilience of this sector amid a difficult global economic environment.3,4

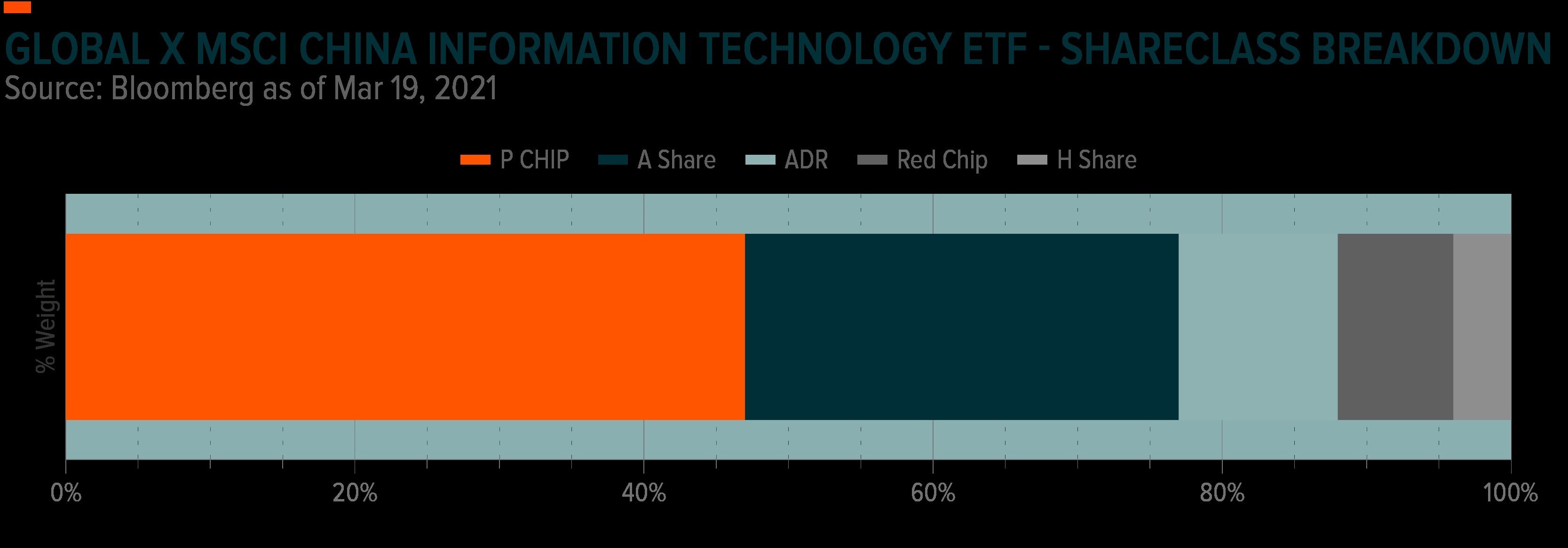

American Depositary Receipts (ADRs) are stocks of Chinese companies listed on American stock exchanges. A shares are listed on domestic stock exchanges in China and have been historically difficult to access. P Chips are stocks of companies operating in China, listed in Hong Kong, and incorporated in the Cayman or British Virgin Islands. Red Chips are stocks of companies based in China, incorporated abroad, and listed in Hong Kong. H shares are stocks of companies incorporated in China and listed in Hong Kong.

Background on the IT sector in China

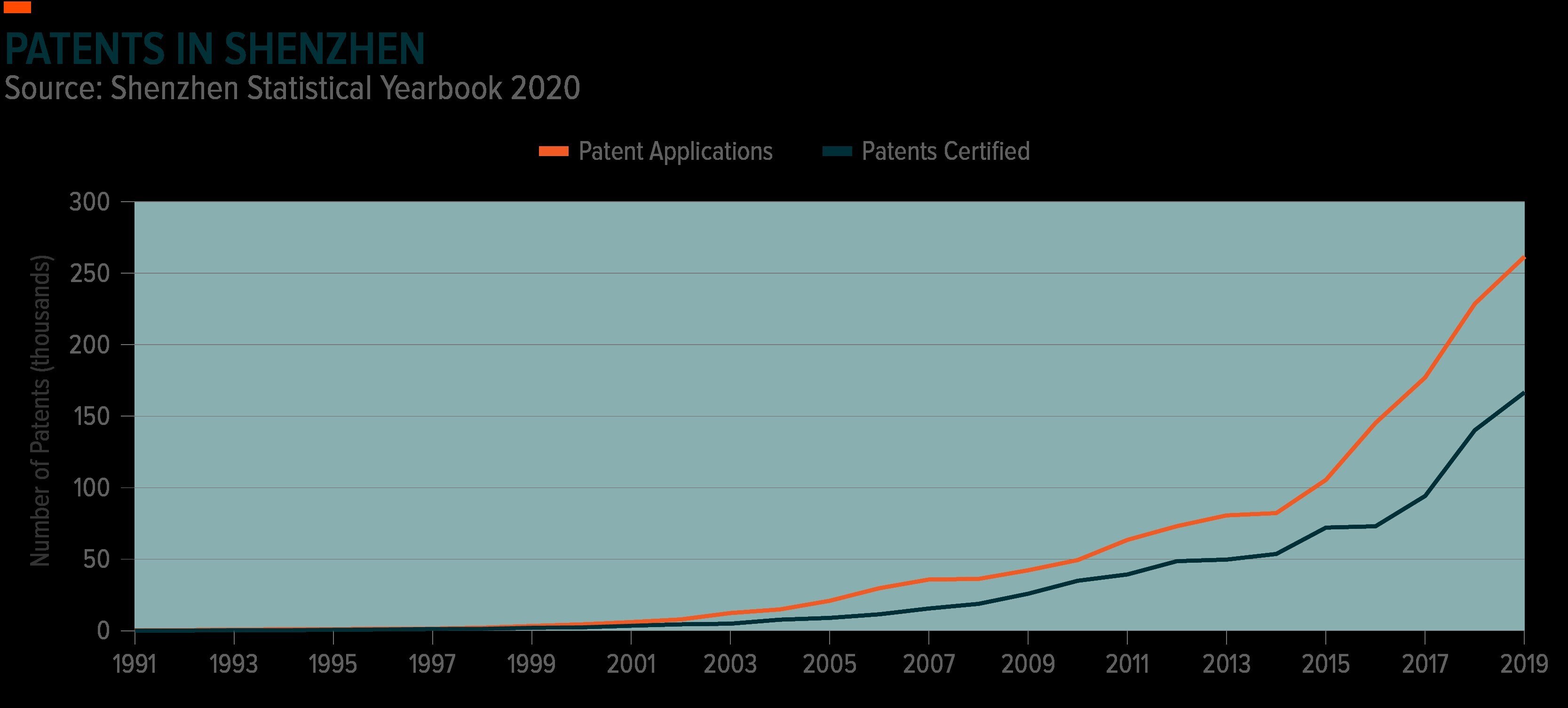

Perhaps no city better captures the quick ascent of China’s IT centre than Shenzhen. In 1980, Deng Xiaoping established a Special Economic Zone (SEZ) in Shenzhen, which at the time was a small city surrounded by underdeveloped villages near the Hong Kong border. As an SEZ, Shenzhen was granted unique privileges of relaxed price controls, foreign direct investment and other capitalist market policies unprecedented since the founding of the People’s Republic of China in 1949. Shenzhen is now a bustling metropolis that boasts a GDP of $429bn, or approximately 3% of China’s GDP, and is home to tech giants like Tencent [0700], Huawei, ZTE [0763] and drone-maker DJI. About 90% of the world’s electronics come from Shenzhen.5

In 1991, there were only 261 patent applications in the Shenzhen SEZ. By 2019, that number skyrocketed about a thousand times to 261,502.

Shenzhen is not the only innovative city in China often compared to Silicon Valley. Shortly before the founding of the Shenzhen SEZ, a cluster of private tech enterprises began to emerge in an area of Beijing known as Zhongguancun.6

The area became known for its crowded electronics markets and the tech giants that it nurtured; Lenovo [0992], JD.com [9618], Kuaishou [1024], Baidu [9888], Bytedance, Didi [DID], Xiaomi [1810] and Meituan [3690] all have roots in Zhongguancun. Zhongguancun and Shenzhen are both important to the Chinese tech industry and worth paying attention to.

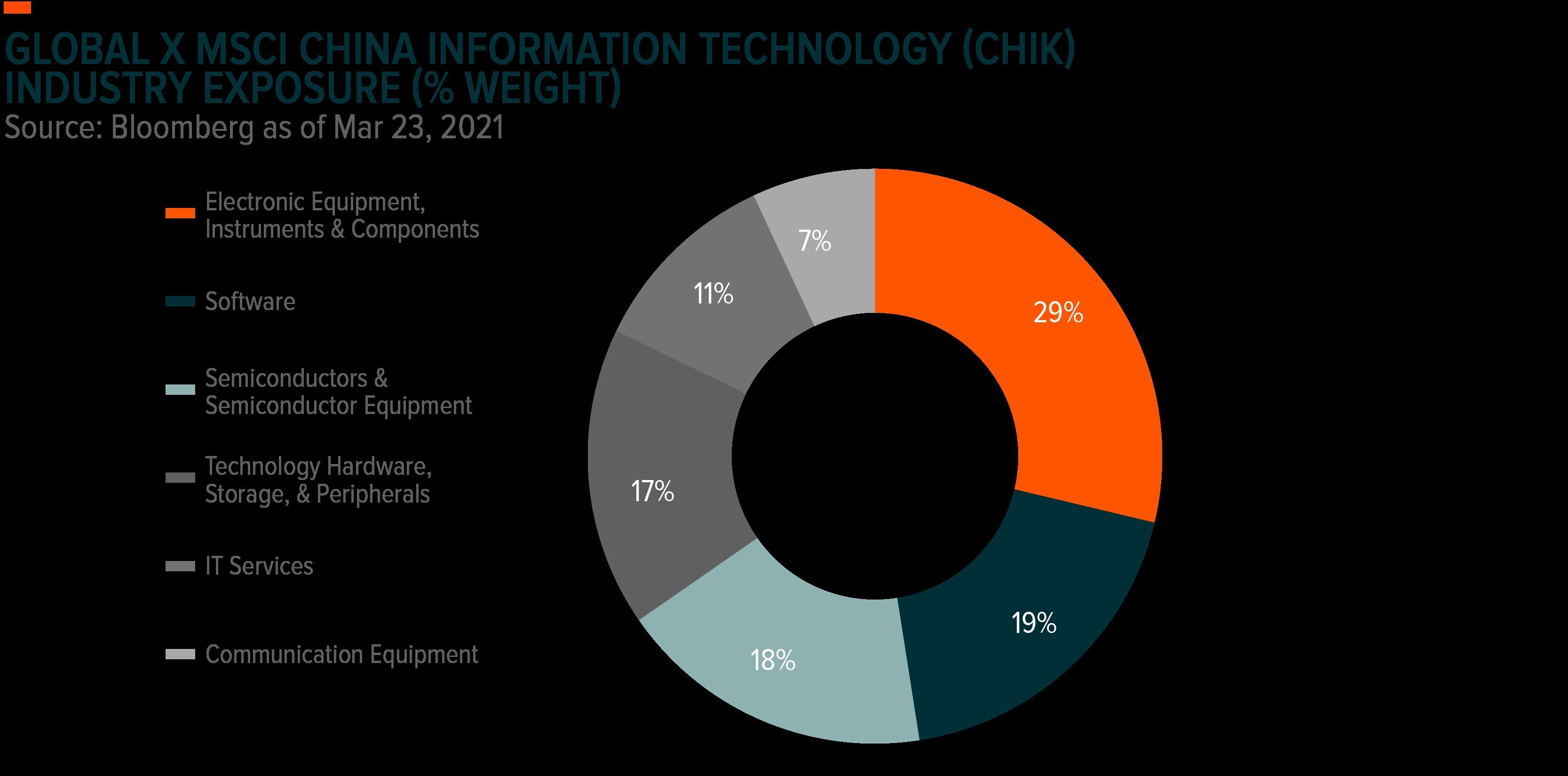

Electronic equipment, instruments and components

The IT sector consists of several industries, each with their own drivers and features. The largest industry group is electronic equipment, representing over one third of the sector.

China’s extensive supply chains, fixed capital investment, and low cost of labour has made it a prime destination for the manufacturing of electronic equipment, instruments and components. China exported approximately $1.4trn in electronic equipment and computers in 2019.7

In response to growing demand from emerging technologies like 5G and electric vehicles, in February 2021 the Chinese Ministry of Industry and Information Technology (MIIT) announced a plan to achieve $322.35bn in total electronic components sales and develop 15 electronic component companies with revenue over the $1.5bn mark by 2023.8

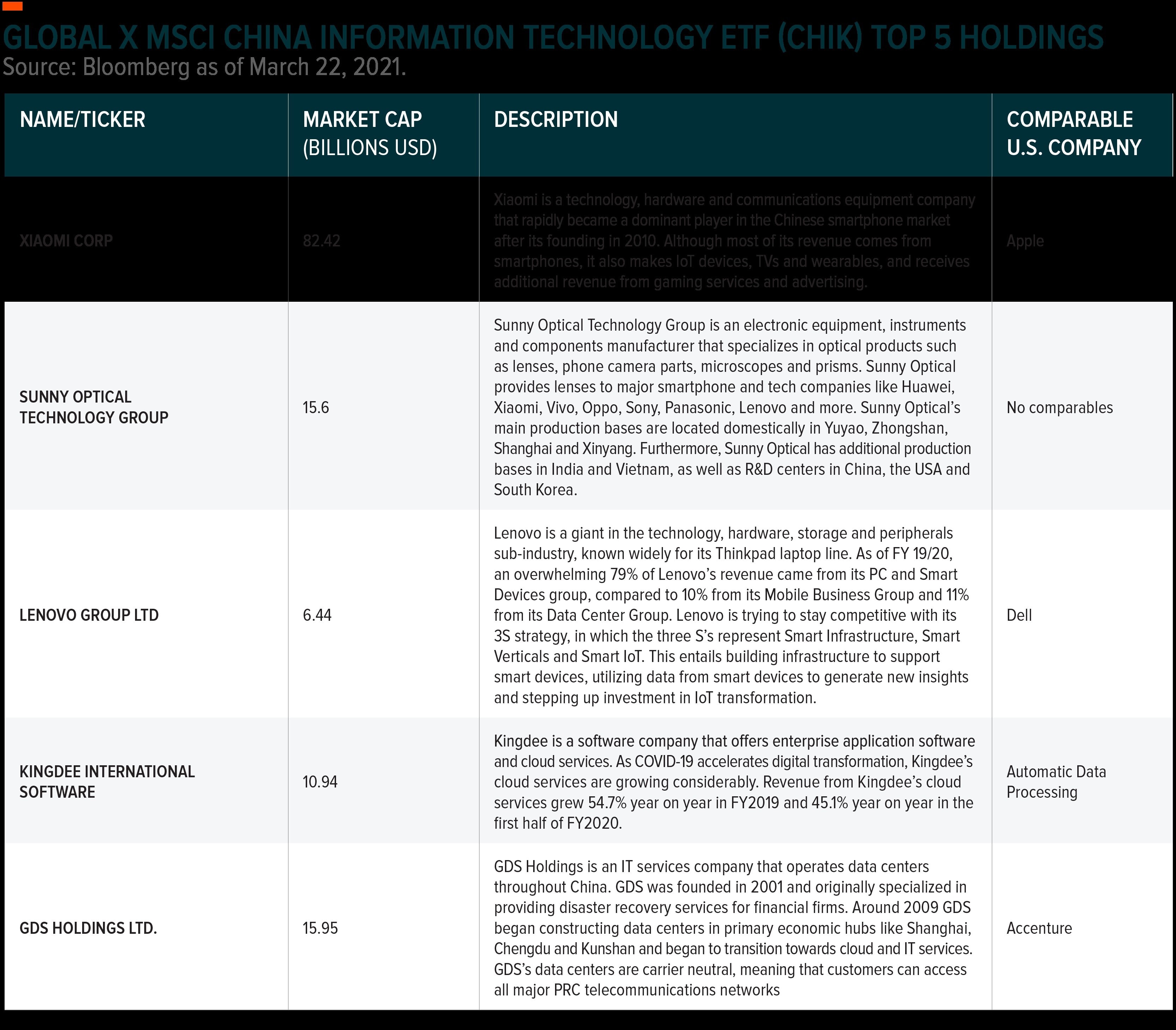

Sub-industry leaders: Sunny Optical [2382], Kingboard [0148], AAC Technologies [2018]

Semiconductors and semiconductor equipment

The third largest industry group is semiconductors and semiconductor equipment, which makes up 18% of the sector. One of the major themes in the Chinese semiconductor industry is the need to establish self-sufficiency. China imports upwards of $300bn in semiconductors every year and lacks the technological expertise needed to fulfil its own domestic need for advanced semiconductors.9

Through policy initiatives like Made in China 2025, the Chinese government has been trying to close the technology gap between local companies and well-established companies in the US, South Korea, Taiwan and Japan.

Most of China’s investment into the semiconductor industry on the national level is carried out through the National Integrated Circuit Industry Investment Fund, which was established in 2014 with $21.2bn in capital, around $14.2bn of which went into semiconductor manufacturing by the end of 2019.

In 2019, the Chinese government poured another $31.2bn into the fund to further stimulate investment in this strategic industry.10 In the fourteenth five-year plan (FYP), which was released in March 2021, China included third-generation semiconductor technology in a list of technologies it wants to support with scientific research programs.11

Out of the $1.4trn that the government plans to spend on the IT industry until 2025, roughly $155bn is earmarked for semiconductors.12 So far these initiatives have had limited success, but Beijing hopes to turn that around. US sanctions against Huawei in 2019 and against SMIC [0981] in 2020 underscore how the Chinese semiconductor industry is vulnerable to political risk.

Sub-industry leaders: Xinyi Solar [0968], Huahong [1347], Longi Green Energy [601012]

Technology, hardware, storage and peripherals

China’s tech and hardware industry has grown quickly with some companies already establishing notable footprints abroad. Lenovo acquired the now well-known ThinkPad laptop line from IBM [IBM] in 2005 and is today a globally renowned brand.

Leading smartphone-makers Xiaomi and Huawei are now formidable competitors with brands like Apple [AAPL] and Samsung [005930] in certain regions, including Europe. China produces 90% of the world’s PCs, 90% of mobile phones and 70% of televisions.13 China’s evolving role in the global hardware industry simply cannot be understated.

Sub-industry leaders: Xiaomi, Lenovo, Ninestar [002180]

Software

Chinese tech giants that specialise in hardware, ecommerce or telecommunication also tend to have a strong presence in the software industry.

In 2020, MIIT published a list of the top 100 software companies in China and the top positions were occupied by companies known for other lines of business, like smartphone-makers Huawei, ZTE, Xiaomi and appliance-maker Haier [6690].14

One notable characteristic of the Chinese software industry is the lack of software-as-a-service (SaaS) giants. Concerns over data security and the reluctance of large companies and state-owned enterprises to shift away from pre-existing investments in traditional software solutions are both factors that prevented the emergence of SaaS giants.15

Whereas eight of the top twenty American software companies in 2019 had a SaaS business model, the same could not be said for any of the top twenty Chinese software companies.16 This is indicative of how there is still room for growth in the software industry as Chinese companies embrace the latest technologies.

Sub-industry leaders: Kingdee [0268], Kingsoft [3888], China Youzan [8083]

Communications equipment

China’s massive domestic market, with nearly one billion internet users, has directly benefitted China’s communications equipment industry.

Huawei and ZTE are major global leaders in 5G equipment with 28% and 9% of global market share of networking equipment, respectively.17 Both of these companies must contend with US sanctions implemented during the administration of former US president Donald Trump, yet continue to benefit domestically from China’s extensive rollout of 5G networks.

The establishment of a national 5G network should support innovation and experimentation across other emerging industries in China, such as the internet of things (IoT), AI, and telemedicine.

Sub-industry leaders: BYD Electronic [0285], ZTE, Hengtong Optic [600487]

IT services

Some of the leaders in Chinese IT services are DHC Software [002065], GDS Holdings [9698], TravelSky [0696] and Kingsoft.

GDS Holdings has data centres around the country and provides cloud services to a wide array of firms. As the name would suggest, TravelSky provides IT solutions primarily to airlines and other tourism-related businesses. Meanwhile, DHC Software specialises in industry software development and other IT services for a diverse range of industries.18

Sub-industry leaders: GDS Holdings, TravelSky, Kingsoft Cloud

Long-term tailwinds for China’s IT sector

National strategic policy

The Made in China 2025 plan was issued by the State Council in May 2015. The 10 year plan, which takes some inspiration from Germany’s Industry 4.0 plan, is designed to comprehensively upgrade China’s manufacturing so that the country can maintain medium to high-speed growth.19

Among the ten critical industries targeted for increased growth are IT, AI, power equipment, chipmaking and advanced robots.

Chipmaking stands out because of how crucial it is to the competitive power of the Chinese tech industry. Although China has the world’s fourth largest chip foundry, SMIC, its technology still lags competitors in South Korea, Japan, Taiwan and the US.

As the recent sanctions against Huawei demonstrated, Chinese tech companies can be vulnerable to foreign policy. Huawei’s smartphone sales tanked by 40% in the last quarter of 2020 because of US sanctions.20

One of the goals of Made in China 2025 is to fix this vulnerability. Beijing’s consternation over dependence on foreign technology was palpable in the fourteenth FYP, which was approved in March 2021 at the thirteenth National People’s Congress.

The fourteenth FYP stands out because of its emphasis on technological innovation and fostering a dual-circulation economy that can withstand external shocks. In particular, the plan sets out a goal of maintaining 7% annual growth in R&D spending over the next five years. Both Made in China 2025 and the fourteenth FYP underscore Beijing’s increasing prioritisation of the IT sector.

Growth of ecommerce

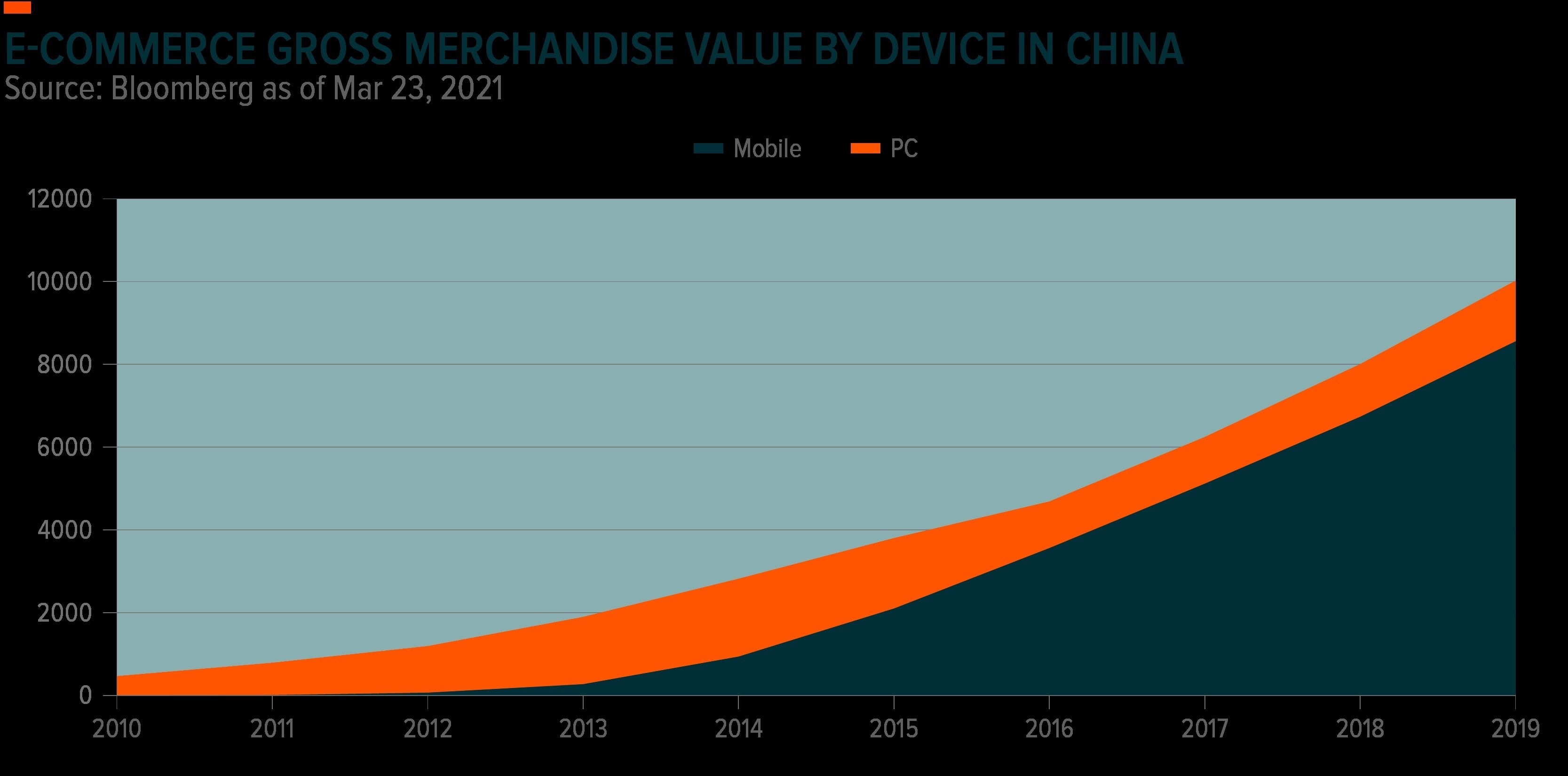

The growth of China’s ecommerce market over the last 15 years has been closely linked to the growth of domestic smartphones and internet services. In 2005, China’s ecommerce market accounted for less than 1% percent of the global market, compared to the US market which accounted for 34.9%.

By 2016, China’s ecommerce market made up 42% of global sales, compared to 24.1% by the US.21 Chinese ecommerce has been boosted by a broad adoption of mobile payments, as evidenced by the fact China’s mobile payment penetration rate stood at 81% in 2019, compared to 29% in the US.22 Continued growth of ecommerce in China will likely propel significant smart phone sales and 5G investments across the country.

While growth in e-commerce sales through PC devices stagnates, e-commerce sales through mobile devices has grown explosively, in part because of the rapid growth of mobile payments.

Increased technology adoption

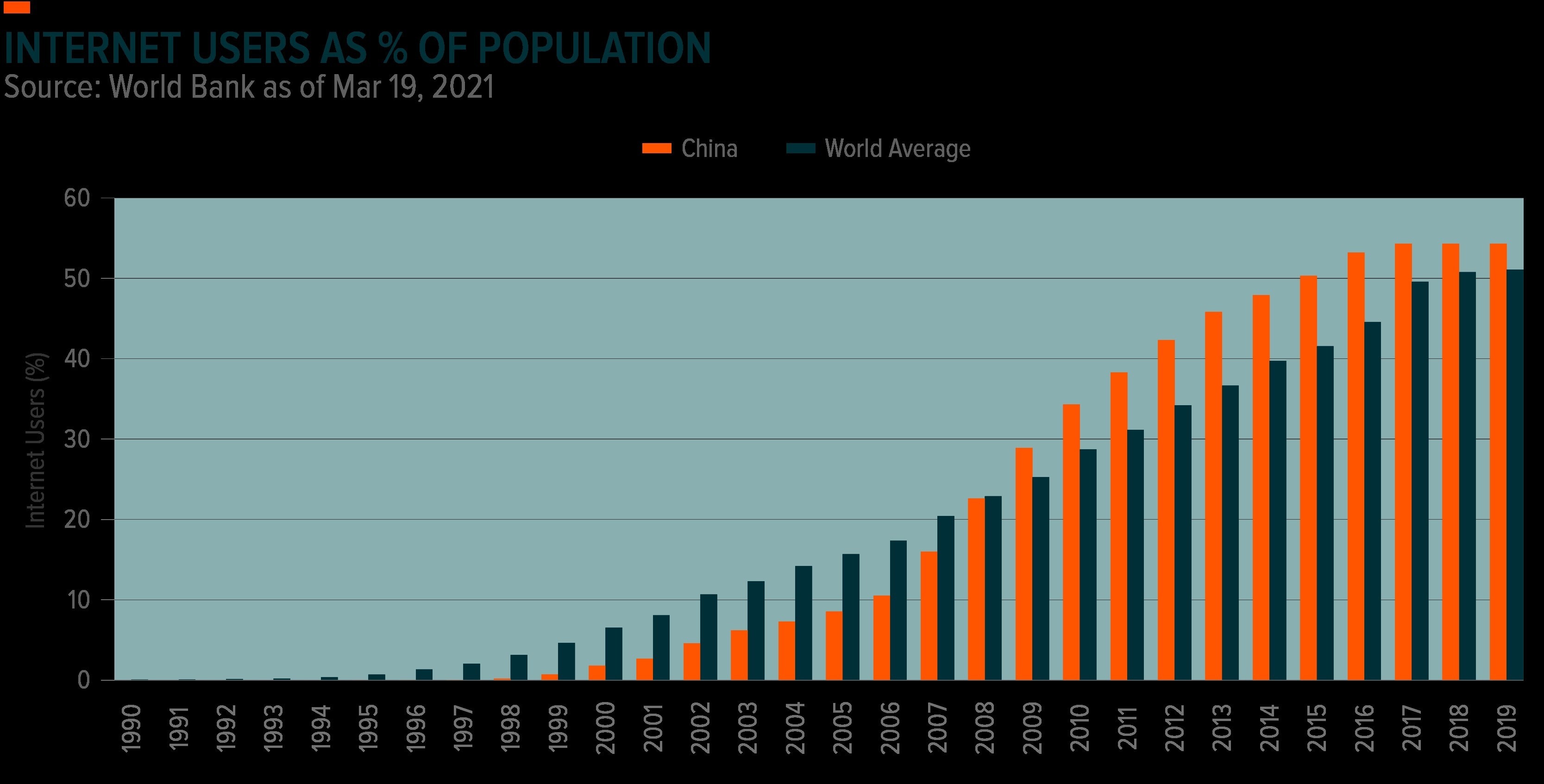

China is quickly adopting technologies both old and new. China’s internet coverage rate rose from 38.3% in 2011 to 59.6% in 2018.23 Although this number is still low compared to developed countries, some of which have internet penetration rates above 90%, China’s massive population means that it has three times as many internet users and 3.75 times as many mobile phone users as the US.

The rapid 4G adoption rate of these online consumers provides the backbone for data-intensive media consumption, mobile payments, and chat features. China is currently rolling out 5G technology to enhance internet speeds.

It has already installed around 700,000 5G bases and plans on installing 600,000 more by the end of 2021.24 A functional and integrated 5G network could form a critical foundation for the emerging IoT industry and AI, helping give China a competitive edge over other major economies.

Growing foreign demand for technology made in China

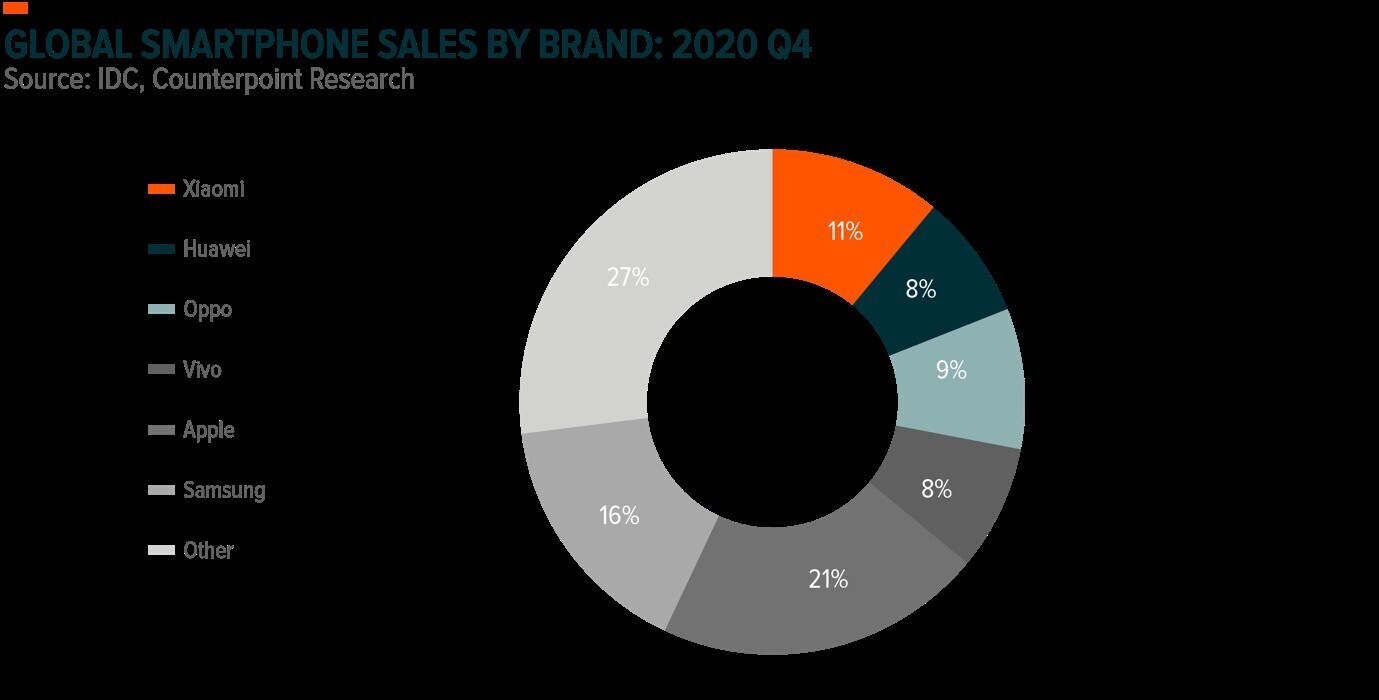

While Chinese tech companies are still building their global presence, their products are gaining popularity abroad. As of Q4 2020, Xiaomi, Huawei, Vivo and Oppo phones made up 11%, 8%, 8% and 9% of global market share respectively.25

In Europe, Huawei went from having a near-negligible market share of 1% back in 2013 to hovering around 18% for most of 2019 and 2020, putting it at third place behind Apple and Samsung.

There are some markets where Chinese products are already preferred, like India where Xiaomi sold 41 million phones in 2020, putting it at first place with a market share of 27%.26 Meanwhile, Lenovo came in first place for the most worldwide PC vendor unit shipments in Q4 2020, with a total of 21,491,000 units shipped.27

Oppo, Xiaomi, Huawei, and Vivo (all Chinese brands) comprised 36% of global sales in Q4 2020. Huawei noticeably dropped down to 8% in Q4 2020 from 14% in Q4 2019, likely due to pressure from US sanctions.

Capital markets expansion

As a result of decades of regulatory reform, China’s markets continue to open up. This has allowed more Chinese IT sector companies to obtain foreign capital. In 2009, the Shenzhen Stock Exchange launched the ChiNext board, which is focused on technology stocks.

Over the last two years, the ChiNext platform has grown substantially and now has 912 listed companies and a total of $1.66trn in stock market value.28 In 2019, the Shanghai Stock Exchange launched its Science and Technology Innovation Board, also known as the STAR Market, which aspires to be a Nasdaq-like platform. Just two years after its founding, the STAR market now has 230 listed stocks and a total of $519.68bn in market capitalisation.29

Headwinds and scrutiny

The IT industry is important for national security and the sudden rise of Chinese tech giants has been met with scrutiny in the West, sometimes in the form of sanctions or trade restrictions.

In 2019, the Trump administration restricted the export of US technology to Huawei. In 2020, the US Department of Commerce sent a letter to American companies stating that certain exports to SMIC would require a special license. And in 2021, Xiaomi was banned from listing in the US for alleged ties to the Chinese military (it is currently listed in Hong Kong).

These sanctions have not been fatal to the aforementioned companies, which have focused most of their growth on the domestic and regional markets, but present a significant political risk worth consideration.

Conclusion

The Chinese IT sector has made leaps and bounds since the formation of Zhongguancun and the establishment of the Shenzhen SEZ. It has been able to do so in no small part due to its large population and quick adoption of digital technologies. Going forward, there are long-term tailwinds that should continue to push growth in the Chinese IT sector as it aspires to be a global competitor taking on giants in Silicon Valley, Seoul and Tokyo.

This article was originally written and published by Global X. The original article, which includes footnotes where readers can find the original source material, can be found here.

SEI Investments Distribution Co. (1 Freedom Valley Drive, Oaks, PA, 19456) is the distributor for the Global X Funds.

Check the background of SIDCO and Global X’s Registered Representatives on FINRA’s BrokerCheck

Investing involves risk, including the possible loss of principal. International investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Securities focusing on a single country and narrowly focused investments may be subject to higher volatility. Investments in securities in the Technology sector are subject to rapid changes in technology product cycles; rapid product obsolescence; government regulation; and increased competition, both domestically and internationally, including competition from foreign competitors with lower production costs. Technology companies and companies that rely heavily on technology tend to be more volatile than the overall market, and are also heavily dependent on patent and intellectual property rights. Sub-industry leaders based on market cap. CHIK is non-diversified.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Carefully consider the funds’ investment objectives, risks, and charges and expenses. This and other information can be found in the funds’ full or summary prospectuses, which may be obtained at globalxetfs.com. Please read the prospectus carefully before investing.

Global X Management Company LLC serves as an advisor to Global X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which is not affiliated with Global X Management Company LLC. Global X Funds are not sponsored, endorsed, issued, sold or promoted by MSCI nor does MSCI make any representations regarding the advisability of investing in the Global X Funds. Neither SIDCO nor Global X is affiliated with MSCI.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy