According to Morgan Stanley, India’s smartphone market could triple in size over the next decade. The country is experiencing a mix of tailwinds, which Bain, Google and Temasek believe could see its digital economy balloon to $1trn by 2030. Emerging markets expert Kevin Carter shares his insights on what makes India the “perfect emerging market”.

- Morgan Stanley expects increasing wealth to drive 11% annual growth in India’s smartphone market over the next decade.

- India’s online retail market set to grow 2.5 times faster than offline, according to Deloitte.

- Nykaa and Reliance shares trading down for the year, but the India Internet & E-commerce ETF posts solid 19.5% gains.

Research from Morgan Stanley suggests that India’s smartphone market will boom over the next decade. The paper, titled ‘India’s Smartphone Market Set to Surge’, claims that demographic trends and economic growth could triple the value of the market to $90bn by 2032.

“After 20 years of lagging behind its global peers, India's smartphone market now looks set to reach its potential,” wrote Erik Woodring, US Hardware Analyst at Morgan Stanley.

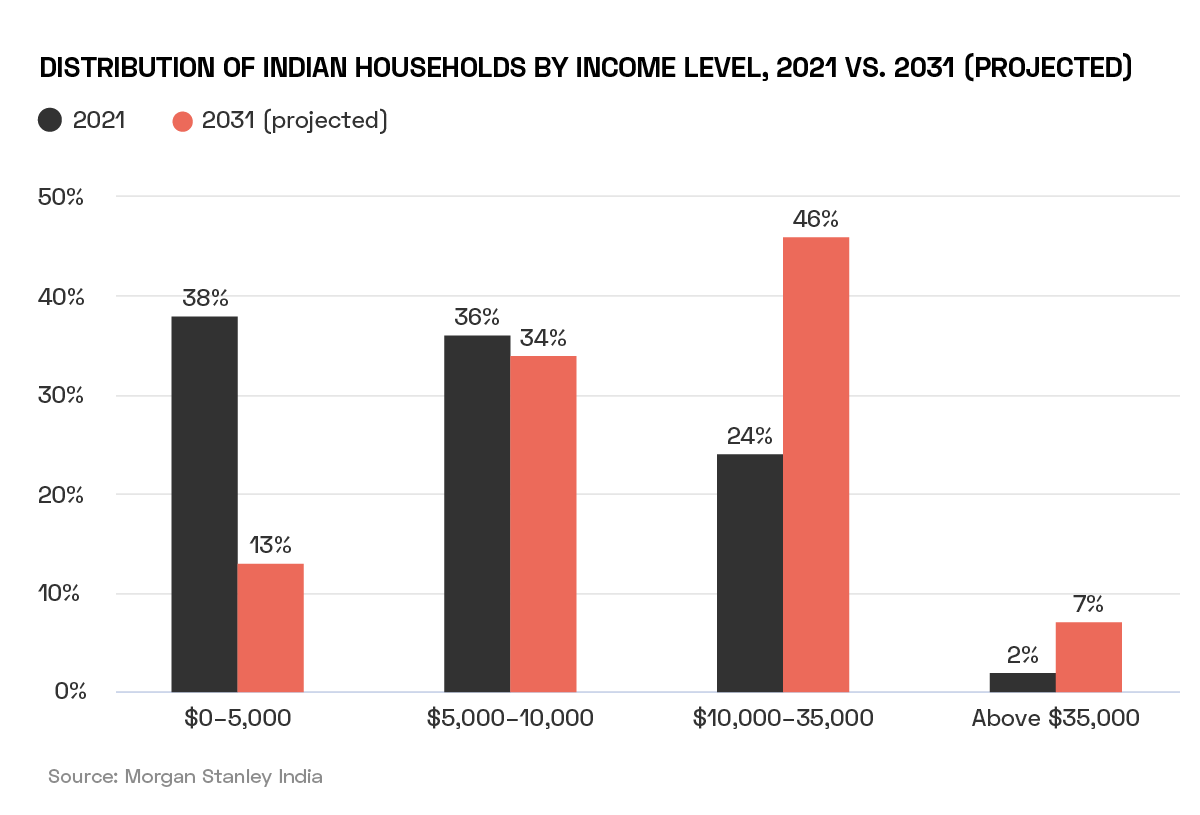

One of the key demographic tailwinds is India’s increasing prosperity. During the period in question, India’s per-capita income is expected to double, and the country could have five times as many high-income households by 2031.

Woodring remarks that this scenario would make India “the sole growth driver in the global smartphone market… ultimately accounting for 20% of worldwide shipments by 2032”.

The report cited research by Morgan Stanley that predicts Indian consumers will prioritise spending on smartphones. Three-quarters of survey recipients across all income levels suggested that they were considering buying a new smartphone in the next 12 months, with respondents aged 18 to 25 voicing willingness to up their spend on the item.

However, according to Kevin Carter, Founder and CEO of EMQQ Global, cheaper models could further boost smartphone penetration in the country. On this week’s episode of the OPTOpodcast, Carter says that penetration “is still only about 50%.

“That will accelerate with the $12 smartphone,” he added.

The Trillion-Dollar Question

Woodring makes the point that smartphones are becoming an essential product for consumers in India, which earlier this year surpassed China as the world’s most populous nation.

The smartphone’s importance is part and parcel of the increasingly digital nature of India’s economy. A report published in June — a collaboration between strategy consultancy Bain & Company, Google, and Singaporean government-owned investment firm Temasek — predicted that India’s internet economy will reach $1trn by 2030.

Sanjay Gupta, Country Head and Vice President of Google India, wrote that “three foundational forces — deepening consumer digital adoption, technology investments by businesses, and digital democratisation with the India Stack — has placed India at a turning point in its digital transformation”.

Business-to-consumer (B2C) e-commerce is one of the key sectors driving this growth; the report’s authors expect it to increase by an order of five to six, to approximately $350–380bn, by 2030, driven in turn by a doubling of the number of online shoppers in the country.

Similarly, professional services firm Deloitte expects India’s online retail sector to grow 2.5 times faster than its offline equivalent over the next decade. Deloitte India’s ‘Future of Retail’ report anticipates that online retail in the country will grow from $70bn in 2022 to $325bn by 2030.

The Picture for Pixel

However, smartphone sales in India hit a bump in the road in the third quarter (Q3) of 2023, falling 3% year-over-year, according to market research firm Canalys.

One brand that has struggled in the country is Google’s [GOOGL] Pixel, which has consistently held less than 0.2% of India’s smartphone market share over the past five years, according to CyberMedia Research.

However, Google looks to be positioning to improve on this, announcing on 19 October that its flagship model Pixel 8 will be available in the coming year, with parent company Alphabet partnering with domestic suppliers for part of its Indian-market manufacturing.

Elsewhere, it has also been a tough quarter for one of India’s e-commerce darlings. On 6 November, Nykaa, the online beauty and fashion retailer owned by FSN E-Commerce Ventures [NYKAA:NS], posted its slowest quarterly revenue growth since listing in November 2021. The company cited an increase in discounting thanks to growing competition both from overseas and domestic brands as part of the reason for slowing sales growth.

India: The “Perfect Emerging Market”?

Carter believes that India is, in many respects, “the perfect emerging market” (EM). He makes the point that it is not only large but also young, with a median age of 28 years. It is also the fastest-growing major economy and has, according to Carter, “the fastest-growing e-commerce market” in the world.

“India checks all the boxes” for an EM investment opportunity, says Carter. “Big, young and fast-growing consumption growth”.

Carter highlights Jio, a subsidiary of the conglomerate Reliance Industries [RELIANCE:NS] as one of the most exciting prospects for investors interested in India.

“By the end of the year, they will have the whole country in 5G,” says Carter of the company. “As a foundation point of connectivity, they’re the middleman. If you’re getting on the internet there, odds are you’re doing that via Jio.”

How to Invest in India Tech

At present, India’s smartphone market is dominated by foreign companies. While this could change in the future, the digital and e-commerce companies that are benefitting from India’s digital expansion are the most natural way for investors to gain exposure to the smartphone explosion.

Reliance Industries has had ups and downs through 2023. Despite having gained 11.6% by 19 July, the stock is down 8.4% year-to-date.

FSN E-Commerce Ventures shares are down 3.6% for the year, though they have gained 29.7% since hitting a low on 27 April.

The India Internet & E-commerce ETF [INQQ] offers investors targeted exposure to those sectors in India. It holds both FSN E-Commerce Ventures and Reliance Industries, with the latter being the third-largest holding at a 6.6% weighting as of 7 November. INQQ is up 19.5% year-to-date.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy