As with almost everything related to Elon Musk, Tesla’s new Cybertruck divides opinion. Bulls such as ARK Invest believe that demand is being significantly underestimated, but pessimistic observers feel the futuristic pickup is likely to become a “cult” product. Cheaper competitors such as Ford’s F-150 Lightning could have broader appeal.

- Tesla finally starts delivering Cybertrucks, priced at nearly $61,000.

- Statista forecasts 22.75% CAGR for the electric truck market 2023–30.

- ARK Autonomous Technology & Robotics ETF gains 34% year-to-date.

Four years after the concept was first unveiled, deliveries of the new Tesla [TSLA] Cybertruck began in late November. The launch of this heavy-duty vehicle could prove a watershed moment in the history of electric vehicles (EVs), but the truck is off to a difficult start.

Sam Korus, Director of Research of Autonomous Technology and Robotics at ARK Invest, set out to model demand for the Cybertruck in May. His article, ‘What Will Demand Be For The Cybertruck?’, is a response to pessimistic forecasts — such as Morgan Stanley’s prediction that the vehicle will be a “cult car” that will not exceed 50,000 units per year.

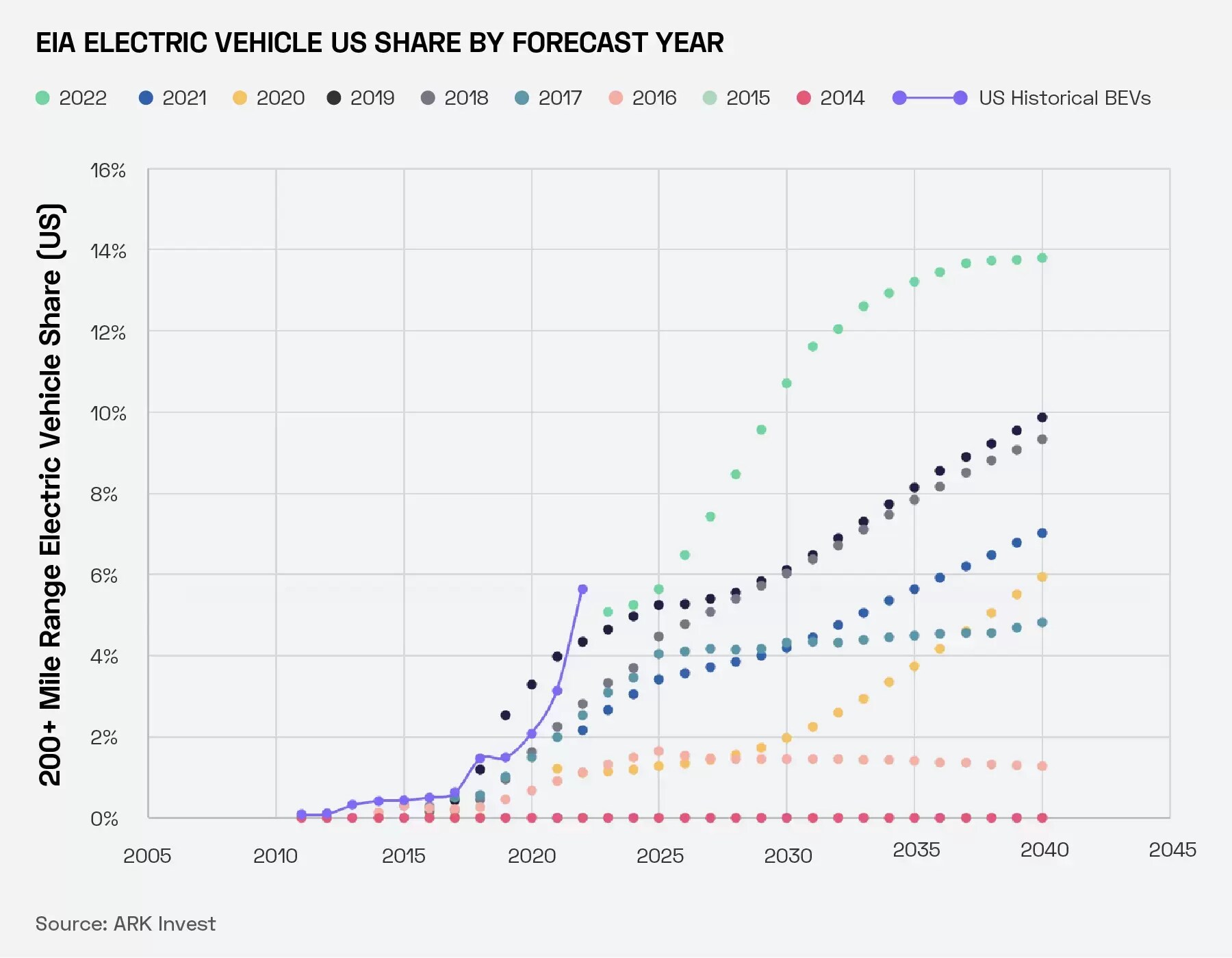

Korus believes that potential demand for the vehicle is currently underestimated, and that low expectations “are based on a blind spot”. He points out that the US Energy Information Administration (EIA) has consistently underestimated the demand for EVs. Despite having increased its forecast every year since 2014, the EIA now forecasts a plateau at approximately 14% of the market in 2040. ARK’s research, however, suggests that global EV market share will reach 70% by 2027.

While the EIA expects electric trucks to account for less than 10% of all vehicles in the US by 2050, Korus points to two signs that suggest this is a significant underestimate.

The first of these is the sheer number of pre-orders that the Cybertruck has registered; 1.5 million, according to reporting from Elektrek one year ago, and as high as 1.9 million, according to a Tesla earnings call in July.

The second signal Korus points to is Google Trends data suggesting that interest in the Cybertruck is not only increasing over time, but that it is concentrated in US states which, historically, have been “truck-loving”. In these states especially, Korus suggests that Cybertrucks could soon become as mainstream as the Tesla Model Y.

Price Parity

Falling prices, both of components such as batteries and, correspondingly, the EVs downstream of them, are a central pillar of ARK’s bullish stance. In its ‘Big Ideas: 2023’ report, ARK argues that EVs with a range of 300 miles or more have reached price parity with internal combustion engine (ICE) vehicles.

Technology research consultancy Gartner has a more modest estimate, forecasting that by 2027 battery EVs will have reached price parity with ICE vehicles of equivalent size and configuration. In Gartner’s view, by the year 2030 EVs will account for more than half of the models sold by carmakers.

Electric trucks, however, are a tiny proportion of this market. Gartner estimates that 30,162 out of 15,426,529 EVs to be shipped in 2023 will be heavy trucks, with vans accounting for a further 218,337 shipments. In 2024, Gartner expects these numbers to rise by 30.5% and 60.3% respectively, out of a total 18,452,573 EVs shipped — an overall increase of 19.6%.

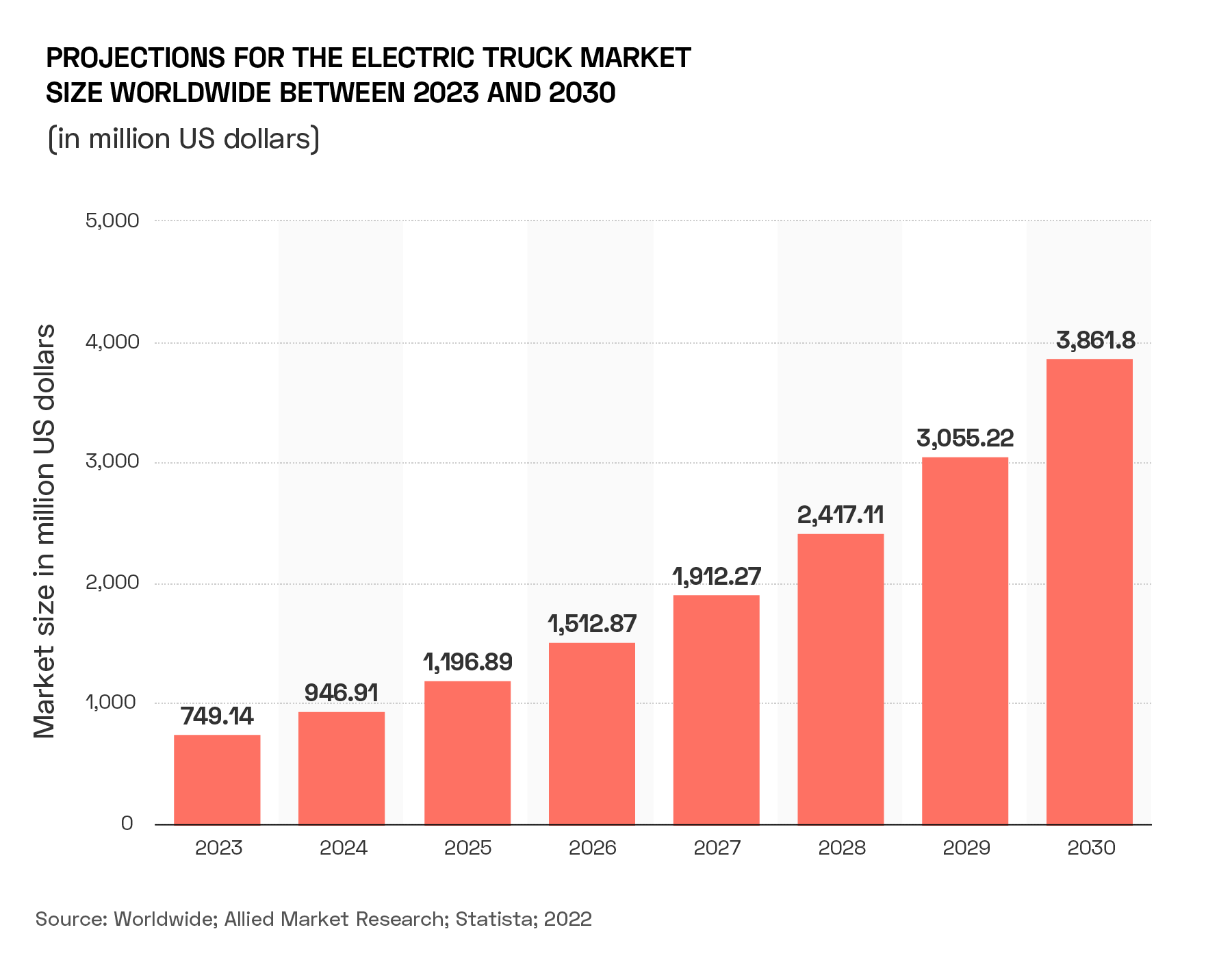

According to Statista, however, there is significant growth potential for the global electric truck market over the longer term. The research firm anticipates a 22.75% CAGR for the market between 2023 and 2030, during which time it is forecast that it will reach a total size of $3.9bn.

Can Supply Meet Demand?

Whatever the future holds for the electric truck market more broadly, the Cybertruck’s launch has encouraged Tesla’s critics. Forbes observed in early December that the Cybertruck as launched is 53% more expensive, at $60,990, and has 50% less range than was promised when the concept was unveiled in November 2019.

This could dent the proportion of the 1.9 million “reservationists” (those who have pre-ordered the Cybertruck with a $100 down-payment) who actually go on to convert.

Speaking to Wired last January, however, Tim Simcoe, professor at the Boston University Questrom School of Business, observed that if Tesla fulfils even 15% of its Cybertruck pre-orders, it will equate to a year’s worth of Toyota’s [TM] US truck sales. Meanwhile, Olav Sorenson, professor of entrepreneurial studies at UCLA Anderson

School of Management, told the magazine that Tesla may need to sell as many as 300,000 trucks per year to break even on its manufacturing costs.

Even if demand holds, Tesla could struggle to match it with supply, as Musk warned investors back in October. Supply shortages could lead to ‘scalping’ — quickly reselling the product for higher than the original purchase price.

Tesla has been threatening to sue anyone who sells a Cybertruck within a year of having purchased it. In November, the company added a clause to its purchase agreement warning it would sue for either the profit on the sale or $50,000, whichever is greater. The relevant clause was removed three days later, but Elektrek reported on 11 December that it has since reappeared.

Will the Electric Truck Market Pick Up?

Thanks to its delayed launch, the Cybertruck will not have the market all to itself. Ford’s [F] F-150 Lightning truck is significantly cheaper than the Cybertruck, at $49,000. Ford estimated last year that it would sell 150,000 Lightnings this year, three times as many as the 50,000 Cybertrucks that Morgan Stanley analysts expect Tesla to achieve.

In July, Rex Jackson, CFO of EV charging infrastructure firm ChargePoint [CHPT], told OPTO Sessions that EV availability in the US had passed an “inflection point” of basic availability. He anticipates that the US fleet will become 100% electric over a 10–15-year period.

However, affordability remains a key potential impediment. “Macroeconomic forces are not as favourable for that as they should be,” said Jackson. Lower-cost models such as Ford’s F-150 Lightning and General Motors’ [GM] 2024 all-electric Chevy Silverado, which starts at $50,000, could help electric trucks go mainstream.

How to Invest in Electric Trucks

Tesla’s share price is up 94.6% year-to-date to 12 December. During this period, Ford’s share price is up 5.2%, while GM’s gained 0.9%.

Toyota doesn’t yet offer an electric pickup truck, but it has confirmed that one is in development, and could arrive in 2025. Toyota’s share price is up 37% year-to-date.

Investors can gain indirect exposure to the growing adoption of EVs via companies that provide the underlying infrastructure, such as ChargePoint. As Jackson pointed out in his OPTO Sessions interview, the company’s revenue is directly correlated with the adoption of EVs in the US. Nevertheless, ChargePoint’s shares are down 75.6% year-to-date.

ETFs can also provide diversified exposure. ARK’s most relevant fund is the ARK Autonomous Technology & Robotics ETF [ARKQ], within which Tesla is the top holdingas of 12 December. However, because it is focused more on autonomous than electric vehicles, it doesn’t hold Ford, GM, Toyota or ChargePoint. All five stocks are held by the iShares Electric Vehicles and Driving Technology UCITS ETF [ECAR:L] as of 8 December. ARKQ and ECAR gained 34.4% and 18.4% year-to-date, respectively.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy