After years of relying on China for critical minerals, including lithium, countries are racing to lock down their own supplies. This has unstoppered a flow of capital from electric vehicle (EV) makers, while plenty of money is also being invested in battery technologies that could help bring down the cost of EVs for customers.

- BYD is to spend $290m on a lithium cathode factory in Chile.

- Volkswagen is building a lithium-ion EV battery cell facility in Canada, its first overseas gigafactory.

- GM has invested $50m in a start-up that has developed a more efficient method for extracting and processing lithium.

The race to secure lithium supplies continues to heat up, as China’s EV giant BYD [1211.HK] announces it’s to spend $290m on a lithium cathode factory in Chile.

According to economic development agency Corfo, BYD Chile has been selected to promote the country’s lithium supply chain as part of a strategy to nationalise its lithium industry and boost its economy. Once it is up-and-running in 2025, the factory should be able to produce 50,000 tonnes of lithium iron phosphate (LFP) per year. LFP batteries are a type of lithium-ion battery that are gaining traction among EV makers.

“We aim to give a significant boost to… the lithium value chain, to drive investment, and to contribute to increasing the sophistication of production processes, as well as generating high-quality employment,” said Corfo executive vice president José Miguel Benavente, in a Spanish-language press release on 19 April.

As part of the agreement, BYD Chile will also be able to access discounted prices on raw battery materials.

The BYD share price is up 8.8% in the past month and up 19.3% year-to-date.

Investing in domestic lithium production mitigates geopolitical risk

BYD’s investment in Chile could be viewed as an attempt to secure its future supply chain and offset the impacts of the Beijing/Washington trade war. China has long dominated the supply of critical minerals, but automakers are having to look elsewhere in order to reduce their exposure to geopolitical risks.

Writing in Sprott’s energy transition materials monthly analysis on 20 April, market strategist Paul Wong and ETF product manager Jacob White explained how huge amounts of capital no longer guarantee supplies of critical minerals. Access is no longer unfettered, but unstable, leading to volatility in prices.

“Resource nationalism may increase as countries attempt to retain and secure their share of critical minerals,” Wong and White pointed out.

Back in February, the White House highlighted the need for the US to boost domestic production of critical minerals and break its dependence on China. At the end of March, the world’s largest lithium producer, Albemarle [ALB], which has facilities in China, duly announced plans to build a $1.3bn lithium plant in South Carolina.

Elsewhere, General Motors [GM] has agreed to spend $650m to help Lithium Americas [LAC] develop and build a mine in Nevada.

According to Wong and White, the EV industry has also been making moves “to hedge against supply bottlenecks and price volatility” through what’s known as vertical integration: taking control of different parts of the supply chain to lock down future supplies.

For example, German automaker Volkswagen (VW) [VOW.DE] is to build a lithium-ion EV battery cell factory in Canada, its first overseas gigafactory, and its largest to date. The company plans to invest up to €4.8bn between now and 2030.

Meanwhile, VW’s newly founded battery subsidiary, PowerCo, and Belgian circular materials technology firm Umicore [UMI.BR] received regulatory approval in March for battery materials production in the EU.

Battery technology key to bringing EV prices down

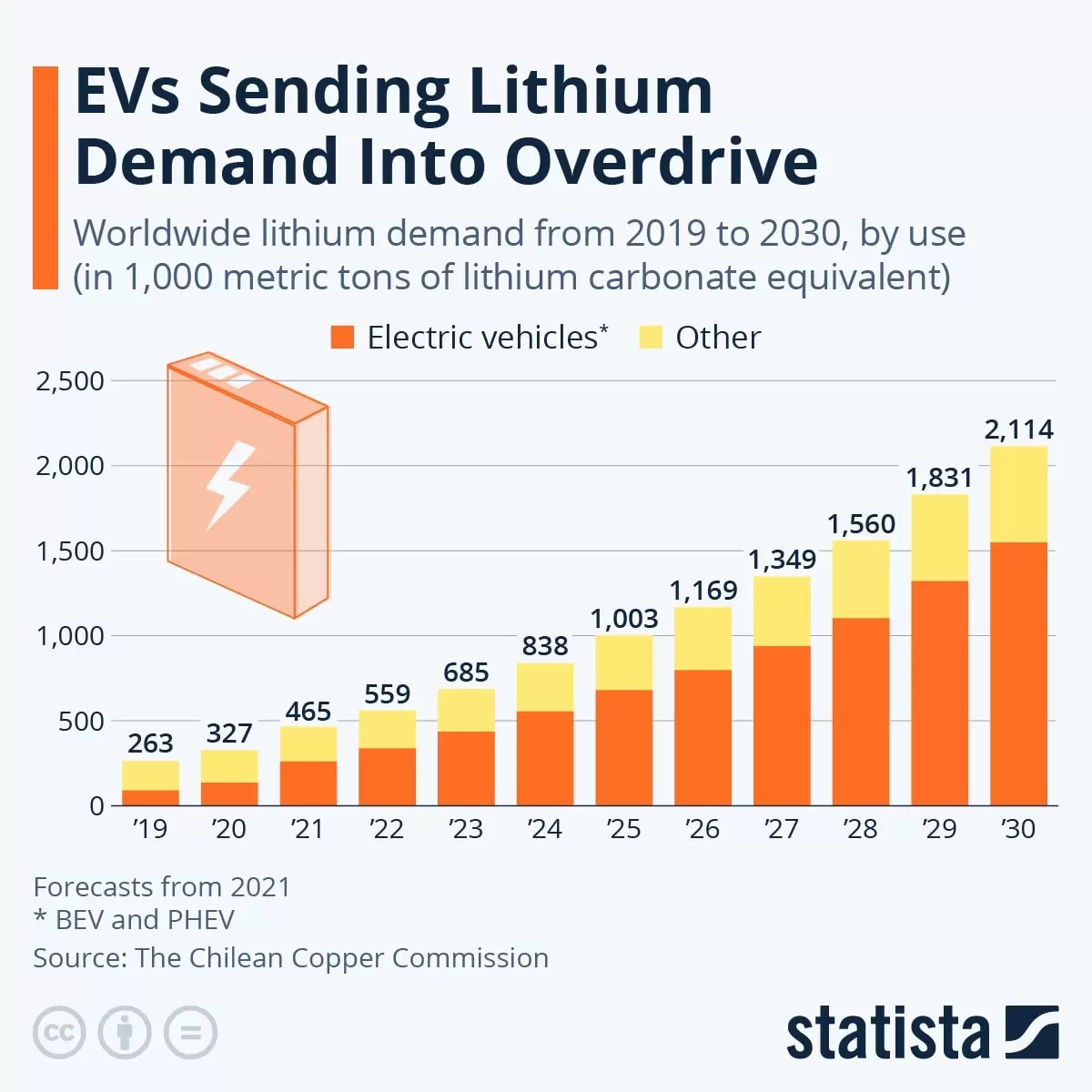

The price of lithium has been falling after it skyrocketed in 2022, as supply failed to keep up with demand from EV makers. Wong and White believe that the long-term outlook for lithium is “very positive” and that demand “will likely outpace supply again”.

Investing in domestic lithium production should reduce global competition for future supplies, which means the critical mineral should be less likely to experience price swings. Nevertheless, as EV makers continue to vie for dominance, they’ll be looking for ways to reduce the price of their cars for customers. This includes investing in lithium technologies that can bring the cost of batteries down.

GM’s venture capital arm is pledging $50m capital to a Texas startup, EnergyX, that has invented a more efficient method for extracting and processing lithium from salt flats. GM vice president of global purchasing and supply chain Jeff Morrison said in a statement that EnergyX’s process was “not only cost-competitive but will also reduce energy, land and water usage” compared to current processes.

Relatedly, TDK [6762.T] subsidiary TDK Ventures has invested in Novalith, a start-up that has developed a less water-intensive process which leverages carbon dioxide to extract lithium.

Mining giant Glencore [GLEN.L] and power company Iberdrola [IBE.MC], meanwhile, are to work together to recycle lithium-ion batteries at scale in Portugal and Spain. EV batteries are not easy to recycle, but the pair hope that recovering resources from waste will minimise dependence on mining for raw materials.

As the global push towards EVs grows, lithium demand is also soaring, as the Statistainfographic shows.

Funds in focus: Global X Lithium & Battery Tech

If EV makers can bring down the cost of their vehicles through battery technologies, this could help to offset any future rises in lithium prices and make them more affordable, potentially translating into higher sales.

Lithium stocks remain volatile, however, at least in the near term. For investors with a long-term horizon, ETFs can offer a less risky way to play the lithium theme.

The Global X Lithium & Battery Tech ETF [LIT] holds Albemarle as its top holding, with a weighing of 7.63% as of 21 April. The fund also has BYD and TDK in its top 10 holdings, with weightings of 5.93% and 4.79%, respectively. Lithium Americas has been allocated 0.72% of the portfolio. The fund is down 1.4% in the past month, but up 1.6% year-to-date.

The Sprott Lithium Miners ETF [LITP] is the only US-listed fund that’s a pure play on the lithium mining theme and offers exposure to companies upstream in the supply chain. Albemarle is the sixth-biggest holding with a weighting of 7.38%, while Lithium Americas is the ninth-biggest, with an allocation of 4.38%. The fund is up 5.5% in the past month, but down 21.4% since launching at the start of February.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy