Intuitive Surgical’s [ISRG] share price rallied close to 10% to an intraday high of $893.79 before closing at a record $891.38 on 21 April, following a solid first-quarter earnings release the previous day.

The post-earnings-beat surge added $9.5bn to the company’s market value, leaving it to sit at $105.5bn by the day’s close, as well as pushing the stock into the green for its year-to-date performance.

Before the rally, Intuitive Surgical’s share price was down 0.8% in the year to 20 April. The stock had fallen 9.7% throughout the first quarter, but began to pick up momentum in April. Intuitive Surgical’s share price rose 17.2% since the start of the month to 26 April, when it closed at $865.94.

According to ETF.com, 9.6 million shares of the robot maker were held across 176 ETFs in the US.

The Global X Robotics & Artificial Intelligence ETF [BOTZ], which holds Intuitive Surgical as its largest allocation with a weighting of 7.86% (as of 26 April’s close), also rose 1.8% on 21 April. The fund was up 6.9% for the year to 26 April’s close.

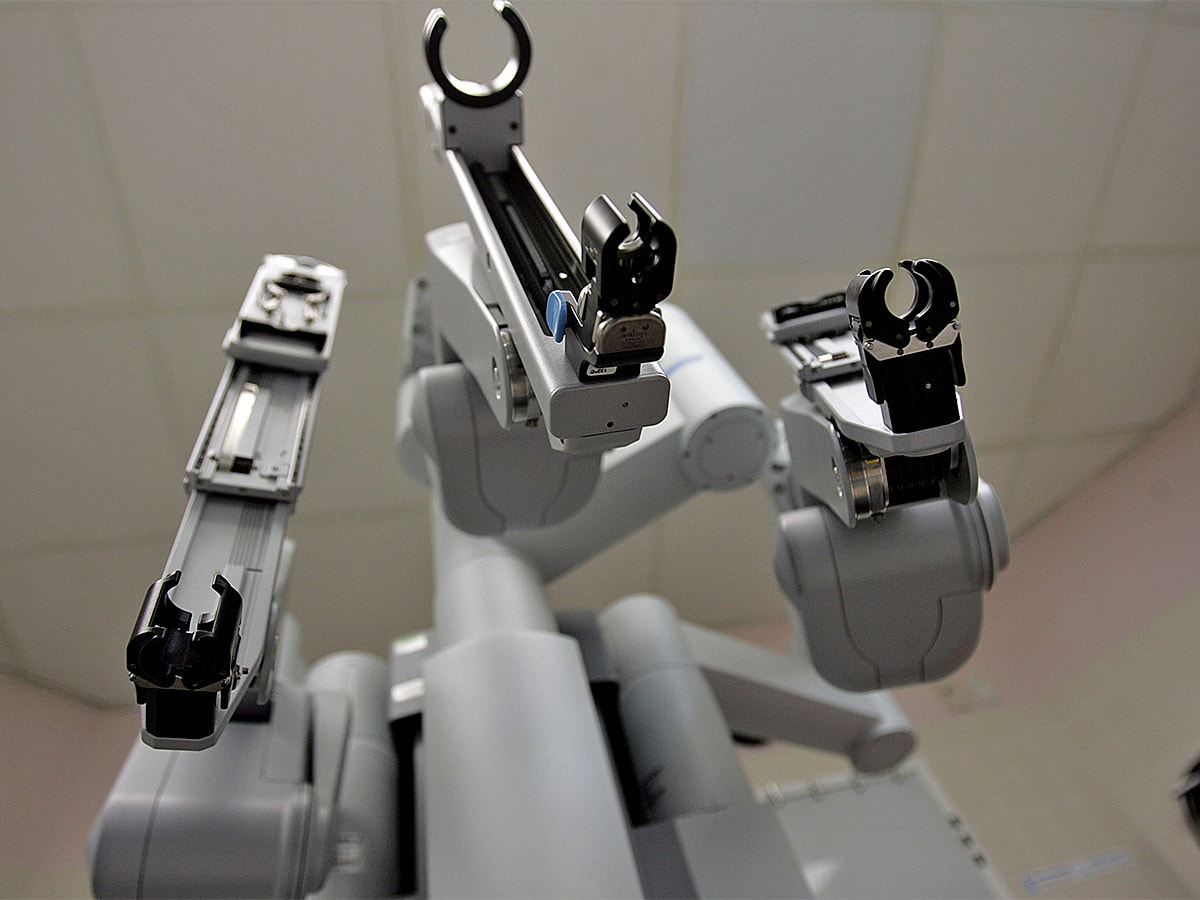

Da Vinci robotic system drives robust revenues

As the pioneer of robotic-assisted surgery, Intuitive Surgical’s da Vinci Surgical Systems, designed to facilitate minimally invasive procedures, were key to the company’s stronger-than-expected earnings.

The California-based company sold 298 of its robotic systems in the first quarter of 2021 — a 26% year-over-year increase — boosting its total installed base to 6,142. A significant rise in system placements meant the number of procedures grew 16% from the year-ago period, which helped raise its revenue by 18% year-over-year to $1.29bn.

Intuitive Surgical’s earnings of $3.52 per share was well above the market’s consensus estimate of $2.63, according to CNBC. Despite the earnings beat rally, both Intuitive Surgical and Global X’s Robotics ETF underperformed the S&P 500’s 11.5% gain in the year to 26 April’s close.

Gary Guthart, CEO of Intuitive Surgical, noted that the coronavirus pandemic had accelerated demand for its telepresence programme throughout the quarter. It now supports 45% of all case observations — up from less than 5% a year ago.

He also highlighted in the company’s earnings call that surgical simulation usage was up 46% from the year-ago period, which validated “the power of digital tools”.

Jamie Samath, senior vice president of finance at Intuitive Surgical, forecasted procedure growth to be between 22% and 26% in 2021 — a substantial uptick from the 1% growth it had in 2020. He also expects the company’s pro forma gross profit margin to be between 70% and 71% of revenue — it had been 68.4% in 2020 due to higher overhead costs.

The optimistic outlook signalled to Imron Zafar, medical technology equity research analyst at Deutsche Bank, that hospital expenditures were “quite robust”, according to Bloomberg. He believes a “sizeable backlog of deferred surgeries and delayed diagnoses/referrals” will be a multi-quarter tailwind.

At the forefront of surgical innovation

Investors reacted positively to Intuitive Surgical reinstating its full-year guidance for the first time since the pandemic.

Mike Polark, a senior equity research analyst at Baird, upgraded the stock from neutral to outperform after the earnings release and gave it a price target of $925, according to Seeking Alpha. In a note to clients, he said that it was “a good company still innovating at a rapid clip”.

"[Intuitive Surgical is] a good company still innovating at a rapic clip" - Mike Polark, Baird

Richard Newitter, a senior equity research analyst at SVB Leerink, also raised the stock’s price target to $860 from $825 and kept a market perform rating, The Fly reported. However, he took a more cautious stance because of its valuation premium.

The analyst reportedly favoured other medical technology growth that had “equal/better growth profiles relative to their multiple”, as he believes there are less expensive ways to gain exposure to the COVID-19 recovery with a better risk-to-reward ratio.

Intuitive Surgical wasn’t the only healthcare firm to see positive growth recently, with Medtronic [MDT], Bristol-Myers Squibb [BMY] and CVS Care [CVS] all passing the $100bn valuation mark last week.

Intuitive Surgical’s share price was rated a moderate buy based on 13 analysts’ ratings compiled by TipRanks, with an average price target of $874.27, representing a 1% rise from its 26 April close.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy