How to Trade Forex: Complete Beginner's Guide

The UK forex market processes over £2.9 trillion in daily trading volume, making London the global centre for currency trading (Bank for International Settlements, April 2024). Whether you're looking to diversify your portfolio or explore active trading, understanding how to trade forex properly is essential before risking any capital

What is Forex Trading? Understanding the Basics

Forex trading involves buying one currency whilst simultaneously selling another, speculating on exchange rate movements between currency pairs. The foreign exchange market operates 24 hours a day, five days a week, with an estimated $7.5 trillion traded globally each day (BIS Triennial Survey, 2023).

Unlike stock markets with centralised exchanges, forex operates through a decentralised network of banks, brokers, and electronic trading platforms. When you trade forex, you’re essentially predicting whether one currency will strengthen or weaken against another. For instance, if you believe the euro will rise against the US dollar, you would buy EUR/USD.

Currency trading typically occurs through derivative products such as CFDs (Contracts for Difference), spot trading, or futures contracts—depending on regional regulations. These are leveraged products that allow traders to control larger positions with smaller deposits. However, leverage amplifies both potential profits and losses—a key risk factor that causes many retail traders to lose money.

The forex market’s high liquidity allows traders to enter and exit positions quickly, with major pairs like EUR/USD often offering spreads as low as 0.6 pips during peak trading hours. Combined with leverage availability that typically ranges from 20:1 to 100:1, depending on local regulations, forex remains attractive to active traders seeking short-term opportunities.

How Does Forex Trading Work?

Understanding how forex trading works requires grasping three fundamental concepts: currency pairs, pip movements, and leverage. Currency pairs represent the exchange rate between two currencies, with the first currency being the base and the second the quote.

For example, if EUR/USD is trading at 1.2750, this means one euro buys $1.2750. If the rate moves to 1.2760, the euro has strengthened by 10 pips—the smallest price movement in forex trading. For most pairs, one pip equals 0.0001, while pairs involving the Japanese yen use 0.01.

Traders worldwide access forex markets through regulated brokers that offer various instruments such as spot forex, CFDs (Contracts for Difference), or futures contracts.

The trading process involves placing orders through a broker’s platform, where you specify your position size, set stop-loss orders to limit potential losses, and optionally add take-profit orders to secure gains automatically. Brokers execute trades at current market prices and typically charge through spreads (the difference between buy and sell prices) or commissions.

Step 1: Choose a Reliable Regulated Forex Broker

Choosing a regulated forex broker is one of the most important steps for any trader. Regulation helps ensure that brokers operate fairly, maintain adequate financial standards, and protect client funds from misuse.

Before opening an account, verify that your broker is authorised by a recognised financial authority in your region. Regulated brokers are required to follow strict compliance and reporting standards designed to safeguard traders and promote transparency.

When comparing brokers, consider factors such as execution speed, platform stability, customer service quality, and clarity around fees and spreads. A trustworthy broker should also keep client funds separate from company operating funds and provide access to risk management tools such as negative balance protection where applicable.

Reputable brokers often offer demo accounts, educational resources, and market analysis tools to help new traders learn and practise safely before trading with real money.

Avoid unregulated brokers or those that promise unrealistic returns, high bonuses, or excessively high leverage. Such offers often indicate poor practices or potential scams.

Step 2: Learn Forex Trading Basics and Terminology

Before risking capital, master essential forex trading basics and terminology. Understanding these concepts prevents costly mistakes and enables informed decision-making when analysing currency markets.

Key Terms Every Trader Must Know:

Spread: The difference between bid (selling) and ask (buying) prices. Tighter spreads reduce trading costs.

Leverage: Borrowed capital that amplifies your trading position. FCA limits retail leverage to 30:1 for major pairs, 20:1 for minors.

Margin: The deposit required to open a leveraged position. With 30:1 leverage, $100 controls $3,000 worth of currency.

Pip: The smallest price movement, typically 0.0001 for most pairs. A 50-pip movement in GBP/USD from 1.2750 to 1.2800 equals $50 profit/loss per standard lot.

Lot Size: Standard lot equals 100,000 units of base currency. Mini lots (10,000 units) and micro lots (1,000 units) suit smaller accounts.

Stop Loss: An order that automatically closes your position at a predetermined loss level, essential for risk management.

Learning these fundamentals through demo trading allows practice without financial risk. Spend at least 4-6 weeks on a demo account before considering live trading. Track your performance, test strategies, and understand how news events impact currency movements.

Step 3: Open and Fund Your Trading Account

Opening a forex trading account involves identity verification, financial assessment, and initial funding. Regulated brokers must verify your identity and assess your trading knowledge to ensure the products offered are suitable for your experience level.

The application process typically requires:

Proof of identity (such as a passport or national ID)

Proof of address (such as a recent utility bill or bank statement)

Employment and income details

Basic information about your trading experience

Most brokers review applications within 24 hours once your documents are verified. Be honest about your experience level—brokers use this information to determine whether leveraged trading is appropriate for you under local regulations.

Funding options usually include bank transfers, debit or credit cards, and digital wallets. Bank transfers may take a few business days, while card and e-wallet deposits are typically instant. Some brokers may charge transaction fees or have minimum deposit requirements.

Start with an amount you can afford to lose entirely—think of it as the cost of learning rather than an investment with guaranteed returns. Many traders begin with $250 to $500, which provides enough flexibility for proper position sizing and basic risk management. Avoid depositing more than you are comfortable risking at any stage.

Step 4: Select Your Trading Platform and Tools

Your trading platform serves as the command centre for market analysis and trade execution. Most brokers offer MetaTrader 4 (MT4), MetaTrader 5 (MT5), or proprietary platforms, each with distinct advantages.

MetaTrader 4 remains the industry standard for forex trading, offering comprehensive charting tools, automated trading capabilities, and thousands of custom indicators. Its widespread adoption means extensive educational resources and community support. MT5 adds more timeframes and order types but has lower third-party support.

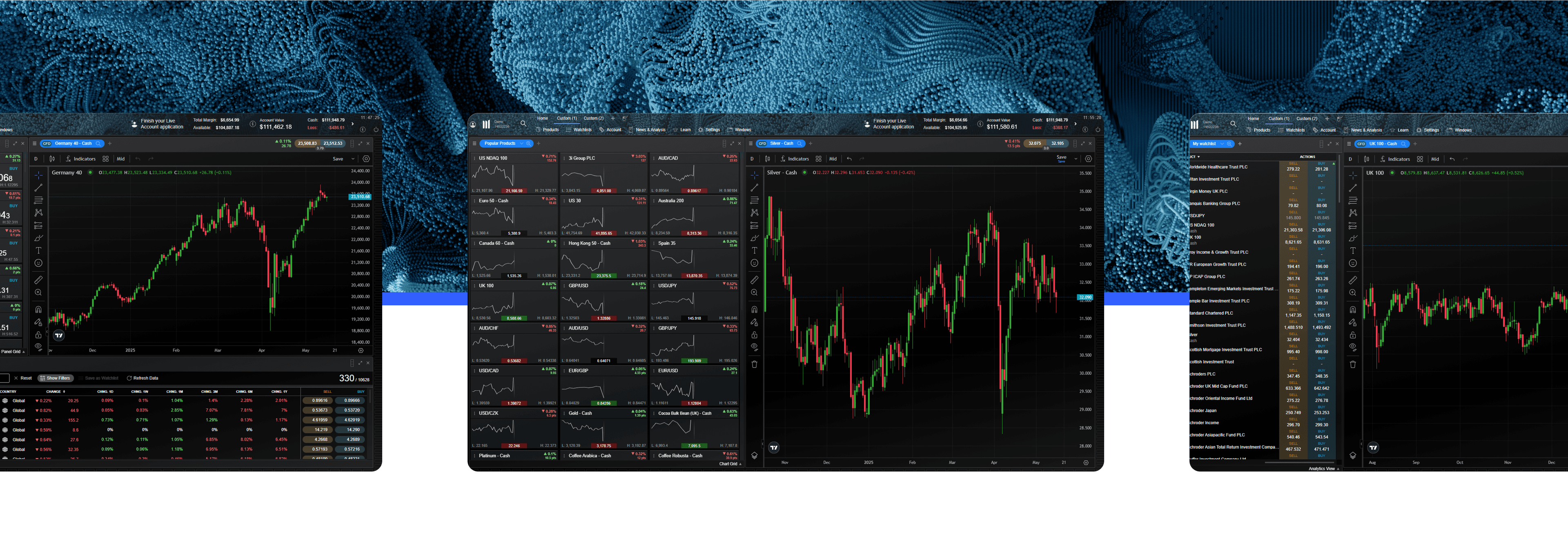

Proprietary platforms like CMC's Next Generation often provide superior charting and offer features like one-click trading, advanced order types, and integrated news feeds from Reuters

Essential platform features to master:

Real-time price charts with multiple timeframes

Technical indicators (moving averages, RSI, MACD minimum)

Economic calendar showing high-impact news events

One-click trading for rapid execution

Risk management tools including guaranteed stop losses

Mobile trading apps complement desktop platforms, enabling position monitoring and trade management anywhere. However, avoid making impulsive trades simply because mobile access makes it convenient. Your forex trading app should support your strategy, not encourage overtrading.

Step 5: Develop Your Forex Trading Strategy

A robust forex trading strategy combines technical analysis, fundamental awareness, and strict risk management rules. Without a defined strategy, you're gambling rather than trading, significantly increasing your probability of losses.

Three Core Strategy Types:

Trend Following: Identifies and trades in the direction of established market trends using moving averages and trendlines. Works best in strongly trending markets but suffers during consolidation periods.

Range Trading: Buys at support levels and sells at resistance within defined price ranges. Suits sideways markets but requires quick exits when ranges break.

Breakout Trading: Enters positions when price breaks above resistance or below support with increased volume. Offers strong profit potential but prone to false breakouts.

Your strategy must define:

Entry criteria (specific technical or fundamental conditions)

Position sizing rules (typically 1-2% risk per trade maximum)

Exit criteria (both profit targets and stop losses)

Trading times (London session for GBP pairs, New York for USD pairs)

Currency pairs to trade (start with one or two major pairs)

Backtest your strategy using historical data before risking real money. Most platforms offer strategy testing features that simulate how your approach would have performed historically. Remember that past performance doesn't guarantee future results, but backtesting reveals strategy weaknesses.

Document every trade in a journal, recording entry reasoning, emotional state, and lessons learned. This discipline separates professional traders from amateurs who repeat mistakes indefinitely.

Step 6: Choose Your Currency Pairs

Selecting appropriate currency pairs impacts trading costs, volatility exposure, and profit potential. The forex market divides into three categories, each with distinct characteristics.

Beginners should focus on major pairs, like EUR/USD and GBP/USD, which offer tight spreads and predictable behaviour. These pairs provide sufficient volatility for profit opportunities whilst avoiding excessive risk from wide spreads or erratic movements.

GBP pairs naturally suit UK traders who follow British economic news and understand factors affecting sterling. The pound's volatility creates opportunities but demands careful risk management—GBP/JPY, known as "the beast," can move 200 pips daily.

Monitor the correlation between pairs to avoid doubling risk unknowingly. EUR/USD and GBP/USD often move together, meaning simultaneous positions effectively create one larger trade. Diversification requires genuinely uncorrelated pairs or different asset classes entirely.

Step 7: Execute Your First Trade (Buy or Sell)

Executing your first live trade marks a significant milestone requiring preparation and discipline. Start with a micro position (0.01 lots) to minimise financial risk whilst experiencing real market conditions and emotions.

Pre-Trade Checklist:

Confirm your analysis aligns with your strategy rules

Check economic calendar for upcoming news events

Calculate position size based on stop-loss distance

Verify sufficient margin including potential losses

Set stop-loss and consider take-profit orders

When you're ready, follow these steps: Open your platform and select your chosen currency pair. Analyse the current trend using your preferred timeframe—daily charts for direction, hourly for entry timing. If trading EUR/USD and your analysis suggests euro strength, you'll buy (go long).

Enter your position size carefully. With a $1,000 account risking 1% per trade ($10), and a 20-pip stop loss on EUR/USD, you'd trade 0.05 lots (each pip equals $0.50). Click "Buy" at market price or set a pending order at your desired entry level.

Immediately place your stop-loss order 20 pips below entry. This automatic exit limits losses if the trade moves against you. Consider adding a take-profit order at 40 pips above entry, creating a 2:1 reward-to-risk ratio.

Monitor but don't micromanage. Constant watching encourages emotional interference. Trust your analysis and let the trade develop according to plan.

Risk Management: Essential Rules for Forex Traders

Effective risk management is the foundation of long-term success in forex trading. Studies across global markets show that the majority of retail trading accounts lose money, primarily due to poor risk control rather than a lack of technical knowledge.

A simple framework for discipline is the 5-3-1 Rule: focus on no more than five currency pairs, master three trading strategies, and trade during one consistent session each day. This approach builds expertise and consistency instead of spreading attention too thin.

Never risk more than 1–2% of your trading account on a single trade. For example, with a $1,000 account, the maximum risk should be $10–20 per position. This conservative rule allows you to survive a long series of losing trades and stay in the game long enough to refine your strategy.

Always use stop-loss orders to protect your capital. Market gaps, sudden volatility, or unexpected news events can quickly move prices against your position. Some brokers offer guaranteed stop-losses, which cost slightly more but provide complete protection during extreme conditions.

Before opening a trade, calculate your position size using the formula:

Position Size = (Account Risk ÷ Stop Distance) ÷ Pip Value

Finally, avoid emotional trading. Never increase trade sizes after a loss to “win it back” or overtrade after a winning streak. Consistent, disciplined risk management matters far more than any single trade outcome.

Is $100 Enough to Start Forex Trading?

Starting with $100 is technically possible but practically challenging for sustainable forex trading. Whilst many brokers accept $100 deposits, this amount severely limits proper risk management and psychological comfort.

With $100, risking 2% per trade means $2 maximum loss—barely covering spreads on standard positions. Micro lots (0.01) on major pairs risk approximately $0.10 per pip, allowing 20-pip stop losses whilst staying within risk parameters. However, this leaves no room for normal market noise or wider stops during volatility.

The psychological pressure of a small account often triggers poor decisions. Traders desperate to grow $100 quickly take excessive risks, use maximum leverage, and abandon stops—virtually guaranteeing losses. Better to save $500-1,000 before starting, providing breathing room for proper position sizing.

If determined to begin with £100, treat it as education expenditure. Trade micro lots exclusively, maintain trading journals, and focus on process over profits. Consider this amount tuition for learning market dynamics, platform operations, and emotional control. Most importantly, don't deposit additional funds until consistently profitable on demo accounts for at least three months.

Common Forex Trading Mistakes to Avoid

Understanding common forex trading mistakes helps sidestep expensive lessons that claim most beginners' accounts. These errors stem from inexperience, emotional decisions, and unrealistic expectations about market behaviour.

Overleveraging destroys more accounts than any other factor. Maximum allowable leverage doesn't mean you should use it. Trading at 30:1 leverage means a 3.33% adverse movement wipes out your position. Professional traders rarely exceed 5:1 actual leverage regardless of availability.

Ignoring economic news leads to unexpected volatility that triggers stops or causes significant losses. NFP (Non-Farm Payrolls), central bank decisions, and GDP releases can move markets 100+ pips within minutes. Check economic calendars before trading and avoid holding positions through high-impact events whilst learning.

Chasing losses through increased position sizes or abandoned stop-losses accelerates account destruction. After losses, reduce position sizes and return to demo trading if emotions override logic. Markets remain open tomorrow—preserve capital for better opportunities.

Overtrading from boredom or excitement generates excessive costs and poor decision-making. Quality trumps quantity; one well-executed trade weekly beats ten impulsive positions. Set maximum daily trades and stick to your plan regardless of market action.

Regulatory Oversight and Trader Protection

Financial regulatory authorities provide robust protection for forex traders through comprehensive frameworks designed to balance market access with consumer protection. These regulations have significantly improved retail trading outcomes worldwide.

Typical regulatory measures include:

Maximum leverage limits for major currency pairs

Negative balance protection preventing losses beyond deposits

Standardised risk warnings on marketing materials

Restrictions on bonus offers and trading incentives

Mandatory segregation of client funds

These protections extend to CFD trading, covering most forms of retail forex activity. Regulators also require brokers to assess client knowledge and experience, while experienced traders may opt for professional status with fewer restrictions but reduced protections.

In many jurisdictions, compensation schemes protect deposits up to a set amount per person, per regulated firm in the event of broker insolvency. These safety nets generally cover account balances but not trading losses, offering an extra layer of confidence when choosing a regulated broker.

Traders should report suspicious brokers or potential scams to the relevant financial authority in their region. Warning signs include promises of guaranteed returns, pressure to deposit quickly, or difficulties withdrawing funds.

Start with a free demo account for learning forex trading basics without financial risk. When ready for live trading, $500-1,000 provides adequate capital for proper risk management whilst building experience. Smaller amounts remain possible but limit strategy options and increase psychological pressure.

Forex markets operate continuously from 10pm Sunday to 10pm Friday UK time. However, liquidity and volatility vary significantly across sessions. The London session (8am-4pm) offers optimal trading conditions for major pairs, particularly during the London-New York overlap (1pm-4pm) when both markets remain active.

Most successful traders require 12-18 months of dedicated study and practice before achieving consistency. This timeline assumes daily market engagement, continuous education, and strict adherence to risk management. Approximately 80% of retail traders never achieve sustained profitability, underlining the importance of realistic expectations and proper preparation.

Trend following on daily charts suits beginners through clear signals and reduced screen time. This approach avoids intraday noise whilst providing sufficient trading opportunities. Focus on one strategy initially, mastering its application before exploring alternatives. Strategy effectiveness depends more on discipline and risk management than the system itself.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.