China's rare earth monopoly wanes as its global mining output share drops from 98% to 58%, prompting the nation to import more raw materials. Meanwhile, Europe and the US strive to reduce reliance on China's lithium supply chain for EV batteries. Can these efforts loosen China's grip on resources crucial for a sustainable future?

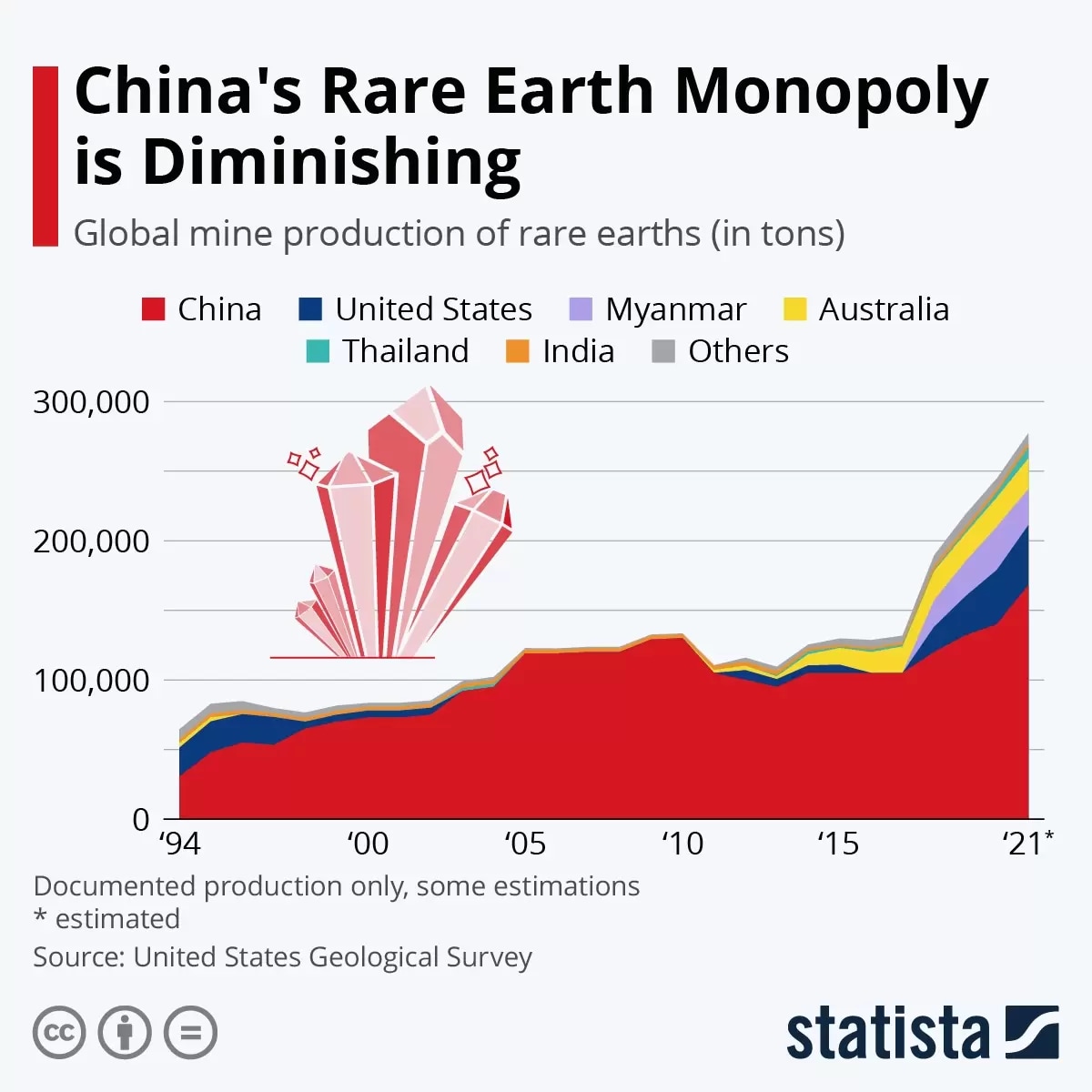

- China's grip on the rare earth industry is weakening, as its global mining output share fell to 58% in 2021 from 98% in 2010.

- Europe and the US are working to reduce dependence on China's lithium supply chain but face regulatory and environmental challenges.

- Despite challenges, Europe and the US are striving to boost their lithium independence to meet growing EV demand and net-zero targets and reduce reliance on China.

China’s grip on rare earths loosens

China's rare earth industry is grappling with a raw materials problem. Despite dominating the global supply chains of rare earth metals, China's grip on production has slipped as other countries have increased their output. In 2021, China's share of global mining output fell to 58% from a high of 98% in 2010. The Statistainfographic below illustrates how its global monopoly is diminishing.

Consequently, the country's imports of rare earth raw materials have surged, growing nearly 40% in 2021, according to The Rare Earth Observer, an industry newsletter, Quartz reported. This has raised concerns about the risks of foreign dependence and the security of raw materials for China's vast industrial system.

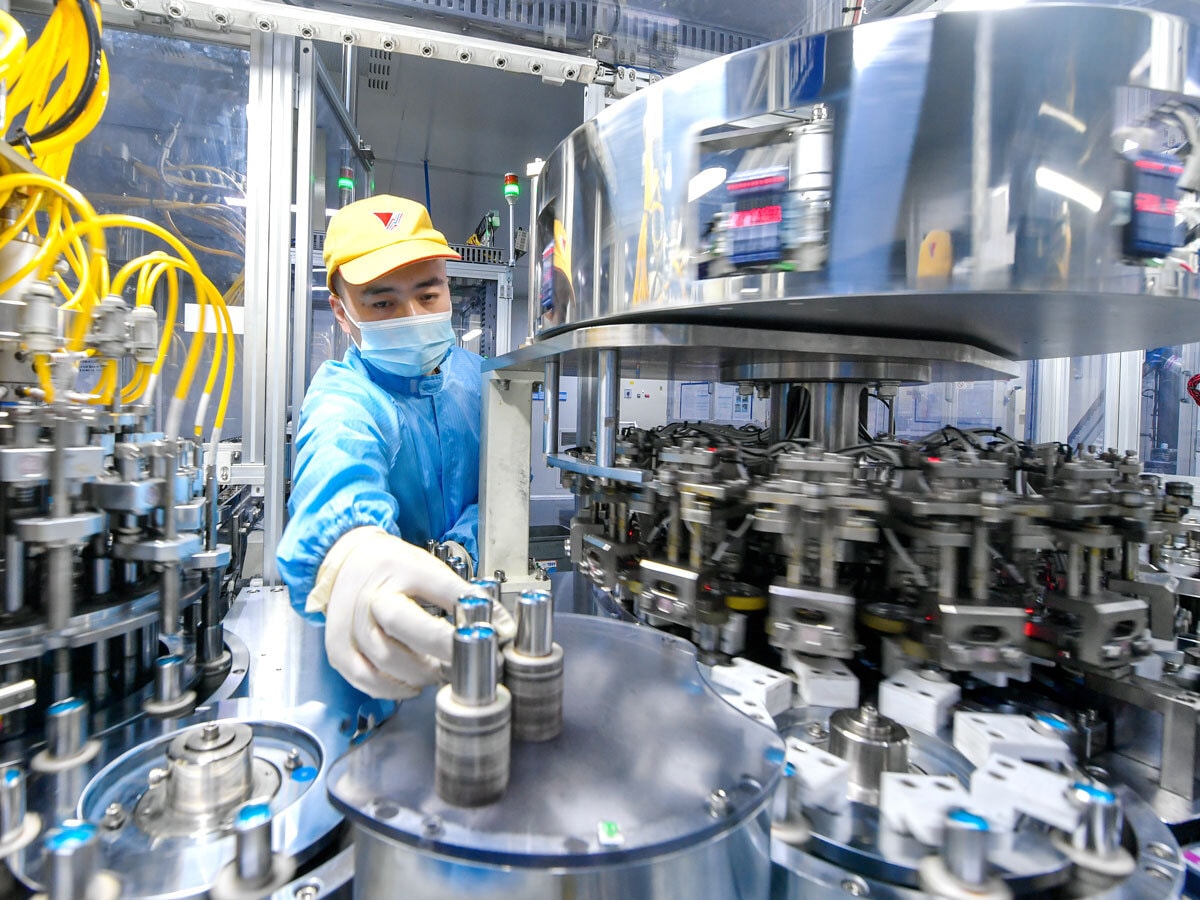

Rare earths are a group of 17 metals critical to many high-tech applications, such as batteries, permanent magnets for EV motors, and wind turbines. China currently has a near-monopoly on the entire production process beyond mining ores. This dominance gives China considerable influence over the global rare earth industry but also means it requires large quantities of ore, primarily mined in China, Australia, the US, and Myanmar.

To address this raw material problem, China is doubling efforts to buy more rare earth raw materials at their source. It is ramping up production domestically and investing aggressively overseas. For instance, in 2021, China restarted operations at four rare earth deposits in Jiangxi province that were previously halted due to environmental concerns.

Chinese companies are also boosting rare earth mining in Myanmar and Laos while establishing a foothold in Vietnam, which has the world's second-largest reserves of exploitable rare earths. In Australia, Chinese rare earth giant Shenghe Resources [600392.SS] acquired a stake in Peak Rare Earths [PEK] and invested in WIM Resource’s mineral sands project in Victoria state.

However, China's global hunt for rare earths is encountering obstacles. The Greenland government rejected a license application for a rare earths mine owned by a company in which Shenghe is the largest shareholder. Canada and Australia are also tightening their investment rules to keep China out of their critical minerals industries.

US and Europe cut reliance on China

While China continues its overseas investment in rare earths, Western nations and their allies are working to rebuild their rare earth supply chains and reduce their dependence on China. Examples of these collaborative efforts include processing monazite sands in Utah, with further refining in Estonia, and a transatlantic project involving rare earth ores mined in Canada with refining in Norway.

Japan has also increased its investment in Australian rare earths company Lynas Rare Earths [LYC] to secure heavy rare earths supplies, reducing its dependence on China from over 90% of imports to 58% within a decade.

Despite China's advantages in rare earth production, its unsustainable policies, such as bans on foreign investments in rare earths, export restrictions, and market-distorting tax rules, may ultimately undermine its monopoly. As a result, Western countries are exploring ways to develop technologies that require fewer rare earths, such as EV maker Tesla's [TSLA] announcement of next-generation motors using rare earths-free magnets.

However, Tesla hasn’t given up on China supply chains. The electric carmaker announced on 9 April it is opening a Megapack battery factory in Shanghai, despite the political tensions between Beijing and Washington.

Lithium & EV supply chains

As electric vehicle (EV) sales increase, the demand for lithium, a crucial component in EV batteries, has surged. China currently controls around 60% of global lithium processing through its extensive network of refineries. Meanwhile, Europe and the US are making efforts to reduce their dependence on China's lithium supply chain, although it's a challenging task, as FT’s Harry Dempsey reported on 16 April.

To achieve net-zero targets, the International Energy Agency estimates that electric cars need to account for approximately 60% of annual vehicle sales by 2030 and 100% by 2050. With over 95% of global lithium production originating from Australia, Chile, China, and Argentina, and China controlling 60% of global lithium processing through its numerous refineries, Europe and the US are working to boost their lithium independence.

Despite being a lithium-rich country, the US has only one operational lithium mine. Projects have been delayed due to lengthy permitting processes and concerns about the environmental and social impacts of lithium extraction. Similarly, plans to open lithium mines in Europe have faced regulatory issues and protests.

China spreads its roots

China is expanding its lithium sources in Africa and Latin America, while the European Commission is considering lowering regulatory barriers to mining and production of critical materials like lithium, cobalt, and graphite. Last year, the US introduced the Inflation Reduction Act, which provides tax credits for EVs using battery raw materials from the US and its free trade partner countries.

General Motors announced a $650m investment in a US lithium mine, reflecting the urgency for automakers to secure domestic supplies. Under net-zero goals, lithium demand is expected to surpass supply, and while efforts to secure this valuable resource are underway, loosening China's grip on the lithium supply chain will take time.

China's lithium market is currently experiencing a decline and displaying signs of bottoming out, with smaller producers seeking to minimise losses after a sharp drop in lithium prices. Despite this slowdown, thin stockpiles and improved prospects for battery storage and EV sales suggest that demand may recover soon. Although the decline is providing relief to downstream customers, lithium remains over four times more expensive than its 2020 low.

Funds in focus: Sprott Energy Transition Materials ETF

In an interview with Opto Sessions, John Ciampaglia, the CEO of Sprott Asset Management, spoke about the importance of lithium, uranium, and other minerals critical to the clean energy transition. When it comes to storing energy, “lithium is the star”, but nickel, cobalt, manganese, and graphite are also crucial to producing batteries, he said. Read more on the interview here or listen to the full podcast here.

Sprott recently launched four new ETFs into its suite of energy transition funds. The Sprott Energy Transition Materials ETF [SETM] was launched in February and is up 8.6% in the last month. The fund offers investors exposure to miners producing uranium, lithium, copper, nickel, silver, manganese, cobalt, graphite, and rare earths. Its top holdings include First Quantum Minerals [FM], Sociedad Quimica y Minera de Chile [SQM] and Lynas.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy