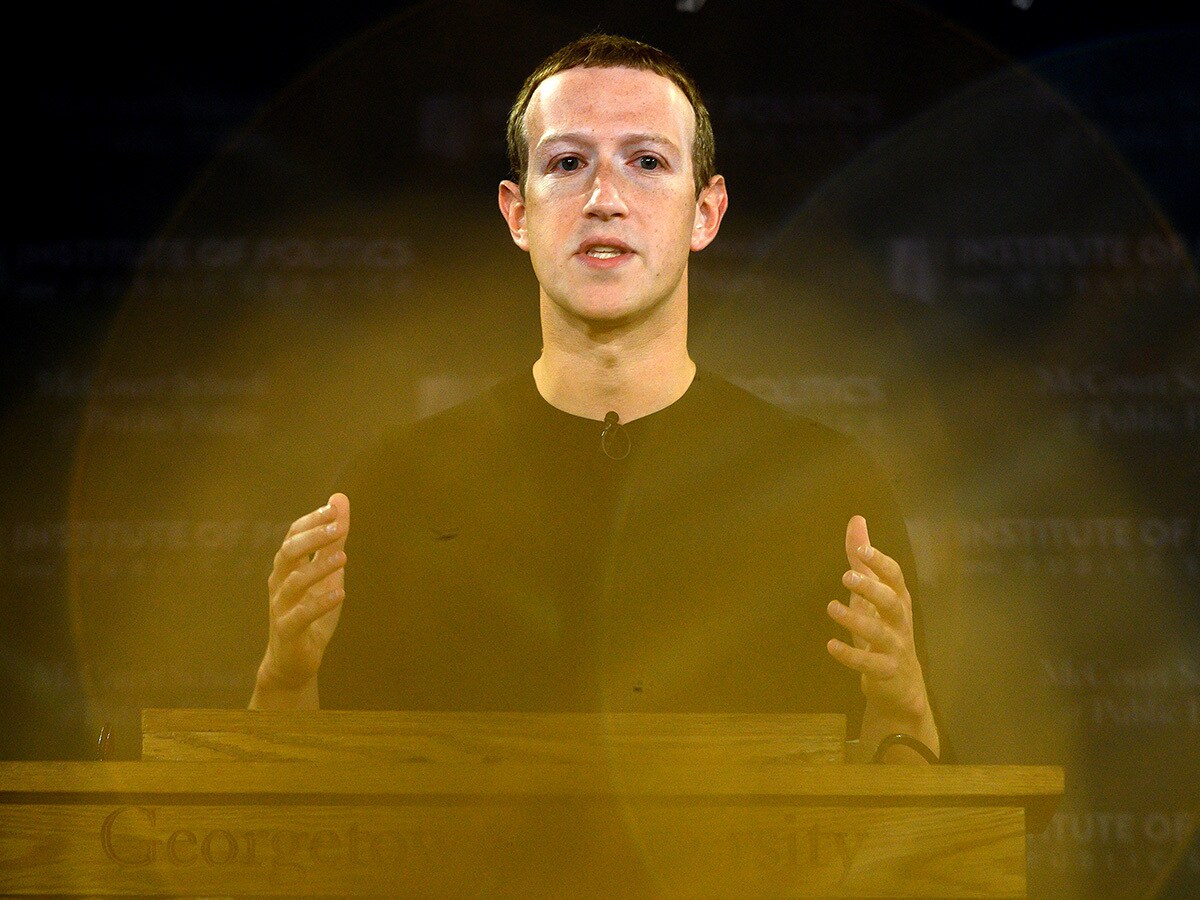

The Facebook [FB] share price has been making plenty of friends so far in 2021. Bumper earnings and strong ad revenues have helped the social media firm shake off regulator scrutiny, sending the stock upwards. So much so that founder and CEO Mark Zuckerburg (pictured) has decided to resume selling off his own stock.

In this article, Opto examines Zuckerburg’s reasons for selling off shares and looks ahead to Facebook’s upcoming second-quarter earnings at the end of July.

What’s happening with the Facebook share price?

The Facebook share price has gained 25% so far this year (as of 20 July close). Having accelerated since mid-March, the stock hit a high of $358.14 on 27 June, however, since that point, the Facebook share price has begun to wane. Over the past five days, it has seen a 3% decline, closing Tuesday at $341.66, just above its $340.74 50-day moving average.

25%

Facebook's YTD share price gains

Zuckerburg cashes in on the Facebook share price

Among those cashing in on the Facebook share price gains so far this year is none other than its founder Zuckerburg. In fact, Facebook’s leader has offloaded shares almost every weekday this year, reports Forbes’ Kenrick Cai, selling $9.4m in stock and raking in $2.8m.

However, Zuckerberg isn’t exactly pocketing the cash. According to Cai, 90% of the sales were made by his philanthropy organisation, the Chan Zuckerberg Initiative (CZI). The CZI was set by Zuckerberg and his wife Priscilla Chan in 2016 with the stated goal of giving away 99% of their Facebook shares to fund areas such as education and research into curing diseases.

$9.4million

Valuation of Facebook stock sold by Mark Zuckerburg

Zuckerburg had stopped selling in November 2019, bar a one-off donation. And while it would be fun to speculate that Zuckerburg has resumed selling to fund his own space tourism company to compete with Jeff Bezo’s Blue Origin, that doesn’t appear to be the case. Last year, among CZI’s funding initiatives, was $25m to speed the development of COVID-19 treatments.

Before investors get worried that there’s something amiss at Facebook, selling stock once a company is public is a common move for a founder. Jeff Bezos, for example, reduced his stake in Amazon, from 42% to 24%. And next to Bezos, Zuckerberg’s stock sale seems puny with the Amazon founder having sold $27m worth of stock.

Will the Facebook share price climb post-earnings?

The Facebook share price has soared despite a spate of negative newsflow, usually tied to continuing antitrust investigations. Helping defy the odds has been its earning results. In the first quarter, Facebook pulled in $26.17bn in revenue, up 46% on the $17.4bn seen in the same period last year. Diluted earnings per share came in at $3.3 a share, up 93% from the previous year’s $1.71 a share.

Facebook pinned the strong performance on the average price of an ad surging 30% year-on-year, and a 12% increase in ads delivered. A large part of Facebook’s huge revenue growth is down to comparisons with pandemic-era earnings, and third and fourth-quarter earnings are likely to see a deceleration in year-on-year growth.

$26.17billion

Facebook's Q1 revenue - a 46% YoY rise

Another headwind for future earnings is the changes in ad targeting, with recent privacy changes for Apple’s ioS 14 privacy settings making it harder for the social media company to serve targeted ads to iPhone and iPad users. This could weigh on upcoming earnings this year, with second-quarter numbers due 28 July.

Among analysts tracking Facebook’s share price on Yahoo Finance, the stock has a $386.47 price target — hitting this would see a 13% upside on 20 July close. Of the 44 analysts tracking the stock, 17 rate Facebook a strong buy and 24 a buy.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy