Big tech giants were once synonymous with peak innovation. Now the landscape is shifting, with smaller and newer companies driving most of the world’s disruptive innovation. Cathie Wood’s flagship ARK Innovation ETF kicked off 2023 with record gains, and Ron Baron’s mutual fund is among the long-term top performers. Meanwhile, Softbank’s Vision Funds posted $5.5bn quarterly losses.

- Cathie Wood started 2023 with a record 27.8% gain for her flagship ARK Innovation ETF.

- Ron Baron’s Baron Partners Fund [BPTIX] was the top-performing US equity fund over the long term.

- Softbank’s Vision Funds posted their fourth quarterly loss in a row, pushing its share price to a 3-month low on Wednesday.

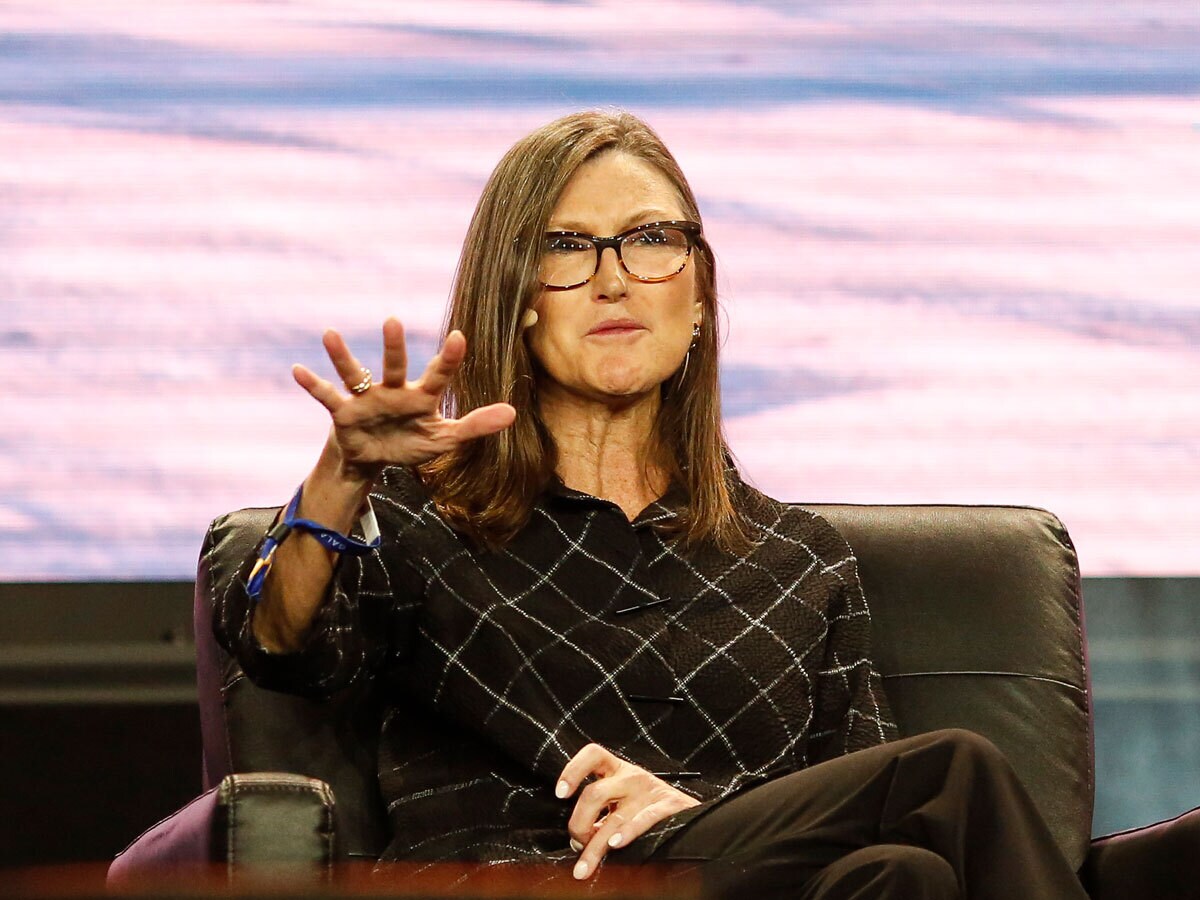

Cathie Wood posted record gains for her flagship ARK Innovation ETF [ARKK], bouncing back from a challenging 2022 with returns of 27.8% for January, the fund’s strongest month since 2014.

Ironically, ARK’s biggest laggards of 2022 were the drivers of the 2023 rally, including Coinbase [COIN], which is up around 65% year-to-date, Tesla [TSLA], Nvidia [NVDA], Exact Sciences [EXAS], Shopify [SHOP] and Roku [ROKU], which have all gained north of 30% this year.

The rebound follows the ETF’s worst year on record, which saw its value plummet 67% as interest rates and inflation soared. “Innovation was one of the biggest victims of the massive interest rate increase we saw last year,” Wood said.

However, despite the drop in returns, ARK logged about $1.3bn in positive inflows, as investors sold their interests in growth benchmarks, among them the Nasdaq, and moved their capital to ARK.

The new Nasdaq?

“We are the new Nasdaq”, Ark Investment Management’s founder and CEO Cathie Wood claimed in an interview with Bloomberg on 2 February.

The Nasdaq 100’s top holdings include the big tech heavyweights that have dominated the market over the last decade, including the likes of Microsoft [MSFT], Apple [AAPL] and Amazon [AMZN]. The ARK Innovation ETF’s top holding is Tesla, which is also a leading Nasdaq stock.

The fund’s other major holdings are smaller, newer companies such as software maker Zoom Video Communications [ZM] and cancer test developer Exact Sciences.

Wood said her fund now offers investors more exposure to long-term innovation than most other popular growth stock benchmarks on the market.

However, ARK has posted a roughly 10% five-year gain, compared with the tech benchmark’s 87%.

ARK’s overarching investment strategy is built on five converging technological innovations expected to transform the landscape in the coming years: energy storage, robots, public blockchains, artificial intelligence and multi-omics sequencing.

A shared faith in Tesla

Morningstar ranks Ron Baron’s Baron Partners Fund [BPTIX] as the top-performing US equity fund over the long term. The fund reeled in a five-year total return of 26.5% on an annualised basis, and a 10-year return of 20.9%.

Baron says he is unfazed by the stock market turmoil, particularly in the tech sector, CNBC reported on Tuesday.

Something Wood and Baron have in common is their strong bet on Tesla. Both the ARK Innovation ETF and the Baron Partners Fund have their largest holding in the EV maker, with a 10.15% weighting in ARK and 31.5% in Baron’s fund.

Baron said he sees unprecedented demand for Tesla’s vehicles, and estimates the EV maker’s value will reach $1,500 per share by 2030, according to CNBC.

The caveat: Softbank

Another major innovation tech investor, however, is not performing so well. Softbank’s Vision Funds posted a quarterly investment net loss of ¥783.41bn, or about $5.5bn, its fourth quarterly loss in a row, sinking its share price to a three-month low on Wednesday.

This was a steep drop from analysts’ estimates of a ¥103.59bn profit, according to S&P Global Market Intelligence.

The fund, which invests in both publicly listed companies and unlisted start-ups in various emerging technologies, saw a drop in value for 73% of its 472 investments.

Softbank Vision Funds’ finance chief Navneet Govil attributed the mounting losses to “significant unpredictability in the labour markets, future monetary policy road maps, as well as corporate earnings”, during an interview on Tuesday.

What did Softbank get wrong?

Softbank’s setback mostly came from continuous losses in its investments in unlisted start-ups, which outweighed the gains from its publicly listed holdings. While they can be highly innovative, start-ups routinely struggle to find their footing, often proving a liability for backers.

In contrast, the holdings of ARK and the Baron Partners Fund are exclusively in companies traded on the stock exchange. That layer of medium-to-large public companies with solid financials, but that are more niche than big tech companies and conglomerates, may be driving performance. Think Tesla.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy