Which were the 5 winning stocks in Q1?Opto has produced a report tracking the top stocks bought by the world's leading funds and investors with over $2.5bn in assets under management (AUM) as of Q1 2023. Based on data from IEX Cloud and through Opto's proprietary research, we present a thematic classification of these stocks and identify two overarching trends: increasing activity in cloud computing and artificial intelligence (AI).

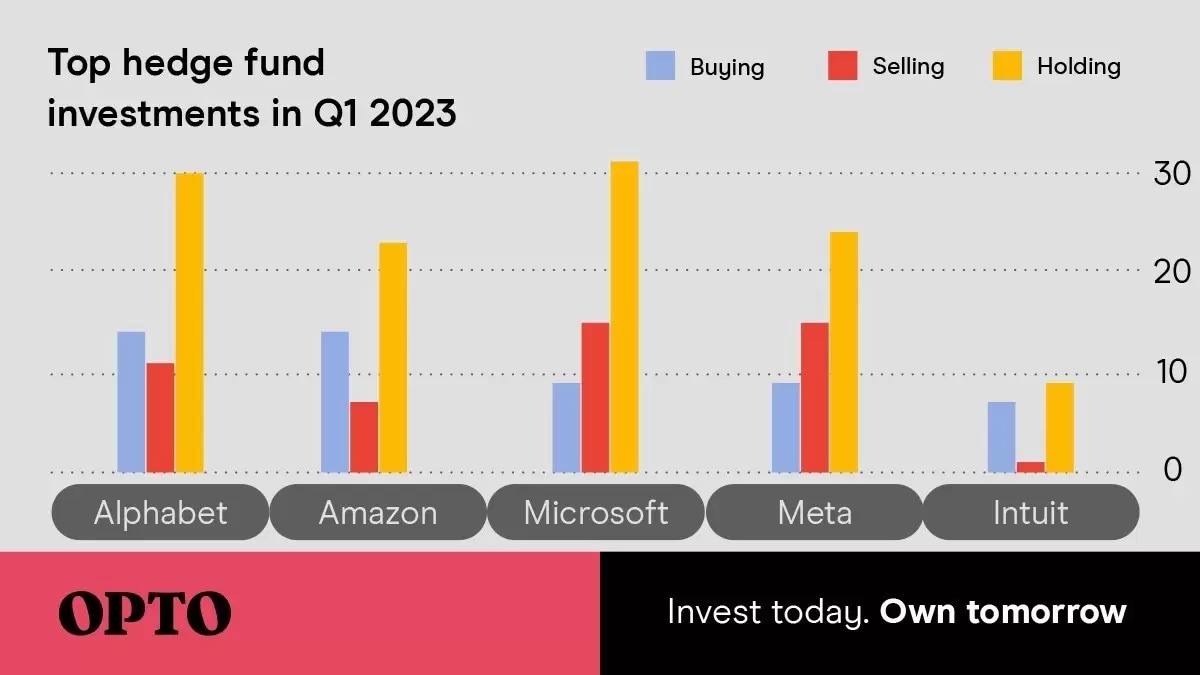

The chart below illustrates the transaction volume of the top five stocks bought, sold and held by some of the world’s leading hedge funds during Q1 2023. These stocks are Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN), Meta (META) and Intuit (INTU).

The graph below follows the share price movement of the five stocks from the beginning of Q1 till 8 June.

Which investors traded these stocks?

| Stock | Investor | Fund | AUM | Shares Bought | Portfolio Change |

|---|---|---|---|---|---|

| Alphabet | Bill Ackman | Pershing Square Capital Management | $10.2bn | 10,254,770 | 10.43% |

| Alphabet | Daniel Loeb | Third Point | $6.1bn | 4,750,000 | 8.06% |

| Alphabet | Chase Coleman | Tiger Global Management | $11bn | 4,636,774 | 4.37% |

| Intuit | Valley Forge Capital Management | $2.64bn | 246,810 | 4.17% | |

| Meta | John Armitage | Egerton Capital | $9.27bn | 1,755,537 | 4.02% |

| Amazon | Polen Capital Management | $37.9bn | 9,734,356 | 2.65% | |

| Microsoft | AKO Capital | $6.57bn | 486,111 | 2.13% | |

| Intuit | Chase Coleman | Tiger Global Management | $11bn | 447,032 | 1.81% |

| Microsoft | Chase Coleman | Tiger Global Management | $11bn | 674,257 | 1.77% |

| Amazon | Chase Coleman | Tiger Global Management | $11bn | 1,094,790 | 1.03% |

| Meta | Viking Global Investors | $21.2bn | 842,184 | 0.84% | |

| Amazon | Dodge & Cox | $88bn | 1,936,700 | 0.23% |

Bill Ackman of Pershing Square Capital Management (AUM: $10.2bn) invested approximately $1.6bn in Alphabet, adding 8.21% of Class C shares and 2.22% of Class A shares to his portfolio.

Warren Buffett of Berkshire Hathaway (AUM: $325.1bn) reduced his holding in Amazon by 1.08%, or 115,000 shares, but still remains the second-largest shareholder in Amazon. As of March-end, he owns 10,551,000 shares worth $1.9bn.

Daniel Loeb of Third Point (AUM: $6.1bn) bought 4,750,000 Alphabet shares, adding 8.06% to his portfolio.

Are you finding this content insightful? Leave us some feedback here.

Overarching trends: Cloud and AI

| Company | Key Theme | Growth Levers |

|---|---|---|

| Alphabet | Cloud Computing | Advertising (Google), Artificial Intelligence (Bard) |

| Amazon | Ecommerce | Cloud Computing (AWS), Online Retail, Advertising |

| Microsoft | Cloud Computing | Intelligent Cloud (Azure, Bing), Productivity Software, Gaming |

| Meta | Social Media | Advertising (Facebook, Instagram), AR-VR |

| Intuit | SaaS | Financial management software (QuickBooks, TurboTax) |

The first four of these are big tech companies, ranking among the world’s top 10 largest companies by market capitalisation, according to Statista. Whilst each of these five operate within different niches under the broader technology industry, two overarching common themes they all share are increasing activity and investment in Cloud Computing and Artificial Intelligence (AI). They are pursuing these both as separate business activities and as a combination, integrating AI to supercharge their Cloud offerings.

Cloud: Amazon Web Services (AWS) is the largest cloud computing provider in the world, with a market share of around 32%. Meanwhile, Microsoft's cloud platform, Azure, is the second-largest cloud computing provider with a market share of about 20%.

AI: Meta has been working on several AI-powered products, such as Portal and Oculus, which use computer vision and machine learning algorithms to enhance user experiences. Meanwhile, Alphabet is a legacy leader in AI research and development, the most significant project being its new AI-powered Google search assistant, Bard.

What do these 5 companies have in common?

Combined SWOT analysis

The chart below highlights the strengths, weaknesses, opportunities, and threats that these five companies share.

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Strong brand and customer base | Dependence on ad revenue | Grow their cloud computing businesses | Higher competition |

| Extensive product portfolios & legacy innovators | Exposure to regulation | Can relatively easily expand into new markets | Ever-changing regulatory environment |

| Strong financials | More antitrust scrutiny | R&D new AI-powered products and services | Technological disruption |

| Extensive data collection capabilities | Privacy concerns | Acquisitions & market consolidation | Economic downturn |

Strengths

These businesses have significant data collection tools that they may utilise to create new goods and services and target advertisements more precisely. For instance, Amazon leverages information gathered from their online store to create popular products like the Echo smart speakers and use algorithms to tailor customer ads based on their search and purchase histories.

Weaknesses

They are all exposed to stringent regulation and are potential targets for antitrust scrutiny, which could restrict their ability to grow. Microsoft, for instance, has been caught up in an ongoing regulatory battle with the US Federal Trade Commission since 2022 over its Activision Blizzard acquisition.

Opportunities

These companies can expand into new markets by developing new products and services or making acquisitions. For instance, Microsoft recently bolstered its existing cloud and search offering by integrating AI tool ChatGPT into its Bing and Azure platforms. In January 2023, Microsoft pledged to invest $10b in ChatGPT creator OpenAI.

Threats

They each face the threats of increased competition, changes in government regulation, technological disruption and economic downturn. Trello, for example, is a smaller company that has captured a significant market share by offering a more accessible and user-friendly platform than Microsoft's project management tool Microsoft Planner. Its success prompted Microsoft to create a similar tool, Microsoft Lists, incorporating Trello's successful features.

Common fundamentals

- Four of the five are trading below SimplyWallSt’s estimates of fair value. Alphabet and Meta are trading significantly lower, by 19% to 22.5%, respectively, while Amazon and Intuit are 6% and 7.9% lower, respectively.

- Earnings are all forecast to grow, within the range of 12.9% (Alphabet) to 36.7% (Amazon) per year.

- Revenue is expected to grow for each, within the range of 9% (Alphabet, Meta) to 11.5% (Intuit) per year.

- Return on Equity is forecast to grow between 14.2% (Amazon) and 33.2% (Microsoft) in 3 years.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy