Alphabet’s [GOOG] share price had a rough start to October. Along with fellow FAANG stocks, Alphabet’s share price buckled on October 4 as mounting pressure experienced in September finally came to a head.

Headwinds putting pressure on the owner of Google are both macroeconomic - the spectre of the Fed signalling tapering could happen sooner rather than later, the semiconductor shortage - and specific - wranglings with the EU over anti-monopolistic practices and CitiGroup analyst Jason Bazinet warning that Wall Street was ‘just too bullish’ on Alphabet and Facebook.

Since the early October stumble, Alphabet’s share price has managed to claw back some of those losses. Still, the firm has been delivering strong earning results this year. Second-quarter results announced in July crushed Wall Street expectations. Earnings per share came in at $27.26 on revenue of $61.88bn, easily topping last year’s EPS of $19.34, on $56.16bn of revenue. Total Google ad revenue came in at $50.44bn, jumping 69% from the same period last year. YouTube revenue soared to over $7bn, up 83% year-on-year.

Beyond ad revenue, Alphabet’s long-term investment case could be helped by its AI limb DeepMind.

$61.88billion

Alphabet revenue as per second quarterly earnnings report

DeepMind’s AI could future-proof Alphabet’s share price

Google’s AI offshoot DeepMind just announced that they are making a profit for the first time. The firm announced a profit of £43.8m in 2020, reversing previous years losses which ran into the hundreds of millions. In a filing with Companies House in the UK, revenue tripled year-on-year, going from £265.5 million in 2019 to £826.2 million in 2020.

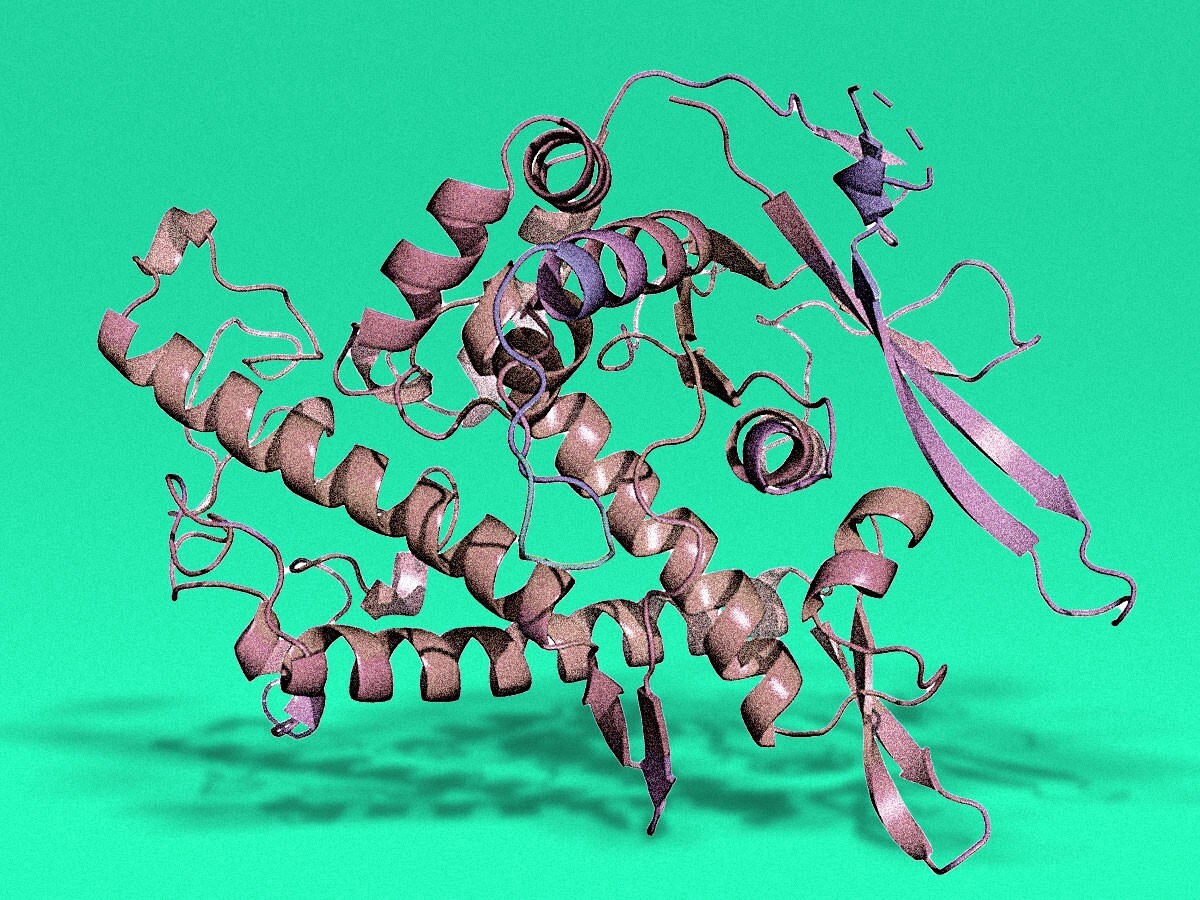

“During this reporting period, we made significant progress in our mission of solving intelligence to accelerate scientific discovery. Our groundbreaking results in protein structure prediction were heralded as one of the most significant contributions AI has made to advancing scientific knowledge,” DeepMind said in a statement.

“During this reporting period, we made significant progress in our mission of solving intelligence to accelerate scientific discovery. Our groundbreaking results in protein structure prediction were heralded as one of the most significant contributions AI has made to advancing scientific knowledge” - statement from DeepMind

DeepMind primarily sells its products to companies owned by Alphabet - it hasn’t announced deals with anyone else, and doesn’t sell directly to consumers. The technology is used by Google, YouTube and X - Alphabet’s self-described ‘moonshot factory’. Recent innovations include improving estimated arrival times on Google Maps.

According to the Financial Times, projects the company works on for Alphabet stretch from sales to its self-driving car, Waymo. It has also started to move into commercial projects, according to the FT. These include a team up with the UK’s Met Office to use machine learning to improve precipitation forecasts.

“I don’t think DeepMind have many or any revenue streams,” an anonymous source told CNBC. “So all that income is based on how much Alphabet pays for internal services, and that can be entirely arbitrary.”

That source suggested the revenue surge could be a case of ‘creative accounting’. And in any case, in the short- to mid-term, this might not have too much impact on Alphabet’s share price considering the sheer heft of its advertising business. Longer-term, as AI emerges as a technological force - and grows as an investment theme - things could start to change.

The AI and Deep Learning investment theme

The AI market looks set to grow as the technology becomes more pervasive in our daily lives. Beyond better weather forecasts, it has implications from everything to online shopping, autonomous driving technology and business operations. A recently published report from Fortune Business Insights estimates that the global Artificial Intelligence market will grow from $47.47 billion in 2021 to $360.36 billion in 2028 at a CAGR of 33.6%.

As an investment theme, AI and Deep Learning has surged 21.5% so far this year. Among the ETFS, the Global X Robotics & Artificial Intelligence Thematic ETF [BOTZ US] has gained over 21%, with top holding Upstart Holdings having surged a monster 712% as of Tuesday’s close.

DeepMind could help Alphabet further tap into this investment theme, even if meaningful impact on the financials is still a way off.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy