In this article, HANetf, an independent ETF provider based in Europe, looks at how the legalisation of sports betting across states in the US is fuelling demand for online gaming, also known as iGaming.

The global gaming industry has generally been fast growing over the last decade (pre-COVID-19) due to exceptional growth in Asia, notably in Macau and Singapore. New global casino projects have also fuelled growth, given strong untapped demand in most markets.

Looking forward, we believe that growth is likely to come from Asia and online wagering on a global basis. On the other hand, the bricks and mortar market in the US is relatively mature. The convention and group travel market is also expected to take time to recover, which will impact locations such as Las Vegas.

The global online gaming market generated around $63bn in revenues in 2019, according to H2 Capital. This is expected to grow by around 11% compound annual growth rate (CAGR) through 2025. In comparison, the US is expected to grow at a 21% CAGR. Despite changing regulations in some markets, Europe and Asia are also expected to record solid growth.

Some of the leading companies in the industry are equally optimistic, with DraftKings [DKNG] and Metro-Goldwyn-Mayer (MGM) both expecting medium-term industry revenues of around $28bn.

It is important to appreciate the differences between sports betting and iGaming, given the differences in market size, growth rates and profitability.

Sports betting legalised in the US

Sports betting is defined as betting on an event connected to sports activities such as the winner of a match or the game’s highest scorer. The variations of wagers are endless. People have been betting on sports since the dawn of time, with horse racing being a favourite time in many different cultures going back centuries.

In some countries, like the US, sports betting had been illegal over fear that the sports could become compromised.

However, social acceptance has shifted. Sports teams, leagues and the media are also supporting the change as betting dramatically increases fan engagement and, therefore, the value of the product.

Online gaming customers are more lucrative than sports bettors, with the average spend per adult expected to be around $105 versus $45 for sports, according to Morgan Stanley. Profit margins are also lower for sports betting, given the higher customer acquisition and other marketing costs.

As a result, we believe that the gaming segment is positioned well for future growth. In particular, the US is expected to grow 23 times from $2bn in 2020 to $53bn in 2033, according to analysts at Goldman Sachs.

$53billion

Expected valuation of the US online sports betting segment by 2033, per Goldman Sachs

Morgan Stanley also agrees: “We see legalised US sports betting and iGaming as a once in a generation shift in what was a mature gaming industry,” Thomas Allen, a managing director at Morgan Stanley, said.

The key catalyst for growth in the US has been a regulatory change. On 14 May 2018, the US Supreme Court struck down the Professional & Amateur Sports Protection Act (PASPA), the 1992 federal law that, until then, limited fully-fledged sports betting to Nevada.

PASPA, having been overturned, allows individual US states the right to legalise sports betting through legalization or constitutional amendments. Having previously been restricted to Nevada, sports betting has rapidly become legal in 24 states and is on its way to 39 states by 2023, according to various analysts. iGaming is also rapidly expanding from the current six states to an expected 11 states in 2023.

Other potential growth drivers may include wider social acceptance of sports betting as an entertainment activity; sports betting support from leagues, teams and media companies; spending conversion from illegal to legal markets; technological improvements that allow of an enhanced online experience; and greater time spent on mobile devices.

Technology, in particular, is also spurring growth as globally, people are spending more time on electronic devices, and 77% of the US population have their own smartphones.

Other technological improvements are also enhancing the gaming experience, such as improved user interface, including design, navigation, speed, and greater personalised marketing.

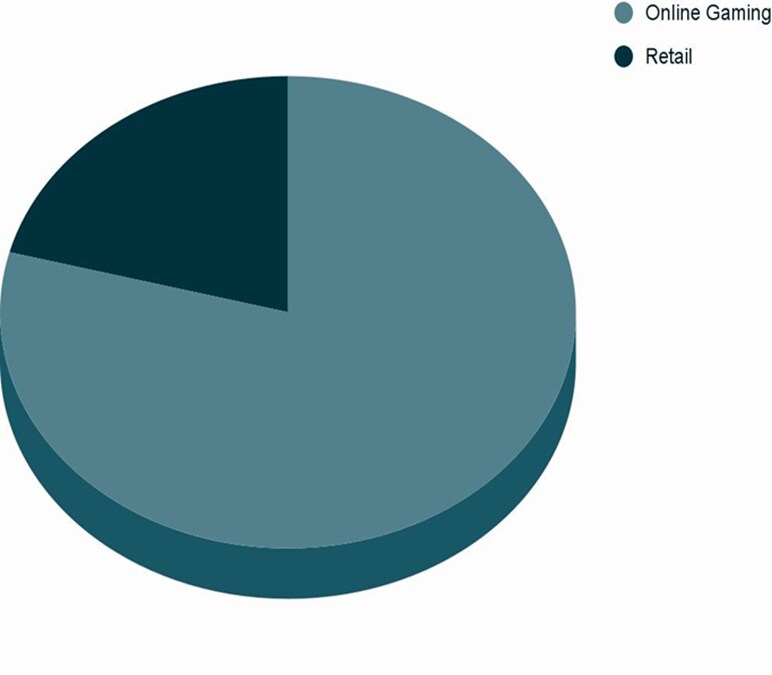

Morgan Stanley expects 82% of sports betting to be online with 18% at retail.

Source: Morgan Stanley

Technological advances also support proposition bets becoming more widely available. Prop bets are typically bets on any event during the game that does not usually impact the outcome of the game. This can include the first person or team to score. While many of these can be considered “gimmicky”, they can also be a lot of fun for casual bettors.

Given the huge size of the illegal gaming market, we expect meaningful conversion from illegal betting to legal betting.

The relatively low growth in the bricks and mortar segment of the US gaming industry is also fuelling greater investment into online or digital gaming for many of the larger companies like MGM Resorts, Caesars and Penn. We believe that this accelerated investment will drive more rapid revenue growth in the shorter term.

Sports Betting and iGaming is still in its infancy as an investible theme, and understandably, some may have their reservations or feel the theme too ‘gimmicky’.

However, we believe that the direction of travel, paired with the weight of the industry’s key players, could make this segment an exciting addition to one’s portfolio.

Investing in sports betting and gaming

Investors looking to get a slice of themes, such as sports betting and iGaming, can consider exchange-traded funds (ETFs). ETFs enable investors to invest in a broad basket of securities that represent companies from a specific sector or theme such as cloud computing, the space economy iGaming.

HANetf is an issuer of a wide variety of megatrend thematic ETFs. Aaron Fischer is a co-founder of the Fischer Sports Betting & iGaming UCITS ETF [BETS]. However, when you invest in or trade ETFs, your capital is at risk.

This article was written by HANetf and originally published on the firm’s website.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy