No one saw it coming.

Well, some people did, but most of us were too busy obsessing with the big-ticket names to notice the steady, upwards climb of some of the less exciting stocks associated with the artificial intelligence (AI) revolution: data storage firms.

Then at the end of 2025 it transpired that the four leading storage stocks — namely, Sandisk [SNDK], Western Digital [WDC], Micron Technology [MU] and Seagate [STX] — had outperformed the rest of the S&P 500.

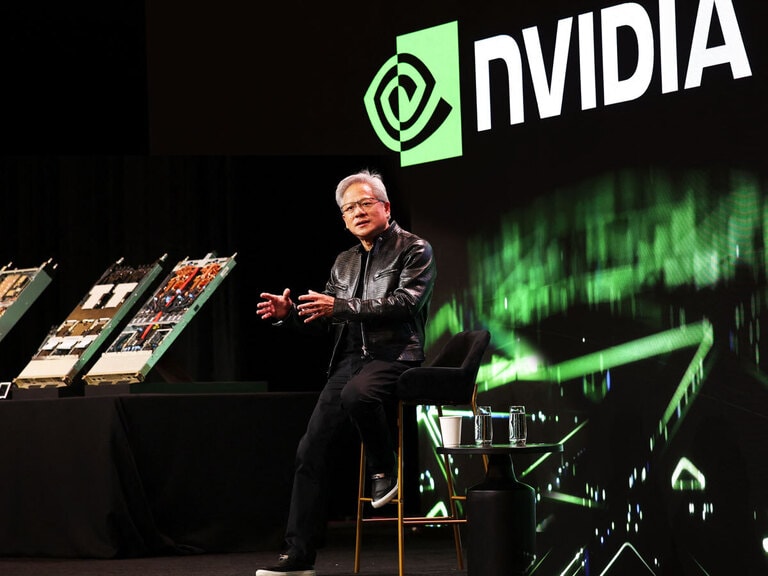

A further fillip came at CES in early January, when Nvidia [NVDA] CEO Jensen Huang called data storage a “completely unserved market”.

“This is a market that never existed, and this market will likely be the largest storage market in the world, basically holding the working memory of the world’s AIs,” he said.

And, with that, the world suddenly woke up to the potential of data storage stocks. Sandisk climbed nearly 28% in a single session after Huang’s speech, while Western Digital, Seagate and Micron also spiked.

What is it that makes these companies so indispensable in the current moment?

As a way to get a handle on the sector as a whole, it makes sense to look closely at what is currently its outstanding player: Sandisk.

From Legacy Tech Firm…

Sandisk was founded in 1988 as SunDisk, focusing on flash memory technology.

The company quickly established itself as a pioneer in NAND flash, producing some of the first commercially viable flash memory cards and USB drives. In the 1990s and early 2000s, Sandisk expanded into consumer storage products, supplying memory cards for cameras, mobile phones and portable media devices.

Throughout its growth, Sandisk pursued both organic expansion and strategic acquisitions, including the 2006 purchase of M-Systems, an Israeli flash storage firm known for its DiskOnChip technology. The company also partnered with major electronics firms to integrate flash memory into devices, becoming a leading provider to both consumer and enterprise markets.

Indeed, if you’re above a certain age, you may recall that the name of the firm was practically ubiquitous for a while.

Then in 2016, Western Digital acquired Sandisk for $19bn, integrating its portfolio of NAND and SSD technologies into a larger storage ecosystem. This move strengthened Western Digital’s position in enterprise and data center storage, while Sandisk’s brand and operations continued to operate under the Sandisk name.

…to Dynamic AI Play

In February 2025, Sandisk was spun out from Western Digital as a standalone company, freeing it up to operate as a pure-play flash memory and enterprise SSD stock.

Since the spinoff, the company has benefited from surging demand for high-performance storage in AI, cloud and hyperscale data centers. It went from being “an overlooked legacy tech company into one of Wall Street’s most dynamic momentum plays”, as Forbes recently framed it.

The key point here is that modern AI systems continuously collect, store and process vast datasets, making enterprise-grade NAND flash and SSDs critical infrastructure.

In addition, the memory market has turned sharply favorable. Years of oversupply and margin pressure have given way to constrained NAND supply amid surging demand. Enterprise SSD prices have jumped roughly 30–40% quarter-over-quarter, with forecasts suggesting further gains through early 2026 and potential cumulative increases of 50–70% in some segments if supply discipline continues.

These factors have fueled intense market activity. By January 2026, Sandisk was among the most actively traded stocks, drawing retail investors, quant funds and momentum ETFs. With roughly 146 million shares outstanding, market capitalization has surged to $56.83bn as of January 14, reflecting both investor enthusiasm and its strategic position at the intersection of AI and storage.

Data on Data Storage: SNDK vs WDC vs MU

Why is Sandisk the stand-out data storage stock at the moment? A comparison with two of its nearest peers is revealing.

First, there’s its former parent Western Digital, which remains a diversified storage company, spanning hard drives and flash memory. Shares have risen more than 360% over the past year, supported by a recovery in memory pricing, AI infrastructure investment and improved focus following the Sandisk spinoff. WDC offers a broader mix of storage products, including hard drives, which provide some cyclicality and diversification versus Sandisk’s pure-play exposure.

Micron Technology, meanwhile, is a leading US memory chipmaker producing both DRAM and NAND. Its shares are up roughly 230% over the past 12 months as AI adoption lifts demand for high-performance memory. Micron benefits from scale and access to hyperscalers but carries exposure to cyclical DRAM markets, which can amplify volatility.

| SNDK | WDC | MU |

Market Cap | $56.83bn | $73.51bn | $375.18bn |

P/S Ratio | 7.28 | 7.72 | 8.89 |

Estimated Sales Growth (Current Fiscal Year) | 45.93% | 24.27% | 99.09% |

Estimated Sales Growth (Next Fiscal Year) | 27.24% | 14.61% | 19.37% |

Source: Yahoo Finance

In terms of the investment case for each, Sandisk offers the purest AI-driven growth play, with the highest leverage to SSD pricing and data center demand. This purity of exposure is likely what is attracting investors, ravenous for the next big AI play.

Western Digital provides diversified exposure with both HDD and NAND businesses, smoothing volatility while still participating in AI tailwinds.

Micron combines exposure to AI-driven NAND growth with broader DRAM cycles, offering scale and margin potential but greater sensitivity to memory market swings. In short, investors must weigh growth concentration versus diversification and volatility when choosing among the three.

Bull Case for SNDK Stock

Surging demand from hyperscale data centers, constrained NAND supply and rising SSD prices support revenue growth and margin expansion. The company’s focused portfolio and spinoff structure allow investors to capture leveraged exposure to AI infrastructure, with potential for further stock appreciation if earnings scale alongside AI adoption.

Bear Case for SNDK Stock

Memory markets are inherently cyclical, and pricing power is unlikely to persist indefinitely. Any slowdown in AI spending, new NAND capacity or demand moderation could trigger sharp declines. After a nearly 1,000% rise from spinoff lows, Sandisk is priced for flawless execution, leaving limited margin for error.

Conclusion

As Forbes puts it, “Whether the stock continues to rise or pauses to consolidate its gains will depend on one key factor above all: how swiftly hype transforms into tangible earnings.” AI investment shows no sign of slowing down — quite the opposite — and many investors will no doubt be hoping that those earnings will soon be flowing in.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy