Nintendo [NTDOY], Sony Group [SONY] and Microsoft [MSFT] are the world’s three leading gaming hardware makers.

Nintendo is a pure play gaming company that launched the highly anticipated Switch 2 game system in June. Sony derives the majority of its revenue from gaming, but also has interests in music, movies, cameras and sensors. Tech giant Microsoft is even more diversified, with its Xbox gaming franchise accounting for a fraction of its revenue.

Here, OPTO examines the recent performances of NTDOY, SONY and MSFT and presents the bull and bear arguments for each.

Sector Talk: Nintendo Switch 2’s Record-Breaking Launch

The gaming sector has been thrust back into the spotlight following the resounding success of the Nintendo Switch 2.

In June, Nintendo announced that the Switch 2 had become the fastest-selling console in the company’s history: 3.5 million units flew off the shelves within the first four days of launch.

Matt Piscatella, video game industry analyst at market research firm Circana, added that the Switch 2 set a new US launch week sales record for video game hardware, surpassing Sony’s PlayStation 4.

The Switch 2’s record-breaking launch reflects the pent-up demand for gaming hardware. Its predecessor, the Nintendo Switch, launched over 8 years ago in March 2017, meaning the Switch 2 was long overdue.

Fans and investors were getting impatient, and Nintendo saw its stock hit its lowest price since the Covid-19 pandemic in March 2023 after the Super Mario publisher reported back-to-back years of hardware sales declines.

In contrast, Sony’s five-year-old PS5 remained a dominant force and continued to top monthly sales charts. The console has seen active users and paid subscribers for its gaming catalogue increase consistently over the years.

Microsoft, meanwhile, has turned to the handheld console market to reverse declining Xbox sales. The company has partnered with Asus [ASUUY] to launch two Xbox Ally handhelds later this year.

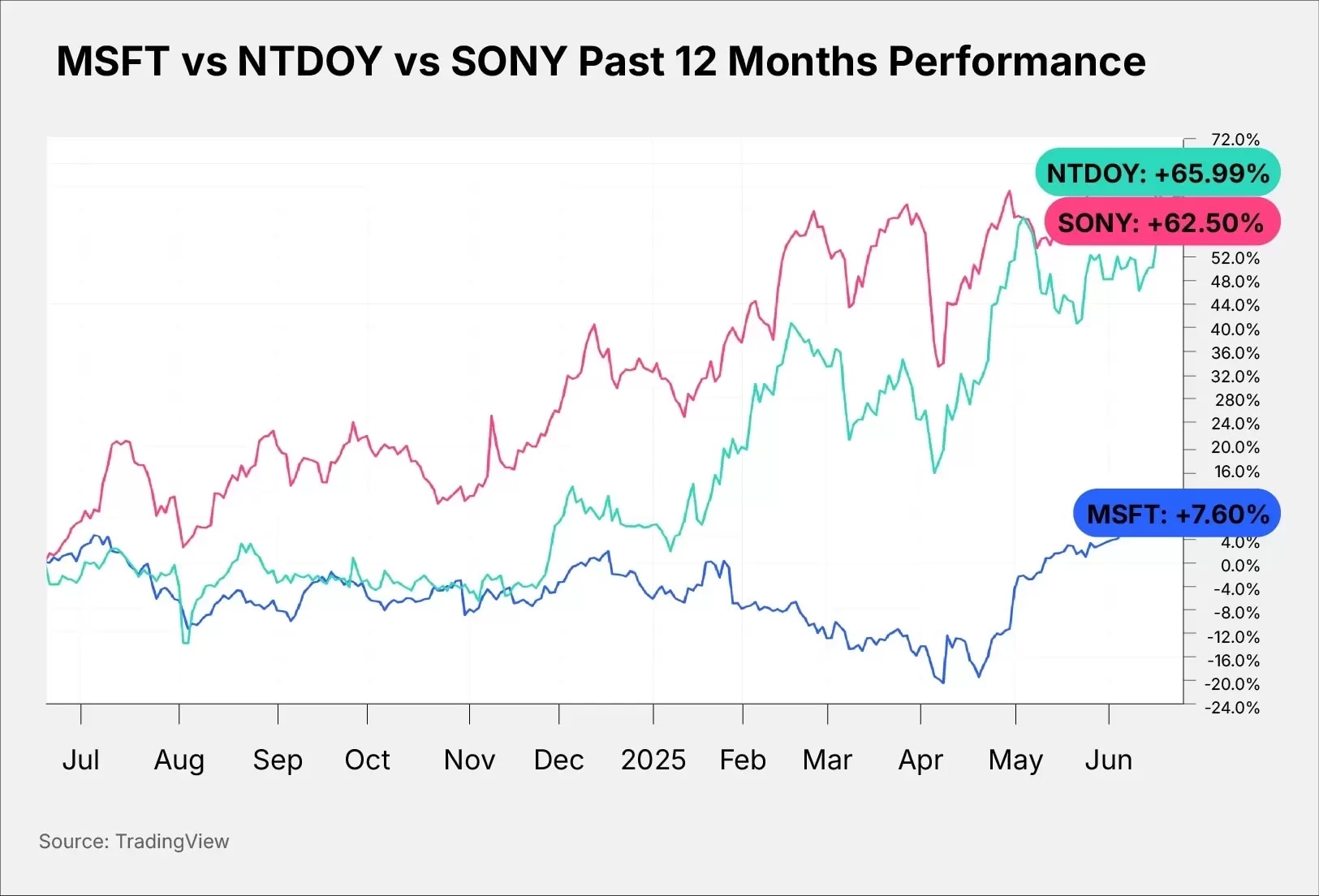

NTDOY, SONY and MSFT Hit All-Time Highs

Following a dip in early April amid wider market turmoil, Nintendo shares began a bull run that peaked on May 6, buoyed by optimism surrounding the upcoming Switch 2 launch. As of June 18, NTODY was trading at record levels, up 56.46% year-to-date

Sony’s New York-listed shares were up 22.31% year-to-date, to $25.88. SONY stock hit a peak of $26.95 on May 29 — its highest valuation since early 2000 — supported by its booming gaming business, which boasts notable titles such as God of War and Spider-Man.

Microsoft shares have increased by 14.65% in the year to date to make it the most valuable company in the world, with a market cap of $3.57trn. MSFT stock hit an all-time high of $481.00 on June 18.

Here are how the fundamentals of the three stocks currently compare to each other.

| NTDOY | SONY | MSFT |

Market Cap | $106.67bn | $157.18bn | $3.57trn |

P/E Ratio | 55.34 | 19.93 | 37.11 |

Estimated Sales Growth (Current Fiscal Year) | 109.75% | 3.40% | 13.83% |

Estimated Sales Growth (Next Fiscal Year) | 13.34% | 4.02% | 13.42% |

Source: Yahoo Finance; Stockanalysis.com

NTDOY, SONY and MSFT Stock: The Investment Case

The Bull Case for Nintendo

There were concerns that the Switch 2 would not meet the standards set by the original Switch, which ranks as the third best-selling console ever, behind only Sony’s PlayStation 2 and Nintendo DS.

But the Kyoto-based company managed to exceed consumer expectations by refining the Switch console in just the right areas: higher frame rates, faster load times, wider screen and increased internal storage. The improved Joy-Con that can be used as a computer mouse also proved to be a big hit among Nintendo fans.

At a starting price of $449, without considering video game title sales, total sales of the console so far amount to over $1.57bn. The Switch 2 has yet to be released in regions such as Southeast Asia.

Nintendo made the conservative forecast of 15 million Switch 2 sales in the full year ending March 2026. Full-year net sales are expected to increase by 61% year-over-year.

The Bear Case for Nintendo

Newly announced US tariffs on imported goods are expected to negatively impact Nintendo’s earnings.

The company said it produces hardware for North America in Vietnam, while hardware accessories are mainly produced in China. It has already assumed a 10% tariff on goods from Vietnam and a 145% tariff on goods from China in its guidance.

Additionally, Nintendo has historically struggled to meet demand for its newly released consoles. In 2017, the original Nintendo Switch experienced significant production and supply chain issues despite strong initial sales and demand.

The Bull Case for Sony

Sony’s gaming business is becoming increasingly important to the company. In fiscal 2024, game and network services contributed over a third of the company’s total revenue.

Pelham Smithers, a gaming stocks analyst, told Bloomberg that he expects 2025 to be “one of the greatest years ever for videogames” and added that “Sony will get a large piece of that.”

It is widely anticipated that gamers will be enthusiastic about Sony’s first-party software releases scheduled for release in 2025, such as Ghost of Yōtei and Death Stranding 2.

The Bear Case for Sony

Like Nintendo, Sony expects US tariffs to negatively impact its bottom line. The Tokyo-headquartered firm said that it expects a ¥100bn impact on its operating income in fiscal 2025.

The ageing PS5 hardware is also expected to see lower unit sales in fiscal 2025, according to Sony’s forecast. The company hopes that an increase in first-party gaming software sales will limit the impact.

The Bull Case for Microsoft

Microsoft beefed up its gaming operations in 2022 with the acquisition of game developer Activision Blizzard in an all-cash deal worth $68.7bn.

The company is starting to see the benefits of the deal, with Xbox content and services revenue increasing 50% year-over-year in fiscal 2024 as Activision Blizzard’s titles, such as Call of Duty, Diablo and Overwatch, changed from third-party to first-party.

Additionally, the acquisition bolsters Microsoft’s presence on mobile, the largest gaming platform, through popular titles such as Candy Crush.

However, investors should note that much of Microsoft’s market valuation as the world’s biggest company by market cap is derived from its cloud computing and artificial intelligence-related growth expectations, rather than its relatively small gaming revenue stream.

The Bear Case for Microsoft

Microsoft’s Xbox Series is not as popular as has been. The company has reported back-to-back years of falling Xbox hardware revenue due to lower sales volume.

Additionally, media reports have suggested that the company has cancelled its in-house Xbox handheld device and is pushing its gaming business towards recurring revenues and a cloud-based model.

As a result, Microsoft has made some Xbox-exclusive gaming titles available on rival consoles.

Conclusion

It is difficult to make an apples-to-apples comparison between Nintendo, Sony and Microsoft. They are different companies with varying degrees of exposure to the gaming sector. However, it might be thought that, with Nintendo riding high on Switch 2 momentum, Sony shares could enjoy a similar boost ahead of the next-generation PlayStation launch.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy