Tesla [TSLA] stock hasn’t had the best August, having slipped 1.6% since the start of the month (through 24 August). Semiconductor shortages, regulatory issues, and the possibility that the Tesla stock is overvalued have come into sharp focus.

But the electric car company’s Artificial Intelligence (AI) Day, held on 20 August, could be a tailwind for the Tesla stock, following its announcement about plans for when a self-driving car would come on the market.

Tesla moves closer to a self-driving car

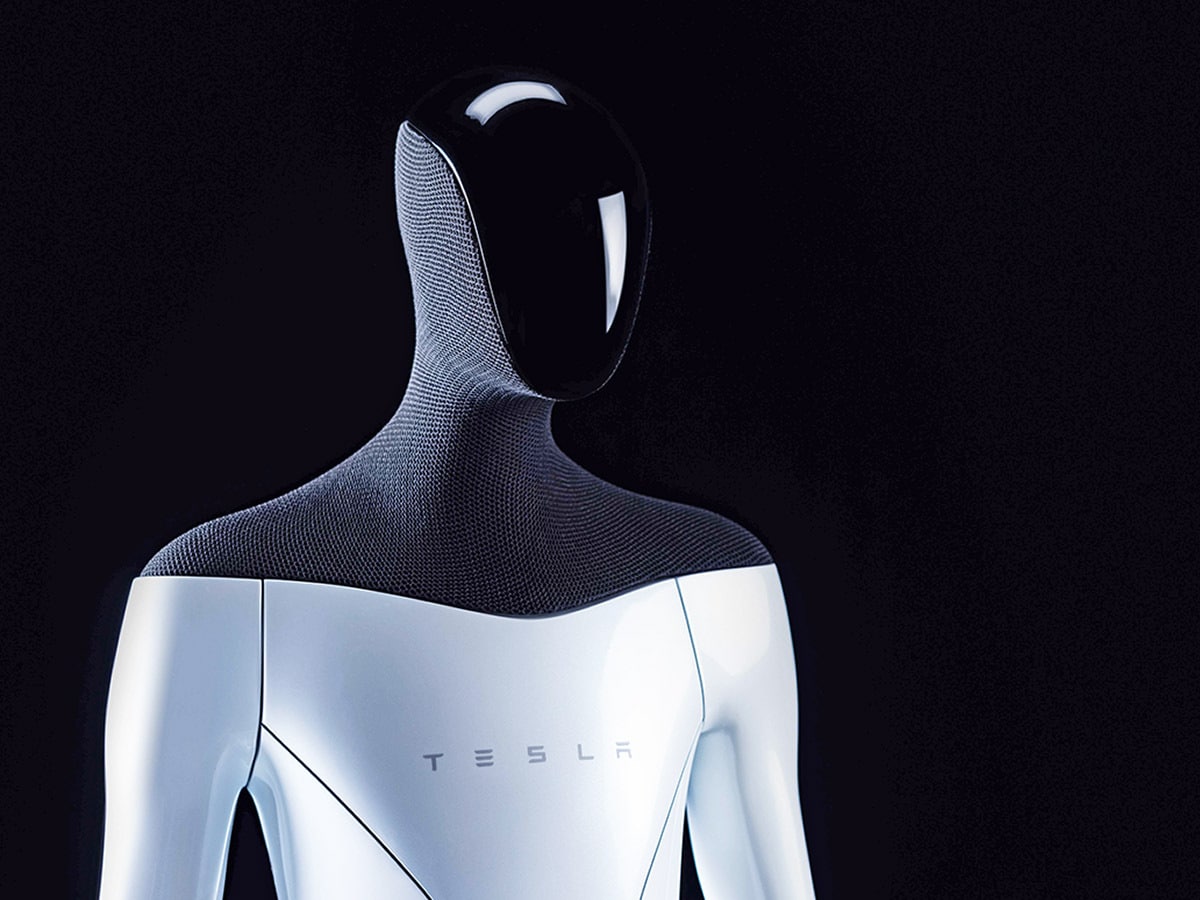

Grabbing the headlines at Tesla’s AI day was the ‘Tesla bot’ – a humanoid robot designed to “eliminate dangerous, repetitive, boring tasks” that responds to voice commands. At the AI Day event, this took the form of a dancer dressed as a robot throwing out some moves. Yet, Elon Musk, CEO of Tesla, claimed that a prototype is due to be finished as soon as 2022.

Of course, nothing may come of the Tesla bot – known internally as ‘Optimus’ – other than an entertaining distraction at an industry event, although it’s worth remembering that Honda [7267.T], Toyota [7203.T] and GM [GM] have all developed their own robots.

The dancing robot almost distracted from what was a showcase of some impressive advances in self-driving technology. And, at its core, Tesla is still an automobile company.

What a lot of people wanted to know on the day was when full self-driving could be a reality. A pertinent question for owners, as all new Tesla’s are sold with “hardware capable of providing Autopilot features today and full self-driving capabilities in the future”, according to the Tesla website.

While an answer to that question didn’t come. At the event, Tesla engineers explained the work done to make its self-driving car safer. This included a video where a driver was taken to their destination by Tesla’s self-driving navigation system, with the driver simply keeping their fingers lightly on the wheel as the car navigated traffic.

To train its AI technology to be able to self-drive, Tesla needs to process a lot of data and has developed the Dojo supercomputer to do this. At the event, Tesla said the supercomputer could be made available to other automakers and tech companies.

But Tesla’s stock could be held down by current technology

Before any self-driving Tesla cars hit the road, regulators will need to be confident enough that the system works in any scenario. And Tesla has run into some issues with regulators regarding its self-driving claims.

Tesla’s current Autopilot feature operates at Level 2 on the driving automation scale. That means drivers must pay attention 100% of the time, with the car handling operations like changing speeds when in cruise control. Other companies like GM [GM] offer assisted driving at this level. At the top of the scale is Level 5, where the car does all the work for you.

The National Highway Traffic Safety Administration (NHTSA) in the US has launched an investigation into Autopilot. This will investigate 11 accidents where a Tesla crashed into another vehicle while on Autopilot. This is a big deal as the watchdog has the power to recall cars – in Tesla’s case, this would be all vehicles sold since 2014.

Separately, two US senators have asked the FTC to investigate Tesla’s marketing of the Autopilot features – i.e., that Tesla’s are marketed as coming with ‘full self-driving capabilities’, when in fact, a fully attentive driver needs to be behind the wheel. It’s these issues that could keep a lid on Tesla’s stock in the short term.

What did AI Day mean for the Tesla stock?

Tesla’s stock has accelerated over 23% over the past three months (through 24 August) and is now trading down under 1% from the start of the year. But are AI innovations likely to impact the stock’s longer-term growth potential?

Well, yes and no. Tesla’s stock has gained 5.2% since AI Day, closing 24 August at $708.49. Whether the company’s AI ambitions are enough to see Tesla’s stock level break out are debatable, for that to happen, it’s likely to come down to cold, hard sales.

Al Root, writing in Barron’s, suggests that investors might have to wait until early 2022 for Tesla’s stock to break out of its current trading range. The journalist cites rising interest rates which will hurt growth stocks and the global semiconductor shortage. Root points out that Tesla’s big events don’t always send the stock higher. Instead, Tesla’s stock could move higher once more capacity comes online in plants in the US and Germany.

“More capacity would give investors’ confidence that the company can deliver about 1.3 million units in 2022, up about 50% compared with the 860,000 deliveries expected in 2021” - Al Root

“More capacity would give investors’ confidence that the company can deliver about 1.3 million units in 2022, up about 50% compared with the 860,000 deliveries expected in 2021,” writes Root.

The fact is that Tesla’s stock is trading at a whopping forward price to earnings ratio of 101.65. Considering revenue growth is already pegged at 56% for this year and around 34% for 2022, according to data from Yahoo Finance, this is an expensive stock, even if it does shift more vehicles.

Among the analysts tracking the stock on Yahoo Finance, Tesla has a $713.15 average 12-month price target – hitting this level would see a 0.7% upside on 24 August close.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy