What is options trading - and how are they traded?

Find out what options are and learn how you can get started with options trading.

What are options?

An option is a type of derivative contract for an underlying asset, such as a share, commodity or fund. An options contract gives the buyer of the contract (also known as the holder) the right, but not the obligation, to buy or sell an underlying asset at a set price (also known as the strike), at a specific future date and time (known as the expiration date). Alternatively, buyers can receive a cash payment based on the difference between the settlement price and the strike price, where the option is cash settled. Options available on our platform are OTC options and are cash settled.

How do options work?

Every option contract has what’s known as an intrinsic value. It’s not the same as the underlying asset’s current market value, which can be impacted by everything from supply and demand to significant geopolitical events. The intrinsic value is calculated from the difference between the option's strike price and the underlying asset's market price. The more significant this difference, the more valuable the option. For example, if an index price rises, a call option on that index would gain value.

Increased volatility in the underlying asset can raise the option's price. When the underlying asset has greater price fluctuations, there's a higher chance of significant price moves, making the option more valuable.

Traders can realise profits or losses by closing their positions before expiration. For cash-settled options, there's no acquisition or disposal of a physical asset, so if the option is ‘in-the-money’ at expiration, the holder receives the cash difference.

The price of a cash-settled option can be broken down into intrinsic value and time value (or extrinsic value). Intrinsic value for a call option is how much the underlying market is above the strike price. Time value accounts for the probability of the underlying moving further into the money before expiration. It’s important to bear in mind that an increase in volatility also raises the possibility of an option swinging toward being ‘out of the money’ at expiration.

The two main styles of options available are American-style options and European-style options. American options can be exercised at any time before they expire, whereas European options can only be exercised in a set period just before their expiration date.

Why do people trade options?

Options can be a powerful way to hedge an existing position on an investment. They allow you to secure a return on an investment that’s volatile or unproven, without making as much of a loss as if you invested directly in the asset. Taking out long option positions gives you certainty over your risk, as you know your maximum loss for the position is limited to the premium paid for the contract. However, the maximum loss on selling a call is unlimited.

Even if you don’t exercise an existing option, trading options can be beneficial. Buyers may pay a higher premium to secure an attractive strike price, particularly if your call option strike price is currently much lower than market value. If the market value falls, and it’s no longer worthwhile to exercise them, you’ve made a profit from the premium.

Call and put options

There are two main types of options contracts: calls and puts. Buying a call gives you the right to buy an underlying asset at a predetermined price when entering the options trade; the buyer of the call ideally wants the price of the underlying asset to be higher than the strike on the expiry date.

Buying a put gives you the right to sell an underlying asset at a strike price determined when entering the options trade; the buyer of the put ideally wants the price of the underlying asset to be lower than the strike on the expiry date.

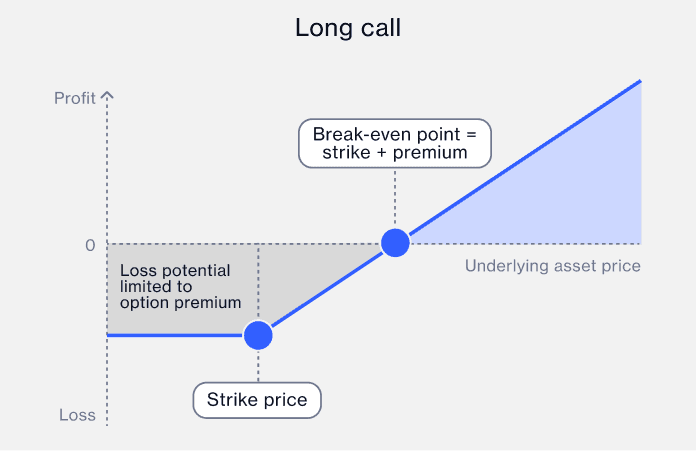

Call options explained

A call option provides the holder (buyer) with the right (but not an obligation) to buy an underlying asset at the strike price. For cash-settled options, buyers receive a cash payment if the underlying price is above the strike price, at a specified expiration date and time.

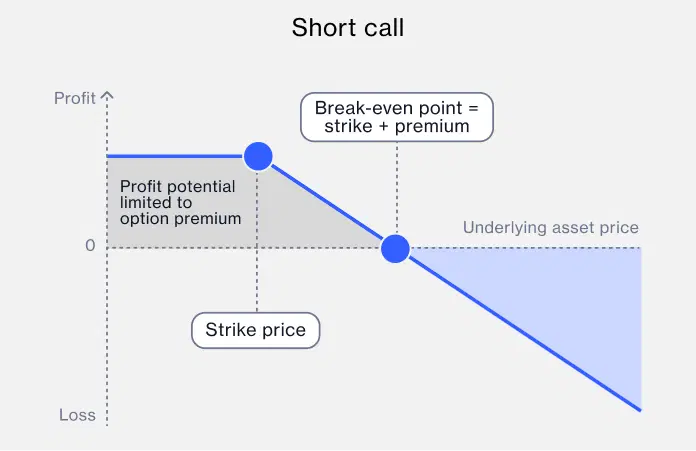

If you are the writer (seller) of a call option, you are obliged to sell the underlying asset. For cash-settled options, writers make a cash payment if the holder/buyer exercises the option.

Long call options example

Imagine that a trader expects the FTSE 100 index to rise over the coming month. The trader buys a call option at a strike price (the pre-agreed price at which an options buyer will settle the contract) of 7,500 points, expiring in one month.

The options we offer on the underlying indices have a multiplier of 1. This means that one option contract refers to one share of the underlying index. The premium for this option is $60.

One month later, when the option expires, the FTSE 100 has risen to 7,650 points. This means that the trade is ‘in the money’, which is when the current market price of the underlying asset is favourable for the holder of the option, by $150 (7,650-7,500), and is therefore favourable to the trader.

In this scenario, the trader has generated a net profit of $90 after the cost of the premium ($60) is subtracted from the in-the-money value ($150).

However, if after one month the index settles at the same level as the strike price of 7,500 points, this is known as being ‘at the money’, where the strike price and the underlying asset’s current price are the same. In this scenario, the option would not be exercised, and the trader would therefore lose the premium of $60.

If the underlying asset price is below the level of the strike price, it’s ‘out of the money’, which is when the current price of the underlying asset is unfavourable for the buyer. The option would not be exercised, and the trader would lose the premium of $60.

Short call example

Let’s assume that a trader expects the FTSE 100 index to remain stable, or slightly decline, over the coming month. The trader sells a call option with a strike price of 7,400 points, expiring in one month. The trader receives a premium of $50 for the sale of the option.

One month later, when the option expires, the FTSE 100 settles at 7,350 points. In this case, the option buyer will not exercise the contract, meaning the trader, who sold the contract, gets to keep the premium of $50 as profit.

However, if the FTSE 100 settles at expiration above 7,400 points, then the buyer will exercise the contract. If the price is significantly above this level, then the seller can incur large losses. For example, if the FTSE settles at 7,500 points, the contract will be exercised and the trader (the seller of the contract) will make a loss of $100.

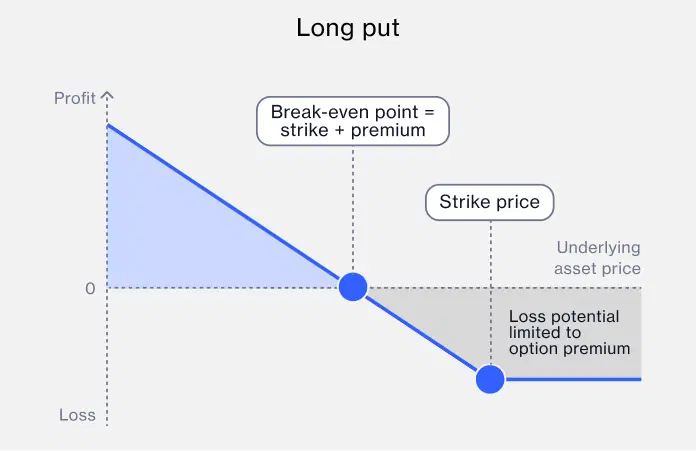

Put options explained

A put option provides the holder (buyer) with the right (but not an obligation) to sell an underlying asset at the strike price. For cash-settled options, buyers receive a cash payment if the underlying price is below the strike price, at a specified expiration date and expiration time.

If you’re the writer (seller) of a put option, you are obliged to buy an underlying asset or, where an option is cash-settled, make a cash payment if the holder exercises the option.

Long put option example

In this example, a trader buys a put option for the FTSE 100 with a strike price of 7,450 points, expiring in one month. The premium for this option is $40.

One month later, when the option expires, the FTSE 100 has fallen to 7,350 points. This means that the trade is ‘in the money’ by $100. The net profit, after deducting the premium of $40, would be $60.

However, if the trader’s assumptions were wrong and the FTSE 100 rises to 7,550 points, the option will expire out of the money. The trader’s loss will be capped at the options premium of $40.

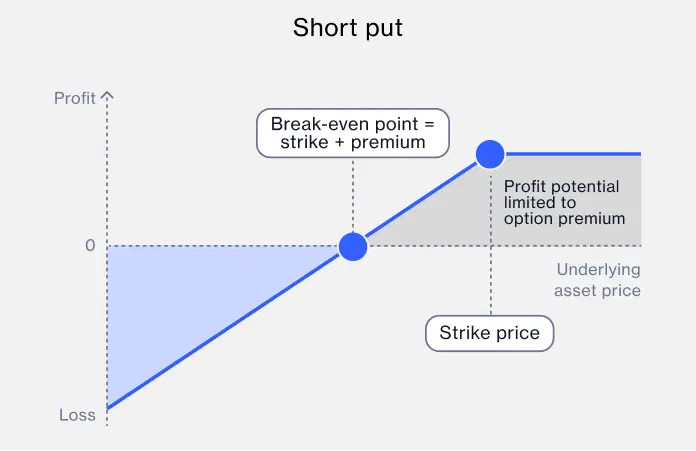

Short put trade example

Let’s assume that a trader expects the FTSE 100 index to remain stable, or slightly increase, over the coming month.

The trader sells a put option with a strike price of 7,500, expiring in one month. The trader receives a premium of $40 for the sale of the option.

One month later, when the option expires, the settlement price is 7,520. In this case, the option buyer will not exercise the contract, meaning the trader, who sold the contract, gets to keep the premium of $40 as profit.

However, if the FTSE 100 settles at expiration below 7,500, the buyer will exercise the contract. If the price is significantly below this level, then the seller can incur large losses. For example, if the FTSE falls to 7,400 points, the trader will suffer a loss of $60 ($100 - $40 [premium received] ). The loss is partly offset by the premium received when the contract was sold.

When should you trade call and puts?

It’s worth noting that options aren’t an entry-level investment product. They are a high-risk investment product, and your losses can quickly add up in case of losing trades.

Options risks

When you trade options, you cannot attach a stop-loss order or take-profit order to your position as you might with a CFD trade.

However, if you buy (go long on) a call or put, your maximum risk is predetermined because your potential losses are limited to the price you paid for the option, known as the ‘premium’.

On the other hand, if you sell (go short on) a call or put, your potential losses are unlimited, and you could lose all the funds you have deposited in your account. If you are a professional client, your losses can exceed your deposits.

How to trade options

Learn key options terminology

Option: A contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specific price on or before a certain date

Strike price: The price at which the underlying asset can be bought or sold

Expiration date: The date at which the option contract expires

Premium: The price paid to purchase the option

Contract: Typically represents 100 shares of the underlying stock

In-the-money (ITM), out-of-the-money (OTM), at-the-money (ATM): refers to the relationship between the stock’s current price and the option’s strike price.

Understand the risks – the Greeks

Option contracts can expire worthless

There’s potential for significant loss, especially with certain strategies

Market conditions can be unpredictable

Options Greeks are risk characteristics that measure how changes in certain factors, such as the underlying asset price or volatility, affect an option’s price. It’s important to understand how these factors can influence your options position. Understanding the Greeks can help traders effectively manage their portfolios and hedge against potential losses.

Research the market you want to trade

Options aren’t solely for stocks. They’re available for a variety of securities, including commodities, indices, and ETFs. It’s crucial to determine the specific market that aligns with your trading goals and risk tolerance. By narrowing your focus, you can analyse specific sectors, implied volatility, price trends, expiration dates, and trading volumes to make informed decisions.

Pick which options to buy or sell

Your prediction about an underlying 'asset's movement guides the type of option you might purchase or sell:

If you think the underlying asset price is moving up, you might look to buy a call option or sell a put option

If you think the underlying asset price is stable, you could choose to sell a call option or sell a put option

If you think the underlying asset price is falling, you might buy a put option or sell a call option.

Predict the options strike price

For an option to maintain value, the underlying asset price should close in the 'in-the-money' range by the option's expiration. Choose a strike price that mirrors where you anticipate the asset will reside during the option's duration.

Choose an options timeframe

Every option has a predefined expiration, dictating the final day it can be exercised. Daily and weekly expirations are for shorter-term trades, while monthly and yearly ones are more suitable for longer-term investors.

The longer the time until the option expires, the more time there is for the underlying asset price to move in a direction favourable to you (as the option holder) – bear in mind that the opposite scenario is also possible. As a result, the option is priced higher by the seller.

Longer timeframes offer more chances for your investment strategy to unfold. However, be cautious of time decay, as the value of options diminishes as they approach expiration, especially if they remain out-of-the-money.Place your options trade

On our trading platform, you'll need to specify:

The underlying asset you want to trade

Whether you're buying or selling a call or put option

A strike price

An expiration date

The number of contracts you wish to trade – the higher the trade size, the greater the margin required, and therefore the higher the risk

Any additional order details, like limit or market orders

Place your options trade

Regularly track your options trade, evaluating it against the underlying asset's movement, time decay, and any market events or news that might impact its value. Adjust or exit positions, if necessary, based on your initial strategy and changing market conditions.

What makes a good options trader?

Here are our five top tips for anyone looking to start options trading.

Don’t use options trading in isolation:

Options are a high-risk product designed for experienced traders, so you should have experience trading lower-risk types of investments before trading options. Options can be a very useful product to use in conjunction with lower-risk investments, such as a share portfolio, as they allow you to hedge your portfolio against adverse market movements.

Understand and stick to your strategy:

Understand whether you’re hedging against losses or actively pursuing profits from under-performing options before making a purchase.

Closely track markets:

It’s important to keep track of market performance, identify potential opportunities, for example, in a particular industry or an up-and-coming company, and undertake thorough research before you begin trading.

Stick to modest trades:

A string of losing trades in options trading can quickly turn into significant losses. Avoid overcommitting on each options trade to ensure that, if a trade doesn’t work out in your favour, your loss is only a small percentage of your overall trading funds.

Diversify as much as possible:

As well as diversifying through alternative, lower-risk assets, it could also be sensible to hold a diverse range of options. If you solely invest in technology or NASDAQ indices, you could leave yourself open to losses if the tech sector doesn’t move in your favour. Choosing options from a range of industries and markets can help balance your risk.

Currently you can trade options on a range of leading indices, including the S&P 500, Nasdaq 100, FTSE 100 and DAX, the 'magnificent seven' US tech stocks, namely Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla and our Gold and Silver ETFs.

Yes, and this approach is used by traders with the aim of helping to manage losses and increase profit potential. There are a number of complex options strategies that traders can potentially benefit from, including straddles and strangles.

The fees associated with options trading are the bid-ask spread, and any currency conversion fee on realised profit and losses. You can find more information about the costs in our Cost Disclosure documents available here.