Regular visitors to Opto will be used to reading about disruptive and innovative investment trends but, from time to time, we engage with industry thought-leaders to help provide insights on exactly how to put this into practice.

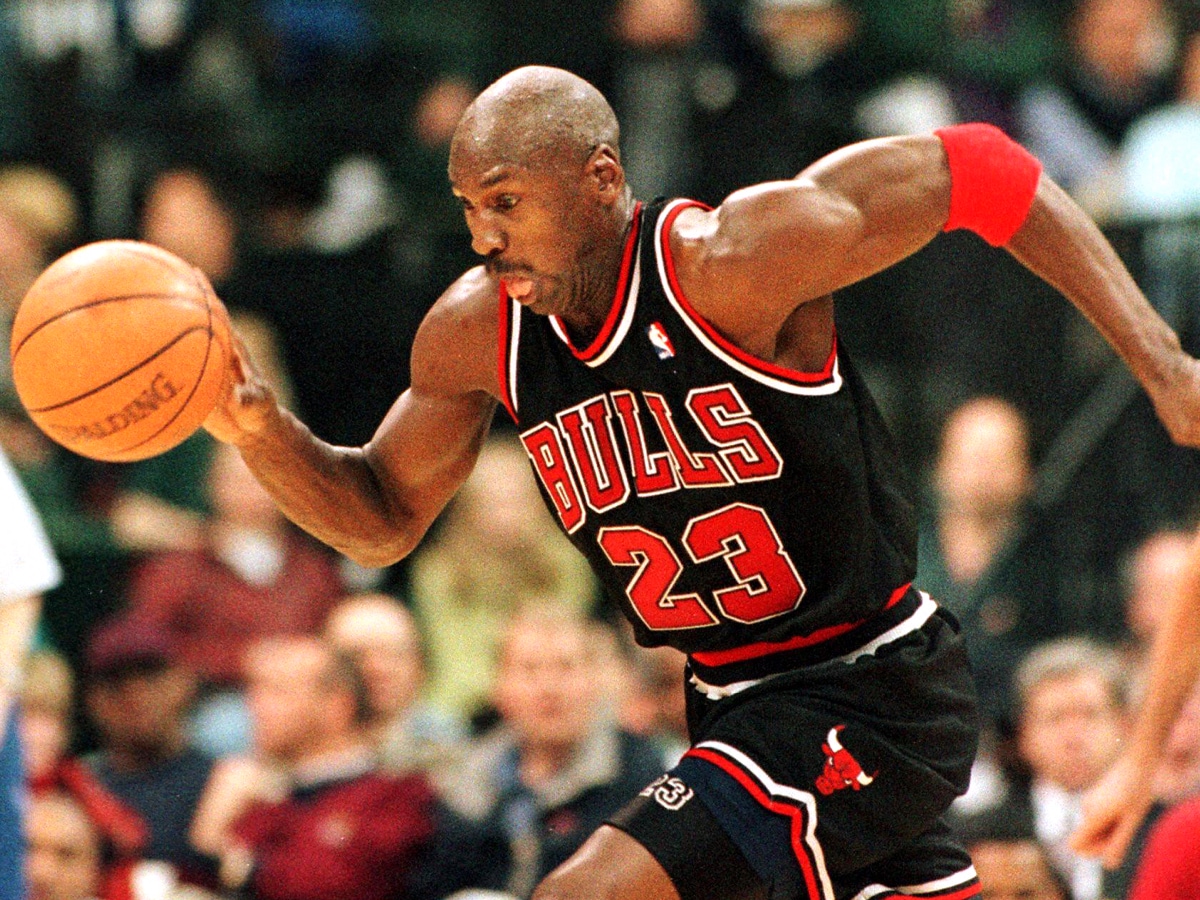

Michael Jordan said he had to reconstruct his body when he went from basketball to baseball back to basketball. Baseball favoured strong arms and chest; basketball required a leaner figure with a stronger core and legs.

Part of the reason Jordan’s basketball return was rusty was because he was still lugging around his baseball arms. “Looking back, I didn’t have enough time to get back to a basketball body,” he said.

Which makes sense. Different sports have different objectives requiring different skills. No one criticises marathon runners for doing things completely differently from powerlifters, despite both being athletes. ESPN covers sports, yet no anchor pretends golf and mixed martial arts are remotely similar.

But when people use the common label “investors,” that same logic breaks down.

Someone recently asked how my investment views have changed in the last decade. I said I’m less judgemental about how other people invest than I used to be.

“Someone recently asked how my investment views have changed in the last decade. I said I’m less judgemental about how other people invest than I used to be”

It’s so easy to lump everyone into a category called investors and view them as playing on the same field called markets.

But people play wildly different games.

If you view investing as a single game, then you think every deviation from that game’s rules, strategies, or skills is wrong. But most of the time you’re just a marathon runner yelling at a powerlifter. So much of what we consider investing debates and disagreements are actually just people playing different games unintentionally talking over each other.

A big problem in investing is that we treat it like it’s math, where 2+2=4 for me and you and everyone — there’s one right answer. But I think it’s actually something closer to sports, where equally smart and talented people do things completely differently depending on what game they’re playing.

“A big problem in investing is that we treat it like it’s math, where 2+2=4 for me and you and everyone — there’s one right answer. But I think it’s actually something closer to sports, where equally smart and talented people do things completely differently depending on what game they’re playing”

What you want might not be what I want. What’s fun to you might be miserable to me.

Your family’s different from mine. Your job’s different from mine. You have different life experiences than I do, different role models, different risk tolerances and goals and social ambitions, work-life balance targets, career incentives, on and on.

So of course we don’t always agree on what’s the best thing to do with our money. There’s no world in which we should.

And if we’re different people who want different things, the investing skills we need might be completely different. Information that’s relevant to you might be a waste of time to me. But it’s rarely parsed that way.

Nineteen-year-old day traders buy Apple [AAPL] stock. So do endowments with century-long time horizons. But the headline usually says something like, “Is Apple undervalued?” Then you see why so many investing debates a waste of time.

Venture capitalists have different priorities than public market investors.

“Nineteen-year-old day traders buy Apple stock. So do endowments with century-long time horizons. But the headline usually says something like, “Is Apple undervalued?” Then you see why so many investing debates a waste of time”

Twenty-year-olds trying to learn about markets have different desires than forty-eight-year-olds saving for their kids’ college.

Ninety-seven-year-old Charlie Munger isn’t as interested in new technology as younger investors because he’s… 97.

It’s fine. Even if we try to find obvious common denominators like, “all investors want to make money,” you can get tripped up by assuming other people want what you do.

Daniel Kahneman once told his financial advisor that he had no desire to become richer; he just wanted maintain a lifestyle he was satisfied with. She told him, “I can’t work with you.” Kahneman told me in an interview:

“She was very puzzled in the context of somebody coming to get financial advice and not trying to get richer. And I’m not sure that I’m all that unusual. Many people retired on pensions and are perfectly satisfied with it and they are not desperate to have more.”

So here’s my advice.

1. Judge less. At least half the people doing things with money that you disagree with are playing a different game than you are. You probably look just as crazy in their eyes.

2. Figure out what game you’re playing, then play it (and only it). So few investors do this. Maybe they have a vague idea of their game, but they haven’t clearly defined it. And when they don’t know what game they’re playing, they’re at risk of taking their cues and advice from people playing different games, which can lead to risks they didn’t intend and outcomes they didn’t imagine.

“That’s how I played the game,” Jordan said. “If you don’t want to play that way, don’t play that way.”

This article was originally written by Morgan Housel and published by the Collaborative Fund. It can be found here.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy