As a series of challenges puts the Tesla share price under pressure, ARK Invest founder Cathie Wood has been buying up the stock at a discount. But Tesla is not the only electric vehicle (EV) maker to be attracting the interest of super investors.

Cathie Wood added 116,048 Tesla [TSLA] shares to her ARK ETFs on 22 March, as the ‘super investor’ bets that the EV stock’s fortunes will see a U-turn.

Tesla has been under significant pressure in recent times; the company’s share price has reversed 52.6% year-to-date as of 27 March.

In Q4 2023, the Texas-based automaker lost its crown as the world’s best-selling EV-maker to China’s BYD [1211:HK].

In January, Tesla reported that operating income fell 46.2% year-over-year in Q4. It also warned that “volume growth may be notably lower” in 2024 as the focus switches to a “next-generation” EV platform, which could be the entry-level $25,000 model that Elon Musk has been hinting at.

Then in March the company reportedly cut back on production at its China factories, down to five days per week from six and a half days, according to Bloomberg.

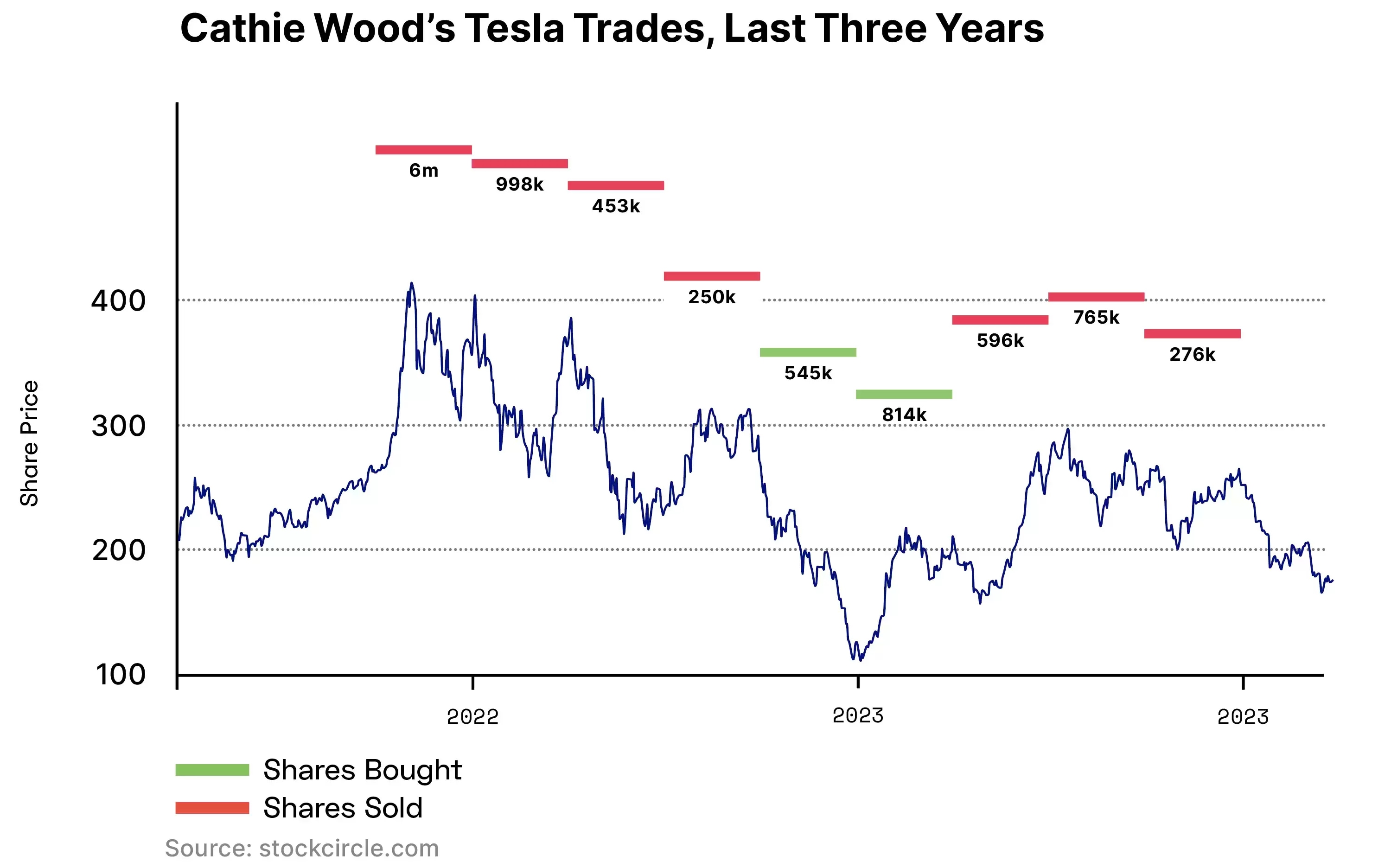

Five super investors sold a combined $940.5m of shares in Q4 2023, although another six super investors snapped up $492.1m, data from Stockcircle shows.

Wood reduced her position by 6.8%, offloading approximately 276,000 shares between September and December; she also sold tranches of approximately 765,000 and 596,000 in Q3 and Q2 2023, respectively.

As of 31 December, Wood held 3.8 million shares worth $944.9m. The EV-maker accounts for 5.6% of ARK Invest’s portfolio, which is valued at approximately $16.9bn.

Other investors apparently think that Tesla is too risky a bet at the moment. Here are some other EV stocks that super investors have been buying and selling.

XPeng

Two super investors splurged $25.7m on XPeng [XPEV] shares in Q4 2023, while one super investor sold $1.1m.

Ken Griffin, Founder and CEO of Citadel, boosted his position in XPeng by 1,304.5%, or approximately 993,000 shares, in Q4 2023, on the back of reducing his position by 97.1%, or approximately 2.5 million shares, in the previous quarter. Griffin first invested in the stock back in Q3 2020. The other Q4 XPeng buyer, adding approximately 625,000 shares, was PRIMECAP Management.

The only super investor seller was Paul Tudor Jones, Founder, Co-Chairman and Chief Investment Officer of Tudor Investment, who reduced his holding by 76.7% in Q4 2023, offloading approximately 67,000 shares.

Nio

Four super investors bought $38.3m of Nio [NIO] shares in Q4 2023, while another three sold $38.2m-worth.

Steven Cohen, Chairman, President and CEO of asset management firm Point72, increased his holding by 5,951.9% in the final three months of last year, buying approximately 3.7 million shares. Griffin bought approximately 940,000 shares, increasing his position by 28%.

Ray Dalio, Founder of Bridgewater Associates, sold approximately 341,000 shares in the final three months of 2023, reducing his holding by 11.5%.

Li Auto

Four super investors sold $20.7m worth of Li Auto [LI] shares in Q4 2023, compared to three super investors who invested just $5.1m in the EV-maker.

Dalio started a new position in Nio, buying approximately 61,700 shares, having exited the stock in the previous quarter. Cohen boosted his position by 34.3%, adding 80,500 shares.

Jim Simons, the veteran founder of quant fund Renaissance Technologies, sold 2.6% of his holding in the final three months of 2023, at 235,000 shares. Griffin reduced his stake in the EV maker by 27.8%, selling approximately 328,000 shares. Jones also sold approximately 10,300 shares, trimming his holding by 6.4%.

Rivian

One super investor bought $25.2m worth of Rivian [RIVN] shares in Q4 2023, while seven super investors sold a combined $97.6m.

The only buyer was Griffin, who increased his position in the EV-maker by 206.2%, purchasing approximately 1.3 million shares.

Simons reduced his holding by 91.9%, offloading approximately 3.7 million shares, while Jones sold 214,000 shares, more than halving his stake. Other sellers included Baillie Gifford, Jefferies Group and PRIMECAP Management.

Another Way to Invest in EVs

The KraneShares Electric Vehicles & Future Mobility Index ETF [KARS] holds Tesla, XPeng, Nio, Li Auto and Rivian as of 26 March. As of 29 February, 44.6% of the portfolio has been allocated to consumer discretionary, while industrials and materials have respective weightings of 25.9% and 24.2%; information technology (IT) accounts for 5.3%.

The fund is down 23.3% in the past year through 27 March and down 13.2% year-to-date.

The Global X Autonomous & Electric Vehicle ETF [DRIV] holds Tesla, Nio and XPeng. As of 29 February, consumer discretionary and IT have weightings of 36.8% and 29.8% respectively, while industrials and materials account for 15.1% and 13.4%; communication services and energy have single-digit allocations.

The fund is up 8.7% in the past year and down 2% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy