‘Super investor’ Cathie Wood pared down her stake in Robinhood in March. However, things are looking promising for the online brokerage as it swung to profitability in Q4 2023 and is hoping a new credit card for its gold members could drive investment and deposit growth.

Robinhood [HOOD] launched a credit card for its gold members last week, a move that could see it take a bite out of Apple’s [AAPL] market share.

The stock popped as much as 6.6% on 27 March, the day of the news, but someone who missed out on the gain was Cathie Wood.

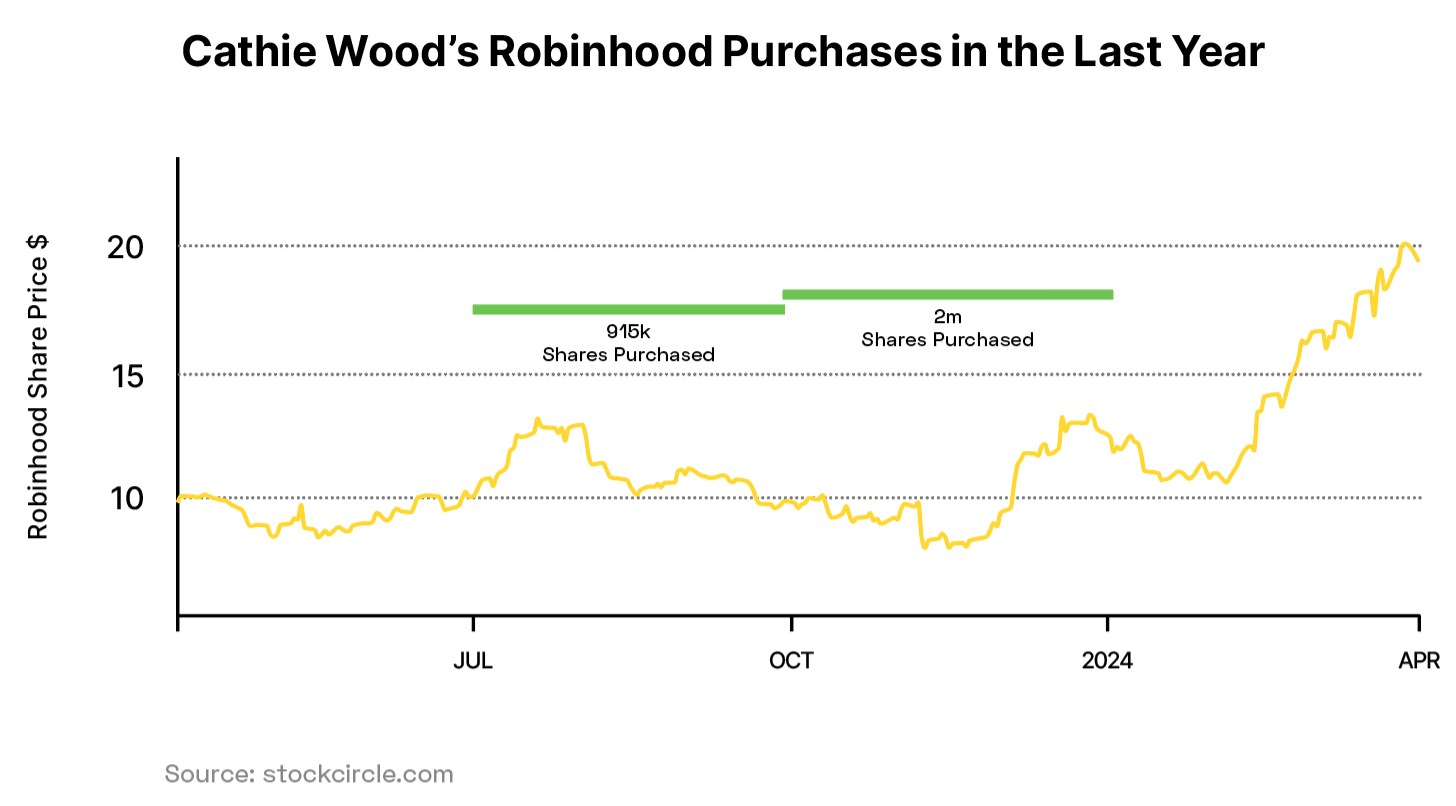

Between 21 and 25 March, Wood dumped 2.1 million Robinhood shares, according to Cathie’s ARK, which tracks all the trades across her firm’s ETFs. Based on the 25 March closing price of $19.08, the sale was worth around $39m. She had also sold several tranches throughout February.

These sales probably shouldn’t come as a surprise, however.

Wood bought 2.1 million shares in Q4 2023, during which time the Robinhood share price tumbled to a 52-week low of $7.91. With the stock having more than doubled in the months since, thanks in part to bitcoin’s rally, Wood likely considered the time was right to pare down her stake.

Wood wasn’t the only ‘super investor’ who took advantage of the dip in Q4 2023. Stockcircle data shows that four investment gurus bought $40.3m worth of shares.

Jim Simons, Founder of quant fund Renaissance Technologies, increased his position by 4.3%, adding approximately 224,000 shares. Citadel Founder, CEO and Co-CIO Ken Griffin bought 1.7 million shares, boosting his stake by 152.7%. The only seller was Point72 Chairman, CEO and President Steve Cohen, who offloaded 636,000 shares, 27.8% of his holding.

Swing to Profitability

Notwithstanding Wood’s sales last week, the stock's outlook has been more positive since its Q4 2023 earnings in February.

The online trading app reported record revenue for the full year of $1.9bn, up 37% year-over-year. It also swung to a surprise profit of $0.03 per share for the October–December period, thanks largely to income from interest on customers’ balances and margin lending.

While income from interest is at the mercy of rates, the company has been growing its customer base aggressively.

Having initially started out targeting younger, first-time investors, customers had opened more than 500,000 securities accounts by the end of last year, with net deposits hitting $17.1bn, up 27% from 2022.

“We won head-to-head net asset transfers from all the other major brokerages in Q4, and that includes Fidelity. So, that means that more assets actually flowed from Fidelity to Robinhood in Q4 than the other way around,” said Co-Founder and CEO Vlad Tenev on the earnings call on 13 February.

Tenev added that Robinhood had brought in more funded customers and net deposits in the first half of Q1 2024 than it had over the two years prior.

Credit Card Offering Could Drive Investment Growth

Robinhood is hoping it’ll be able to keep attracting more customers through its first credit card offering: the Gold card.

The new programme offers 3% cashback rewards and 5% cashback on bookings made through its online travel booking portal. There are no fees, but access to the card requires a gold membership that costs $5 per month or $50 per year. While the card itself is made from stainless steel, the company will give solid gold cards worth $1,000 to the first 5,000 people who manage to refer 10 others to sign up for gold memberships.

“What I predict we’ll see is a significant number of customers that join for the credit card and then become investors,” Tenev told Axios in an interview ahead of the launch last week. (Image shows Tenev and Co-Founder Baiju Bhatt celebrating after ringing the bell on Robinhood’s IPO on July 29, 2021).

Robinhood’s Share Price Recovery

The Robinhood share price has gained 50.7% year-to-date through 3 April and is up 96.7% over the past 12 months.

While the bitcoin rally has buoyed the stock in recent months, the crypto market can be volatile. Instead of buying Robinhood shares outright, another way to invest in the stock is through thematic ETFs.

The Amplify Transformational Data Sharing ETF [BLOK] has Robinhood as its fifth-largest holding, with a weighting of 3.5% as of 3 April. The fund is up 80% in the past year and up 15.7% year-to-date.

The Direxion Moonshot Innovators ETF [MOON] has allocated Robinhood 3.7% of its portfolio. The fund is down 10.1% in the past year and down 8.5% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy