The automobile industry is accelerating into the future, with the advent of software-defined vehicles set to reshape the business models of all automakers. At the recent CES conference in Las Vegas, car and technology companies alike announced a slew of innovations that aim to capture increasing consumer demand for connected cars.

- S&P Global and Morgan Stanley believe that SDVs are in the ascendant.

- McKinsey shows that 63% of American BEV consumers are planning to buy connectivity features in their next car.

- Investors can gain exposure via both carmakers and technology companies.

The automotive sector is nearing an inflection point, according to S&P Global, with the advent of ‘software-defined vehicles’ (SDVs) fast approaching.

This new era will be defined by the CASE acronym: connected, autonomous, shared and electric.

The key shift is from a world in which automakers concentrate on optimising their hardware costs, with software being a secondary consideration, to one in which software is strategically crucial. Tesla’s [TSLA] pioneering of ‘over-the-air’ software updates was a key catalyst behind this change.

S&P Global expects a degree of turbulence to accompany the transition: “This change threatens to upend the industry’s value chain, which has been taken for granted since Henry Ford’s first moving production line in 1913 at Highland Park,” wrote S&P analysts led by Calum MacRae, Director of Research and Analysis, in a December newsletter.

Investment bank Morgan Stanley reported in January that SDVs could come to dominate the auto industry by 2040. Lee Simpson, Morgan Stanley’s Head of Technology Hardware Research in Europe, believes that “the car is evolving from a static network of software systems that are encased in moving hardware to be an intelligent, super-connected mobile electronic device”.

According to Morgan Stanley, SDVs’ share of auto production could increase from 3.4% in 2021 to 90% in 2029. However, the investment bank warns that the road to mass adoption will be “long and circuitous”, with safety a key consideration for regulators and consumers.

That said, there already exists a customer base which eagerly embraces innovations such as autonomous parking, emergency braking, blind spot detection and lane-line recognition, suggesting that further developments in connected vehicles could meet a receptive audience.

Consumer Preferences Shifting

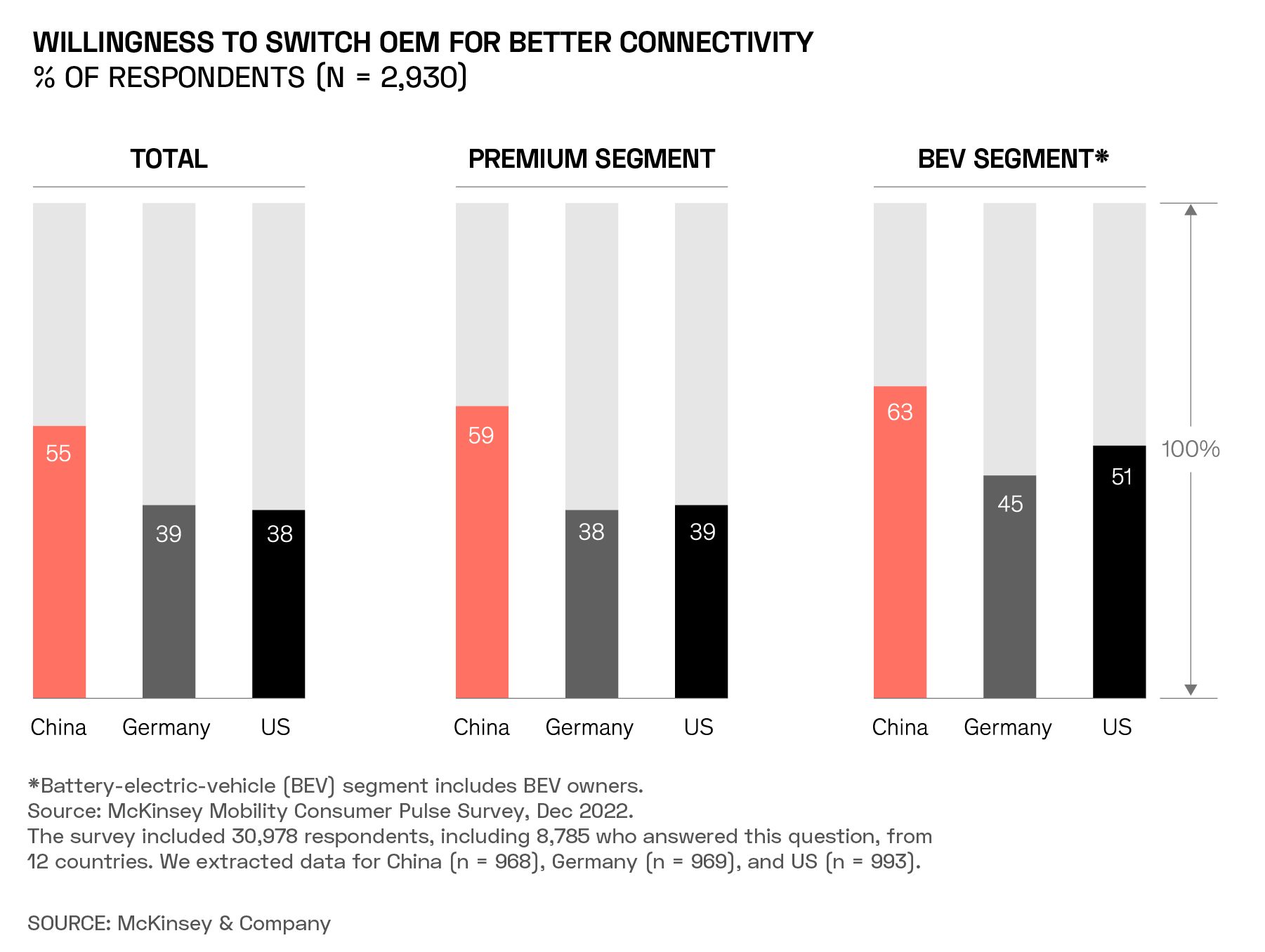

This conclusion is supported by research from strategy consultancy McKinsey, which found in a survey that better connectivity features would be a reason for respondents to switch original equipment manufacturers (OEMs). This was especially the case among Chinese respondents, 55% of whom said that they would switch brands for better connectivity. Among battery electric vehicle (BEV) customers, 63% of those surveyed in China said they would switch for better connectivity.

Underscoring the fact that consumers are showing a preference for connectivity features already, McKinsey also found that 60% of Chinese respondents and 47% of US respondents are likely to buy connectivity features in their next vehicle. This is especially pronounced among BEV consumers: 62% of Chinese BEV consumers and 63% of those from the US want their next car to have connectivity features.

Manufacturing firm Jabil [JBL] highlights five auto connectivity trends that are driving the future of the market. An article by Trevor Neumann, Vice President of Business Units and Business Development, looks at: the rise of the SDV; connectivity playing a greater role in autonomous driving; smart mobility driven by vehicle-to-everything connectivity; evolving software architectures for vehicle connectivity; and increasing personalisation.

“Both the incumbents (traditional OEMs and tier ones), as well as those from adjacent industries (big tech, software developers and telecom providers), know the shift is here,” writes Jabil. “The product is becoming the platform, and it’s likely one that will be subscription- and services-driven.”

Big Tech Connections

Big tech got the ball rolling at the Consumer Electronics Show (CES) 2024 last week in Las Vegas, where Danish auto technology start-up Connected Cars revealed that it has integrated Microsoft’s [MSFT] Connected Fleets reference architecture to enhance its suite of products. The integration will deliver “high-quality vehicle data, heterogeneous vehicle connectivity, and specialised telematics expertise to the fleet management ecosystem”, according to a press release.

Elsewhere, Samsung [005930:KS] has announced a collaboration with Hyundai [HYMTF] to bring connected technology to the automaker’s cars, as well as those of its subsidiary Kia [KIMTF]. The partnership will expand Samsung’s SmartThings platform to enable full integration between smart home devices and cars. Samsung also announced a collaboration with Tesla to connect SmartThings Energy to Tesla products via Tesla’s open APIs.

“Tesla Energy’s customers can now manage and monitor the power status of their homes through SmartThings Energy and Samsung devices in addition to the Tesla app,” Chanwoo Park, EVP and Head of IoT Development at Samsung Electronics, said in a press release.

With cloud technology central to the ability of connected cars to download software updates over the air, it is no surprise that Amazon [AMZN] is getting in on the act. Having partnered with Stellantis [STLA] since 2022 to provide software updates to its cars via Amazon Web Services, the two companies announced a “virtual cockpit” at CES that, according to Reuters, can reduce the development and testing time of new controls systems from months to, in some cases, as little as 24 hours.

Generative Automotive AI

Traditional automakers are taking advantage of artificial intelligence (AI) technology to make their cars more conversational. Mercedes-Benz [MBGAF] unveiled a voice assistant at CES that will be rolled out across its product suite, including its new EV Concept CLA Class. Volkswagen [VWAGY] also revealed that it will release a voice assistant integrated with ChatGPT, reports Reuters.

TomTom [TOM2:AS] and Microsoft are collaborating to bring generative AI to connected vehicles. The partnership, announced last month, has yielded a fully-integrated AI-powered conversational assistant which combines voice interaction, infotainment, location search and vehicle command systems. Developments such as these allow drivers to verbally instruct navigation systems to change route or adjust the car’s heating, among other typical onboard capabilities.

According to IoTnews, the system incorporates a number of Microsoft’s AI and cloud technologies, including Azure OpenAI Service, Azure Kubernetes Services, Azure Cosmos DB and Azure Cognitive Services.

How to Invest in Connected Cars

Traditional auto firms are increasingly incorporating connectivity features into their products. Hyundai (and its subsidiary Kia), Stellantis, Mercedes-Benz and Volkswagen are among the carmakers that have made significant connectivity announcements early in 2024. In the 12 months to 16 January, Hyundai’s share price is up 29.9%, Kia’s is flat, Stellantis has gained 57.7%, Mercedes is flat and Volkswagen has fallen 20.3%.

Then there are the tech companies that are developing the underlying technology for connected vehicles. Samsung’s share price has gained 18.8% in the past 12 months, while TomTom’s has dropped 8.4%. ‘Magnificent seven’ stocks are heavily involved in the trend, particularly Amazon, which gained 57.6%, and Microsoft, which gained 63.8% over the same period.

Intersecting all of these groups is Tesla, a magnificent seven technology stock whose primary focus is the production of autonomous vehicles, and which pioneered various aspects of car connectivity. Tesla shares are up 78.8% over the past 12 months.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy