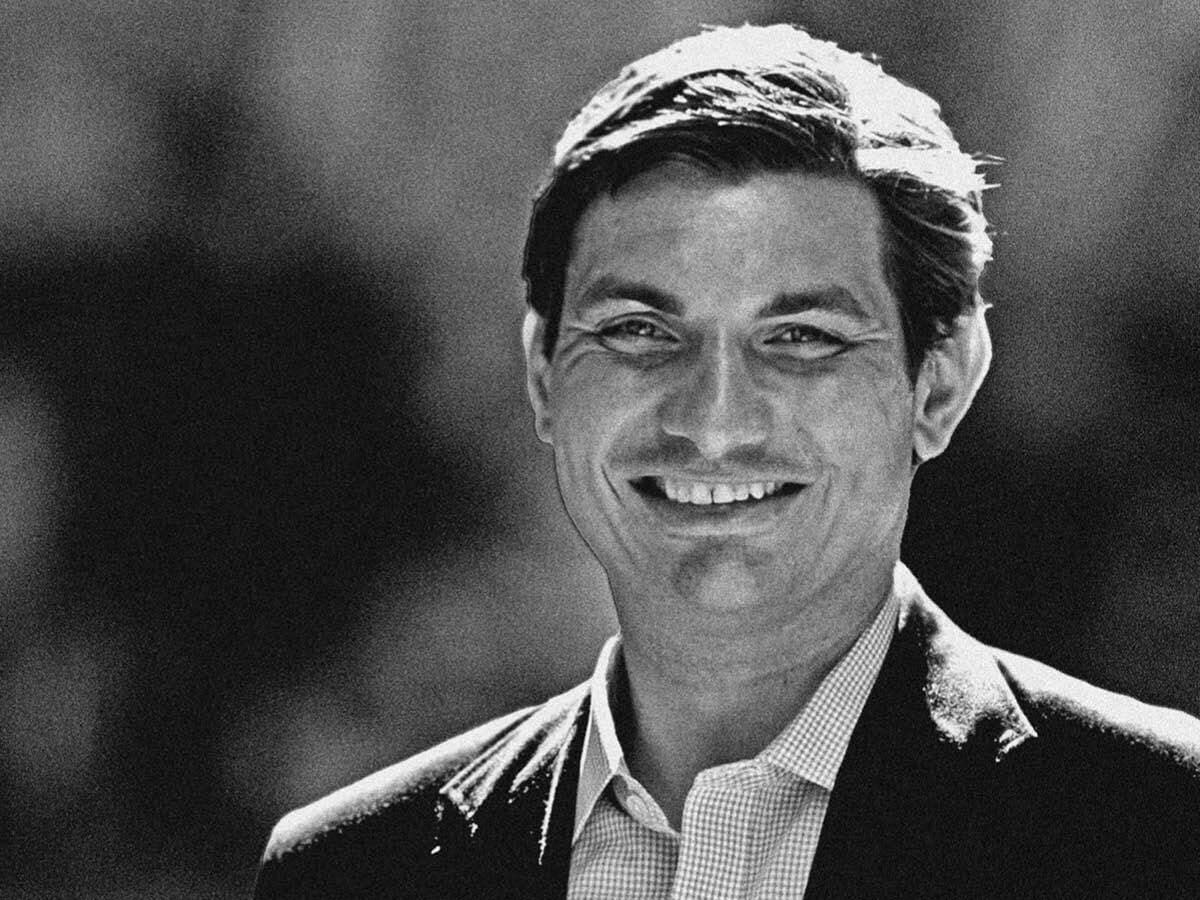

James Davolos, portfolio manager at Horizon Kinetics, oversees the Inflation Beneficiaries ETF [INFL], which launched in January 2021 and now comprises $855m worth of assets under management, up 26% since last year.

LISTEN TO THE INTERVIEW:

Rising global inflation has certainly helped, but with so much buzz around the three or four interest rate hikes expected from the US Federal reserve later this month, Davolos’s fund is in the eye of the storm.

As Davolos explained, the decision to raise interest rates is complex because of the domino effect it has. “If we raised too aggressively, and the dollar gets too strong, and you see big capital outflows from emerging markets, a lot of which have dollar-denominated debts, and a lot of their current accounts are basically predicated on their currencies, interaction with the dollar could cause really, really severe ripple effects.”

$855million

Total assets under management by Davolos's Inflation Beneficiaries ETF

Davolos’s opinion is that interest rate increases must not affect economic growth. He argued that “the risk of tipping the economy into recession is far larger of a risk than to have inflation running a bit hot, especially relative to the benefit of the basing debts”.

Contrary to popular belief, the current inflation is more widely spread across various product categories and cannot be reversed in one swooping blow, Davolos said. The Consumer Price Index tracks a broad basket of categories, many of which cannot be controlled with easy measures. For example, he explained, the price increases for cars or semiconductors can be fixed with building manufacturing facilities. Supply chain issues could be curbed through various measures, but the rising cost of copper requires a long cycle to contain. A greenfield mine takes 15 years to complete, Davolos pointed out.

According to him, the run in the equities market has defied the indications offered by bond yield prices for over a decade. “As a generalist and a pragmatist, I would say that if you looked at what the 10-year [government bond] has been telling us for 12 years, it’s been pretty negative and the markets just shot higher and higher and higher.”

In the midst of the pandemic and surging digital economy, hard assets have been overlooked, Davolos explained, referring to a Goldman Sachs analyst who called it ‘the revenge of the old economy’. “We’ve basically tried to digitise everything. And now we’re talking about the metaverse and people working from home forever,” he said, adding that “for the economy to actually work, you need a lot of these tangible hard assets, and it’s not as simple as just plugging in a new server or adding a new software user.” This requires capital and labour, both of which have stalled.

“[For] the economy to actually work, you need a lot of these tangible hard assets, and it’s not as simple as just plugging in a new server or adding a new software user” - James Davolos

To identify winners in an inflationary environment, Davolos said it is important to identify companies that have capital-light business models and can pass on the additional costs to consumers. Apple [AAPL], for instance, may find its supply chain costs remain 5% higher, but it could build that into the product cost. But Davolos expects that these businesses would see a correction, because if things continue a clutch of companies would have a market capitalisation higher than the US economy.

Instead, Davolos believes that sectors like shipping, real estate and insurance hold growth promise. “The entire world is going through a strong underwriting cycle for insurance. Shipping has gone through a very volatile cycle, kind of bouncing back and coming back in. Commercial real estate, even if prices have been choppy there, the leasing and sales cycles are picking up.”

To hear more insights from Davolos, listen to the full episode on Opto Sessions.

And for more ways to listen:

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy