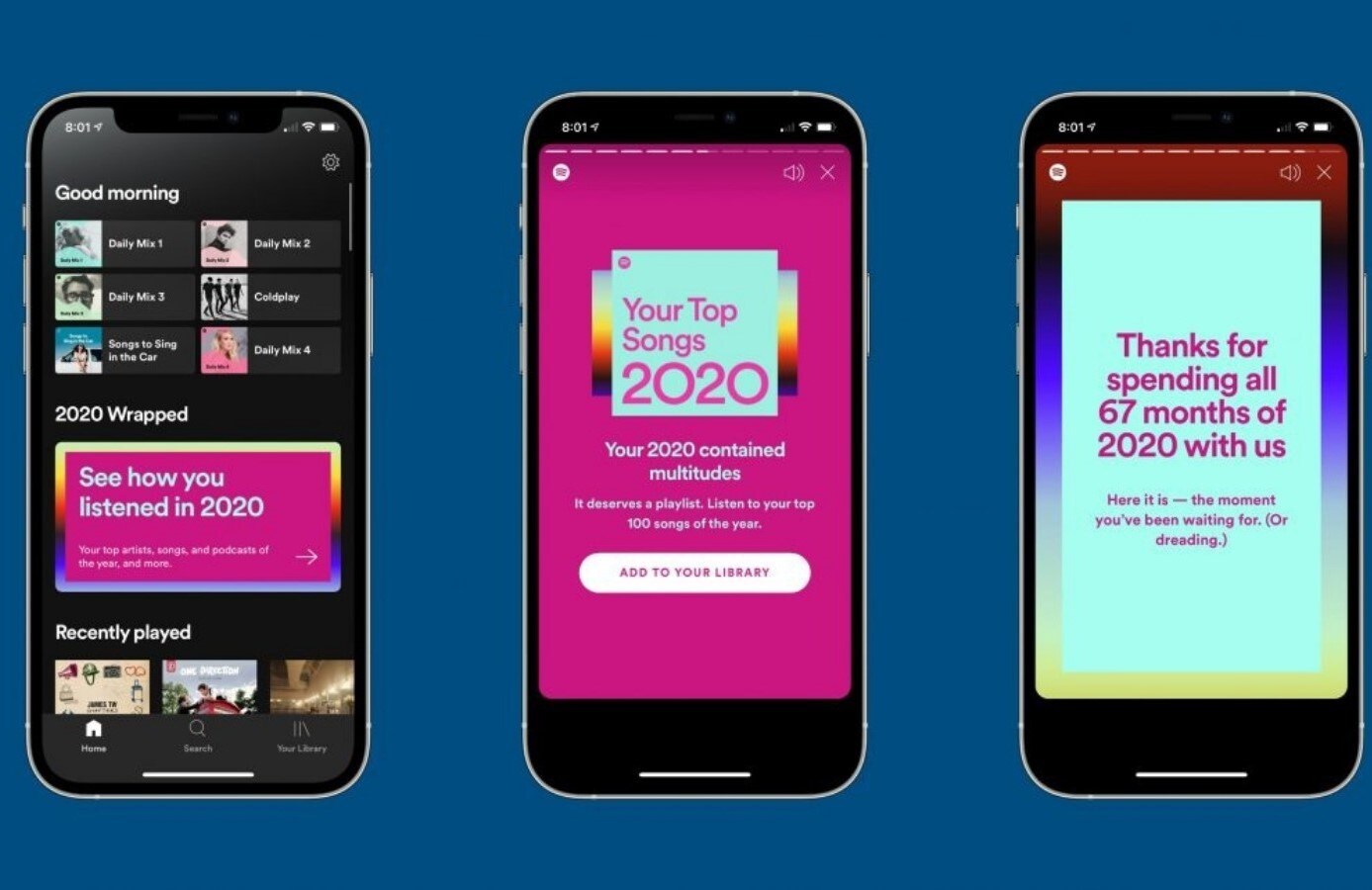

Yesterday, Spotify (NYSE: SPOT) gave us the opportunity to share our top songs, favorite artists, and most-listened-to podcasts of 2020 on the ‘Wrapped’ feature. The popular year-end review took over social media as Spotify listeners around the world shared the results of their #2020Wrapped playlist on their profiles and stories. Spotify’s ranking on the App Store skipped from No.27 on the 30th of November to No.9 currently.

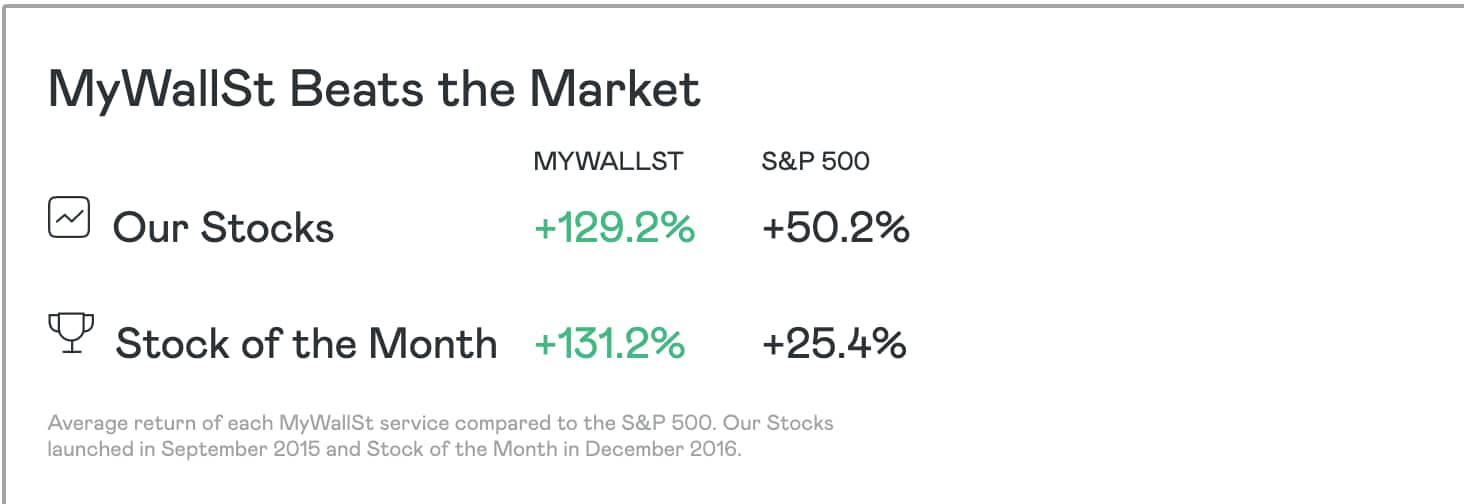

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

Wrapped is a wonderful viral marketing campaign for Spotify, causing the stock to jump 12.6% on Wednesday. Shares closed at an all-time high of $320.89 as investors also rallied over the new features and data which pointed towards momentum building over its podcast push. Spotify’s stock has more than doubled in 2020 and this week’s jump has pushed its market capitalization up to $60.8 billion.

Spotify’s #2020Wrapped

The Wrapped feature includes additions designed to boost engagement, including in-app quizzes, badges, a ‘Story of Your 2020’ feature allowing users to follow their favorite song’s journey throughout the year, and personalized playlists including ‘Your Top Songs’ and ‘Missed Hits.’ Customization options for social sharing allowed users to post the results easily on their own social media accounts.

The 2020 iteration contained additions designed to spice up engagement and increase listening time spent on the app across its user base, which totaled 144 million paid subscribers in the third quarter of 2020, up 27% year-over-year. This year Wrapped was also extended to non-paying Spotify users via spotify.com/wrapped.

To prove Spotify’s continuing investment in podcasts, Wrapped also included more metrics for users’ podcast listening habits in 2020. Spotify added a new way for podcasters and artists to view how their fans listened to their content by offering individualized microsite experiences. The new metrics showed how users listened to podcasts, detailing how many minutes were spent listening and information on their favorite podcasts of the year. Creators will now also get daily alerts and share cards in the app to show when their show makes it to the charts.

Spotify’s acquisition of self-publishing platform Anchor has really paid off. The company bought the podcast firm alongside Gimlet last year for $340 million. This year, Anchor was used to create 80% of new podcasts on Spotify — that’s 1 million titles.

It’s fair to say the Swedish-based company has been acquisitive lately. In November it bought podcast publishing and advertising company Megaphone for $235 million and earlier this year spent $200 million on Bill Simmons’ ‘The Ringer’ podcast and media startup. Spotify also spent $100 million on an exclusive podcast deal with Joe Rogan. In total, Spotify has forked out over $800 million in the last two years on podcast content and tech deals.

Spotify’s bet on focusing on publishing exclusive content seems to have paid off. In the second quarter of the year, it overtook Apple as the podcast leader. The company announced that its exclusive titles, including ‘The Michelle Obama Podcast’, were among the top five most popular podcasts globally in 2020.

In October, Spotify posted disappointing earnings. The company lost the equivalent of $0.68 cents a share on sales of $2.31 billion in Q3. Analysts had expected it to lose $0.61 a share on sales of $2.36 billion. Investors are left wondering if these new features and marketing campaigns will increase subscribers to help the company compete against its rival Apple Music.

Spotify’s future

The popularity of the app was proven this week as playlists flooded our screens and its focus on publishing exclusive content really seems to be paying off. Furthermore, Spotify overtaking a huge corporation like Apple as a leading podcast provider really shows the strength of the company.

The company is definitely going in the right direction and this week’s boost in share price proves how popular the streaming service is with the social media generation in particular.

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy