The second article in this two-part series sees Janus Henderson emerging market experts Daniel Graña, Matt Doody and Jennifer James consider the potential investment implications of China’s decarbonisation plans.

While the phrase is liberally applied by investors, few global developments actually rise to the level of “mega-theme”. China decarbonisation, however, meets this standard. A summary observation is that this theme is concentrated on China and within the energy complex. It’s not.

We believe that this ambitious initiative has the potential to change the landscape for multiple asset classes, regions and economic sectors. As with any paradigm shift, there will be winners and losers in each of these categories.

With the launch of its decarbonisation initiative, a global arms race to renewable supremacy has begun.

China, as the world’s largest energy consumer, has shifted the calculus on climate economics. It has also thrust itself into a potential leadership position in innovative renewable technology.

As the largest energy consumer, much of this value chain will be a closed loop within China. Yet it also could export these technologies to other countries seeking to meet their — now accelerated — climate targets.

Regional losers are likely to be hydrocarbon exporting countries that have failed to diversify their economies. This stands to not only weigh on the financial prospects of the production companies and refineries, but also on their sovereign debt and currencies. Leaders in the Middle East and Russia have just been put on notice that their economic status quo may have a finite shelf life.

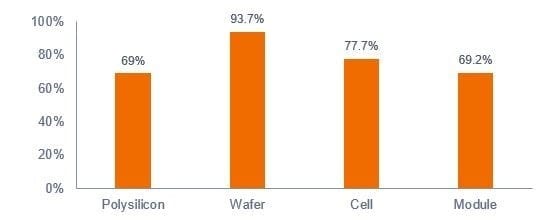

Exhibit 4: China share of total global photovoltaic solar industry

Source: China Photovoltaic Industry Association, as of 2019.

Developed market energy companies also face headwinds. Given solar and wind’s focus on electricity production, coal miners appear acutely vulnerable. Oil companies face a longer-term threat as the potential for electric vehicles (EVs) and batteries increases, but even within China, hydrocarbons stand to be the primary fuel for transportation over the near term.

Globally, industrial companies will compete to dominate business verticals such as solar, wind and EVs. Other industries affected by this initiative are waste disposal, carbon capture and the mining of the metals needed to support advanced energy production. Among these are copper, nickel, cobalt and lithium. As evidenced by this list’s compositions, battery technology and fuel cells are positioned to be a growth industry.

Given the multi-decade nature of this mega-theme, equities within the renewable energy value chain can be categorised as long-duration growth opportunities. Accordingly, they may attract high valuations, but the secular nature and the magnitude of this opportunity, in our view, should justify elevated earnings multiples — as long as they don’t get overextended.

The capital expenditure to bring these initiatives to fruition is massive. Companies are likely to access debt markets to fund growth and often this issuance may benefit from state backing. Conversely, strategically disadvantaged hydrocarbon producers will likely see their earnings prospects deteriorate and balance sheet quality diminish. The rate at which this occurs will depend upon the specific segment in which these companies operate and the degree to which management teams recognize the threat.

As decarbonisation touches state actors, multinationals across a range of sectors and societies at large, understanding its long-term investment implications requires a holistic, interdisciplinary approach. We believe that a country-level – and regional-level – macro lens is appropriate, especially given the degree government policy will help to shape the renewable playing field.

China has fired the opening salvo and we expect other countries to follow. A company-focused lens is necessary as management teams across industries will need to conduct a strategic overview of their carbon footprint, addressing how they produce and consume energy.

As in other periods of transition, some companies will pick winning strategies; other less forward-thinking ones risk an existential crisis. Lastly, decarbonisation aligns well with the acceleration of ESG investment themes. China has the potential to turn a vulnerability — its management of the environment — into a strength. Similarly, the social implications are considerable.

Wage gains for workers engaged in more productivity-enhancing value-added industries, improved health outcomes for urban dwellers and ultimately a lower risk of social and economic disruption caused by the worst effects of climate change such as desertification, food insecurity and mass migration are all societal benefits from a large-scale shift toward renewable energy sources.

Publicly listed corporations will be both drivers and driven by climate economics and this energy transition. Within the context of governance, management teams and boards will need a deep understanding of how the energy marketplace is changing so that they can develop strategies that enable them to act in the long-term interest of shareholders.

This article was originally published on the Janus Henderson Investors website.

Disclaimer Past performance is not a reliable indicator of future results.

CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Continue reading for FREE

- Includes free newsletter updates, unsubscribe anytime. Privacy policy