The payments industry is worth $2.2trn, according to Mastercard, but the pace of innovation in the space is rapid. The company identifies six trends that could shape payments in the years ahead. Additionally, buy now, pay later continues to solidify, while one UK start-up stands to disrupt big tech business models.

- Six trends, including crypto and cybersecurity, set to shape payments innovation.

- Visa launches three AI-driven security features.

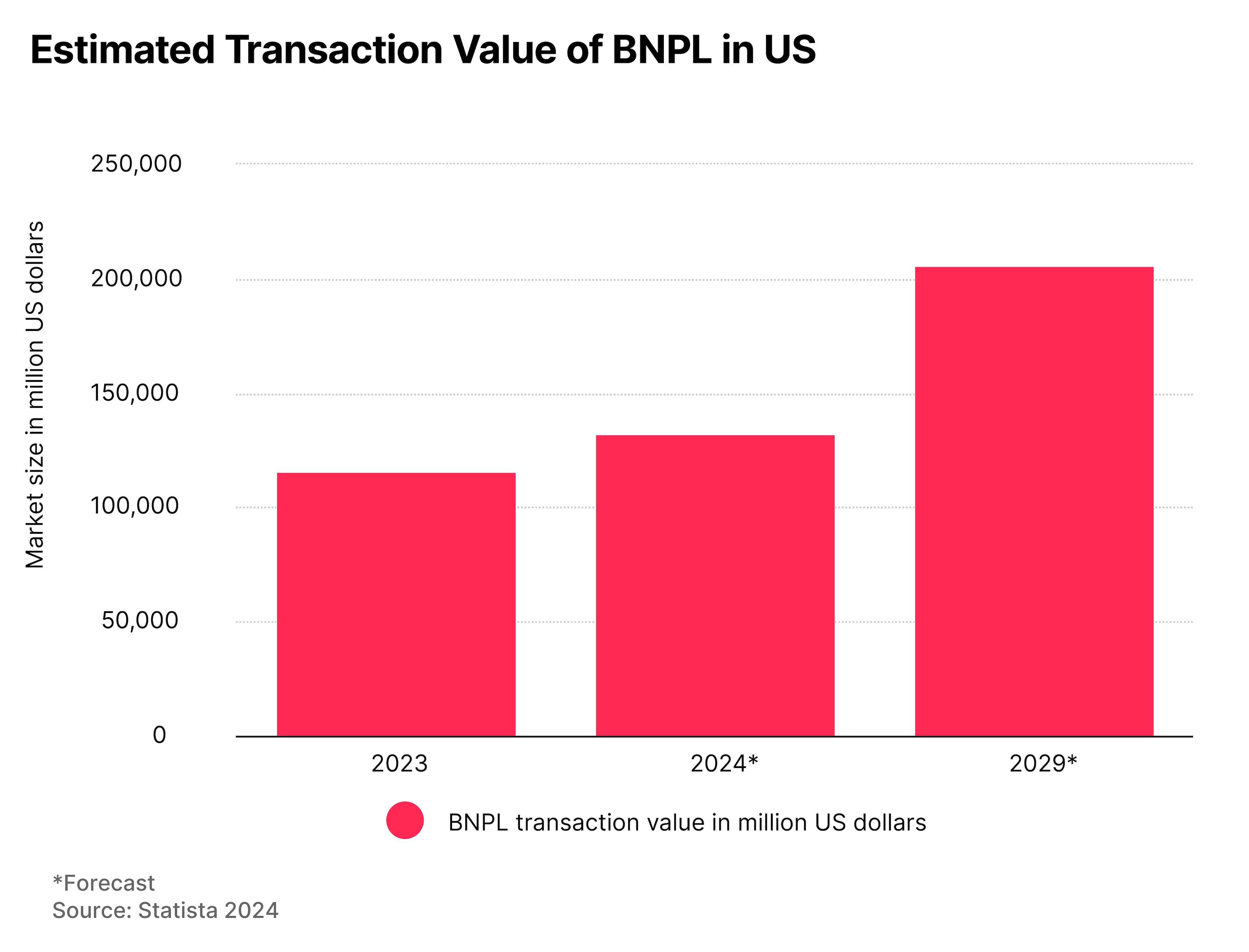

- BNPL market could top $200bn by 2029.

Big Numbers, Big Potential

The payments sector currently generates approximately $2.2trn in annual revenues, according to Mastercard [MA].

Data from Statista shows that over 1.3 trillion cashless transactions took place globally in 2023, and that number is projected to increase to nearly 2.3 trillion by 2027.

This potential would seem to be bolstering the share price of the payment giants.

Mastercard’s share price has gained 24.3% in the 12 months to 18 April, and 8.2% year-to-date. Visa’s [V] share price, meanwhile, gained 17.7% over the past 12 months, and 4.9% year-to-date.

New Ways to Pay

Six trends could be set to disrupt the payments landscape over the coming years, according to a February report from Mastercard.

1. Alternative payment rails

While credit cards remain the most popular payment method globally, with transactions valued at over $13trn by payment processing company Worldpay, other forms of payment are also gaining ground. Some of these include digital wallets, QR codes and real-time payments.

2. Open banking and data

According to Juniper Research, the total number of global open-banking transactions more than doubled between 2022 and 2023, nearly reaching $850m. The segment could grow exponentially to $6.5bn by 2027.

3. Merchant acquisition

Merchant acquirers — the businesses that transfer information from a card transaction between the retailer and the card issuer — could drive industry growth at a CAGR of 8.7% to 2026, by which time the market could exceed $160bn, according to BCG.

4. Crypto and innovative payments

According to Mastercard, the total number of cryptocurrency wallets surged 75% to 81 billion between 2020 and 2022.

There is extensive scope for innovation in blockchain technology to enable payments. Tom Duff Gordon, Vice President of International Policy at Coinbase [COIN], told the Innovate Finance Global Summit (IFGS) 2024 in London this week that he views stablecoins as “a breakout use case for crypto”.

“Stablecoins are here, and they work,” he added. Blockchain technology, he observed, is already capable of transferring cryptocurrencies internationally “like a text message”.

5. ESG integration

As with many sectors, Mastercard highlights that environmental, social, and governance (ESG) integration is now a key social and regulatory priority in the financial and payments industry. Rather than just a regulatory requirement, Mastercard observes that many companies now see ESG as a source of competitive advantage.

6. Fraud and payments security

This final trend is a key part of the payments landscape. According to Juniper Research data cited by Mastercard, the volume of global e-commerce fraud grew 16% between 2022 and 2023.

Can AI Make Payments More Secure?

As Mastercard points out, continual improvements to data security infrastructure are key for payments firms to maintain the trust of their customers.

Visa is leveraging the potential of artificial intelligence (AI) to meet this threat.

Bloomberg reported in March that the payments company was supplementing its suite of products for businesses with three new AI-powered security tools.

One of these will build on Visa’s existing AI solution that assists in detecting and blocking fraudulent activity made digitally, but without a credit card.

Another will enable companies to monitor account-to-account payments in real time, while the third will open Visa’s Advanced Authorization and Risk Manager products to transactions that don’t involve a Visa card.

“It’s very important that you work with companies that are investing very heavily in cyber defence,” said Georgina Bulkeley, Director of EMEA Financial Services Solutions at Alphabet’s [GOOGL] Google Cloud, at the IFGS conference.

Google Cloud is a key provider of security systems to payment companies. For example, PayPal [PYPL] uses Google’s Cross-Cloud Network to provide security to its payments network.

The Rapid Rise of BNPL

One other trend that is disrupting payments is the increasing ubiquity of buy now, pay later (BNPL) services. Darren Deal, Senior Vice President of Fintech, Government and Digital Partnerships at Mastercard, explained to IFGS how the speed of BNPL adoption underscores how quickly innovation can take effect in payments.

“Five or six years ago, BNPL was pretty much never heard of,” he added. The mechanism has forced large banks to change “how they think about credit”, with fintech companies and consumers following suit.

Payment products such as Block’s [SQ] Afterpay are now integrating BNPL payments into their platforms. Block’s Chief Financial Officer Amrita Ahuja recently told CNBC that integrating Afterpay with Block’s Cash App is “an incredible opportunity to bring commerce into Cash App”.

According to Ahuja, “We had over 20 million users on an annual basis using Afterpay with increasing frequency”, emphasising that “younger customers” account for much of this interest.

Block gained 15% over the past 12 months, and 15% year-to-date.

Statista data puts the value of the BNPL market in the US at $116.3bn for 2023, and estimates it could rise to $132.7bn in 2024 and $205.8bn in 2029.

Could AI Take Ad Revenues to Zilch?

One start-up to keep an eye on is UK payments provider Zilch. CEO and Co-founder Philip Belamant told IFGS that the company is setting out to provide better costs and outcomes for customers by auctioning demand for specific products.

On top of the hundreds of billions of dollars spent on interest fees per year, Zilch has also identified inefficiencies in the amount that sellers spend on advertising through big tech companies such as Google and Meta [META], said Belamant.

Zilch uses “the ad budgets of brands to subsidise the cost of traditional consumers”. Users can search for a product in the company’s app, which then allows vendors to bid for that demand.

“If the customer says I'm looking to buy trainers, Footlocker [FL] can bid on that for 5% of the sale. We can see in real time that Nike [NKE] is willing to pay 8%, and so on and so forth. We then present that to the customer in a rank order of cost for credit offset by that condition.”

So far, said Belamant, Zilch has facilitated over $3bn in sales through this platform.

Zilch is currently private, but Belamant explained the company’s thinking around a potential IPO.

“If we want to keep growing and driving this business, we think it needs to be a public company,” he said. “We want to just make sure we get certain things right leading up to that.”

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy