Tariffs Latest: Chips Yes, Critical Minerals No

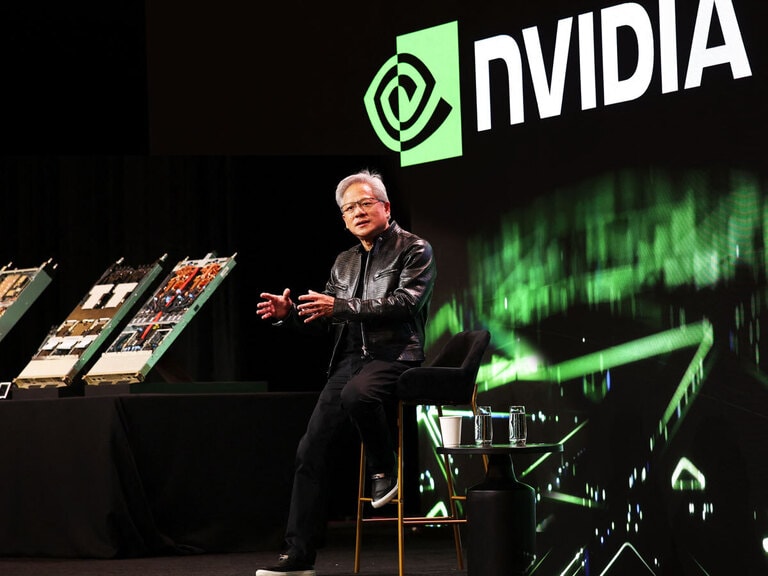

US President Donald Trump earlier this week imposed a 25% tariff on select high-end semiconductors, including Nvidia’s [NVDA] H200 and Advanced Micro Devices’ [AMD] MI325X, following a probe that deemed semiconductor imports a national security risk. President Trump, however, paused tariffs on critical minerals, instead pursuing supply deals with allies and exploring price floors to reduce reliance on foreign supply chains.

ASML Rises with TSMC’s Tide

Elsewhere in semiconductors, Dutch chipmaker ASML [ASML] became only the third European company to surpass a $500bn market value, after its key customer Taiwan Semiconductor Manufacturing Co [TSM] delivered a stronger-than-expected 2026 outlook. ASML shares jumped as much as 7.6%, lifting its valuation to about $527bn, Bloomberg reported. Only LVMH [LVMUY] and Novo Nordisk [NVO] have reached similar levels.

New OpenAI Infrastructure Deal

In yet more chip-related news, OpenAI has struck a $10bn multiyear deal with startup Cerebras Systems to secure 750MW of computing power through 2028, diversifying away from dominant suppliers such as Nvidia and AMD. Cerebras, valued at $8.1bn, says its dinner-plate-sized chips deliver far faster artificial intelligence (AI) inference than traditional GPUs, the Financial Times reported.

Coherent Corp Booms on Data Center Demand

Pennsylvania-based Coherent Corp [COHR] has become an under-the-radar beneficiary of the AI boom, with demand for its products in data centers driving financial gains. As a ‘picks and shovels’ stock serving both the AI data center and semiconductors markets, its stock price has gained over 100% in the past 12 months. OPTO asks if it’s too late to hop on the bandwagon, or if Coherent is set to keep delivering.

Apple Spurns OpenAI

In a development which may or may not be related to the above, Apple [AAPL] has struck a deal to use Alphabet’s [GOOGL] Google’s Gemini models to enhance iPhone features and Siri. This move is a “blow” to OpenAI, the Financial Times opined, which had been baking in “Apple Intelligence” features for mobile devices since 2024, in the hopes of a lasting deal.

Are Smart Glasses at a Tipping Point?

HSBC expects the smart glasses market to grow to as much as $200bn by 2040, driven by early strong sales from EssilorLuxottica [ESLOY] and Meta [META], Bloomberg outlined. User numbers could jump from 15 million in 2025 to 289 million by 2039. Potential entries from Apple, Samsung [SSNLF] and Amazon [AMZN] could accelerate adoption and investment.

Sandisk: One of Wall Street’s Most Dynamic Plays

Since its spinoff from Western Digital [WDC] in February 2025, Sandisk [SNDK] has benefited from surging demand for high-performance storage in AI, cloud and hyperscale data centers, changing from “an overlooked legacy tech company into one of Wall Street’s most dynamic momentum plays”, as Forbes recently framed it. OPTO examines what helped this overlooked AI play the lead the S&P 500 in 2025, and why 2026 looks to be a standout year for data storage stocks.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy