Canopy Growth Corporation (NASDAQ: CGC) is one of the first publicly traded Canadian cannabis companies. It is perhaps the most well-known cannabis stocks and is one of the largest with a market cap at roughly $10.7 billion. Canopy Growth, formerly known as Tweed Inc., has been extremely volatile since going public in 2014. But does the positive outlook for the cannabis industry mean Canopy Growth is one to watch?

This article was originally published on MyWallSt — Investing Is for Everyone. We Show You How to Succeed.

The bull case for Canopy Growth stock:

The legalization of cannabis has gained traction in recent years, and currently, there are only 15 states that outlaw the drug completely. Public opinion has changed significantly, and there is a more positive outlook among the general population in regards to usage. Legalization was on the ballot in several states for either recreational or medicinal purposes and was met with enthusiasm and was passed in these states. From an economic standpoint, recreational use can also provide tax revenue and has encouraged the legalization.

Canopy Growth sells a wide range of products under several brand names and supports these with the infrastructure that is needed to succeed. These products include edibles, beverages, vapes, and hand creams.

Canopy Growth reported 77% revenue growth year-over-year (YoY) in fiscal Q2, 2021 to a record $135 million. Adjusted for a restructuring charge incurred in fiscal Q2 of 2020 it is 24% growth YoY. This growth was driven predominantly by a 380% surge in B2B revenue for recreational products. It also has $1.7 billion in cash, and short term investments and free cash flow improved significantly.

Canopy Growth continues to increase market share. In Canada, it currently has a 15.5% market share for the recreational cannabis market, an increase of 2% YoY. It also has a 54% market share of the cannabis beverage market that is undoubtedly helped by its partnership with Constellation Brands (NYSE: STZ) which owns a large stake in the business. This allows Canopy Growth to leverage the distribution network and gives strength to the balance sheet. Both companies’ governmental and legal teams are also engaging with politicians and lawmakers to help shape legislative decisions.

The bear case for Canopy Growth stock:

It is still unprofitable and burning cash with a loss of $85 million in fiscal Q2 2021 narrowing from $150 million the year previously. Management is cutting expenses such as selling, general, and admin expenses in a bid to become profitable, however, this appears to be a while off yet. Gross margins also remain suppressed at 19% rather than at 40% which management is “committed” to delivering. A large number of competitors in the space will also suppress margins and revenue. Investors will have to keep an eye on how this develops and if management is executing.

The broader cannabis industry is also up against cannabis sold on the black market which can put pressure on margins. It closed two indoor cultivation greenhouses earlier this year as a cost-cutting measure. Still, management also stated that “Nearly 17 months after the creation of the legal adult-use market, the Canadian recreational market has developed slower than anticipated”. A survey carried out by the Canadian government also found that 40% of users still turned to the black market despite legalization. This may be a worrying sign for investors who anticipated rapid adoption and growth in the industry.

There are also a number of other challenges such as state taxes and a lack of federal legalization. Despite the enthusiasm from investors after election news, it is far from a foregone conclusion that the next administration will end the federal ban on cannabis.

So, should I watch Canopy Growth stock?:

Canopy Growth’s strong position in the market at this early stage is encouraging for investors, along with increasing market share and strengthening brand awareness. After the election, cannabis stocks have been on a tear with investors eyeing federal legalization. However, an investment in Canopy Growth should be approached with caution, and investors may want to let the story play out a bit more before thinking about investing.

Quickfire Round:

Who is the CEO of Canopy Growth?

David Klein, who was appointed in January 2020.

Where is Canopy Growth based?

It is based in Ontario, Canada.

When was it founded?

It was founded in 2013 as Tweed Marijuana Inc.

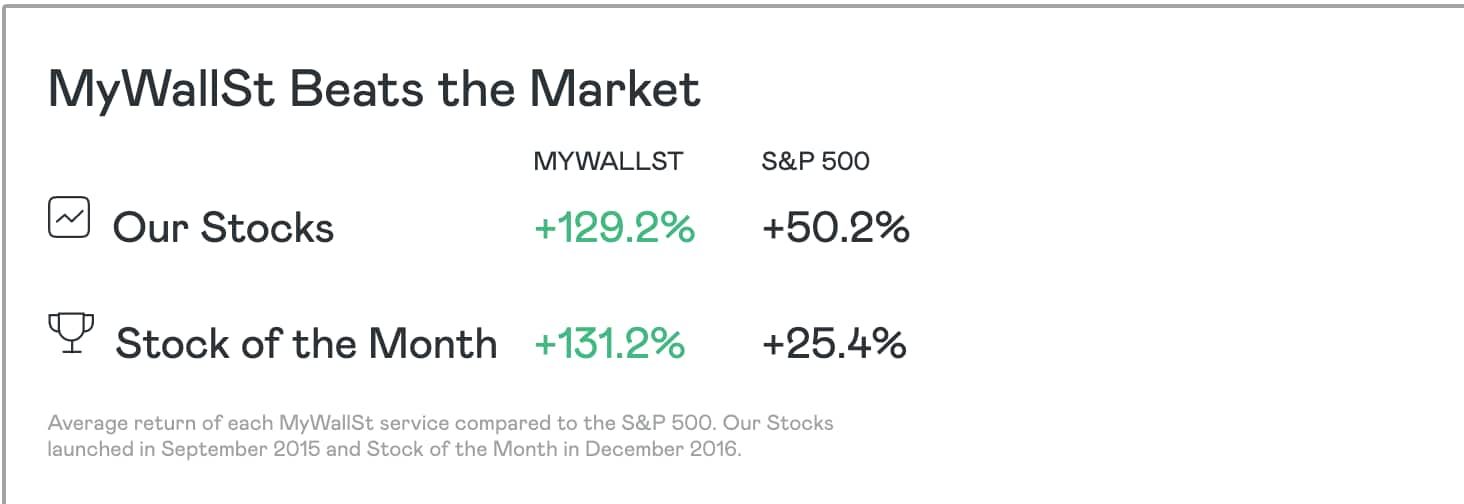

MyWallSt makes it easy for you to pick winning stocks. Start your free trial with us today— it's the best investment you'll ever make.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy