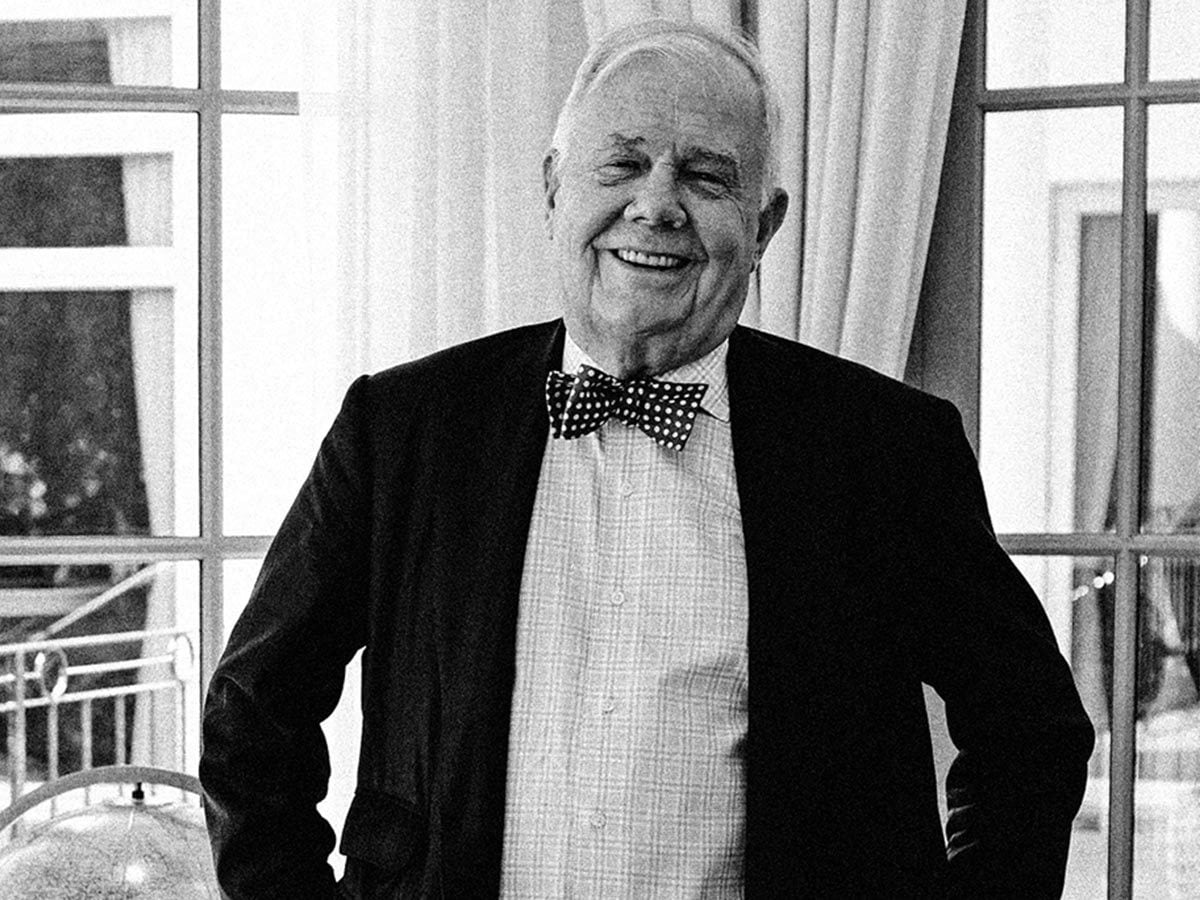

He could not have predicted a devastating, global pandemic, but veteran investor Jim Rogers — who co-founded the Quantum Fund with George Soros — has long warned that the world is heading for a severe economic and market reversal.

That time has come. Companies are issuing profit warnings and laying off workers, countries are reporting enormous GDP falls and stock markets have plunged from record highs.

“Since 2008, debt has skyrocketed. Central banks have cranked up the printing presses and continually bailed out companies and even national economies, delaying the inevitable by propping them up,” Rogers says.

“[I and others said] it’s not going to work. You’re going to make things worse before it’s over. That’s what recessions in bear markets are supposed to do – clear out the underbrush and the dead wood, so the forest can grow better.”

Rogers says China spending its rainy day money “saved the world” in 2008 and 2009 — but the country no longer has the capital reserves to make such an intervention.

“Even China has a lot of debt now and there’s nobody left to save us,” he warns. “It’s why I’ve said that the next time we have a bear market it’s going to be the worst in my lifetime. We’ll have a prolonged downturn after a series of minor rallies.”

Listen to the full podcast episode here:

Educated guesses

How, then, can investors best respond to these strange volatile times?

First, Rogers says they need to limit the amount of background noise they are hearing. “Only invest in what you know about. Don’t listen to some guy on the internet, an Opto interview or anything else,” he says. “If I told you that you could only have 20 investments in your life, you would be extremely careful. You wouldn’t be jumping in and out [of moves]. You’ve really got to do your homework before you take the plunge. Everybody wants a hot tip, but [those could] take you to the poor house.”

“You’ve really got to do your homework before you take the plunge. Everybody wants a hot tip, but [those could] take you to the poor house”

Rogers says such scrutiny should revolve around a company’s balance sheet. “You have to know how they work. Bear markets teach us over and over again that if you have a lot of debt, the chances are that you are not going to survive,” he states.

Investors also need to have a close eye on the wider industry their target operates in. “Maybe company X is great, but then there’s six firms like it also with strong balance sheets. So maybe that’s not a long play,” he explains.

“ You also have to see if there's a technological change coming that's going to put them out of business. Horseshoes went out of business [when] automobiles came along. You’ve got to make sure you've looked at everything.”

“You also have to see if there's a technological change coming that's going to put them out of business. Horseshoes went out of business [when] automobiles came along. You’ve got to make sure you've looked at everything”

Buy low, sell high

Rogers also likes to operate according to an age-old rule of thumb: buy low, sell high. In the current market, Rogers sees many opportunities for those seeking out depressed valuations.

“There are some things that are very, very depressed and I expect this to get much worse before it’s over in the next year or two,” he says. “I’m not mortgaging the farm yet, but I have started buying a few things when I see serious panic, [for example] I bought a shipping company in Russia. I usually invest in something that is ignored, is cheap, and is struggling, or where something is changing.

“People say I am buying a cheap, bankrupt company but I see that it is going to be a good investment. The Russian firm has been smashed recently but if I’m right, it won’t be going down much more and coming out of this it is going to do very well ”

“People say I am buying a cheap, bankrupt company but I see that it is going to be a good investment. The Russian firm has been smashed recently but if I’m right, it won’t be going down much more and coming out of this it is going to do very well”

Rogers says the most value to be found right now is in the travel, transportation or tourism sectors, which have been rocked by lockdown measures.

According to YCharts, airline group IAG [ICAGY] has seen its market capitalisation plummet from around $16bn in February to around $5.4bn today. Meanwhile, car maker Ford [F] is down from a market cap of $37bn last December to around $20bn.

“Airline stocks are down a great deal. Nobody is going to hotels or tourist sites,” he says. “But I stop and think ‘Well, are we all going to go back and use buses again in the future? Are we going to fly someday?’ [Of course] we will be flying in airplanes again someday and airports will open and there will be large amounts of money made if you get it right. There is risk, of course, but if you buy cheap then even if I’m wrong, I probably won’t lose so much money.”

“There is risk, of course, but if you buy cheap then even if I’m wrong, I probably won’t lose so much money”

Visit our YouTube channel to see more of our Opto Sessions episodes.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy