Net-zero targets are becoming a key pillar of companies’ ESG commitments, and organisations are increasingly adjusting their business models with sustainability in mind. According to Schroders, this trend is bringing the carbon intensity of stock market indices down over time. Carbon capture and sequestration could be a key technology in efforts to decarbonise business.

- Schroders identifies a downtrend in the carbon intensity of global stock markets; according to Morgan Stanley, this could boost profitability.

- The S&P 500 Net Zero 2050 Paris-Aligned ESG Index has outperformed the broader S&P 500 in 2023 so far.

- Apple gains 45% year-to-date, despite concerns over the validity of its net-zero claims.

“Pressure from consumers, regulators and campaign groups is already leading companies to decarbonise their operations or commit to doing so in the future,” write Barbara Wilson, Head of Sustainable Solutions, and Ben Popatlal, Multi-Asset Strategist, in Schroders’ ‘Investor’s Guide to Decarbonisation’.

“Out of the 2,000 largest publicly traded companies, 931 have set net-zero targets already,” according to Wilson and Popatlal.

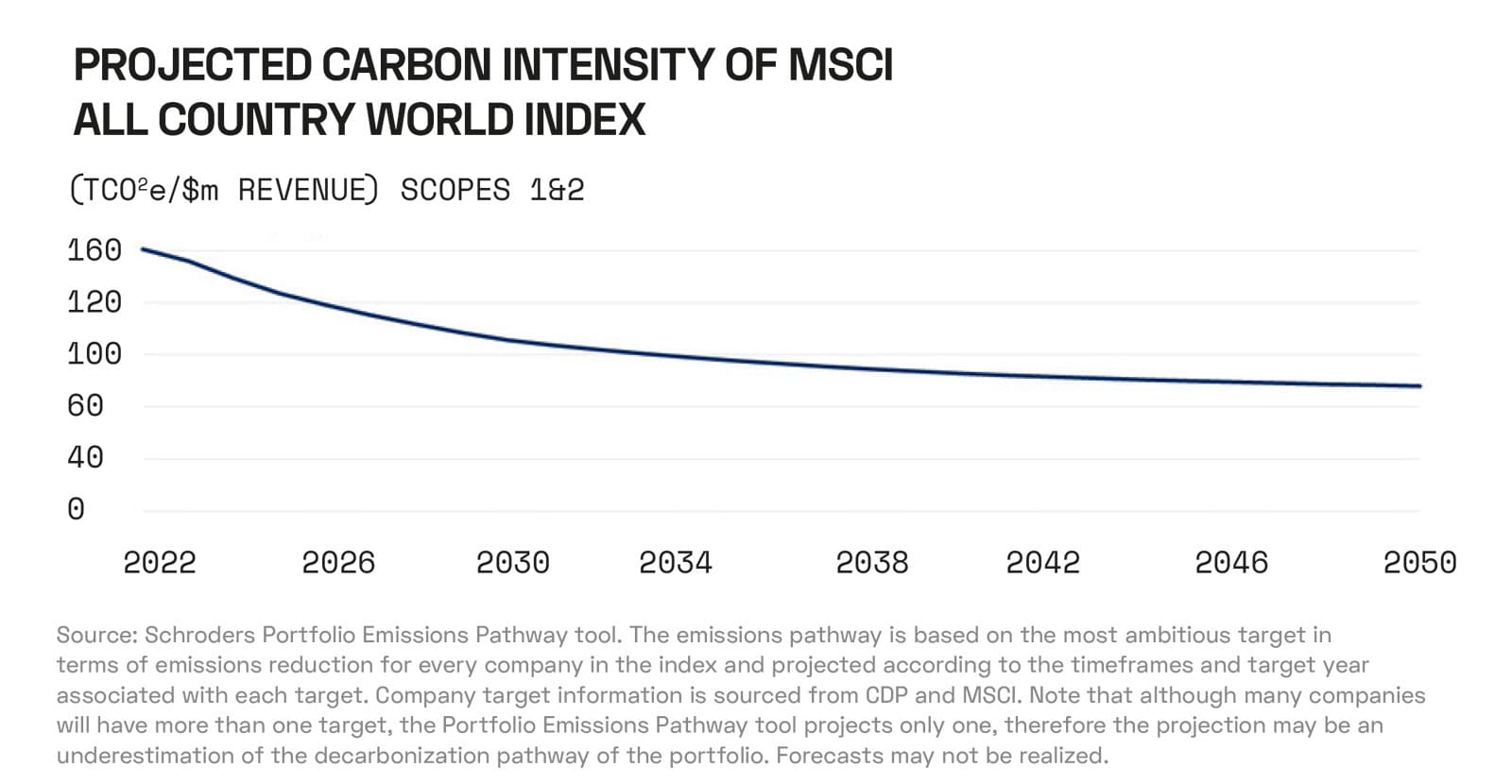

The upshot of this is that financial markets and portfolios are becoming progressively less carbon-intensive. Schroders estimates that the weighted average carbon intensity of the MSCI All Country World Index (ACWI) will fall by 50% by 2050, assuming that all its constituents’ current decarbonisation targets are met.

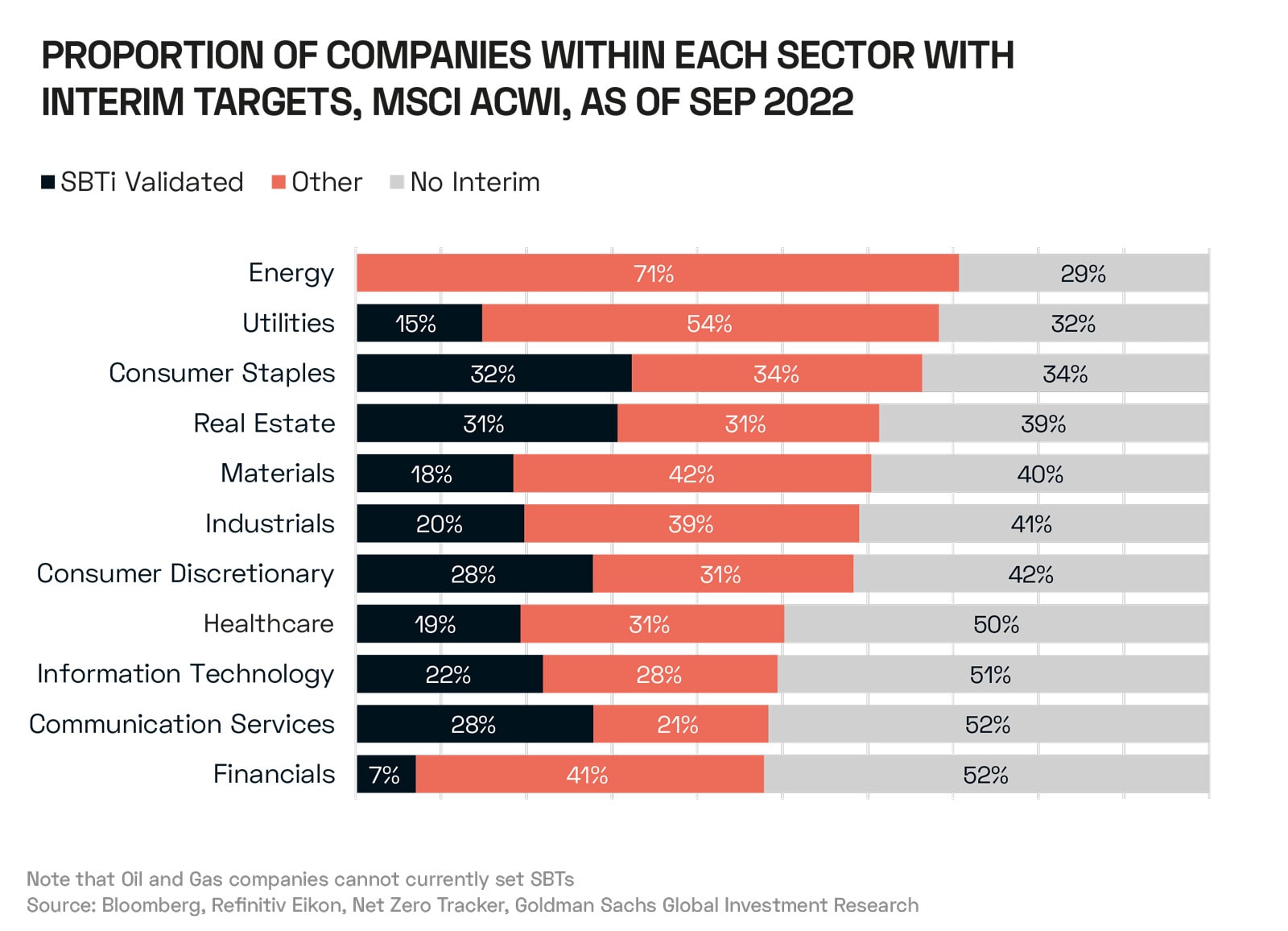

Goldman Sachs Investment Research has noticed a similar trend. In its ‘Net Zero Guide’ published in September, equity analysts led by Emma Jones, Vice President of ESG, observed that 54% of companies in the ACWI had established a net-zero target by the time of the report, an increase of 50% since July 2022.

The analysts broke down these commitments according to sector. Energy has the greatest overall proportion of companies with an interim net-zero target, though none of these have been evaluated by the Science-Based Targets initiative (SBTi). Financial companies have the lowest proportion of interim targets among eligible sectors.

There is evidence that companies which do have net-zero targets will outperform those which don’t over the long run. In its October report, ‘Managing Climate Change Risks with High Quality, Low Carbon Portfolios’, Morgan Stanley observed that “carbon emissions are in fact capital-intensive”, meaning that there is a strong inverse correlation between carbon intensity and return on operating capital employed. For example, software companies — “even with the remarkable growth of cloud-computing services” — have relatively low carbon emissions per unit of revenue.

A $12trn Opportunity

Over the past 12 months, companies that have net-zero commitments aligned with the Paris Agreement have outperformed their peers in stock market returns. The S&P 500 Net Zero 2050 Paris-Aligned ESG Index has outperformed the broader S&P 500, with returns of 16.5% in the year to 15 November, compared to the latter’s 12.6%.

This is despite the fact that, as strategy consultancy McKinsey points out, “navigating the net-zero economy has become more complicated over the past 12 months amid higher energy prices, supply chain pressures, increased interest rates, higher input costs, and lacklustre economic growth”. In its ‘Full Throttle on Net Zero: Creating Value in the Face of Uncertainty’ report, McKinsey analysts led by Senior Partner Laura Corb argue that demand for net-zero services could generate $9–$12trn in sales by 2030.

In an October report, PwC highlighted that investment in climate technology has fallen steeply over the past two years, to levels not seen for five years. According to the report, climate tech’s share of private equity and grant investment is climbing, rising to 11.4% in the third quarter of 2023. Yair Reem, Partner at Extantia Capital, told the analysts that “pressure from politicians, as well as demand from the corporate level and from consumers” is needed to close the green funding gap.

Negative Credits

On 12 September, Apple [AAPL] unveiled a suite of new carbon-neutral Apple Watches, as part of its “ambitious Apple 2030 goal to make every product carbon neutral by the end of the decade”.

However, Apple’s claims swiftly garnered criticism due to the fact they rely on carbon credits. According to the Financial Times, the EU is moving to ban the use of the term “carbon neutral” in corporate marketing by 2026, because basing such a claim on the use of credits is misleading.

Niklas Kaskeala, Chair of the Board at the non-profit Compensate Foundation, highlighted “systemic flaws” in such schemes. The paper also noted that the trees planted in one of Apple’s schemes have since been felled for timber.

Renat Heuberger, Co-founder and CEO of consultancy South Pole, one of the world’s first carbon companies to achieve unicorn status, stepped down on 10 November, following persistent allegations of greenwashing, especially at its Kariba project in Zimbabwe. South Pole schemes purchased by the likes of BP [BP] and Spotify [SPOT] have also recently been linked to the exploitation of Uyghur forced labour in Xinjiang, China.

Capturing the Trend

While offsetting emissions as a net-zero strategy comes under fire, the idea of capturing them at source is gaining traction.

Carbon capture and sequestration (CCS) technologies were among those to receive a tax credit in the Inflation Reduction Act of 2022, and, according to economic Substack newsletter Doomberg, they could be set for an upsurge.

“There’s going to be a wave of excitement around carbon capture and sequestration,” Doomberg told OPTO Sessions in October, adding that the technology is a “way out of the [climate] crisis in the minds of the fossil fuel industry”.

On 30 October, Aker Carbon Capture [AKCCF] was awarded a feasibility study by green energy producer TES for a 400,000-tonnes-per-year carbon capture plant in Germany. Aker already operates a 100,000-tonnes-per-year facility in the Netherlands and is developing a 500,000-tonnes-per-year site in Denmark.

How to Invest in Net Zero

Aker’s share price is down 16.1% year-to-date.

Apple has been among the top-performing stocks of 2023, with gains of 45.1% year-to-date. These gains have made the tech giant the top performer of the S&P 500 Net Zero 2050 Paris-Aligned ESG Index’s constituents as of 31 October.

Investors looking to tap directly into this index can select from a range of ETFs, including the Franklin S&P 500 Paris Aligned Climate UCITS ETF [500P:L] and the iShares S&P 500 Paris-Aligned Climate UCITS ETF [UPAD:L]. The funds have gained 17.9% and 22.6% respectively.

As of 31 October, the index is weighted 29.5% in favour of information technology companies, followed by healthcare (15.2%), financials (13.7%), consumer discretionary (11.2%), communication services (9.4%), industrials (8.8%), consumer staples (7.3%), real estate (2.6%), materials (2.2%) and utilities (0.2%).

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy