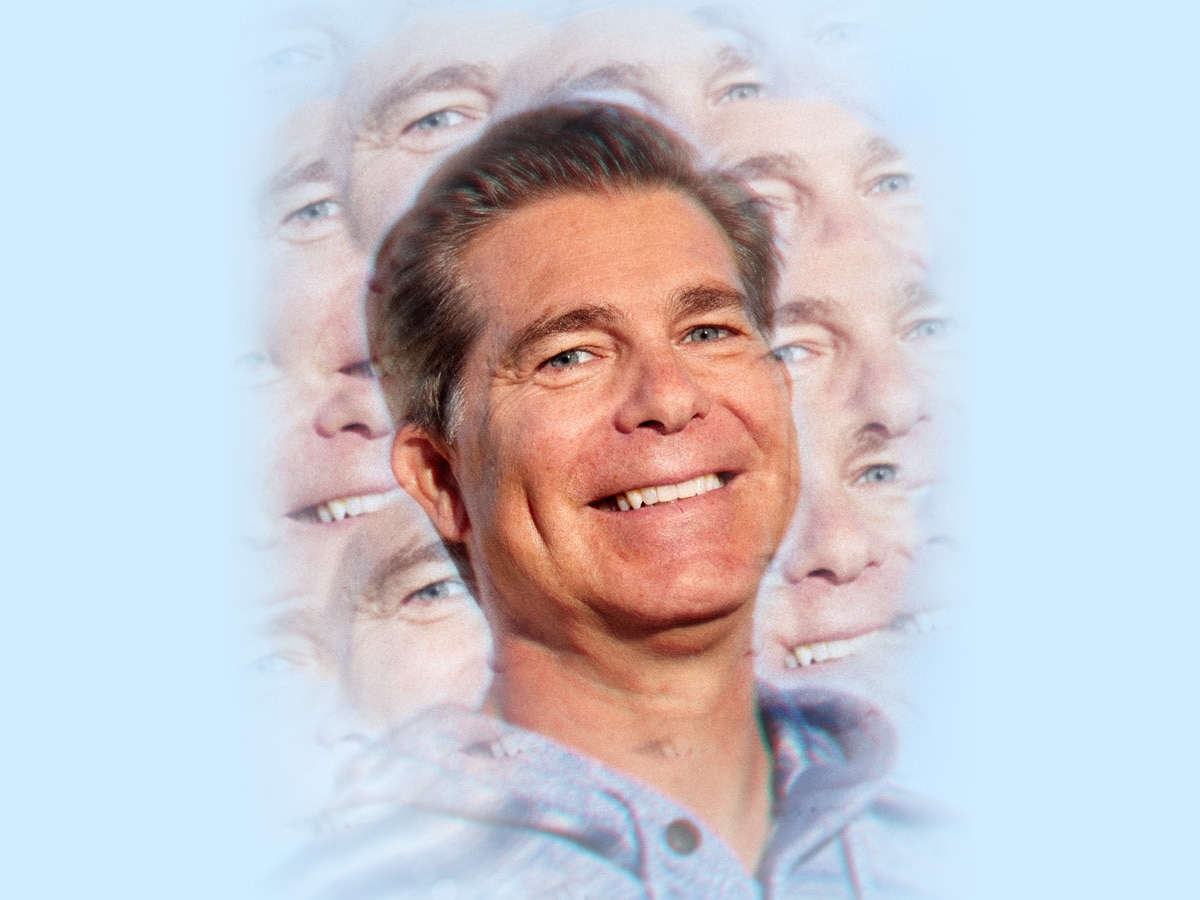

Ross Gerber, founder and CEO of Gerber Kawasaki Wealth and Investment Management, talks to Opto about what makes him tick, which alluring narratives he believes could shape the future of investing and why a thematic investing wrapper has staying power.

Most successful money managers operate under tried-and-tested investment concepts such as risk and return. But Ross Gerber, founder and CEO of Gerber Kawasaki Wealth and Investment Management, doesn’t only invest conceptually.

He has developed and refined a multi-thematic approach that identifies nine investing trends generating seismic shifts in business and economies of scale. Yet, for each investment idea, Gerber counts most on what he sees and uses around him. Observing his family and friends engage with products and connecting with consumer ecosystems is an integral part of the fund manager’s research process.

A lifelong Apple [APPL] stockholder and Tesla [TSLA] Model S Plaid driver, Gerber is always keen to experience newly launched products to validate investment cases. A self-described “real-life investor”, Gerber tells Opto that he goes to “enormous lengths with the products and services we invest in to make sure we love them”.

"If I invest in Peloton, I get a Peloton bike and ride it. I use all the services. I talk to Peloton fans" – Ross Gerber

“If I invest in Peloton [PTON], I get a Peloton bike and ride it. I use all the services. I talk to Peloton fans,” he says in an excitable California accent. It’s this practical and intimate investing style that has helped Gerber identify the changing behavioural and consumption patterns behind Gerber’s enviable investment track record.

Gerber’s firm started with assets under management of just $30m when it was founded in June 2010, but that has since grown to more than $2.2bn. The client base, which now exceeds 8,000, comprises millennials and Generation X predominantly.

As the face of Gerber Kawasaki, the media-trained industry veteran’s ability to look beyond a company’s numbers, which is captured in the countless interviews he’s done with Bloomberg, Reuters and CNBC, has proven that high-conviction investing requires a long-term mindset.

Trendspotting: A thematic investing edge

Gerber Kawasaki’s investment strategy is rooted in investing in the next decade of innovation. From climate change and electric vehicles (EVs) to gaming and consumer brands, the firm has zeroed in on nine investment trends it expects will continue to grow exponentially.

Gerber bases his investment strategy on a 10-year timeframe, on the understanding that each decade marks a seismic cultural shift in the US, whether it’s in music, fashion or even sports teams. “When I make a decision about how I see the future,” he says, “I have such high conviction that I’m willing to invest aggressively into that vision.”

The thematic trend spotter’s storied career is a testament of his ability to adjust and keep pace with an evolving digital landscape. “Every decade that I’ve made money investing has been on profound themes,” Gerber says. “Like this decade, it’s climate change.”

Gerber expects that the leveraging of technology — particularly in energy and transportation — to offset climate change and create a more sustainable planet that will drive investment returns for a significant amount of time. “That trend started with Tesla, but it’s now over the hump,” Gerber says, adding that he first invested in the EV maker in 2013.

Back then, when he first got sight of the Model 3, Gerber immediately knew that this car would trigger an auto revolution and believes that sustainable investing as a theme was kickstarted by Tesla in the transportation industry. Since then, EV companies have proliferated and the industry has expanded to encompass battery technology, charging infrastructure and electric utility grids.

Alongside sustainability, Gerber expects to see “amazing breakthroughs in medicine in the next decade”. The healthcare and biotech industries have seen large investments off the back of the coronavirus pandemic as well as other issues, such as dealing with ageing populations. For Gerber, climate change, healthcare and technology are all areas seeing the most amount of macro changes.

Tracking technological paradigm shifts

Technology has long been the cornerstone of Gerber’s investment strategy. While Gerber admits that it’s challenging staying up to date with emerging technologies — out of the 48 companies he has invested in, he knows at least half of them as well as his children.

He explains that he spends a lot of time reading and talking to people when gathering information about a potential investment. For example, Gerber, who drives a Tesla Model S Plaid, says that he knows more about the company than anyone else. It’s part of the way he uncovers investments.

“That’s my goal with a company — I want to know more than everybody else. The level of digging I do, whether it be by reading financials and articles, [or] more importantly, [talking] to people, experts and employees to learn about how things work, [it’s] almost like being a part of the company in some ways because you become part-owner.”

Gerber also finds new investment ideas through his children. Indeed, he was quick to see an investment opportunity when he found his kids playing Roblox [RBLX]. The videogame platform allows players to meet online in virtual worlds to hang out and play. Not only is the platform moderated with no ads, but many investors see it as the precursor to the metaverse.

“Videogames are the new social media — now they’re calling it the metaverse. We’ve been in on this theme for a while now.” A videogame player himself, Gerber counts gaming as one of the nine themes that he’s invested in through companies like Roblox — the stock has doubled since its IPO in March 2021.

While the firm’s portfolio also singles out consumer brands, streaming and entertainment, and real estate disruption as separate themes, each trend is rooted in technology, and there are numerous overlaps. For example, Nvidia [NVDA] may be seen as a gaming play, but it is a diversified bet on artificial intelligence (AI) and autonomous vehicles, given that Tesla uses Nvidia’s A100 GPU to power its Autopilot hardware.

“That’s my goal with a company — I want to know more than everybody else. The level of digging I do...[it’s] almost like being a part of the company in some ways because you become part-owner” – Ross Gerber

“When I think about the next decade, technology underpins most change, so that’s one of the main themes of our fund. This is driven by AI and machine learning, as well as what I would call the internet of money — fintech.”

While the firm does not distinguish fintech as a separate investment theme — it’s part of its broader tech plays — it does hold positions in cryptocurrency stocks, such as Coinbase. The firm is also extremely bullish on bitcoin and has developed a standard for investment firms that want to open accounts in the cryptocurrency for clients. “If you want to open a bitcoin account with us, it’s just like opening any other investment account [that’s compliant with] AML and SEC rules,” Gerber explains. “I don’t think it’s revolutionary to think that everybody’s going to be using bitcoin and driving EVs in 10 years’ time. But that’s what we’re betting on, and that’s what will happen.”

Joining the mainstream

Outside of technology, the firm is capitalising on other transformative trends that are less obvious. For example, when Gerber first saw the amount of money being poured into pet care, it baffled him. Although he couldn’t personally emphasise with people fawning over their pets, he saw an investment opportunity, which led to the theme: ‘Pets live like humans’.

“When you think about the world today, for example, the pet industry is insane. In LA, people treat their dogs better than each other,” he says. From complicated surgeries to indulgent spas, the business of veterinary services has been booming.

Gerber sees it as one of the leading growth industries of the next decade and has big positions in Petco Health and Wellness Company [WOOF], Zoetis [ZTS], which makes drugs for animals and pets, and Chewy [CHWY], because Gerber sees it as the “Amazon for pets”.

Much like life, Gerber’s investments are not all in the business of consumption. When California legalised cannabis, he went on to set up the investment thesis: ‘Things that used to be illegal’. The unwinding of regulations has created burgeoning investment areas, including cannabis, psychedelics in psychiatry, online gambling and sports betting.

Across states in the US, many investors have been capitalising on the relaxation of cannabis and gambling laws. Gerber notes that there is such a slew of players in the business that, despite these industries’ flourishing natures, competition is fierce.

As an investor who lives in the centre of the cannabis culture, the fund manager has seen the industry scale and expects it to become more akin to a mature alcohol business. “Southern California was the first state to legalise. It’s the biggest state for cannabis sales. Therefore, I know the cannabis business better than anybody else.” He also sees the potential of psychedelics in psychotherapy to treat mental health issues, but clarifies that this trend is growing slower than cannabis.

Leaders invest in people

Gerber’s investment approach to identify growth companies positioned in transformative themes manifested into an exchange-traded fund (ETF) after AdvisorShares approached him about setting up an active fund. On 2 July 2021, the firm launched the AdvisorShares Gerber Kawasaki ETF [GK] to give investors multi-thematic exposure to the markets without having to set up an account with a financial adviser. The fund had risen 5% by the end of 2021 and as of early 2022 had 50 positions, with its biggest positions in Tesla, Nvidia, Microsoft [MSFT], the Global X Lithium Battery Technology ETF [LIT] and Apple.

The three primary questions that Gerber’s investment strategy considers when deciding on a theme to invest in within the fund is, first, what industry is seen to be growing? Second, which companies are leading in the industry? And third, who are the players running these businesses?

“The main thing is flexibility. I have a lot of flexibility in my viewpoint, which I think is important for an investor.” – Ross Gerber

“This is one of the things that differentiates us a lot. We spend a lot of time on the people who are running the businesses because we very much believe a company is its leadership. We invest with people — that’s how we look at it. For example, I invest with Elon Musk, Tim Cook, Jack Dorsey and Brian Armstrong,” Gerber says.

Many of these enigmatic business figures are seen as disruptors in their respective industries, but identifying a single source of alpha can be difficult. Gerber clarifies that while a lot of investing is unquantifiable, it’s their unwavering track record to turn innovation into sizeable returns that make them investable.

Compared to taking a tech theme-led approach with a 10-year time horizon, investing in disruptive businesses doesn’t reliably offer the consistency and immediacy of returns. “Conceptually, disruption can be a very bad way to invest because the results of the disruption take time to play out.” Gerber expands on this theme by highlighting the example of the digital real estate disruptor Zillow, which is a holding in the firm’s portfolio. While he likes the idea of buying houses online, Gerber points to the fact that Zillow had to close its house-flipping programme after overpaying for properties.

“There’s another company called Opendoor Technologies, which is a really good company. But people aren’t buying houses online right now. It’s just too early. As much as I like this business model, it’s losing money, and I just don’t see consumer behaviour changing enough that we want to make a big investment. Changes happen over time, but the delta or rate of change can vary greatly, based on so many factors that we can’t predict.”

The dawning of a high-tech future is central to Gerber’s philosophy, but as a prudent money manager, he also adjusts his exposure as needed. “Our goal is to have our fund and investments grow by 20% a year and our equities over the long term.

“The main thing is flexibility. I have a lot of flexibility in my viewpoint, which I think is important for an investor.”

From Hollywood to Wall Street

Gerber was just 13 years old when he became a shareholder — he still owns his first investments in Apple and Disney [DIS] that were gifted to him by his grandfather, and keeps a stock certificate hanging up in his office.

An early fascination with the idea of financial independence was what initially attracted him to trading the markets. But before Gerber started becoming a successful investment manager, he first dabbled in music as a singer and guitarist with his own band — he still plays in a group called The Danger Band.

A passionate musician, Gerber studied communications, business law and music at the University of Pennsylvania and eventually worked at several major record labels, including Disney’s Hollywood Studios.

At the time, tech was booming, and he could see that Napster, which was eventually acquired by MelodyVR for $70m in August 2020, was going to completely revolutionise the music industry. “The last thing I wanted to do was work in an industry that was going to die. It just shows how disruptive technology can be,” Gerber says. “The fact that I didn’t think anybody in the industry got it was what really drove me out of the music industry and into investing.”

At 23 — after just six months in the music industry — he picked up a laptop and started betting on the internet through AOL, one of his first successful trades, with Charles Schwab: “I saw the innovation that was happening in America in the 90s and decided to just invest in it.” Looking back, he doesn’t think his vision of computers taking over was that surprising, as it seemed quite obvious to him. “Many things I’ve done in hindsight look very innovative. But at the time, I just felt I was doing what other successful people were doing.”

Between 1994 and 1999, Gerber made a series of tech plays that led him to become a multi-millionaire by the time he was 28. He made money investing in desktop stocks, such as Dell Technologies, Microsoft and Gateway, which was bought by Acer in 2007. For example, shares in Microsoft soared 2,335%, from $2.41 to $58.69, during the five years to the start of 2000.

“In the 90s, we played the PC [personal computing] and internet boom. Then in the 2000s, we saw the rise of the cell phone and mobility,” he says. During this period, Gerber shifted his investment focus and started building stakes in cell phone carriers such as T-Mobile [TMUS] and Verizon Communications [V], as well as in phone makers like Nokia and Apple, which became a much bigger player in 2010.

The next big shift in behaviour came with the rise of social media. Gerber describes this period as the Facebook era. The internet and video streaming were at the fore of this transformation, he says, because of increased broadband capabilities that made it possible to watch TV on phones.

“I saw the innovation that was happening in America in the 90s and decided to just invest in it” – Ross Gerber

A catalyst for change

But all bull markets eventually end. From the dotcom bubble to the financial crisis of 2008, the next decade of Gerber’s investing career was shadowed by sustained down periods. The Lehman Brothers collapse convinced Gerber that the industry was going to have to change. “The world had changed, and I realised that it was never going to go back,” he says.

To adapt to the dramatic shift and provide better transparency to the markets, he started the very first social media strategy for an investment firm, which was picked up by the Financial Industry Regulatory Authority (FINRA) and the Securities Exchange Commission (SEC). FINRA was starting a pilot programme for social media, and so they approached Gerber to help set the standards for regulating social media posts.

At the time, he had been working for more than 15 years as COO and CIO at ICM, managing mutual funds for retirement plans. Gerber says that while it was “simple in a lot of ways, it was also the core to learning how to scale financial services, which is really when we started GK.

“We modernised the entire approach. The idea was to step up the game with technology. Instead of having 15 offices and telephone calls every day, we went to one office with social media every day. That was the big change,” he says, adding that the second big idea was developing an active management approach.

Gerber wanted to approach financial planning and investment management differently. He ultimately partnered with Danilo Kawasaki and founded Gerber Kawasaki Wealth and Investment Management in June 2010, with 20 advisers and $30m in assets. The firm quickly scaled and refined an approach to investing in emerging macro trends.

Gerber Kawasaki’s investment strategy initially consisted of a three-pronged approach focused on tech, communications and entertainment. But as macro consumer behaviours and macroeconomic factors evolve, the firm’s strategy has since expanded alongside the exponential growth in tech to nine standout investment trends.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy