How to Trade Gold : Complete Step-by-Step Guide

What is Gold Trading? Understanding the Basics

Gold trading involves speculating on price movements of the precious metal through various financial instruments without necessarily taking physical delivery. As of October 2025, gold trades at approximately $3,991 per troy ounce, reflecting a remarkable 48% increase year-over-year.

The market offers multiple access points ranging from Contracts for Difference (CFD) to futures contracts and exchange-traded funds. Each method carries distinct characteristics regarding leverage, costs and settlement procedures. Understanding these fundamentals helps traders select appropriate instruments aligned with their objectives and risk tolerance.

Gold serves dual purposes: as a safe-haven asset during economic uncertainty and as a speculative vehicle for traders seeking to profit from price volatility. Central banks worldwide accumulated 1,045 tonnes in 2024, with similar levels expected in 2025, according to the World Gold Council. This institutional demand provides structural support to prices alongside retail and investment flows.

The relationship between gold and traditional markets differs from most assets. Gold generates no dividends or interest, deriving its value purely from price appreciation and its role as a store of wealth. This characteristic makes it particularly sensitive to real interest rates — the nominal rate minus inflation expectations.

Ways to Trade Gold: CFDs, Futures, ETFs and Physical Gold

Traders access gold markets through four primary methods, each with distinct advantages and risk profiles.

CFDs allow speculation on gold price movements without owning the underlying metal. Data from Finance Magnates Intelligence indicated that CDFs on precious metals made up 60% of global broker volumes in the first half of the year, with the majority coming from gold contracts. These instruments offer leverage, enabling traders to control larger positions with less capital. However, leverage amplifies both gains and losses.

CFD benefits include no storage costs, ability to profit from falling prices through short selling and fractional trading capabilities. Drawbacks include overnight financing charges for positions held beyond the trading day and counterparty risk with the broker.

Gold Futures represent standardized contracts to buy or sell gold at predetermined future dates. The COMEX 100-troy-ounce contract dominates trading, with an average of 180,000 contracts changing hands daily. Futures provide institutional-grade liquidity and transparent price discovery.

Futures contracts require less capital than purchasing equivalent physical gold but involve margin requirements and rollover costs as contracts approach expiration. Settlement can occur through cash or — rarely in retail contexts — physical delivery.

Gold ETFs track gold prices through shares traded on stock exchanges. The SPDR Gold Trust (GLD) holds 1,038 tonnes as of November 2025, making it one of the largest institutional holders of gold. ETFs combine the convenience of stock trading with gold price exposure.

Management fees typically range from 0.2% to 0.5% annually. ETFs eliminate storage concerns but introduce tracking errors and do not provide the security benefits of physical possession during extreme scenarios.

Physical Gold ownership through bullion, coins or jewelry requires storage arrangements and insurance. Premiums over spot prices range from 3% to 10% during normal market conditions depending on form and dealer, with ongoing storage costs reducing net returns.

Step-by-Step: How to Start Trading Gold Online

Initiating gold trading requires systematic preparation across regulatory, technical and strategic dimensions.

Step 1: Select a Regulated Broker

Prioritize FCA regulation, which ensures adherence to capital requirements, client fund segregation and dispute resolution mechanisms. Examples of FCA-authorized brokers include Pepperstone, IG and Plus500. This does not constitute an endorsement. Traders should verify authorization status on the FCA Register.

Evaluation criteria include trading costs, available instruments, platform functionality and execution quality. Test execution speeds during volatile periods using demo accounts before committing capital.

Step 2: Complete Account Verification

Know Your Customer requirements mandate identity verification through government-issued documents and proof of address within three months. This process protects both traders and firms from financial crime.

FCA-regulated entities store client funds in segregated accounts, providing protection up to £85,000 under the Financial Services Compensation Scheme should the firm fail.

Step 3: Fund Your Account

Deposit methods include bank transfers, debit cards and e-wallets. Minimum deposits vary by broker, ranging from £0 to £200. Consider funding costs — some brokers charge for credit card deposits or withdrawals.

Step 4: Configure Risk Management

Establish position sizing rules before executing trades. Risk management experts recommend limiting exposure to 1–2% of total capital per position. Set stop-loss orders at levels that reflect both technical support points and risk tolerance.

Step 5: Develop a Trading Plan

Document entry criteria, exit rules, position sizing methodology and performance evaluation metrics. Plans should specify whether the approach emphasizes trend following, mean reversion or event-driven strategies. This structure reduces emotional decision-making during market volatility.

Step 6: Practice with Demo Accounts

Most brokers provide simulated trading environments with virtual capital. Practice executing orders, managing positions and interpreting charts without financial risk. Demo trading reveals platform limitations and helps refine strategies before real-money deployment.

Understanding Gold Price Movements and Market Drivers

Gold responds to a complex interplay of economic, monetary and geopolitical forces. The World Gold Council’s Gold Return Attribution Model identifies four primary drivers: economic expansion, risk and uncertainty, opportunity cost and momentum. Past performance is not a reliable indicator of future results.

Interest Rates and Real Yields

Gold competes with interest-bearing assets. When real yields — nominal rates minus inflation expectations — decline, gold becomes relatively more attractive. Research and market analyses indicate that declines in Treasury yields often coincide with meaningful gold price increases, but the precise percentage change varies with market conditions, inflation expectations and geopolitical factors.

The Federal Reserve’s rate decisions exert outsize influence. Historical data shows gold gains significantly in the 12 months following Fed rate cut cycles. Current market consensus expects 100 basis points of cuts by year-end 2025.

Inflation and Currency Debasement

Gold preserves purchasing power during currency devaluation. The 1970s stagflationary period saw gold surge from $35 to over $800 per troy ounce as inflation reached double digits. However, the relationship proves more complex than simple correlation.

What matters is inflation relative to interest rates. When inflation outpaces yields, gold typically benefits as real returns on bonds turn negative. US Consumer Price Index readings in September 2025 showed inflation at 3%, above target levels, supporting gold’s appeal.

US Dollar Strength

Gold prices maintain an inverse relationship with the US Dollar Index. A weaker dollar reduces gold costs for foreign buyers, stimulating demand. The dollar’s 11% decline in the first half of the year contributed significantly to gold’s rally.

Dollar weakness often signals concerns about US fiscal sustainability or shifts in global reserve composition. Central banks, particularly in China, India and Poland, accumulated gold reserves to diversify away from dollar-denominated assets.

Geopolitical Risk

Uncertainty drives safe-haven demand. An increase in the Geopolitical Risk Index is often associated with gold price gains. Trade tensions, military conflicts and political instability all support gold prices.

The metal’s anonymity, portability and universal acceptance make it valuable when traditional financial systems face strain. Recent escalation in global trade disputes contributed to gold reaching all-time highs in October 2025.

Central Bank Demand

Official sector purchases provide price-insensitive demand. The People’s Bank of China reported reserves of 2,264 tonnes as of June 2025, while Poland led European purchases with 131 tonnes. This structural bid supports prices regardless of short-term market conditions.

Gold Trading Strategies

Successful gold trading combines technical and fundamental approaches tailored to individual timeframes and risk profiles.

Trend Following

This strategy identifies established directional moves and enters positions aligned with momentum. Traders use moving averages, with crossovers of 50-day and 200-day averages signalling potential entry points. Historical data shows gold exhibits persistent trends during major economic shifts.

The approach works best during clear bull or bear markets but generates false signals during consolidation. Risk management through trailing stops protects profits while allowing winning positions to run.

Range Trading

When gold oscillates between defined support and resistance levels, range traders buy near support and sell near resistance. This method suits sideways markets but requires discipline to exit when ranges break.

Support levels often correspond to technical indicators like previous lows or key moving averages. Resistance emerges at prior highs or psychologically significant price points.

News Trading

Gold responds sharply to Federal Reserve announcements, employment data and inflation reports. Traders position ahead of scheduled releases or react to unexpected outcomes. The most volatile periods occur during Federal Open Market Committee meetings and major geopolitical events.

Risk increases substantially during news events due to widened spreads and rapid price swings. This approach demands quick execution and tight risk controls.

Hedging Strategy

Institutional and sophisticated traders use gold to offset risks in other portfolio holdings. When equity markets decline or inflation accelerates, gold positions can cushion overall portfolio volatility. This defensive approach prioritizes capital preservation over aggressive gains.

Hedging typically involves longer holding periods and less leverage than speculative strategies. Position sizing reflects the desired correlation benefit rather than profit maximization.

Swing Trading

This intermediate-term approach captures multi-day price movements. Swing traders combine technical patterns with fundamental catalysts, holding positions from several days to weeks. The method requires less monitoring than day trading while offering more opportunities than long-term investing.

Swing traders often target specific risk-reward ratios, commonly 1:2, where potential profit targets double the distance to stop-loss levels.

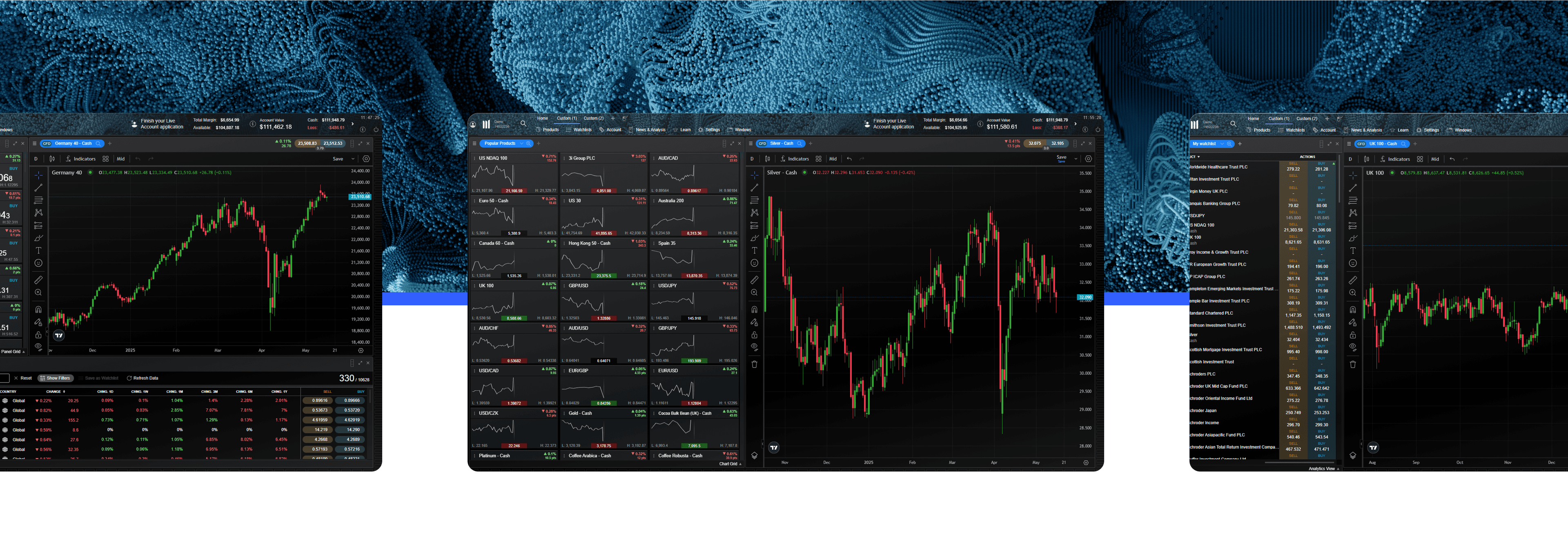

Choosing a Gold Trading Platform

Platform selection significantly impacts execution quality, costs and available tools.

Regulatory Compliance

Only trade with FCA-authorized firms. Verify authorization on the FCA register using the firm reference number. Regulation ensures adherence to capital adequacy standards, conduct rules and compensation schemes.

Trading Costs

Spreads represent the difference between bid and ask prices. Commission structures vary — some brokers charge per-lot fees while others widen spreads.

Calculate total cost including overnight financing for positions held beyond the trading day. These swap rates can significantly impact profitability for longer-term positions.

Available Instruments

Leading platforms offer gold against multiple currencies beyond USD, including EUR, GBP, JPY, CHF and AUD. This currency flexibility allows traders to manage currency exposure separately from gold views.

Some brokers provide gold measured in grams (GOLDgr) alongside standard ounce-denominated contracts, enabling more precise position sizing.

Platform Technology

MetaTrader 4 and 5 offer advanced charting, algorithmic trading capabilities via Expert Advisors, and extensive technical indicators. Proprietary platforms from IG, Plus500 and others may provide superior mobile experiences or unique analysis tools. Test multiple platforms via demo accounts to assess personal preference.

Execution Quality

Execution speeds below 30 milliseconds reduce slippage — the difference between expected and actual fill prices.

Requote frequency and partial fill policies also affect execution quality. Premium brokers provide higher fill rates at requested prices.

Research and Education

Quality brokers supply economic calendars, analyst commentary and educational resources. Tools like Autochartist and Trading Central identify potential trade setups automatically. While not substitutes for independent analysis, these resources enhance decision-making.

Risk Management: Tips for Trading Gold

Effective risk management separates sustainable traders from those who deplete accounts.

Position Sizing

Never risk more than 1–2% of total capital on a single trade. If holding a $10,000 account, maximum risk per trade should not exceed $100–200. This ensures that a series of losses will not eliminate trading capital.

Calculate position size by dividing risk amount by stop-loss distance. If risking $100 with a 20-pip stop loss, position size equals five micro lots.

Stop-Loss Orders

Every position requires predetermined exit points for adverse moves. Place stop-losses at technically significant levels beyond which the original trading thesis becomes invalid. Arbitrary placement based on desired risk-reward ratios without chart context invites unnecessary stop-outs.

Many beginners set stops too tight, leading to premature exits on normal market noise. Others place them too wide, accepting excessive risk. Balance technical validity with capital preservation.

Leverage Discipline

Lower leverage reduces the speed at which losses accumulate. Conservative traders often employ 1:5 or 1:10 leverage regardless of availability.

Leverage amplifies both gains and losses by identical proportions. A 5% adverse move with 1:20 leverage could result in 100% account loss. Without negative balance protection, losses can exceed deposits.

Diversification

Avoid concentrating capital in single trades or correlated positions. Spreading risk across uncorrelated instruments reduces portfolio volatility. Gold itself often serves as a portfolio diversifier against equity holdings.

Emotional Control

Revenge trading — doubling position sizes after losses — commonly destroys accounts. Accept that losses form part of trading. Maintaining consistent position sizing and strategy adherence proves more profitable than attempting to recoup losses quickly.

Avoid trading during periods of emotional distress or under the influence of fatigue. These conditions impair judgment and invite impulsive decisions.

Account Protection Features

Utilise negative balance protection. This feature prevents losses exceeding account deposits. Guaranteed stop-losses, available for fees at some brokers, ensure stops execute at specified levels even during gaps.

Gold Trading Hours and Times to Trade

Gold trades nearly 24 hours during weekdays, but liquidity and volatility vary significantly across sessions.

Market Structure

Gold markets open Sunday evening (approximately 11:00 PM GMT) and close Friday afternoon (around 10:00 PM GMT). A brief daily maintenance window occurs, typically 10:00-11:00 PM GMT, when most brokers pause trading.

Optimal Trading Windows

The London session (8:00 AM – 5:00 PM GMT) and New York session (1:00 PM – 7:00 PM GMT) provide the highest liquidity. The overlap period between these sessions, 1:00 PM – 5:00 PM GMT, generates peak trading volume and tightest spreads.

Seasonal Patterns

Analysis since 1975 indicates gold prices typically decline in March and remain weak in April. While past performance does not guarantee future results, seasonal awareness informs timing decisions.

News-Driven Volatility

Major economic releases — Non-Farm Payroll, Consumer Price Index, Federal Reserve decisions — create explosive price movements. These events typically occur during US trading hours. Traders must decide whether to position ahead of announcements or wait for post-release clarification.

Spreads widen materially around high-impact news, increasing execution costs. Some brokers impose trading restrictions during major announcements.

Common Mistakes to Avoid When Trading Gold

Understanding typical errors helps traders bypass expensive learning experiences.

Insufficient Research

Entering trades without understanding gold’s macroeconomic drivers leads to poorly timed positions. Gold responds to inflation expectations, real yields, dollar movements and geopolitical risk. Ignoring these factors reduces trading to guesswork.

Successful traders monitor Federal Reserve communications, inflation data and global events that influence safe-haven demand.

Trading Without a Plan

Operating without predetermined entry and exit criteria invites emotional decision-making. Plans should specify position sizing, acceptable loss levels, profit targets and conditions that invalidate the trade setup.

Written plans create accountability and enable post-trade analysis to refine approaches.

Overtrading

Beginners often believe more trades generate more profits. In reality, overtrading increases transaction costs and exposes capital to unnecessary risk. Quality trades identified through careful analysis outperform quantity.

Commission and spread costs compound with trade frequency. A trader executing 100 trades monthly with 0.5-pip spreads pays significantly more than one making 10 carefully selected trades.

Ignoring Costs

Physical gold involves premiums over spot prices ranging from 2–10%, plus storage and insurance expenses. ETFs charge management fees of 0.2–0.5% annually. CFDs incur overnight financing charges.

These costs accumulate, particularly for longer-term positions. Calculate the total cost of ownership when comparing instruments.

Over-Concentration

Some analysts suggest that portfolios include a small proportion of gold (for example, 5–15%) for diversification purposes. This is a general observation, not personal investment advice. Excessive concentration limits participation in equity market gains during bull markets. Gold serves as a portfolio stabiliser, not a replacement for growth assets.

Chasing Performance

Gold’s gain in 2024 attracted investors expecting continued rapid appreciation. However, markets rarely replicate prior year performance. The economic conditions supporting 2024’s rally — specific inflation and interest rate dynamics — differ from 2025’s landscape.

Investors who chase recent winners often enter near cycle peaks, experiencing subsequent volatility or declines.

Panic Selling

Gold experiences normal pullbacks within longer-term uptrends. Selling during temporary weakness locks in losses. Traders with sound fundamental reasons for holding positions should maintain discipline through volatility unless their original thesis changes materially.

Wrong Instrument Selection

Gold futures suit experienced traders comfortable with margin requirements and contract rollovers. Beginners fare better with ETFs or smaller CFD positions. Matching instrument characteristics to knowledge level and capital reduces unnecessary complexity.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.