To gain exposure to a trend such as artificial intelligence (AI), it’s important to clearly identify a company’s sources of revenue. In this new OPTO series, we examine stocks that offer the purest exposure to key themes through a detailed assessment of their revenue streams. This week we unpack the investment case for C3.ai, a leader in the booming AI space.

Thematic investing relies on exposure to long-term trends. However, many thematic indices and funds contain stocks that do not align with their stated objectives.

Seasoned emerging markets (EM) investor Kevin T Carter made this point on OPTO Sessions, while explaining the drawbacks of the MSCI Emerging Markets Index, which he says selects companies based on the location of their headquarters: “When you’re investing in EM consumer technology, you don’t care about where the company is. You care about where the revenue is coming from.”

In other words, to gain exposure to a trend (such as EM consumer technology), it’s important to clearly identify a company’s (or a fund’s, or an index’s) sources of revenue. In this new OPTO series, we examine stocks that offer the purest exposure to key themes through a detailed assessment of their revenue streams.

Artificial intelligence (AI) drove outsized stock market returns during 2023. However, the headline ‘Magnificent Seven’ stocks are predominantly large, diversified big tech companies that don’t necessarily offer pure AI exposure. Investors seeking a more specialised stock might consider C3.ai [AI].

Enterprise AI

C3.ai was founded in 2009 by the Silicon Valley investor Thomas M Siebel, who remains its Chairman and CEO.

According to Macrotrends data, C3.ai employed 914 staff in 2023, nearly 60% more than it did two years prior. It has six offices in the US, including its headquarters in Redwood City, California, as well as five offices in Europe and sites in Australia, India, Mexico and Singapore.

C3.ai develops AI products for enterprises — particularly manufacturing, financial services, government, utilities, oil and gas, chemicals, agribusiness and defence. Its offerings break down into three main categories:

- ‘Out-of-the-box’ applications. C3.ai offers suites of pre-built applications specifically designed for a range of business use cases, such as sustainability, financial services and supply chains. Some are also designed for particular sectors, such as government and defence.

- AI platform. C3.ai’s open, AI-first architecture offers enterprise teams (such as data scientists and IT) a platform with which they can customise their own AI tools, and which integrates with their proprietary data. According to its website, C3.ai’s AI platform delivers AI development up to 26 times faster than its competitors.

- Generative AI. C3.ai also offers users a generative AI platform that can retrieve domain-specific information and answer intuitive questions through a chat interface. Like the AI platform, the basic C3.ai generative AI chat functionality can be tailored for specific customers and industries: for example, it was used to create a customer service chatbot by a leading UK financial services company with 16 million customers.

It has taken nearly 15 years to build this AI middleware layer, and this investment amounts to a key competitive advantage for C3.ai. Additionally, the flexibility that is built into its offerings means it can serve a wide range of customers.

Software, and a Service

Besides large, diversified big tech companies (such as Alphabet [GOOGL] or Microsoft [MSFT]), AI stocks often fall into the ‘picks and shovels’ category; i.e., companies such as Nvidia [NVDA] who build the underlying technology that enables AI applications.

C3.ai, however, is neither of these. It is one of a small number of tradeable companies whose core business line is the sale of AI applications themselves.

Furthermore, with 91% of Q2 2024 revenue being derived from subscriptions, C3.ai is effectively a SaaS company that builds AI software. Given that all of its software products utilise AI technology, this segment of the business is directly correlated to enterprise demand for AI.

The remaining 9.3% of C3.ai’s revenue for the quarter ended 31 October came from ‘professional services’. The company’s management envisages this segment accounting for 10–20% of revenue over the long term, making it a potentially significant aspect of its business.

According to an SEC filing, professional services “can include training, application design, project management, system design, data modelling, data integration, application design, development support, data science, and application and C3 AI Software administration support”. Given that all of these services relate to C3.ai’s software, all of which involve AI, this segment can also be directly attributed to the demand for AI products.

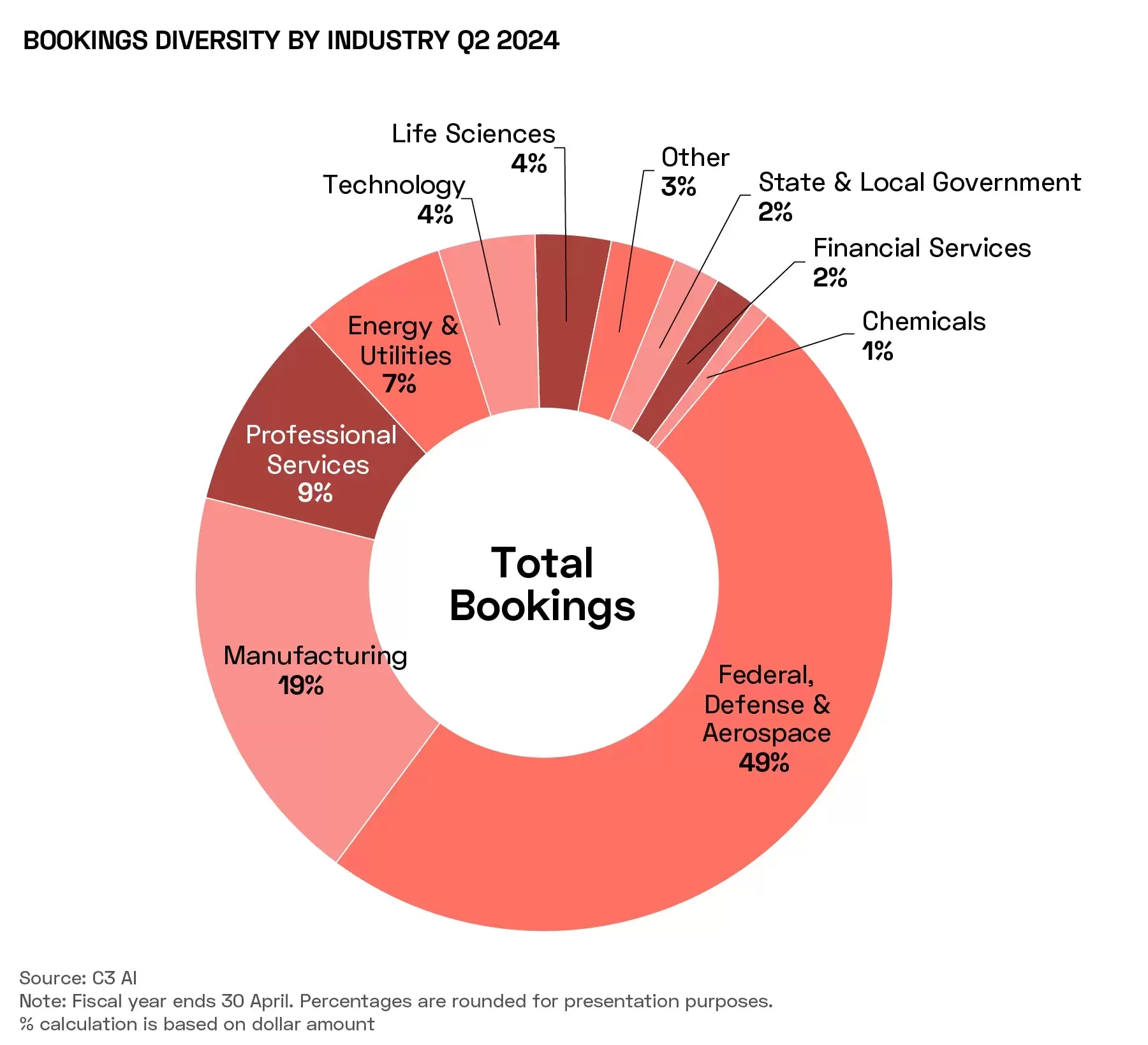

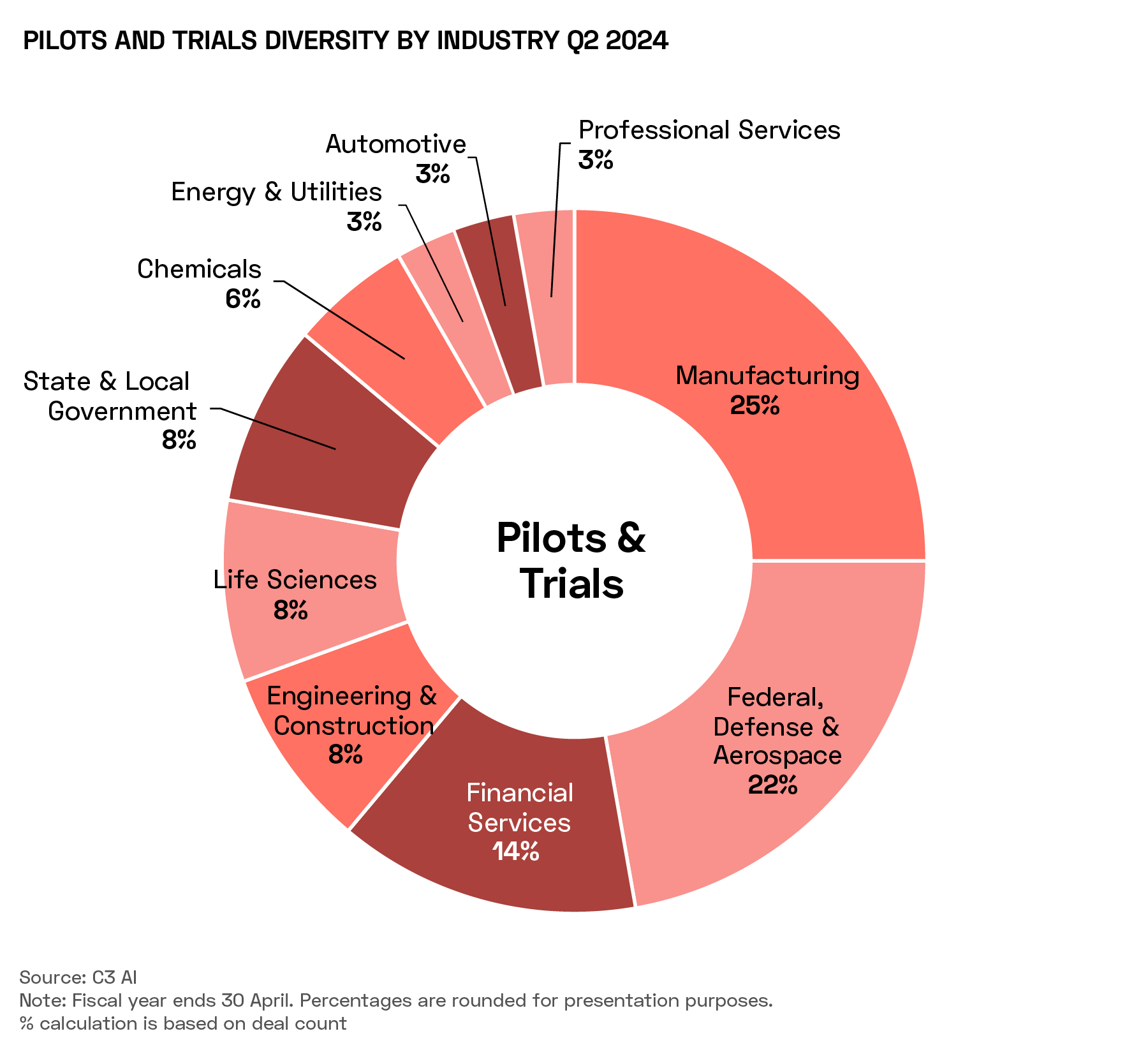

Additionally, given the breadth of industries it caters to, and the ability for individual customers to tailor C3.ai’s products to their industry and needs, C3.ai implicitly captures a broad, intersectoral array of enterprise demand for AI. According to a supplement to its Q2 results, 49% of C3.ai’s bookings come from the federal, defence and aerospace industry, 19% from manufacturing, 9% from professional services, and 7% from energy and utilities.

However, when considering companies engaged in pilots or trials of its software (i.e., prospective near-term future customers), the industry mix is much more evenly distributed.

It is worth noting that C3.ai’s software, like that of most SaaS companies and many AI platforms, is hosted in the cloud.

Customers can thus run the company’s products in C3.ai’s cloud environment. However, this cloud environment is provided by third parties (most notably by Amazon’s [AMZN] AWS). According to its SEC filing, “Customers who choose to run the software in [C3.ai’s] cloud environment pay the hosting costs charged by our cloud providers” — in other words, C3.ai doesn’t directly recognise any revenue from cloud services.

C3.ai, therefore, offers pure and broad AI exposure; all of its revenue is derived from enterprises looking to leverage AI technology.

Why is C3.ai Lagging Behind Other AI Stocks?

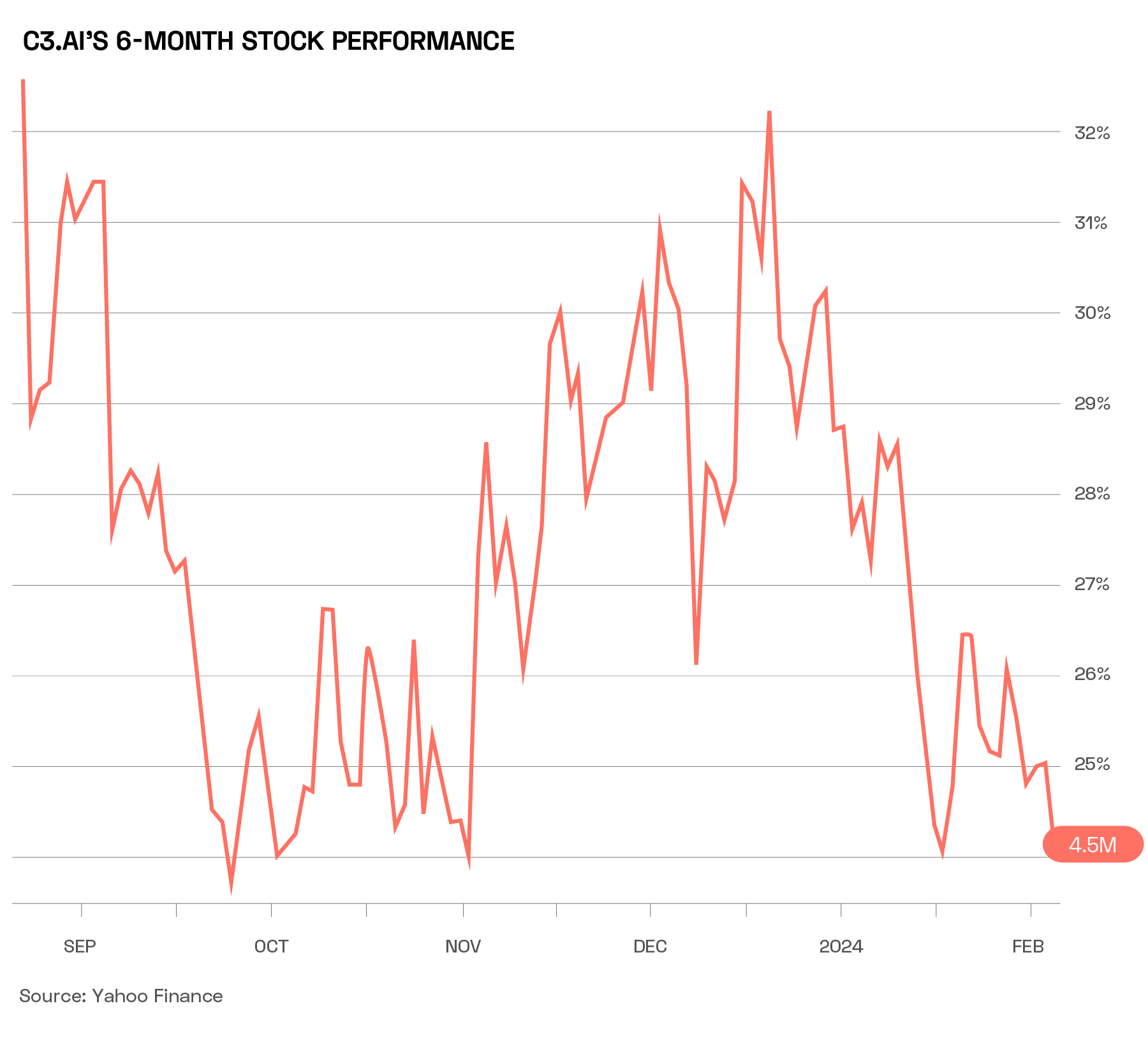

AI stocks captured the market’s attention during 2023, and the bull run appears to be continuing. As of 6 February, the Global X Artificial Intelligence and Technology ETF [AIQ] has gained 3% in 2024. The fund is composed of companies that stand to benefit from the development and utilisation of AI products, and holds C3.ai at a weighting of 0.3% as of 5 February.

However, AI demand is predominantly benefitting the Magnificent Seven stocks, as demonstrated by the relative overperformance of the Roundhill Magnificent Seven ETF [MAGS], which has gained 9% year-to-date.

C3.ai’s stock is down 16% year-to-date. Sentiment around AI was dampened somewhat in January when Microsoft and Alphabet announced disappointing earnings results, but both stocks are outperforming C3.ai so far in the year (though both still lag behind Nvidia).

It might seem that C3.ai’s own lacklustre set of Q2 results, announced in early December, is the principal drag on the stock.

The company posted a greater-than-expected loss (of $0.13 per share) and issued guidance that dampened investor hopes it might turn a profit this year, according to Reuters. The company warned that pilot programs, which enable potential customers to effectively trial its services, would eat into its profitability in the near term.

C3.ai next reports results on 28 February. Shareholders will hope for a positive update on progress towards the company’s goal of breaking even, in order to reverse the recent downtrend.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy