Lithium is a key component of EV batteries. A global supply shortage may be reversed into a surplus for 2023, Bank of America predicts, as two new major reserves of the metal were recently discovered. The first one, possibly the world’s second largest, was found in Iran, creating a set of geopolitical implications. The second one was found in India, but mining the resource comes at a major environmental cost. Meanwhile, South America also plans to expand its lithium mining and EV batteries manufacturing capabilities.

- Iran discovered a lithium reserve holding about 8.5 million tonnes. But under strict sanctions from the West, Iran’s trade partner China would most likely benefit from any mining activity.

- India discovered a 5.9 million tonne lithium deposit, but mining the resource comes at a high environmental cost, with subsidence resulting in dislocation and pollution.

- Argentina, Chile, Bolivia, and Brazil plan to work together to convert more of South America’s mined lithium into battery chemicals and move into manufacturing batteries and EVs, according to Argentina Mining Undersecretary Fernanda Avila.

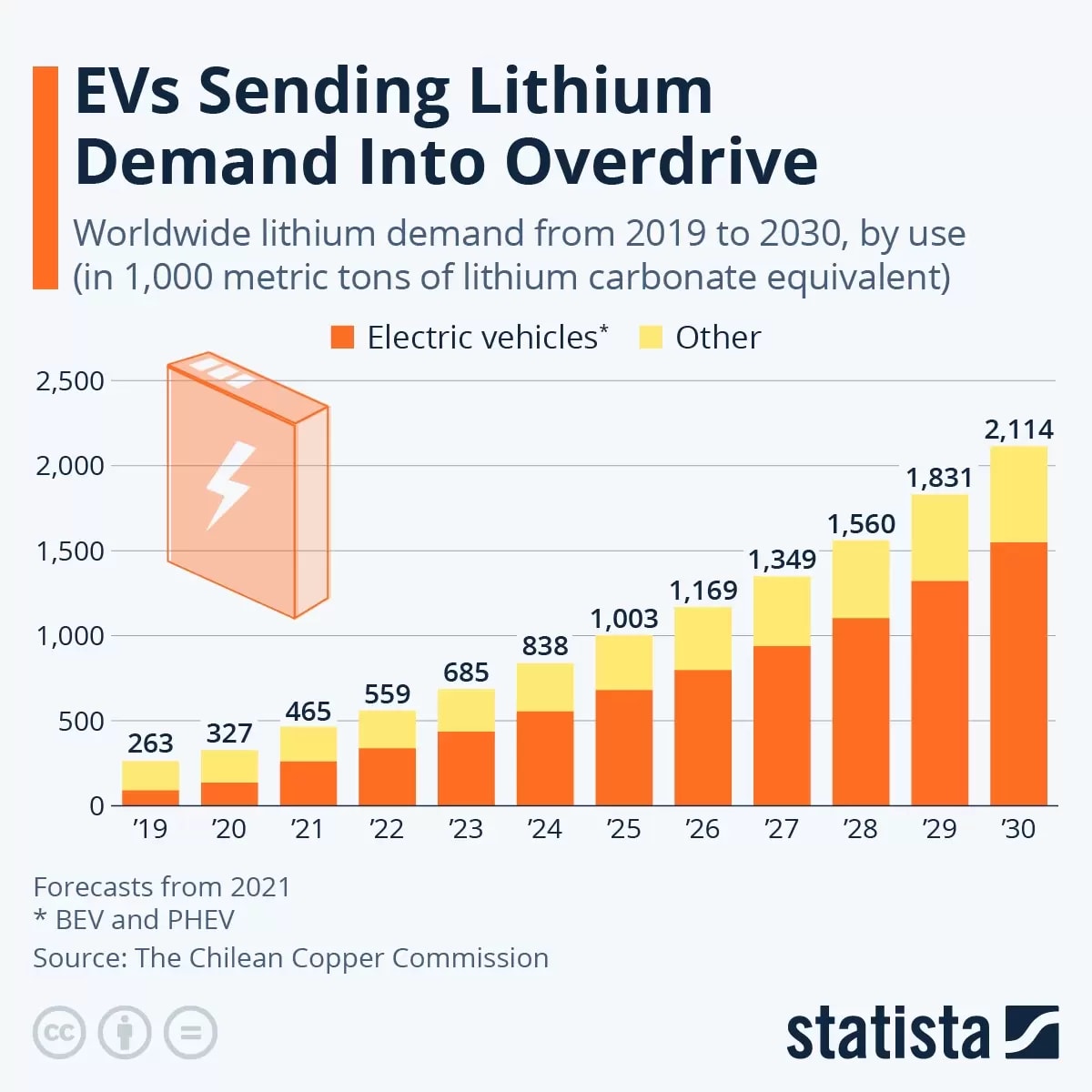

Often called "white gold," lithium is a key component of lithium-ion batteries, crucial for electric vehicles (EVs). Lithium is a finite resource, unlike others like wind and solar, and limited supplies are creating a global scarcity. With EV adoption fast growing worldwide, the demand for the metal used to power their batteries is also rising. Credit Suisse expects lithium demand to triple between 2020 and 2025, and the International Energy Agency (IEA) says there could be a global supply shortage by 2025.

A lithium shortage could significantly set back the world’s green energy and climate goals. About 2 billion EVs need to be on the road by 2050 for the world to hit net zero, according to the IEA.

The lithium dilemma is more a problem of accessibility than quantity: only one-quarter of Earth’s 88 million tonnes of lithium are economically feasible to extract as reserves. However, with the discovery of two major new lithium reserves, the global supply shortage could reverse and turn into a surplus instead.

Iran’s discovery and geopolitics

Iran has discovered its first lithium reserve in its Hamedan province. Iran’s ministry of industry, mines, and trade said it believes the deposit holds about 8.5 million tonnes of lithium. This discovery would make Iran the largest lithium reserve holder outside Latin America and possibly almost one-tenth of global lithium resource supplies.

This development likely comes with geopolitical implications for a country that has been under strict sanctions imposed by western countries for years. It could give Iran an economic advantage and more bargaining power. As a big emerging EV player and Iran’s only trading partner with lithium-refining capabilities, China would likely benefit most from the extractions.

However, how much of Iran’s lithium can be viably extracted remains to be seen. “The key questions are exactly how high grade it is and how economical it might be to mine,” Thomas Chandler, the principal lithium analyst at SFA Oxford, said.

India’s deposit: a double-edged sword

India recently stumbled upon a significant lithium deposit, suddenly boosting its potential to become a major player in batteries and EVs.

In February, lithium reserves estimated at 5.9 million tonnes were found in the Jammu and Kashmir province. The discovery was met warmly by the country that is trying to shift away from fossil fuels and that has traditionally had to import lithium from Australia and Argentina.

But mining the resource comes at an environmental cost as it will worsen subsidence in the Himalayan region leading to dislocation, pollution, ecological damage.

“It will take several years for the resources to be mined," Pankaj Srivastava, a professor specialising in mineral exploration at the University of Jammu said. “India would need to acquire specific technologies for mining and refining lithium,” he added.

"Ensuring an environmentally friendly mining process is also essential to attract investment from large international companies given the growing global scrutiny of the battery value chain's environmental footprint," Siddharth Goel, a senior policy advisor at the International Institute for Sustainable Development, noted.

South America’s lithium coalition

South American countries are forming a lithium coalition to push further down the EV supply chain. Argentina, Chile, Bolivia, and Brazil plan to work together to convert more of the region’s vast reserves of mined lithium into battery chemicals and move into manufacturing batteries and EVs, according to Argentina Mining Undersecretary Fernanda Avila.

“We have to prepare ourselves for what’s coming and be able to adapt — beginning perhaps with cells, working toward industrialization, and getting to batteries,” she said in an interview. “Adding value is central.”

The lithium triangle of Argentina, Chile and Bolivia is responsible for over 50% of global lithium supplies, and Brazil and Argentina have experience in automaking. This alliance could form the foundation of a regional electro-mobility platform, Avila said.

Chilean company Sociedad Quimica y Minera (SQM) is the world’s largest lithium producer.

From shortage to surplus?

Bank of America sees a potential lithium surplus in 2023 as higher supply volumes coincide with easing demand.

Bank of America Securities’ head of Asia Pacific basic materials, Matty Zhao, told CNBC she anticipates a 38% increase in lithium supply due to more mining activity. Zhao expects EV demand growth in China to slow from 95% in 2022 to 22% in 2023.

Lithium prices are growing 550% annually, according to a McKinsey report published in 2022. This surge is mainly prompted by lofty emissions goals by Europe and North America, pushing the demand for EVs and lithium batteries. Soaring lithium prices since 2021 have incentivised competition and new supply streams, Zhao said.

Lithium demand is expected to grow as EVs become more popular. The Statista infographic below demonstrates how demand is set to grow by 2030.

Funds in focus

Several thematic ETFs offer exposure to the lithium, battery tech, and EV industries.

The Global X Lithium & Battery Tech ETF [LITU] includes Albemarle [ALB], Samsung [6400.KS], and Panasonic Holdings [6752.JP] as its top three holdings. It also includes a 5.23% holding in Chinese EV maker BYD [1211.HK] and a 4.01% holding of Tesla [TSLA] as of 13 March. The fund is down 11.5% in the last month.

The Global X Autonomous & Electric Vehicles ETF [ECAR] includes semiconductor company Nvidia [NVDA] and Samsung among its top ten holdings as of 13 March. The fund is down 8.05% in the last month.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy