It is easily missed amid the hype around Nvidia’s AI-driven gains this year, but the semiconductor industry is grappling with a slowdown in demand. Despite global inventories being on the rise, however, management consultancy Bain & Company views the current cool patch for semiconductors as a cyclical phenomenon and plays down fears of a supply glut.

- Bain: oversupply fears are overblown.

- Global production highly geographically concentrated; companies moving to diversify production sites.

- Beth Kindig identifies four semiconductor picks (and Nvidia isn’t one of them)

Nvidia’s [NVDA] share price has gained an impressive 301.3% year-to-date as of 11 October. However, the broader semiconductor industry was flagging by comparison, with the S&P 500 Semiconductor Index gaining 33.5% over the same period.

According to strategy consultancy firm Bain & Company, a fall in demand following the chip shortage associated with the Covid-19 pandemic has prompted fears of oversupply in the semiconductor industry.

“We have gone from a chip shortage in 2021–22 to an underutilisation of capacity in some parts of the semi value chain,” said Bain in a September 2023 report.

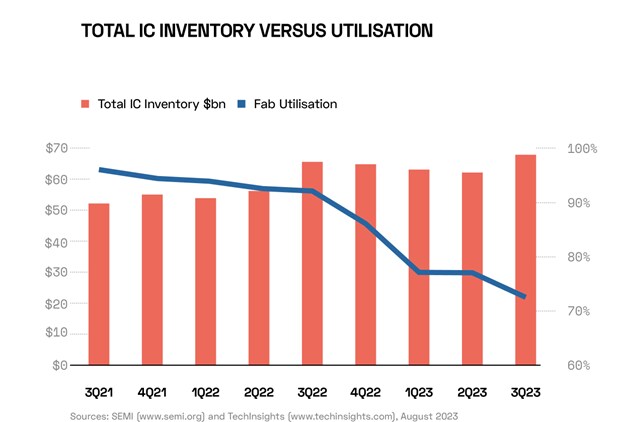

Inventories have certainly been increasing. Data from semiconductor industry association SEMI shows that global semiconductor inventories have grown of late, while fabricator utilisation is falling.

“Some say this is a harbinger of a massive capacity glut, implying we no longer need to worry about securing our semiconductor supply chain,” says Bain. The consultancy disagrees, noting that, while cyclicality is a natural feature of the semiconductor industry, it is dampening. The firm attributes this to a broadening of end markets, with different demand cycles balancing each other; the smaller representation of memory chips — the most cyclical segment of the market — as a percent of total demand; and a concentration in the market, with fewer suppliers resulting in “less irrational supply”.

While cyclicality will likely continue, Bain takes the view that “structural or long-term overcapacity is unlikely for several reasons”. For example, the costs of advanced semiconductor fabricator shells and equipment can reach $11bn, according to Bain, with ramp-up times of up to 18 months. For this reason, chipmakers often respond cautiously and well in advance to forecast changes in demand, which can cause exacerbated swings in supply.

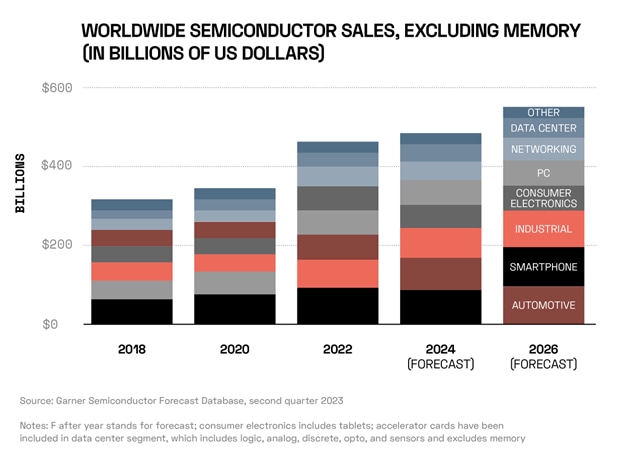

Despite the recent cyclical slowdown, the market for semiconductors is growing across a wide range of verticals. While Bain forecasts slow growth for the sector between 2022 and 2024, it expects the market to grow by 19.5% between 2022 and 2026.

Market Trajectory

Semiconductor inventory stock declined by eight days quarter-on-quarter from its 54-day peak during the first quarter (Q1) of 2023, according to an inventory analysis from Wolfe Research. “Semi customer inventory remains elevated, but improved… Looking forward, declining customer inventory is a bullish signal” for semiconductor producers, according to Wolfe.

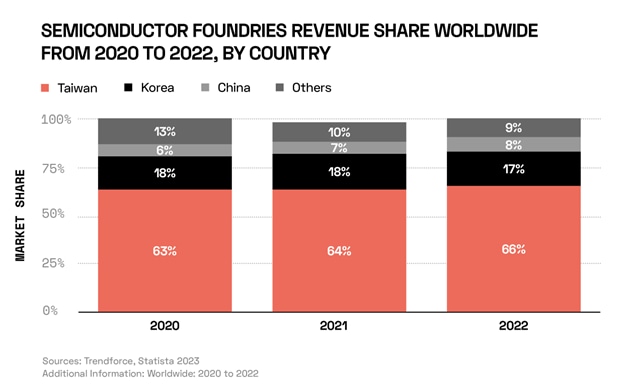

The greater fear when it comes to semiconductor supply, especially once demand picks up, could be the geographic over-concentration of production. Taiwan accounted for approximately two-thirds of the world’s semiconductor foundry revenue in 2022, according to data from Statista.

It is this global over-reliance on Taiwan for semiconductor production that has last week’s Opto Sessions guests, the financial Substack Doomberg, so concerned about the prospects of conflict between China and Taiwan.

“Taiwan is the home of some of the most important factories in the world,” Doomberg told Opto. The global dependence on the technological know-how deployed at these factories means that their employees “are among the most important humans on the planet”.

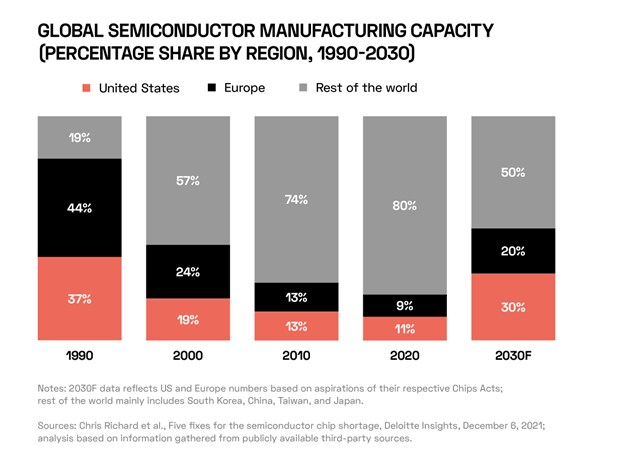

According to Deloitte, the US’ share of global semiconductor manufacturing capacity fell from 37% in 1990 to 11% in 2020; Europe’s share fell from 44% to 9% over the same period.

“As shortages began manifesting in 2020, policymakers in the US and Europe recognised that the high concentration of chip manufacturing in Asia served to harm their competitive advantage and created massive supply chain vulnerabilities,” said Deloitte in an April 2023 report.

TSMC Moves to Diversify

While individual countries diversify their semiconductor supply chains, one of the leading producers — Taiwan Semiconductor Manufacturing Company (TSMC) [TSM] — is diversifying its production sites.

The company has sent hundreds of support staff to Kumamoto in Japan to install tools at the company’s $8bn fabrication plant, due to begin production in 2024. However, TSMC’s facility in

Arizona, despite having been announced a year earlier than the Kumamoto plant, is not expected to be online until 2025.

Infineon [IFX.DE] and Intel [INTC] are among chipmakers expanding their footprint in Malaysia, according to the FT. Both are investing $7bn into fabricators in the country, with Infineon’s set to be the world’s largest production site for silicon carbide chips.

As global production diversifies within and away from Asia, the EU passed its own legislation in April aimed at encouraging chipmakers to invest in the bloc. More recently, news broke in August that TSMC plans to build a €10bn plant in Dresden, Germany, which is expected to begin production by the end of 2027.

Closing the Circuit

The artificial intelligence (AI) revolution, fuelled by the world’s most advanced semiconductors, may be coming full circle to drive the future of the semiconductor industry.

According to Deloitte Global, by using AI to design chips, semiconductor companies are driving efficiency gains in time and cost while increasing chip performance. The advisory firm predicts that the industry will spend $300m on AI tools for chip design in 2023, and that the figure will increase 20% annually for four years, surpassing $500m in 2026.

“These tools can increase supply chain security and help mitigate the next chip shortage,” said Deloitte in a November 2022 report.

Beth Kindig’s Chip Picks

“Broadcom [AVGO] and TSMC continue to be defensive stocks with strong bottom lines,” said Beth Kindig, Lead Tech Analyst at I/O Fund, in her review of semiconductor stocks in Q2 2023, published in Forbes. “Navitas [NVTS] and indie Semiconductor are high beta stocks that are putting up nearly triple digit growth.”

Broadcom gained 59.2% year-to-date as of 11 October, while TSMC gained 25.3%. Navitas gained 79.5% despite falling 41.8% since 1 August. Indie Semiconductor fell 4.8% year-to-date.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy