Healthcare: Agentic AI’s Next Frontier?

Hot on the heels of OpenAI’s announcement of ChatGPT Health, Anthropic has revealed Claude for Healthcare, a suite of artificial intelligence (AI) tools for providers and patients. Similar to OpenAI’s ChatGPT Health, it syncs data from phones and wearables but won’t use it for model training. Claude for Healthcare will also be able to access platforms and databases, TechCrunch outlined. Meanwhile, OpenAI has acquired health records startup Torch for $100m.

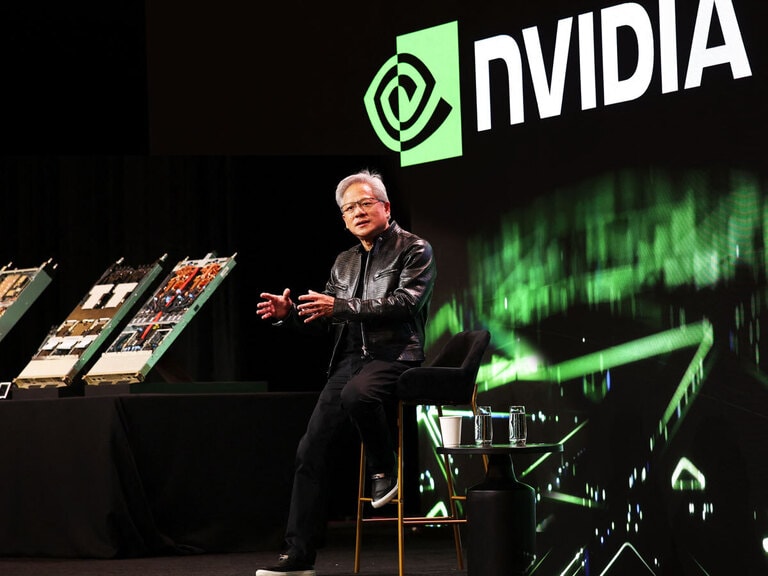

Nvidia Announces Drug Discovery Collab

The chip giant [NVDA] is to partner with Eli Lilly [LLY] in investing up to $1bn over five years to build an AI-powered lab. The facility will use Nvidia’s BioNeMo platform and Vera Rubin architecture, alongside robotics and physical AI, to accelerate and scale drug development. “AI is transforming every industry, and its most profound impact will be in life sciences,” said Nvidia CEO Jensen Huang in a statement seen by Seeking Alpha.

Why Did ARK Snap Up These Gene Editing Stocks?

According to a report published on January 9, the bioengineering market could be worth $347.04bn in 2026, up from $295.28bn in 2025. Driving market growth will likely be DNA and genomic sequencing technologies. Gene editing and artificial AI platforms have been forecast to grow at a CAGR of 22% over the same period. OPTO unpacks the investment cases for three gene editing and genomic sequencing stocks that were recently bought by Cathie Wood’s ARK Invest.

Brain/Computer Interface

Medtech leader Medtronic [MDT] is partnering with Precision Neuroscience to integrate its StealthStation surgical navigation system with Precision’s Layer 7 brain-computer cortical interface. The collaboration aims to provide neurosurgeons with real-time structural and functional brain data during surgery, addressing limitations of using separate devices and improving intraoperative decision-making, the companies said.

Pressure Mounts on Musk Over Grok

X’s AI chatbot Grok is under fire for generating non-consensual, explicit images of children and women. US Senators Ron Wyden, Ben Ray Luján and Edward Markey have written to Apple [AAPL] and Alphabet’s [GOOGL] Google saying Grok’s “likely illegal” content was a clear violation of app store policies. The UK’s Ofcom has also launched an investigation.

Another Mining Megamerger?

The Financial Times reported that Glencore [GLNCY] and Rio Tinto [RIO] are in merger talks. This would create the world’s largest copper producer and mining group, with an enterprise value above $260bn. The combined “GlenTinto” would produce over 7% of global copper in 2026, plus sizable shares of zinc, cobalt and nickel. Copper demand is surging amid the clean energy transition, electrification and AI data center expansion.

CES 2026 Takeaways: What Tech Investors Need to Know

It’s billed as “the most powerful tech event in the world” and commentators tend to agree: CES is seen as a barometer for how cutting-edge tech will evolve over the next 12 months. 2026 proved to be a particularly exciting year: unsurprisingly, Nvidia dominated the headlines, but there were plenty of other scintillating reveals from across the tech sphere. OPTO unpacks the key trends that emerged from CES 2026.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy