Rio Tinto’s margins suffered a double squeeze in 2022 as low commodity prices and increased costs slashed its profit margins. The Anglo-Australian miner cut its dividend by more than 50% in response, pushing its share price down by 3%. However, analysts reckon 2023 could see commodities recover.

- Rio Tinto’s share price nosedives after profits and dividends drop for 2022.

- Falling demand in China has hit commodity prices.

- Rio largest holding in First Trust Indxx Global Natural Resources Income ETF.

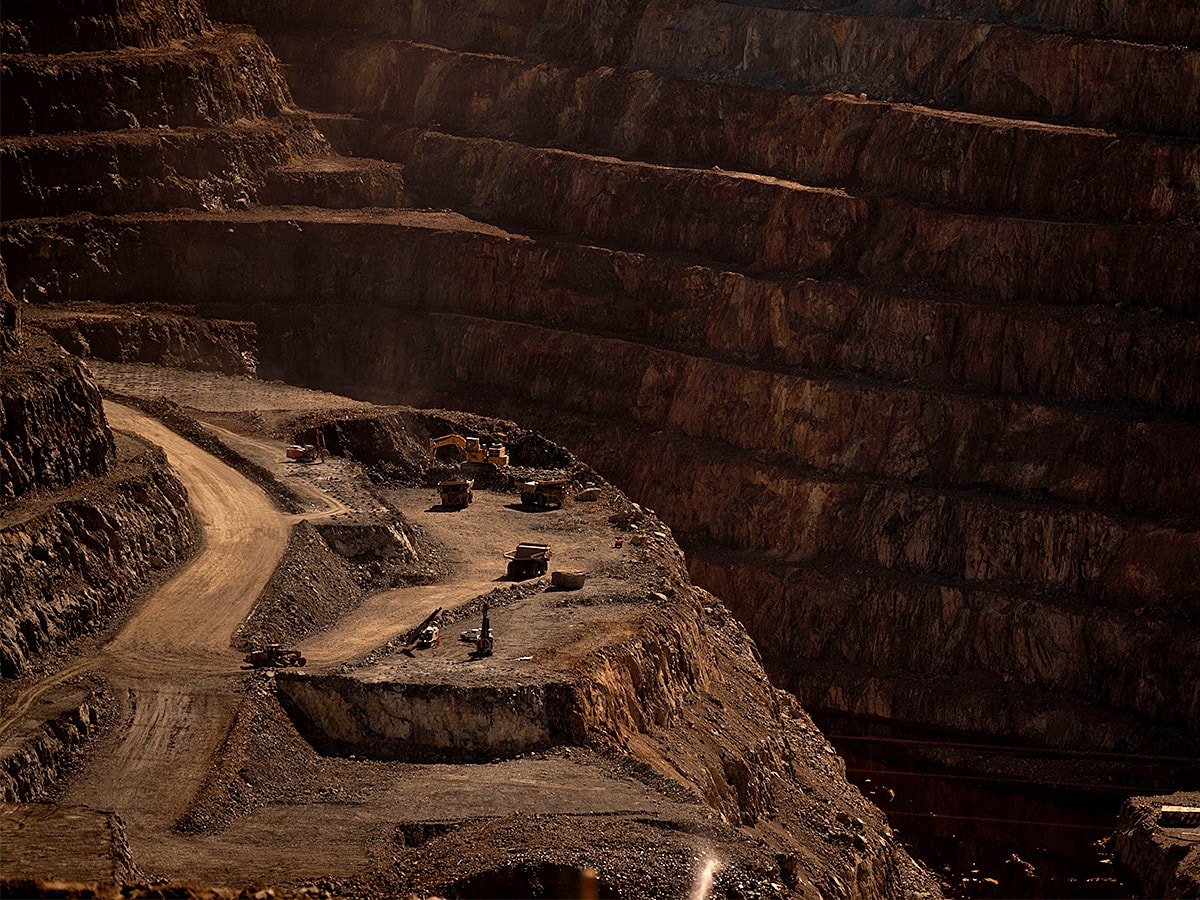

Low commodity prices and elevated costs ate into Rio Tinto’s [RIO.L] profit during 2022, prompting the Anglo-Australian miner to reduce its dividend by more than half.

Rio Tinto’s share price fell as much as 3.2% in mid-day trading on Wednesday in response to the results, which were announced before the opening of UK markets.

The stock had gained 7% in the year to its closing price on Tuesday, as macroeconomic conditions for miners have appeared to be improving. Over the previous 12 months the stock gained 15%, despite declining to its 52-week low of 4,424.50p in late October, as dollar strength and falling demand depressed commodity prices.

However, there is tentative evidence that the factors that caused this slump may have begun to ease during the early weeks of 2023, and many analysts take the view that the global economy will see revived demand for commodities by the end of the year.

Margins undermined

Rio Tinto’s revenue plummeted in 2022, falling 13% year-over-year from $63.5bn to $55.6bn. Despite being a significant decline from the company’s year-ago performance, revenue exceeded the $55.2bn consensus estimate among analysts polled by Refinitiv, marking a 25% increase on the equivalent figure from 2020.

Underlying EBITDA fell 20%, from $37.7bn to $26.3bn. Underlying EPS fell 38%, from $13.21 to $8.20. This was 5.5% short of the $8.68 that analysts had expected, although it again marked a 6% increase from the $7.70 posted in 2020.

A $8.1bn fall in underlying EBITDA was attributed to movements in commodity prices, particularly those of iron ore and copper, although an uplift in aluminium prices partially offset this.

These lower prices were exacerbated by increased input costs, including of labour: for example, iron ore from Rio Tinto’s Pilbara unit cost $21.3 per tonne in 2022 compared with $18.6 per tonne in 2021. This contributed to the unit’s margins falling from 76% in 2021 to 68% in 2022.

The slump in underlying profitability led Rio Tinto to slash its ordinary dividend from $7.93 last year to $4.92, which, factoring in the $2.47 special dividend paid in 2021, cuts the total dividend 52.69% year-over-year, from $10.40.

Capital investment guidance for 2023 was lowered to $8bn from $8-9bn, while expectations for 2024 and 2025 were raised to $9-10bn. Production and unit cost guidance for 2023 was reiterated.

Commodities back in demand?

Rio Tinto blamed slow demand for commodities in China for the fall in prices that have hampered the company’s profitability. However, there are signs that this demand might be on the rise in 2023.

Commodity price reporting agency Argus reported that the spot price of 62% iron ore deliveries to north China hit $128.80 per tonne on Monday, close to the peak price in 2023 to date and 63% higher than 2022’s low of $79. This was driven by an increase of iron ore inventories in Chinese ports to 140.9 million tonnes over the preceding week, with the equivalent figure having fallen to 130.2 million tonnes in October, reports Reuters.

Rival miner BHP’s [BHP] CEO Mike Henry said on his company’s earnings call that he was confident “we will see an acceleration in the Chinese domestic economy” this year. However, he also warned that recession in the US or Europe could have a negative impact on Chinese exports.

Funds in focus: First Trust Indxx Global Natural Resources Income ETF

Rio Tinto is the top holding in the First Trust Indxx Global Natural Resources Income ETF [FTRI] as of Tuesday, with a 10.56% weighting. BHP Group is the second holding with 10.39% of assets under management; between them and third holding Vale S.A. [VALE], they account for more than 30% of the fund’s holdings.

FTRI has fallen 1.6% in the past 12 months, reflecting the challenging year for miners as commodity prices were hit by falling demand. However, the recent tentative recovery is highlighted by the fund’s gains of 1.1% year-to-date.

Josh Fulton, an analyst at Fastmarkets, believes that the base metals market will see a sustained recovery during 2023, particularly towards the end of the year, when inflation is likely to have peaked, and dovish moves from the Fed will have reduced the value of the dollar.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy