Options trading

Unlock new opportunities with our options on leading indices, the 'magnificent seven' stocks, and gold and silver ETFs.

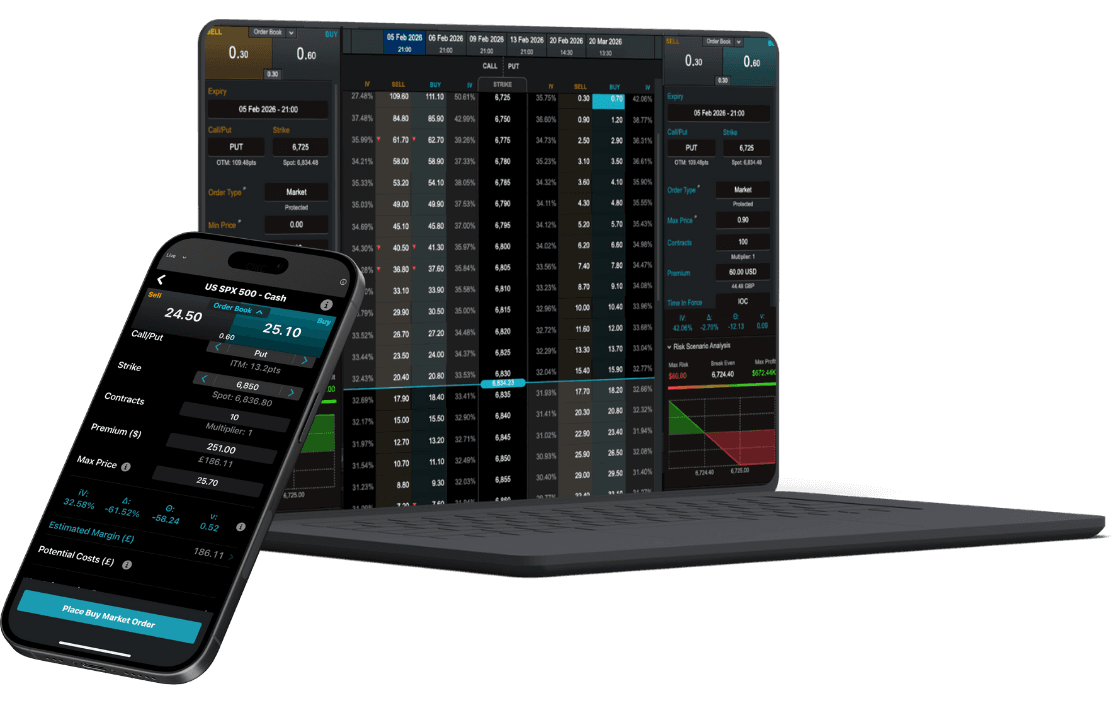

Trade with zero commission¹, and access fractional options through our award-winning online trading platform².

What are options?

An option is a contract that gives the purchaser the right, but not the obligation, to buy or sell a financial product at an agreed price if the product moves beyond that price within a specific period of time.

With us, you'll use a CFD account to trade OTC* options that are cash settled. Currently, you can trade on leading US and European stock indices.

You can trade options with us across major US and European stock indices, gold and silver ETFs, plus the magnificent seven US tech giants: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Find out more*OTC = over the counter. Learn more about OTC financial products here.

Why trade options with us?

Speculate on price movements across major US and European indices, the 'Mag 7' US stocks, and gold and silver ETFs.

With our fractional options you can take a position size as small as a hundredth of an option (0.01 of a unit).

Protect your downside and mitigate potential losses to an existing portfolio.

Take advantage of the flexibility that options offer, whether you favour daily or monthly time horizons, yield enhancement strategies, or trading non-directionally in flat markets.

If you’re a retail (non-professional) client when you enter into a long OTC option trade with us, you risk losing the entire margined amount when opening the trade. When you enter into a short OTC option contract, your potential loss is unlimited – however, retail clients benefit from negative balance protection, which means any potential loss is limited to your invested capital. Learn more about the risks here.

What are other traders saying about CMC Markets?

See bid and ask prices, premiums, and more up front, helping you to understand your costs before you place a trade.

Explore trends with our pattern-recognition scanner, and take the pulse of the market sentiment with our client sentiment indicator.

Gain deeper insight into your options trades with real-time Greeks. Assess risk and market movements, empowering more informed trading decisions.

Download our mobile app to open, close and modify trades on the move.

Receive alerts by push notification, text message or email, so you never miss a key market development.

FAQs

Here are the broad steps involved in becoming an options trader.

Learn how options work

Research and choose an options trading strategy

Create a CFD trading account

Pass our options suitability test (unless you’re a professional client)

Make your first trade

You don’t need a separate account. If you’re a retail trader, you’ll need to pass our suitability test before you can trade options using your existing CFD account. If you’re a professional client, you can trade options using your existing CFD account without needing to pass the suitability test.

As a CMC Markets customer, you won’t pay any commission, holding fees or financing fees when you trade options with us. The only costs you’ll pay are the spread and, if the instrument you’re trading is priced in a currency other than your home currency, a currency conversion fee. We charge 0.5% of the realised profit or loss to convert foreign currencies into your home currency

There is no minimum amount needed to open an options account with us.

Our website has a range of learn articles, guides, and resources to help you navigate your options trading journey. You may find the following resources useful:

Trading options with CMC

Option trades on our platform are cash-settled. Trading options with us doesn’t entitle you to any rights in relation to the underlying asset, and exercise of an option doesn’t result in the acquisition or disposal of an instrument. Instead, an option contract which has reached its expiry date will be closed and cash settled, with an amount payable to you (if the market moved in your favour) or by you (if the market moved against you).

Currently you can trade options on a range of leading indices, including the S&P 500, Nasdaq 100, FTSE 100 and DAX, the 'magnificent seven' US tech stocks, namely Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla and our Gold and Silver ETFs.

CMC Markets has 15 global offices, including in the UK, Australia, Germany, Canada, New Zealand, Singapore and Bermuda. CMC Markets' entities are licensed and regulated by the local authorities, for example, CMC Markets Bermuda is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority (‘BMA’).

As a CMC Markets' client, your money is held separately from CMC Markets' own funds. It is held in segregated client bank accounts distributed across a range of major banks, which are regularly assessed against our risk criteria. Under the BMA rules, retail clients must be provided with negative balance protection. This means that your maximum loss is the amount you have deposited with us.

If you're trading on MT4 or MT5, select the instrument you wish to trade ('double-click' on your PC), and a new order window will appear. Enter your desired volume (in lots), add any risk-management orders such as a stop-loss or take-profit order. Then place a market order in the direction you wish to trade; buy to go long, or sell to go short. There are several ways to place trades or orders using MT4 or MT5 – you can learn more about MT4 or MT5 functionality by navigating to Help > Help topics or Help > Video guides.

If you’re trading on our Next Generation platform, search for your desired instrument from the 'Product Library'. Select your chosen instrument ('right-click' on your PC), and select ‘Order Ticket’. In the order ticket box, choose your order type (from Market, Limit, and Stop-Entry Order), and then enter your desired volume in units or amount (this can be configured from the ‘Settings’ menu in the main navigation). Add stop-loss and take-profit levels to minimise your risk, and choose to ‘BUY’ or ‘SELL’, depending on whether you want to go long or short. When you’re ready, select ‘Place Buy Market Order’, or ‘Place Sell Market Order’.

For retail clients, the maximum leverage you can currently trade with is 200:1 (or 0.5% margin) with our CFD trading and FX Active accounts.

TradingView is a trading research platform where you can view charts, analyse trends and interact with an online community. You can connect your TradingView account to your CMC Markets account, enabling you to open, manage and close trades within TradingView. Learn more about TradingView here.

MetaQuotes' MetaTrader 4 and MetaTrader 5 are globally popular forex and CFD trading platforms. TradingView is a trading and charting platform which you can link to your broker account to place trades. Our proprietary web-based platform is feature-rich and enables access to trade CFDs on 12,000 instruments.

With each platform you can choose from our CFD trading or FX Active accounts. Our FX Active account offers spreads from 0.0 pips on six major FX pairs, with a 25% spread discount on all other pairs. There is a fixed, low commission at $2.50 per $100,000 notional value traded.

Our trading platform doesn’t require any downloads, while MT4 and MT5 requires downloading to fully utilise its features, such as algorithmic trading (through Expert Advisors) and social trading available via the MQL4 and MQL5 communities.

The MetaTrader platforms offer hedging positions by default, while CMC’s trading platform offers netted positions by default.

Yes, you can open an opposite, related, or alternative trade, with no interruption for traders using Expert Advisors.

Log in to your MT4 or MT5 client portal or our trading platform and follow the instructions in the funding section.

You can reset your password by selecting 'Forgot password?' on the login page. We'll then send instructions for changing your password to the email address you use to log in to your account.

Our aim is to provide a high level of service to all our clients, all of the time. We value all feedback and use it to enhance our products and services. We appreciate that from time to time things can go wrong, or there can be misunderstandings. We are committed to dealing with queries and complaints positively and sympathetically. Where we are at fault, we aim to put things right at the earliest opportunity. You can find our complaint handling procedure here or contact us at global@cmcmarkets.com to begin your account query. Please note that all queries and complaints will be handled in English.

Dive deeper

Trading options with us

Learn how to trade options on our platform. Discover the options chain, our range of order types, how to open an order ticket and more.

Options volatility

Find out how market volatility affects option prices, and discover strategies to optimise your trading in turbulent times.

Ready to get started?

If you already have an account, log in to your chosen platform.

Don't have one yet? Open an account now.

Do you have any questions?

Email us at1 You won’t pay any commission when you trade options with us. The only costs you'll incur are the spread (the difference between the bid price and the ask price) and, if the instrument you're trading is priced in a currency other than your home currency, a currency conversion fee, which is charged at 0.5% of your realised profit or loss.