Research firm McKinsey has predicted that generative AI’s impact on productivity could contribute between $2.6trn and $4.4trn to the global economy in corporate profits. To put this in context, the UK’s GDP in 2023 was $2.3trn, according to Statista.

Generative AI continues to be deployed in offices, but it has many use cases across multiple industries, from optimising supply chain routes to aiding drug discovery.

There are hundreds of investment opportunities in the generative AI space and, as the technology continues to evolve, more and more will be created. Some will be useful, some will be novel; some will prosper, some will fail. That’s the nature of innovation.

Uncovering opportunities in the AI boom requires separating hype from long-term value. Download the OPTO app to discover some of the most exciting AI stocks — among then the following five.

Five Top AI Stocks to Watch in July

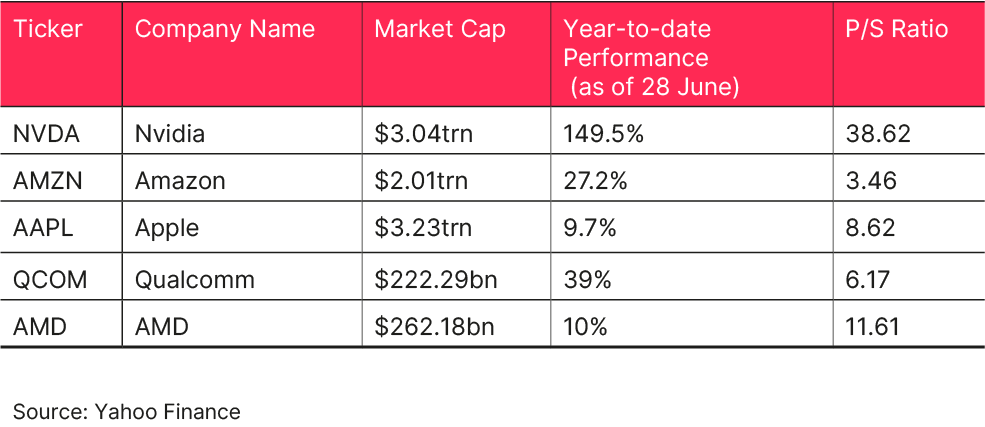

Nvidia [NVDA]

Chipmaking giant Nvidia is the bellwether of AI stocks; its share price performance has driven the sector’s rally in recent months.

Why invest in Nvidia?

Demand for chips that can power AI applications helped Jensen Huang’s company to more than double its annual revenue to $60.9bn in fiscal 2024, while LSEG analysts have estimated that the figure could reach $120.5bn in the current fiscal year and $161.4bn in fiscal 2026. Hitting these revenue estimates will depend on the popularity of Blackwell, its newest AI chip, which is twice as fast as its Hopper GPU. Shipment of Blackwell chips has already started and should ramp up in Q3.

Amazon [AMZN]

Amazon has invested $4bn in OpenAI competitor Anthropic and is looking to integrate generative AI into its services.

Why invest in Amazon?

Sources have told Business Insider that the e-commerce giant has been secretly developing a ChatGPT competitor, codenamed Metis. The news at the end of June came just days after Reuters reported that the company is looking to make its loss-making Alexa voice assistant profitable by charging customers between $5 to $10 per month. The premium offering, dubbed ‘Remarkable Alexa’, promises a more personalised experience and, when connected to smart devices, would be able to write emails, order food and even make coffee.

Apple [AAPL]

Apple has entered the generative AI game by partnering with OpenAI.

Why invest in Apple?

The Cupertino company finally unveiled its AI strategy at its Worldwide Developers Conference last month, including plans to integrate ChatGPT into its voice assistant Siri and iOS 18, which is launching in September. After iPhone sales slumped 10% in the quarter ended in March, CEO Tim Cook will be hoping that generative AI can lead to an iPhone upgrade cycle, as consumers, who may have been delaying upgrading due to the cost-of-living crisis, are tempted to get their hands on new devices with better capabilities.

Qualcomm [QCOM]

Qualcomm is taking on Intel [INTC] in the AI PC race after its chips were selected by Microsoft [MSFT].

Why invest in Qualcomm?

CEO Cristiano Amon believes generative AI “will become indispensable for both personal and business applications”. Microsoft has selected the chipmaker’s Snapdragon X series to power the first CoPilot+ PCs. “One thing is going to be different about this new PC. Unlike the past, your Windows PC will get better over time,” declared Amon during his keynote at the COMPUTEX 2024 expo in Taipei, Taiwan, in early June. Qualcomm isn’t expecting a material rise in revenue from AI PCs in the current quarter, but is hoping to get a revenue bump from the back-to-school season.

Advanced Micro Devices [AMD]

AMD Is another contender in the battle for AI PC dominance and hopes to rival Qualcomm.

Why invest in AMD?

The integration of AI is “the biggest inflection point in PCs since the Internet with the ability to deliver unprecedented productivity and usability gains,” AMD President and CEO Lisa Su said on its Q1 2024 earnings call at the end of April. Her keynote at COMPUTEX last month was used to launch a pair of AI chips for PCs, which could rival the dominance of Qualcomm’s Arm-based [ARM] chips and help AMD to gain PC market share. In the wake of AMD updating its AI GPU roadmap, Citi analysts reckon the chipmaker can grab 10% of the data centre GPU market.

To discover more stocks benefitting from the AI revolution, download the OPTO app.

How to Invest in AI

Investing in the software and hardware companies powering the generative AI revolution has the potential to be highly rewarding, especially in a bull market. However, a slowdown in corporate spending on AI and data centres could result in lower revenue and earnings, which could lead to AI stocks ceding recent gains.

Besides buying and holding shares in individual companies, another way to gain exposure to the nuts and bolts of generative AI is through thematic ETFs.

The Roundhill Generative AI and Technology ETF [CHAT] is an actively managed fund, which means a fund manager takes on the responsibility of selecting stocks based on their assessment of company news and industry updates.

The Global X Robotics and Artificial Intelligence ETF [AI] is a passively managed fund that tracks the performance of the Indxx Artificial Intelligence & Big Data Index.

Compare the performances of more AI-focused thematic ETFs on the OPTO app.

Conclusion

Despite there being a lot of froth over AI, the rally is showing no signs of letting up for Nvidia, Amazon, Apple, Qualcomm and AMD.

Gene Munster, Managing Partner at Deepwater Asset Management, reckons AI could fuel a bull market for the next three to five years. However, it could all end in spectacular fashion, Munster has warned: a note of caution that investors would be wise to heed.

Download the OPTO app and start riding the AI wave today.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy