How to Trade ETFs: A Comprehensive Guide for Investors

Exchange-traded funds have become a cornerstone of modern portfolio construction, offering investors access to diversified exposure across global markets. This guide explains how to trade ETFs effectively while navigating regional regulations, tax considerations and platform requirements.

What Are ETFs and How Do They Work?

An exchange-traded fund (ETF) is an investment vehicle that tracks an index, sector, commodity or basket of assets while trading on stock exchanges like individual shares. Unlike traditional mutual funds, ETFs can be bought and sold throughout the trading day at market prices that fluctuate based on supply and demand.

ETFs operate through a creation and redemption mechanism involving authorised participants — typically large financial institutions. When demand for an ETF increases, these participants create new units by assembling the underlying securities and exchanging them for ETF shares. The reverse process occurs when redemptions exceed creations. This mechanism keeps the ETF’s market price closely aligned with its net asset value.

Most UK-available ETFs are UCITS-compliant, meaning they meet European regulatory standards for investor protection. These funds must maintain diversification requirements and cannot use excessive leverage. Physical ETFs hold the actual underlying securities, while synthetic ETFs use derivatives to replicate index performance — the latter carrying counterparty risk you should understand before investing.

ETF vs Mutual Funds vs Index Funds: Key Differences

Understanding how ETFs compare to mutual funds and index funds helps you select the appropriate vehicle for your circumstances.

ETFs generally offer lower costs than actively managed mutual funds, though the gap narrows when comparing them to passive index funds. The key advantage lies in intraday liquidity — you can enter or exit positions during market hours rather than waiting for end-of-day settlement. However, this flexibility introduces timing risk, as intraday price movements may work against you.

Why Trade ETFs? Benefits and Advantages

ETFs offer several compelling advantages for UK investors, though each benefit carries corresponding considerations.

Diversification: A single ETF can provide exposure to hundreds or thousands of securities. A global equity ETF, for instance, might hold stocks across 50 countries. This reduces company-specific risk, though market-wide downturns will still affect your holdings.

Low costs: Morningstar data from 2024 shows the average ETF charges 0.51% annually, compared to 1.01% for the average mutual fund. These seemingly small differences compound significantly over decades. However, you must also consider trading costs and potential bid-ask spreads.

Transparency: Most ETFs publish daily holdings, allowing you to know precisely what you own. This contrasts with mutual funds, which typically disclose holdings monthly or quarterly with a lag.

Tax efficiency: Within a Stocks and Shares ISA, ETF gains and income are entirely tax-free. Outside an ISA, ETFs generally distribute fewer taxable events than actively managed funds due to lower portfolio turnover. Capital losses remain, however, and you may face dividend taxation if holding outside tax-advantaged accounts.

Liquidity: Major ETFs trade millions of shares daily, allowing you to exit positions quickly. Niche or thinly traded ETFs may have wider bid-ask spreads, increasing transaction costs.

How to Start Trading ETFs in the UK: Step-by-Step

Trading ETFs requires a few straightforward steps, though each decision carries implications for costs and tax treatment.

Step 1: Choose between ISA and General Investment Account

The Stocks and Shares ISA offers tax-free growth and income on up to £20,000 invested per tax year (2025/26). Any UK resident aged 18 or over can open one ISA per tax year. If you have already used your ISA allowance or wish to invest beyond the limit, a General Investment Account remains available, though gains above £3,000 annually face Capital Gains Tax.

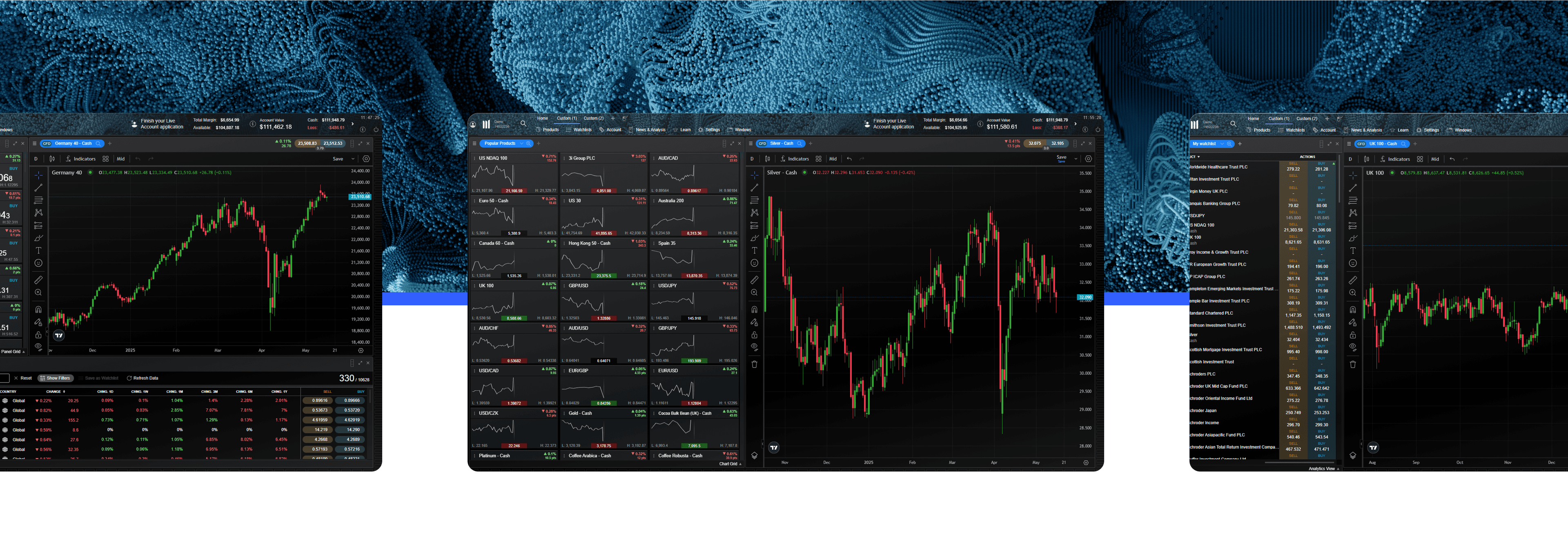

Step 2: Select a trading platform

UK investors can access ETFs through traditional brokers, online platforms and robo-advisors. Compare platform fees, available ETF range, research tools and whether they offer ISA accounts. Most platforms charge either a percentage of assets or flat fees per trade.

Step 3: Research and select ETFs

Identify ETFs that match your investment objectives, risk tolerance and time horizon. Check the fund’s total expense ratio, tracking difference, assets under management and whether it reinvests dividends (accumulation) or pays them out (distribution). UCITS ETFs offer stronger regulatory protection than offshore alternatives.

Step 4: Place your order

ETFs trade like shares. You can use market orders (executed immediately at current price) or limit orders (executed only at your specified price or better). For liquid ETFs during market hours, market orders typically suffice. For less liquid ETFs or volatile markets, limit orders provide price protection.

Step 5: Monitor and rebalance

Review your portfolio quarterly or semi-annually. ETFs may drift from target allocations as different assets perform variably. Rebalancing maintains your intended risk profile, though frequent trading generates costs and potential tax events outside ISAs.

Choosing a Trading Platform for ETFs

Platform selection significantly impacts your long-term returns through fees and available features.

Note: Fee structures and product availability may change. Other platforms are available. This table is illustrative, not exhaustive.

Frequent traders may benefit from platforms with low or zero per-trade fees, even if annual percentage fees are higher. Buy-and-hold investors may favour low percentage fees over trading commissions. Consider your likely portfolio size — those with substantial assets might consider platforms with flat monthly fees, as percentage-based fees become expensive on larger portfolios.

Verify that your chosen platform offers FSCS protection up to £85,000 for cash holdings, though remember that investment values can fall and are not protected by FSCS. All platforms mentioned above are FCA-regulated.

ETF Trading Strategies for Different Investor Types

How you trade ETFs should align with your financial goals, time horizon and risk capacity.

Buy-and-hold: Purchase a diversified portfolio of ETFs and maintain positions for years or decades. This approach minimises trading costs and tax events while capturing long-term market returns, such as when saving for retirement savings, but outcomes vary depending on market conditions and individual circumstances. Rebalance annually or when allocations drift significantly.

Pound-cost averaging: Invest fixed amounts at regular intervals regardless of market conditions. This removes timing decisions and can reduce average purchase price during declining markets. However, Vanguard research from 2023 shows lump-sum investing outperformed pound-cost 68% over the 1976–2022 period, as markets trend upward more often than downward.

Core-satellite: Holding low-cost, broad-market ETFs as your portfolio core (70–90%) while using specialised ETFs for tactical positions (10–30%) combines diversification with the ability to express market views. The satellite portion carries higher risk through concentration in specific sectors, regions or themes.

Tactical allocation: Adjust portfolio weights based on market conditions or valuations, such as increasing bond allocation when equity valuations appear stretched. This requires market timing ability, which evidence suggests few investors possess consistently. Frequent rebalancing also generates trading costs and potential tax consequences.

ETFs for UK Traders

The following examples illustrate common ETF categories. This is not investment advice — suitability depends on your individual circumstances.

Global equity exposure: ETFs tracking the MSCI World or FTSE All-World indices provide diversification across developed markets. Examples include Vanguard FTSE All-World UCITS ETF [VWRA] and iShares MSCI World UCITS ETF [IWRD]. These carry equity market risk, including potential declines of 30–50% during severe downturns.

UK equity exposure: ETFs tracking the FTSE 100 or FTSE All-Share offer concentrated UK exposure. Consider whether geographic concentration aligns with your risk tolerance, particularly given the UK’s significant weighting toward financial services and energy sectors.

Bond exposure: Government and corporate bond ETFs provide portfolio ballast and income. Rising interest rates cause bond prices to fall, while default risk affects corporate bonds. UK gilt ETFs offer lower credit risk but sensitivity to Bank of England policy.

Sector and thematic ETFs: Technology, healthcare or clean energy ETFs offer targeted exposure but concentrate risk. Sector-specific ETFs typically exhibit greater volatility compared to broad market equivalents due to concentrated exposure to one section of the market. Approach thematic investing cautiously, as concentration amplifies both gains and losses.

Understanding ETF Costs, Fees and Tax Implications

Total costs significantly impact long-term returns. A portfolio charging 1% annually underperforms an identical 0.2% portfolio by approximately 20% over 25 years through compounding.

Ongoing charges: The total expense ratio or ongoing charges figure covers fund management, administration and custody. UK-domiciled equity ETFs typically charge 0.05–0.50% annually. This fee is deducted from fund assets and does not appear as a separate transaction.

Trading costs: Platform trading fees can cost up to £12 per transaction. The bid-ask spread — the difference between buying and selling prices — represents an implicit cost. Liquid ETFs may have spreads of 0.01–0.05%, while niche ETFs can exceed 0.5%.

Tax treatment: Within a Stocks and Shares ISA, all returns are tax-free. Outside an ISA, you face Capital Gains Tax on profits above £3,000 annually (2025/26 allowance) at 18% or 24% depending on your income tax band. Dividend income is taxed at 8.75%, 33.75% or 39.35% depending on band, with a £500 dividend allowance for 2025/26.

ETFs avoid the stamp duty of 0.5% charged on UK share purchases — a significant advantage for frequent traders. Irish-domiciled ETFs, common for US equity exposure, offer favourable withholding tax treatment on US dividends compared to direct US-listed ETFs.

Common ETF Trading Mistakes to Avoid

Certain errors undermine returns even when your underlying investment thesis proves correct.

Chasing past performance: Last year’s top-performing sector or region often reverts to average returns. Performance persistence is rare across asset classes.

Ignoring tracking difference: An ETF may underperform its index by more than the stated expense ratio due to sampling methods, trading costs or cash drag. Review the actual tracking difference over multiple years rather than relying solely on expense ratios.

Over-trading: Frequent buying and selling generates cumulative costs through trading fees, spreads and potential tax events. Evidence suggests transaction costs destroy more value than most investors recognise.

Neglecting rebalancing: Without periodic rebalancing, your portfolio drifts from target allocations. A 60/40 stock/bond portfolio experiencing strong equity returns might become 75/25, substantially increasing risk beyond your intentions.

Misunderstanding synthetic ETFs: These use swaps rather than holding physical securities, introducing counterparty risk if the swap provider defaults. UCITS rules limit but do not eliminate this risk.

ETF Trading Tips for Beginners

Start with broad, low-cost index ETFs: Global equity and bond ETFs provide immediate diversification. Avoid complex strategies or niche sectors until you understand how markets behave through various cycles.

Use an ISA: Can provide tax advantages, as returns are sheltered from income and capital gains tax. These benefits may compound over time, though individual outcomes depend on personal circumstances and future tax rules.

Understand what you own: Read the ETF’s Key Investor Information Document and review its top holdings. Avoid investing in ETFs whose strategy or risks you cannot articulate clearly.

Check trading volumes and spreads: ETFs with average daily volumes below £500,000 may prove difficult to trade at fair prices. Review the bid-ask spread as a percentage of the share price before buying.

Avoid unnecessary complexity: Leveraged, inverse or exotic ETFs introduce risks unsuitable for most investors. These products are designed for short-term tactical use by sophisticated traders.

Yes. ETFs are subject to market risk, and the value of your investment can fall as well as rise. You may receive back less than you invested. Diversification reduces but does not eliminate risk.

You can begin with as little as one share, typically $5–500 depending on the ETF. However, consider trading fees — a $10 commission on a $50 investment represents a 20% cost hurdle.

Yes. Dividends from ETFs held outside an ISA count toward your $500 dividend allowance (2025/26). Excess dividends face income tax at your marginal rate. Within an ISA, dividends are entirely tax-free regardless of amount.