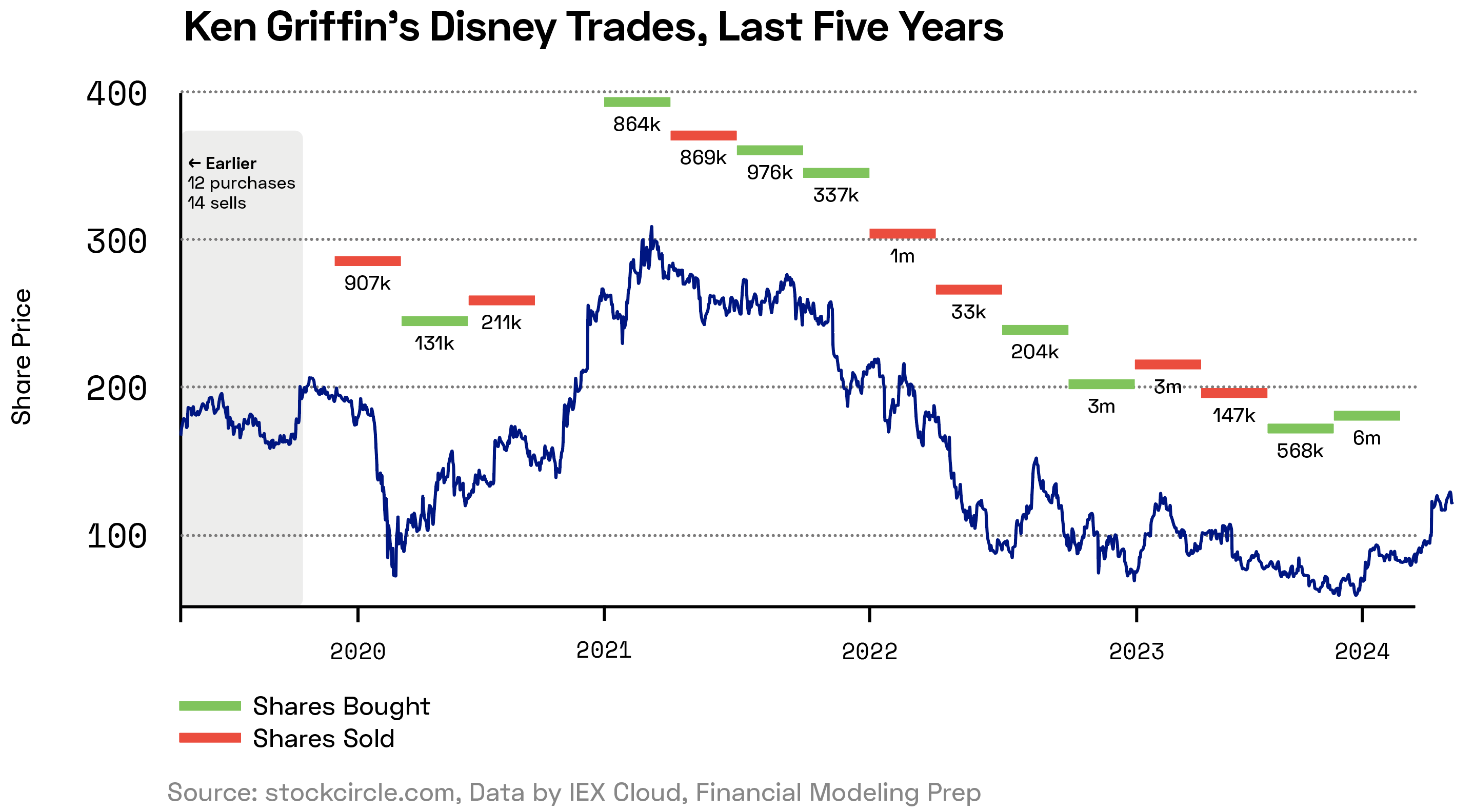

Ken Griffin, founder and CEO of Citadel, the world’s most successful hedge fund, has pursued a clear strategy of buying Disney shares ahead of upturns in its price, and selling during downward runs. Griffin appears to have executed a timely trade in Q4, ahead of Disney’s blockbuster earnings announced in February.

Griffin Piles into Disney

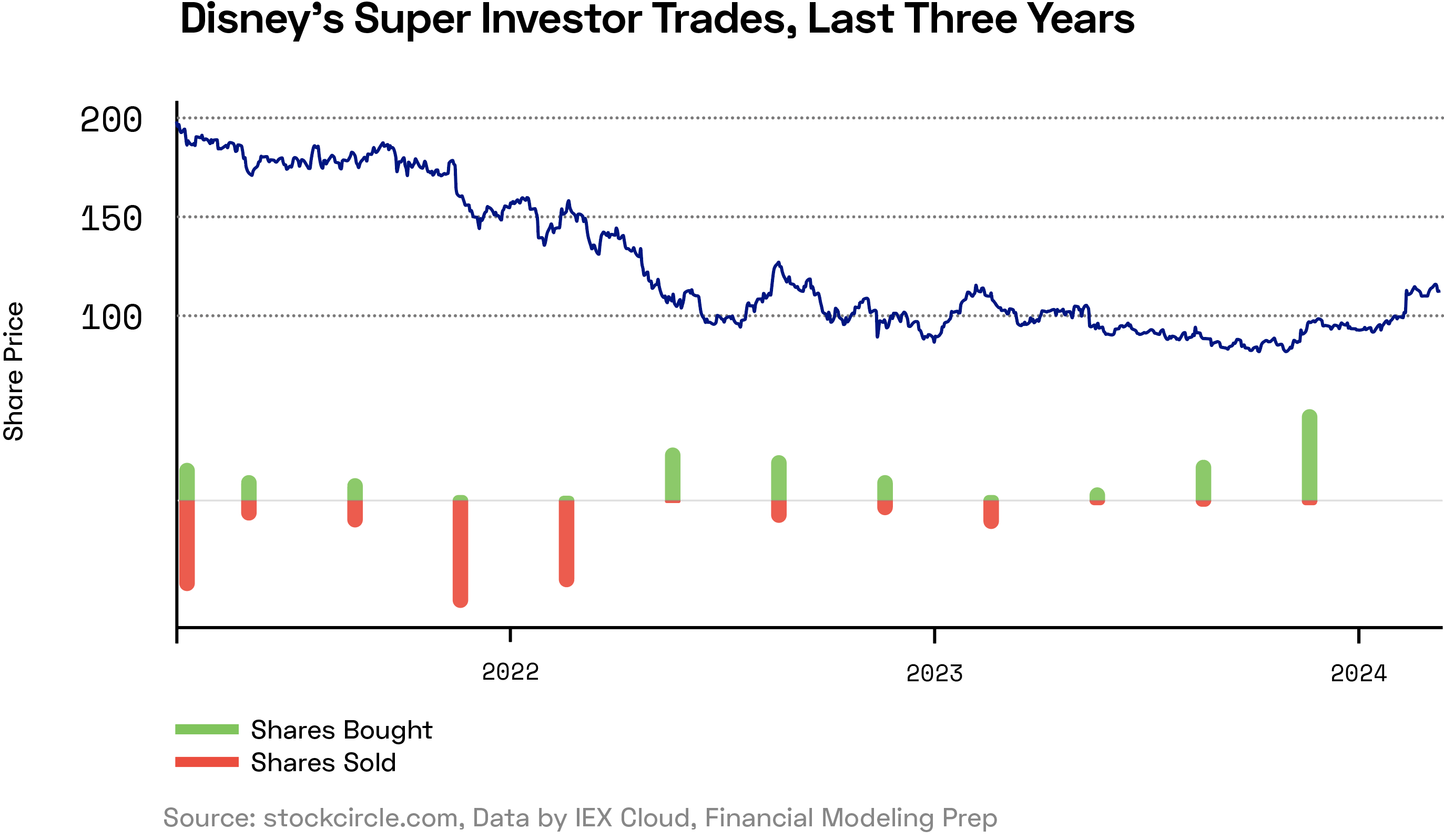

‘Super investors’ — the world’s most renowned and influential institutional investors — collectively bought $1.2bn worth of Disney [DIS] shares during Q4 2023, according to data from Stockcircle.

This marked the third successive quarter of increasing net purchases of the company’s shares by super investors.

The most prolific purchaser of Disney shares was Ken Griffin, Founder, CEO and Co-Chief Investment Officer of Citadel. Griffin bought 6.34 million of the company’s shares during the quarter, at an average closing price of $88.16.

During the first half of 2023, Griffin sold 3.1 million of his shares in Disney. However, Q4’s purchase builds on 568,000 bought during Q3, to restore Griffin’s substantial stake in the company.

About Ken Griffin

Ken Griffin founded Citadel — the most successful hedge fund of all time, with over $74bn in gains since its inception — in 1990, one year after graduating from Harvard, under the premise that talented people could use advanced software to find unique opportunities in the stock market.

Citadel’s portfolio is currently worth $101bn, according to Stockcircle. 26.2% of this is in the technology sector, and 13.9% in finance.

Disney sits at number 11 in the list of Citadel’s holdings, with 0.8% of its portfolio. Nvidia [NVDA] is the top holding at 3.2%, followed by the SPDR S&P 500 ETF Trust [SPY] at 2.8% and Microsoft [MSFT] at 1.7%.

Griffin is also the Founder of Citadel Securities, a leading US market maker, as well as a keen philanthropist who has given billions to educational efforts in the US. He also played a vital role in the country’s Covid vaccine rollout.

Has Disney Turned a Corner?

Griffin’s historical Disney trades reflect a general pattern of selling the stock during quarters when its value falls, and buying it when it is on the up.

With Disney’s share price having reached a long-term bottom during Q4, Griffin appears ready to back the stock going forward.

He was rewarded for his confidence in February when Disney posted blowout earnings for its Q1 2024 (ended 30 December 2023).

Earnings per share increased 23.2% year-over-year to $1.22, beating Refinitiv analyst expectations of $0.99 by the same amount. Revenue only increased 0.2% year-over-year, while net margin rose to 8.16%.

Disney shares gained 11.5% on 8 February following the results, and have gained 1.6% since.

Bob Iger, CEO of Disney, said that the company’s “strong performance this past quarter demonstrates we have turned the corner”. Iger was hitting back at the criticisms levelled at his governance of the company by activist investors, particularly Nelson Peltz’ Trian Fund Management.

Peltz is not convinced, having recently published a 133-page memo urging Disney to scrap sequels and “restore the magic”.

However, Griffin’s backing demonstrates confidence in the current management, as well as in strategic moves such as Disney’s partnership with Epic Games to build a Fortnite-connected Disney universe.

Griffin’s relationship with Disney goes further than simply trading the stock, though.

In October, Griffin personally paid for 1,200 of Citadel’s Asian staff and their families to spend three days in Tokyo Disney Resort to celebrate the 30th and 20th anniversaries, respectively, of Citadel and Citadel Securities.

Staff outside Asia already enjoyed a similar trip in 2022, but Covid restrictions prevented many of the company’s Asian staff from attending.

BNGE on Disney Shares

Disney’s share price hit a 52-week low of $78.73 on 4 October last year, but has since staged a strong recovery, gaining 42.7% to close 11 March at $112.31. This leaves Disney’s share price 21.7% up over the past 12 months, and up 24.4% year-to-date.

Investors seeking exposure to Disney and the broader streaming industry can select the First Trust S-Network Streaming & Gaming ETF [BNGE], in which Disney is the fourth-largest holding, with a 5.2% weighting as of 11 March. BNGE has gained 6.7% year-to-date and 33% over the past 12 months.

Investors seeking more diversified exposure to Disney can consider the AdvisorShares Gerber Kawasaki ETF [GK], a multi-thematic, actively managed ETF which seeks exposure to long-term transformational trends. Disney is a sizeable holding in GK, with a 5.3% weighting. GK has gained 10.9% year-to-date and 25.5% over the past 12 months.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy