What Is the Bid-Ask Spread? A Complete Guide for Traders

Understanding the Bid-Ask Spread Basics

The bid-ask spread represents the difference between the highest price a buyer will pay (bid) and the lowest price a seller will accept (ask) for a security. This fundamental market mechanism exists in every tradeable asset, from FTSE 100 stocks to forex pairs and commodities.

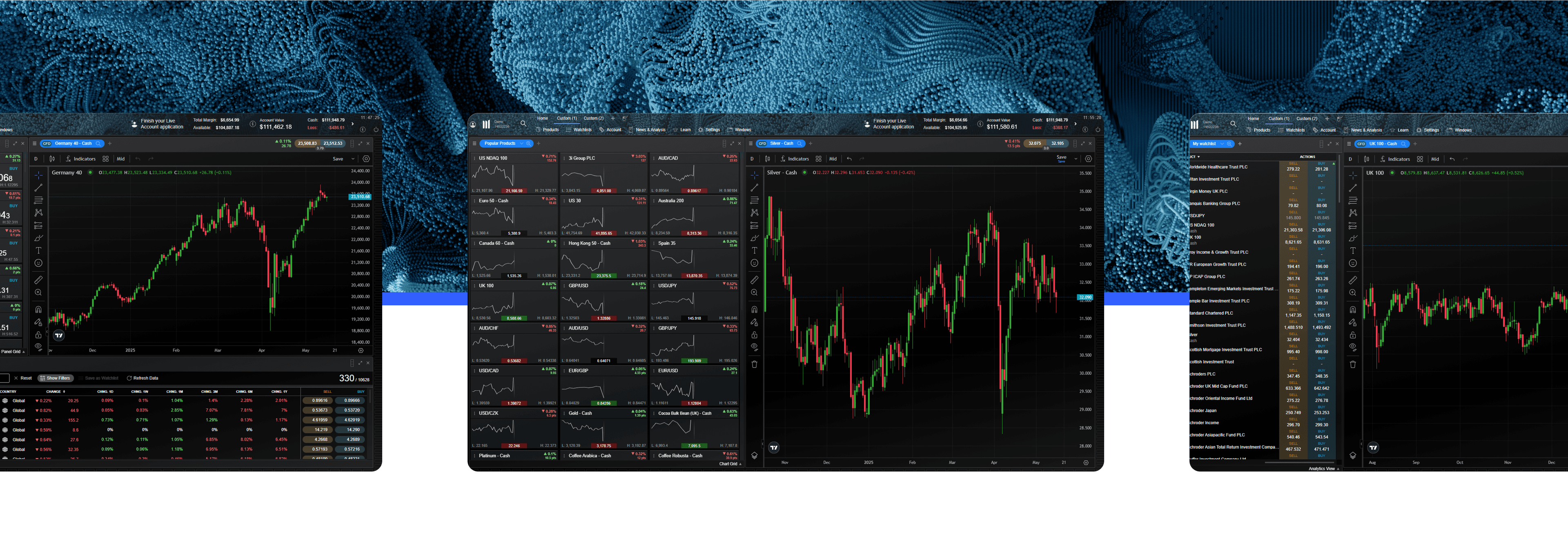

When you look at any trading screen, you’ll see two prices for every security. The bid price sits on the left, showing what buyers are prepared to pay right now. The ask price (also called the offer price) appears on the right, displaying the minimum sellers will accept. The gap between these numbers — the bid-ask spread — acts as a transaction cost built into every trade.

Consider company shares that are trading with a bid of 198.50p and an ask of 198.70p. The 0.20p difference represents the spread. If you buy at the ask and immediately sell at the bid, you lose 0.20p per share before considering any other costs. This reality makes understanding bid vs ask prices essential for cost-conscious traders.

The spread compensates market makers for providing liquidity. These financial institutions stand ready to buy when you want to sell and sell when you want to buy. They seek to earn income from spreads, although actual returns depend on market conditions and order flow.

How to Calculate the Bid-Ask Spread (Formula & Examples)

The bid-ask spread formula is straightforward:

Spread = Ask Price - Bid Price

For percentage calculations, which enable comparison across different price levels:

Spread (%) = ((Ask Price - Bid Price) / Ask Price) × 100

Practical Bid-Ask Spread Examples

These hypothetical examples demonstrate how spreads vary dramatically across asset classes and liquidity levels. Large-cap equities typically show the tightest spreads, while small-cap stocks often exhibit wider gaps due to lower trading volumes.

A bid-ask spread calculator helps traders quickly assess trading costs. Many brokers provide these tools within their platforms, automatically computing both absolute and percentage spreads. The calculation becomes particularly important when comparing costs across different brokers or assessing the impact on your overall returns.

Consider a day trader executing 20 round-trip trades monthly on stocks with an average 0.15% spread. This cost can accumulate to around 3% of total traded value (0.15% × 20), highlighting why spread awareness matters for active traders. These transaction costs can significantly erode profits if not properly managed.

Factors That Influence the Spread

Multiple variables determine the width of bid-ask spreads, and understanding these factors helps traders anticipate cost changes and select optimal trading times.

Liquidity stands as the primary driver. Highly liquid securities like major forex pairs or blue-chip stocks maintain tight spreads because abundant buyers and sellers compete for transactions.

Volatility widens spreads as market makers demand compensation for increased risk. For example, during the March 2023 US banking crisis, spreads on financial stocks widened significantly. Market makers protect themselves against rapid price movements by widening the gap between bid and ask prices.

Trading hours significantly impact spreads. UK equity bid-ask spreads typically tighten between 9:00 and 16:00 GMT, during peak activity times on the London Stock Exchange. Pre-market and after-hours trading can feature spreads 2–5 times wider than regular session spreads.

Market Conditions and Spread Behaviour

Company-specific factors also matter. Market capitalisation, average daily volume and news flow all influence spreads. Small-cap stocks on the Alternative Investment Market (AIM) typically show spreads around 5–10 times wider than FTSE 100 constituents, reflecting their lower liquidity and higher risk profiles.

Why Bid-Ask Spreads Matter for Your Trading Strategy

The bid offer spread directly impacts your profitability threshold. Every trade starts with an immediate loss equal to the spread, meaning price must move favourably just to break even. This reality shapes optimal strategy selection and position sizing.

For forex scalpers (traders who use high-frequency trading strategies to make numerous small, short-term profits) targeting 5–10 pip moves in forex, a 2-pip spread consumes 20–40% of potential profit. Contrast this with position traders holding for weeks where the same spread represents less than 1% of expected returns. Your trading timeframe should align with spread costs.

Spread analysis can reveal market sentiment and potential volatility. Widening spreads often precede significant market moves as market makers anticipate increased risk. Professional traders monitor spread patterns alongside price action, using abnormal widening as an early warning signal.

The concept of ‘spread capture’ drives many algorithmic trading strategies. High-frequency traders place limit orders inside the spread, attempting to buy below the ask and sell above the bid. While retail traders cannot compete at microsecond speeds, understanding this dynamic can explain certain market behaviours.

Cost accumulation from spreads will affect different strategies disproportionately:

• Day traders: Face spread costs on every round trip, potentially 0.5–2% daily

• Swing traders: Absorb spreads less frequently, for example, 0.5–1% weekly

• Long-term investors: Minimal impact, often below 0.1% annually

Risk warning: Frequent trading increases the proportion of returns consumed by spread costs. Research suggests a high proportion of retail day traders — around 70% — lose money, with transaction costs cited as a primary factor.

How to Trade with Bid-Ask Spreads

Smart execution techniques can minimise spread costs and improve overall returns. The choice between market orders and limit orders fundamentally affects how much you pay in spreads.

Limit orders allow you to specify exact execution prices, potentially trading inside the spread. By placing a buy limit at the bid price, you join the queue of buyers rather than paying the ask. This patience can save the full spread amount, though execution isn’t guaranteed.

Market orders guarantee immediate execution but always incur the full spread cost. You buy at the ask and sell at the bid, accepting this cost for certainty of execution. Using market orders when capturing a move matters more than saving basis points.

Trading during peak liquidity hours reduces spread costs substantially. The overlap between London and New York sessions (12:00–17:00 GMT) offers the tightest spreads for most major markets.

Advanced traders use ‘spread trading’ strategies that profit from spread movements rather than price direction. Pairs trading, for instance, involves simultaneously buying one security and selling a correlated one, profiting when their spread relationship normalises. These strategies require sophisticated analysis, though outcomes depend on execution quality and market conditions.

Electronic communication networks (ECNs) and direct market access (DMA) platforms often provide tighter spreads than traditional brokers. These venues aggregate liquidity from multiple sources, creating competition that narrows spreads. Professional traders may use multiple venues to optimise execution, routing orders to capture the best available prices.

Retail traders should be aware these tools often require advanced systems and experience.

Common Mistakes to Avoid

Ignoring spread costs ranks among the most expensive errors traders make. A strategy showing theoretical profitability can become a consistent loser once real-world spread costs are included. Always factor spreads into your backtesting and position sizing calculations.

Trading illiquid securities without understanding their wide spreads catches many newcomers. A promising AIM stock might show an attractive chart pattern, but a 5% spread means price must move significantly just to break even. Traders should stick to liquid markets until they thoroughly understand spread dynamics.

Chasing momentum during volatile periods often means buying at inflated asks as spreads widen. The excitement of a breaking news event can blind traders to spreads that have expanded from 0.1% to 1%. Always check current spreads before entering positions, particularly during major announcements.

Many traders fail to account for spread changes throughout the day. A strategy profitable during liquid afternoon sessions might fail during wider-spread morning hours. Track your execution costs by time of day to identify patterns.

Using market orders exclusively represents another costly mistake. While appropriate for liquid markets and urgent executions, habitual market order use guarantees paying maximum spread costs. Reduce risks with limit orders for routine trades.

Overlooking broker spread markups costs traders significantly over time. Different brokers may apply varying spread structures. Always check total trading costs, including any markups or commissions, across brokers. Spread markups can significantly increase apparent trading costs for retail clients.

Risk warning: Wide spreads during volatile markets can lead to substantial losses. Never trade with capital you cannot afford to lose. Consider practising with demo accounts to understand spread behaviour without financial risk.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.